A Byte of Blockchain - Week 43 Crypto Assets Custody

Anand N

Anand N

0Image by mohamed Hassan from Pixabay

Recap

Last week we explored keys (private & public), addresses & signatures which are used to link an individual to his / her cryptocurrency.

We explored private keys which are random numbers generated by the system through entropy. These private keys are then used to generate public keys through ECDSA (Elliptical Curve Digital Signature Algorithm).

From the public key, Ethereum Addresses are generated by hashing the public key.

When a transaction is generated, it is "signed" using a parameter from the transaction & the private key.

We also explained "seed phrase" which are a set of random words generated by the wallet & allows the wallet owner to regain access to his / her wallet in case it is broken (hardware wallet) or in case the owner loses their phone (mobile wallet).

As Spiderman said - "With great power comes great responsibility". This means with a hardware wallet, we have complete custody of our crypto funds and can transfer it to anybody (with a valid Ethereum address) or invest it without any limitations. This also raises the bar in terms of individual responsibility to manage the crypto funds & ensure its safety & security.

Let us delve into custody of crypto assets & explore the options available.

Custody

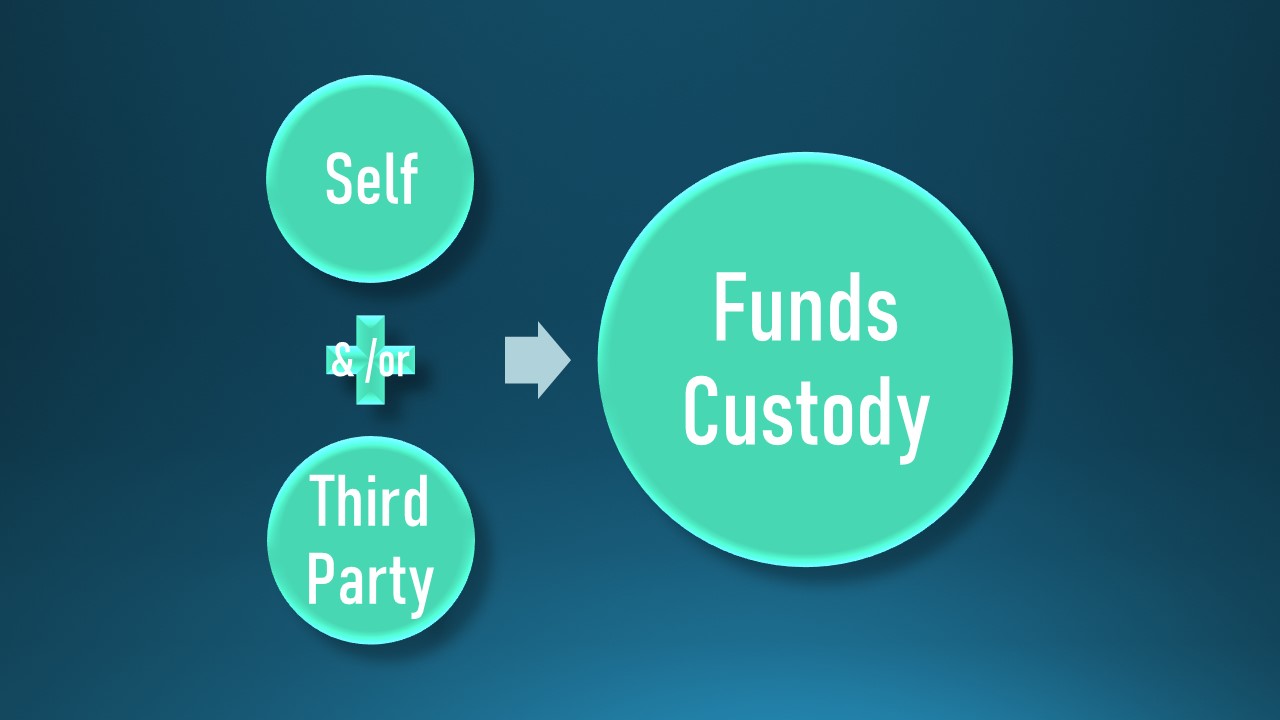

Before we get into crypto asset custody, let us take a step back & understand how funds are currently managed. They are managed :

a. By the individual (Self) or

b. By a Bank or Institution on behalf of the individual (Third Party)

By the Individual (Self)

We used to (or still !) manage fiat money by keeping it in wallets or purses (I mean good ol' fashioned leather wallets) & paying for goods or services as necessary.

Image by John Loo from Pixabay

Here, the fiat money is in the owner's physical custody and no one else other than the owner has access to their cash. This is called self - custody.

By a Bank or Institution on behalf of the individual owner (Third Party)

If we maintain accounts with banks or brokerages, the funds are held in the bank or the brokerage. We can park the funds there, transfer funds to any third party or withdraw funds for our use.

In such cases, the funds are held by the third party (the Bank, Financial institution or Brokerage) on our behalf subject to internal procedures & regulations surrounding KYC / AML. (KYC refers to KNOW YOUR CUSTOMER & AML refers to ANTI MONEY LAUNDERING).

These Banks & Institutions are legally recognized as custodians & allowed to hold & manage funds on behalf of others through regulations. They charge fees & other charges for managing & storing these funds. The responsibility for ensuring our funds are protected from hacks is that of the Institution.

Crypto Asset Custody

From leather wallets, we have now come to

Hardware Wallets or

Software (Web or mobile) Wallets

Image by mohamed Hassan from Pixabay

Just like in traditional finance, crypto currencies or holdings also need to be stored securely.

Similar to traditional finance, there are two main types of crypto custody :

Self Custody

Third - Party Custody

Self Custody

Self Custody is where the individual personally owns the wallet & that individual solely manages the private keys without any Institutional support. Thus, owning an individual wallet carries with it the responsibility of ensuring best practices in key management & support.

As I mentioned last week, if we lose our private keys or seed phrase (recovery phrase), we lose our crypto holdings forever & there is no way to retrieve it back. Hence, the responsibility may be too much for some to self custody & these individuals opt for the second option.

Third Party Custody

At the beginning, people who want to dabble in crypto purchase their first cryptocurrency through exchanges or third party crypto custodians. These third party crypto custodians are typically registered financial services providers (like traditional Financial Institutions) that are licensed to serve as custodians of crypto assets.

It is easier to manage cryptocurrencies through exchanges as we are used to our financial holdings being managed by third parties. The Institution is responsible for securely managing our funds & ensure compliance with the necessary rules & regulations. However, there are fees or charges which are deducted by these custodians for the services provided as in traditional finance.

Also, the private keys used to hold these cryptocurrencies are that of the exchange & not the individual. So, if the exchange is hacked, it means that its private keys which holds your crypto assets are hacked & you lose all your holdings. The most famous exchange hack is that of Mt. Gox.

Also, if the exchange is going through liquidity issues, they can restrict access or lock you out of your holdings.

So, there are pros & cons of selecting one option over another & depends on how comfortable you are in the technical aspects of managing wallets & key security. There is a steep learning curve that comes with the responsibility of managing your own crypto holdings with regard to security & technical expertise.

Subscribe to my newsletter

Read articles from Anand N directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by