[SAP HCM] A neat approach to capture retroactive wage types

Việt Dũng

Việt Dũng

BREAK dungbv7.

1. Understanding business requirements

During the salary calculation process, when HR users modify employee data that affect the past payroll results (eg increase/decrease salary in the past), the system needs to:

- Recalculate those past payroll results

- Compare the new results to the old ones, each wage type that changed must be captured into a distinct retroactive wage type in the current payroll period

For example:

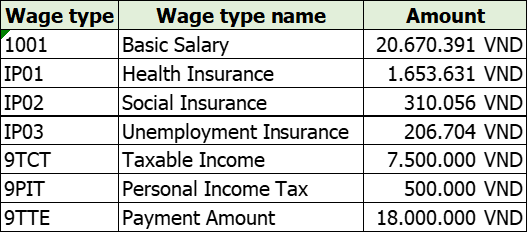

Remuneration sheet for 01/2022 (the payout version):

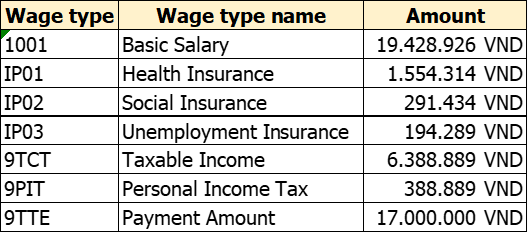

Remuneration sheet for 01/2022 (recalculation version):

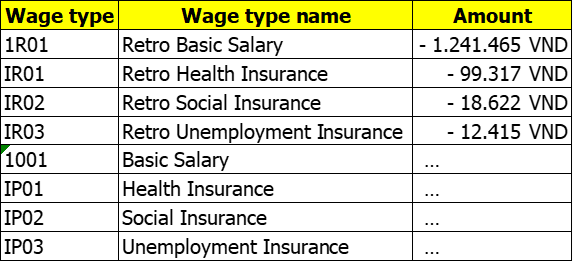

Remuneration sheet for 02/2022 (monthly payroll + retroactive amounts):

2. Understanding the retroactive mechanism of SAP HCM

When a retroactive event occurs, SAP behaves exactly like the example above.

The old payroll results are recalculated, then the differences in amount are captured into some specific wage types.

After that, these different wage types are imported as input for the current payroll period.

3. System configuration solution

If you look closely at the tables in part 1, you will notice that the retroactive amounts had been transferred into a new wage type when entering the current payroll period.

Wage type 1001 (Basic Salary) is turned into 1R01 (Retro Basic Salary).

The purpose of this procedure is to help HR users not get confused between the Basic Salary generated by retroactive and the Basic Salary of the current month.

Another thing is not all wage types that vary during the recalculation process are captured in the current payroll input. You can see that the wage types 9PIT (Personal Income Tax) and 9TTE (Payment Amount) are not collected into the current month's payroll.

In almost every project that I participated in Vietnam, the chosen solution is to follow the structure of schema XRR0 - "Retroactive accounting INTERNATIONAL".

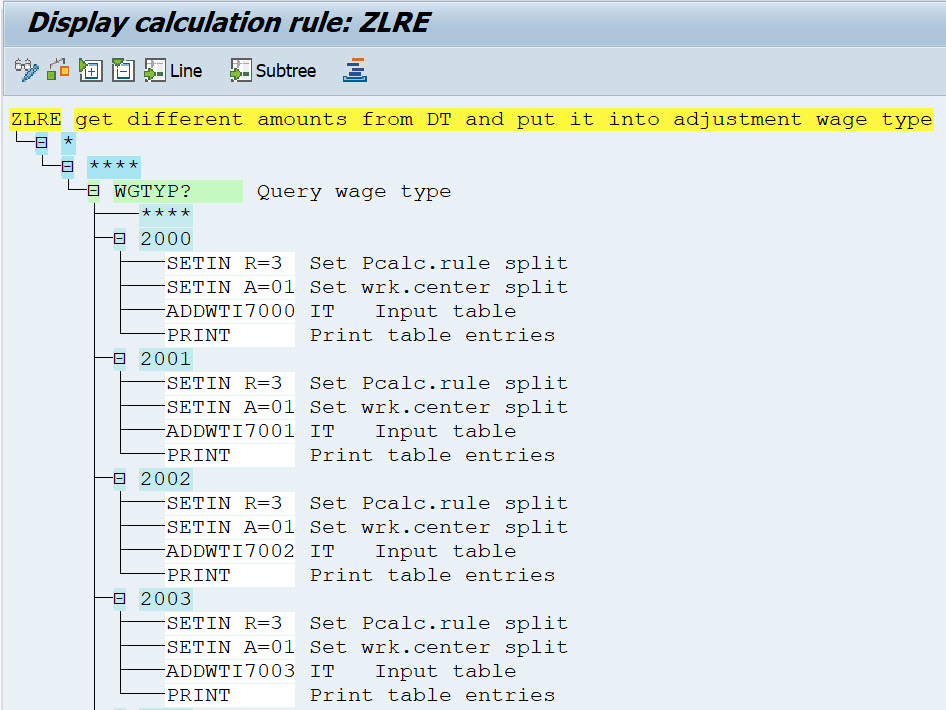

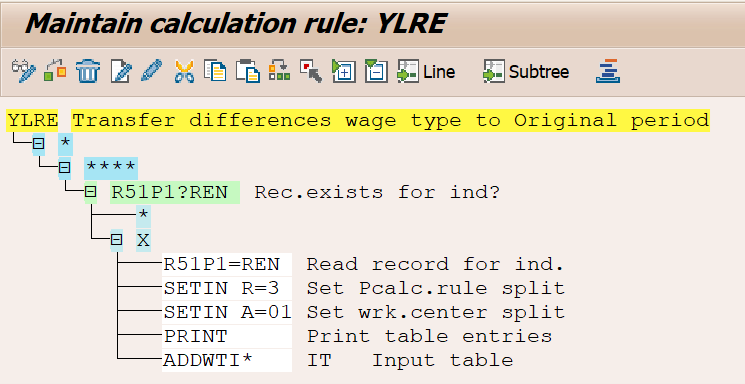

The three most important PCRs used in this schema are: Z042 – Transfer wage type from ORT to DT Z043 – Transfer wage type from IT/RT to DT ZLRE – Transfer wage type from DT to IT

Inside these PCRs, all the wage types are listed along with their corresponding retroactive ones.

A huge disadvantage of this solution is that PCR is too lengthy and hard to manage.

So today I will introduce to you another choice to make your PCR looks neat and cool 😎.

4. A new approach

With the new approach, we will use the Wage type assignment feature.

The wage type assignment feature in country grouping 99 is used for the deductions process but we can take advantage of it here as well.

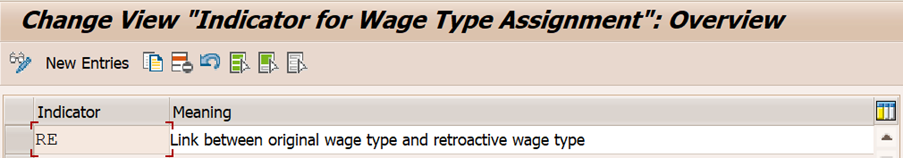

Step 1: Create an indicator for wage type assignment

Access Tcode SM30 and edit maintenance view V_T51P3

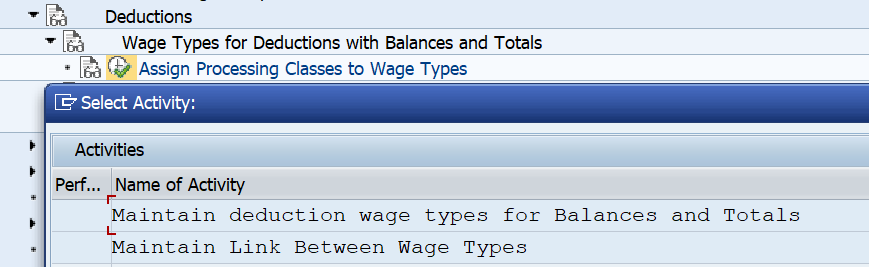

Step 2: Create links between original wage types and retroactive wage types

Wage type assignment configuration can be found under the following path in SPRO:

SAP Reference IMG -> Payroll -> Payroll International -> Deductions -> Wagetype for Deduction with Balances and Total -> Assigning Processing Classes to Wage types -> Maintain Link Between Wage Types

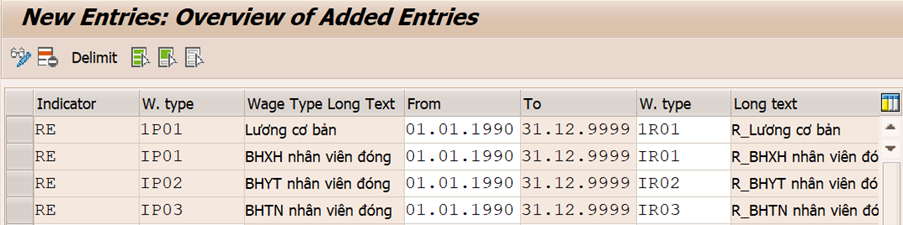

In maintenance view V_T51P1, we will create new wage type assignment lines as below:

Now you can replace your thousand-of-line ZLRE with this new one:

Operation R51P1?REN will read table T51P1 using the current processing wage type and indicator RE, if the system finds out any record, it will fill X in the variable key.

With the same logic, operation R51P1=REN will read table T51P1 using the current processing wage type and indicator RE, then write the linked wage type into wage type value in table OT.

As a result:

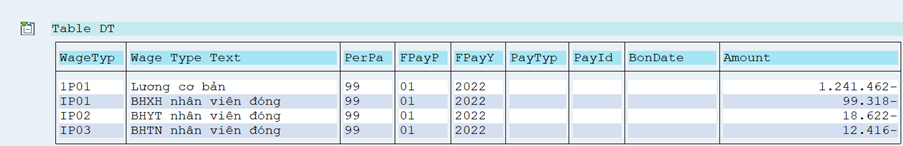

Table DT:

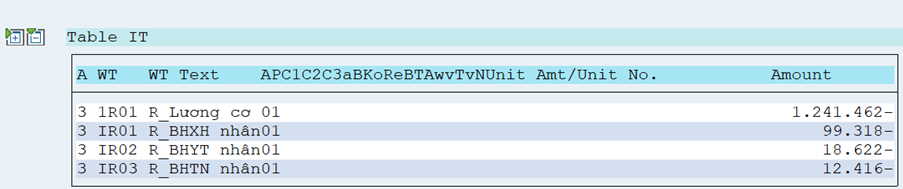

Table IT:

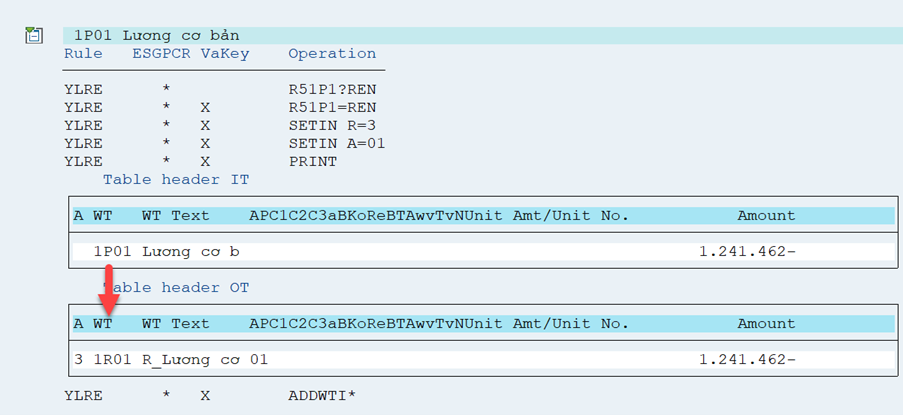

When we click for detail processing of 1P01, we can see that it is transformed into 1R01 during PCR execution:

Ok, that is all for today. Thanks for reading 😀

May the best solution be with you

Subscribe to my newsletter

Read articles from Việt Dũng directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Việt Dũng

Việt Dũng

I am a SAP HCM consultant from Vietnam.