It's Time To Build For Builders

swyx

swyx

The financial media have been depressing this year with doom and gloom with recession and layoff news.

But here is a brief recap of notable early stage devtools VC fundraising over the last 3-4 months alone in 2022 (after a 31% drop in the Nasdaq in 1H 2022):

- Heavybit: +80m focused on devtools and enterprise

- Afore: +150m for pre-seed

- BoldStart: +192m for devtools, crypto infra, and SaaS

- Redpoint: +650m for seed-to-B

- Amplify: +400m focused on technical founders

- CRV: +1b for seed-to-A

- Lightspeed: +2b for seed-to-B

Applying a healthy discount as some of these are generalist funds, this represents at least $3,000,000,000 in "dry powder" cash waiting to be invested in early stage devtools startups.

Cloudflare also announced a "Workers Launchpad" nominally pegged at $1.25b, but we are not counting this because while there are a bunch of funds that certainly represent money ready to invest, the accounting is unclear.There are also new types of funds emerging that aren't traditional devtools, for example Sarah Guo's new $100m Conviction fund focused on Software 3.0 (aka investing across the AI/ML full stack from hardware to prompts).

There has never been a better time to be a devtools founder.

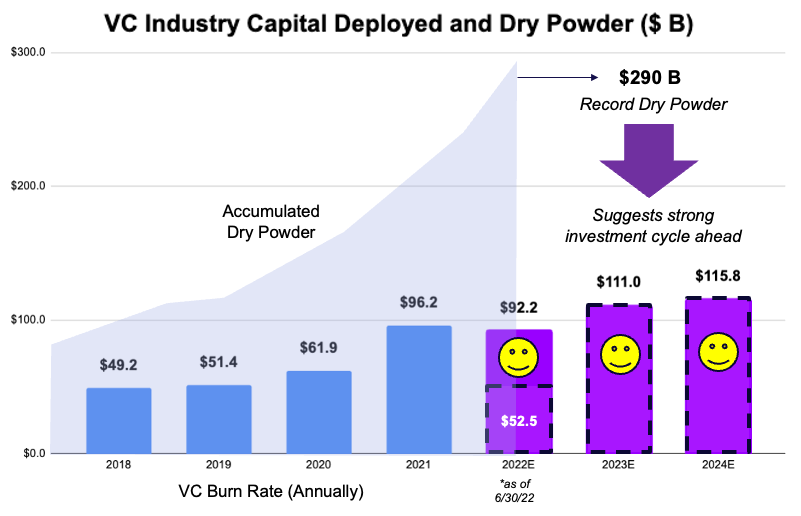

As Decibel Partner's Jon Sakoda points out, the total VC industry dry powder, right now, might go as high as $290 Billion.

There's plenty of angel investor money too, from freshly liquid Snowflake, Figma, Airbnb and Coinbase employees all the way down to successful founders who want to pay it forward.

I've been running the devtools-angels Discord (better UI here) for 2 years now and our group of 100+ investors can invest checks of up to $100k. Hit us up!

Subscribe to my newsletter

Read articles from swyx directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

swyx

swyx

Writer & Curator, DX.Tips