Bits and Bytes

Victor Ugochukwu

Victor Ugochukwu

Lately, there's hardly any time you surf the internet or log onto social media without being barraged with information on NFTs. Understandably, I am knowledgeable about the subject of blockchains and the application of DLTs (Decentralized Ledger Technologies); hence, my mind can piece this information together, trying to make sense of them. But not everyone is me. Some even barely know what Bitcoin (a form of cryptocurrency; the most popular application of blockchain) is, talk more of making sense of Non-Fungible Tokens or the aspect of tokenizing virtually everything in our universe.

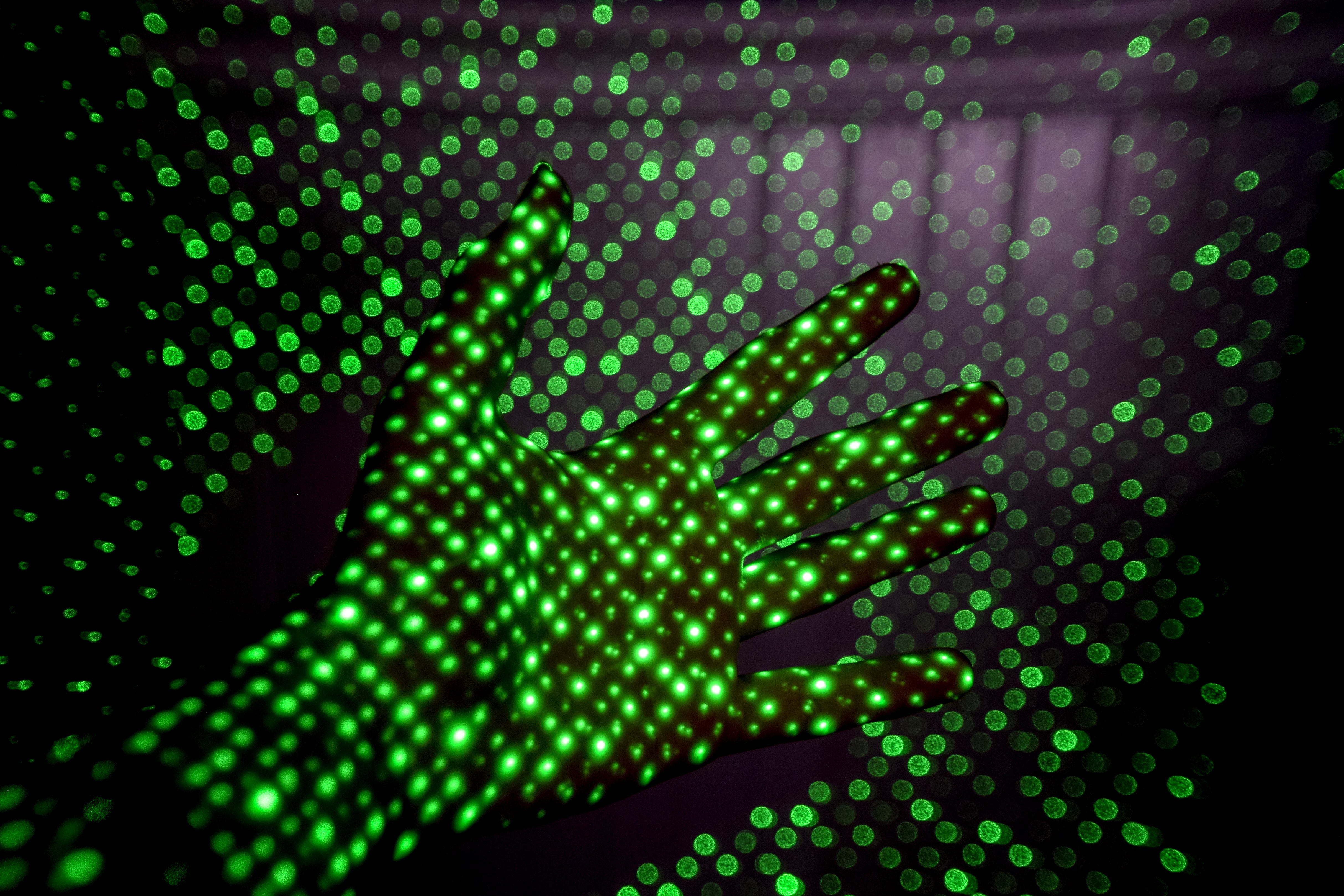

Andreessen Horowitz will say, "Software is eating the world", but I think in the end, our universe comprising the physical and virtual realms will be governed by bits and bytes. I speak of a completely tokenized universe.

If you're reading this, chances are your viewpoint relative to mine on this subject matter could be any of:

- The world is already being governed by bits and bytes since the proliferation of the internet

- Yes, the internet makes everything easy, but the idea of a completely tokenized world is absurd.

- It has to be a mix of both, but I bet that more people will be forced to plug into a tokenized system.

Whichever way you're leaning, I'll say you're not wrong. The internet already revolutionized Communication, Health, Business, Public Administration and whatnot. As someone who believes in the theory of evolution, the internet today is miles apart, different in looks and functionality during the Netscape days. But a more disruptive change is still in the offing.

Now imagine a situation where you could track the value or ownership of any item or asset through a digital token. But that's not even the banger here. The real deal is in being able to trade such tokens online, at any time, to whoever values them the most. I see your eyes lighting up with a spark. That's exactly how I feel whenever I allow my mind to run wild, imagining what tokenization would do to our universe.

The emphasis is on anything, which could even mean that your airline or hotel loyalty point you accrued as a traveller, an idea or expertise as a creative, right to rent or royalty payments for your art or music as an artist, in-game currency/points as a gamer etc. What if you could seamlessly convert any of these into tokens? Then, exchange them into something else unrelated to their earlier state, like paying for your cross-continental dish in an exquisite restaurant, watching your favourite team play live in the games arena, paying for your wards school fees, etc. I speak of exchanging items (physical or virtual) for other things like utility or luxury without any friction. This is what tokenization can do and is only obtainable through the power of blockchain. Beyond cryptocurrencies which many still dismiss as a fad, tokenizing real-world assets will be the killer app for blockchain technology besides cryptocurrencies.

People are already selling tweets (Twitter CEO Jack sold his first tweet for $2.9 million), dissidents like Edward Snowden selling his iconic artwork for $5.5 million and Beeple's EVERYDAYS: THE FIRST 5000 DAYS selling for $69.3 million all in NFT auctions.

Another frontier tokenisation through NFTs is blowing up is the creator economy. Quite clearly, social media revolutionised how we interact with people of varied influence. Surfing through the various social platforms like Facebook, Twitter, Instagram, YouTube, the common denominator as challenge most creators face is monetization. It's not enough to create content that goes viral; how does it translate to a boost in their income? Even when some have that figured out by leveraging payment platforms like Stripe, PayPal or even Patreon, charges in fees always rear up as issues. For instance, I've seen a digital creator once complain saying:

Once you make at least $500K via Stripe, it’s time to look for other payment processors. The headache & charges aren’t worth it at all.

Personal Tokens

Creators, athletes, artists, experts realize they can even tokenize themselves to bypass the "gatekeepers" who often charge them exorbitant fees or limit what they can offer for sale on their platform.

Last year, Spencer Dinwiddie, a Brooklyn Nets player, defied the norm even with the threat of a professional career ban; Dinwiddie tokenized his NBA contract. Using Securitize, a security token platform built atop Ethereum, Dinwiddie turned his three-year, $34.4 million contracts with the Nets into an investment vehicle called Dream Fan Shares. Per the contract, Investors will receive a 4.95% monthly return, with the full principal paid off at maturity. Dinwiddie, on the other hand, receives $13.5M of his 3-year contract up-front.

Others like Matthew Vernon, who goes by the alias dApp Boi is a designer who is also experimenting with the concept of personal tokens. As a professional designer, Matthew created 100 $BOI tokens representing 100 hours of his time. Anyone who holds these tokens (especially clients) could then redeem them on anything ranging from UI/UX design to prototyping to brand design.

Pi-NFTs (π)

I mentioned NFTs earlier. A non-fungible token means they are by nature illiquid. While other fungible items like common stocks, digital currencies are fungible, NFTs aren't easily transferrable or their values ascertainable. Hence, even when an artist or anyone decides to tokenize any of their real-world assets, they still face the problem of liquidity or clear value. Pi-NFTs solve this issue. NFTs were first created and standardized on the Ethereum blockchain using the ERC-721 token standard. But for NFTs to become mainstream, they won't live just on a single blockchain.

Pi-NFTs are still relatively new and address the interoperability of non-fungible tokens. As NFTs continue to proliferate through tokenized real-world assets, the ease of creating them, valuing them and transferring them will decide their ultimate adoption and how we relate with our universe.

DeFi is already pushing the boundary of finance to what most people never imagined; it will get even better when people can leverage their traditional assets on most open-source protocols like Uniswap, Aave, Compound, PancakeSwap etc. The vast amount of liquidity that can be pushed on-chain live on the blockchain through tokenized NFTs is huge. Brookfield, an asset management company based in the United States, cited that the real-world asset economy is a $10 trillion investable universe.

Personally, I think the DeFi industry currently operating based on the principle of negative leverage (the cost of borrowing money is greater than the return a party makes on an equity investment where users must stake more than they are allowed to borrow) will grow to a $500 billion industry within the next few years if people can begin to unlock values from their NFTs. And these NFTs can be tokenized real-world assets or a part of themselves now brought on-chain through the power of blockchain technology.

Perhaps the end game for this world is a tokenized universe with the power to easily transfer a part of you to another using decentralized ledger technology. The future is already being tokenized, do well to become a part of it.

Subscribe to my newsletter

Read articles from Victor Ugochukwu directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by