The Horrific Demise of FTX

CFXN Token

CFXN Token

On November 11, 2022, FTX, one of the leading crypto exchanges, filed for Chapter 11 bankruptcy protection following a quick fall from glory. Sam Bankman-Fried saw his $16 billion net worth drop to almost nothing as the company’s value plummeted from $32 billion to bankruptcy in a couple of days.

The unstable cryptocurrency market was shaken by FTX’s collapse, losing billions of dollars in value and falling below $1 trillion.

The fallout from FTX’s sharp downturn and demise will affect cryptocurrencies for a long time and may even bring down more general markets.

On November 16, 2022, a class-action lawsuit was submitted to a Florida federal court, stating that Sam Bankman-Fried had fabricated a cryptocurrency scam scheme intended to defraud unskilled investors from all over the nation. In addition to Larry David and Kevin O’Leary, other well-known people who allegedly assisted Bankman-Fried in carrying out the scheme are Steph Curry, Shaquille O’Neal, Shohei Ohtani, Naomi Osaka, and Shohei Ohtani.

The FTX collapse will be discussed at a hearing by the U.S. House Financial Services Committee in December 2022.

###A Quick FTX History

Founded by Bankman-Fried at 28, FTX has blossomed into one of the largest cryptocurrency exchanges with a $32 billion valuation in three years. Bankman-Fried used aggressive marketing tactics, including a Super Bowl ad campaign and purchasing naming rights to the Miami Heat’s home arena. He rose to prominence due to his political lobbying, donations, and efforts to support the cryptocurrency industry in general. For example, as token prices fell in early 2022, he facilitated $1 billion in deals to help cryptocurrency companies struggling due to token price declines.

###What Happened to FTX

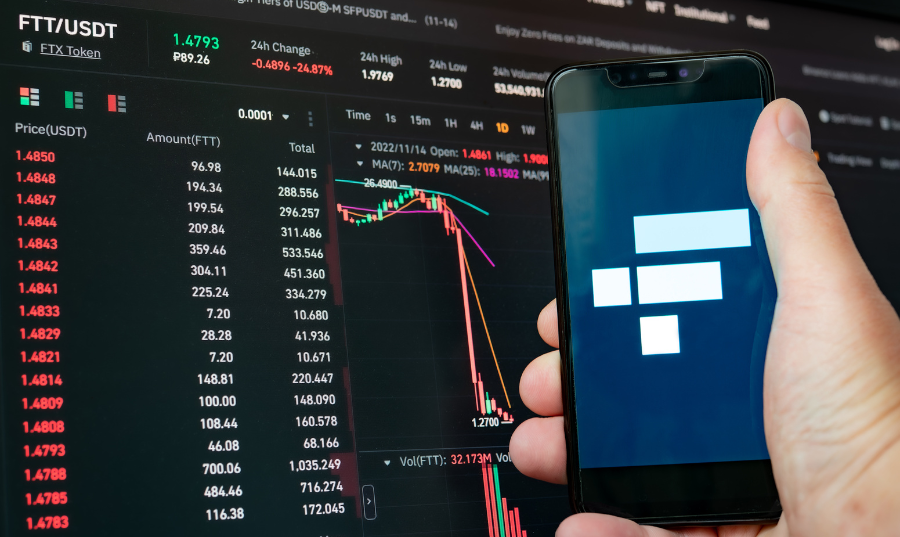

The crash of FTX occurred over ten days in November 2022. A CoinDesk scoop on November 2 showed that Alameda Research, the quant trading firm also run by Bankman-Fried, held a $5 billion position in FTT, the native token of FTX. According to the report, Alameda’s investment foundation was also invested in FTT, the token created by its sister company, rather than a fiat currency or other cryptocurrency.

The cryptocurrency industry is concerned about Bankman-companies’ Fried’s undisclosed leverage and solvency.

What Binance is Saying

On November 6, Binance announced that it would sell its whole position in FTT tokens — roughly 23 million tokens worth $529 million. Following the demise of the Terra (LUNA) crypto token earlier this year, Binance CEO Changpeng “C.Z.” Zhao said the decision to liquidate the exchange’s FTT position was based on risk management.

Crisis in FTX liquidity and the Binance Deal

The following day, FTX went through a liquidity crisis. Bankman-Fried made an effort to reassure its investors their assets were safe, but in the days that followed the CoinDesk revelation, the customers demanded withdrawals totaling $6 billion. Before resorting to Binance, Bankman-Fried looked for more funding from venture capitalists. As a result, FTT’s value decreased by 80% in just two days.

On November 8, Binance revealed it had signed a non-binding deal to acquire FTX’s non-U.S. business for an undisclosed fee, helping its close rival out.

Binance cancels the bailout agreement with FTX.

The promise of rescue was only temporary, as Binance withdrew from the agreement the following day. The exchange said on November 9 that it would abandon the FTX acquisition after corporate due diligence revealed concerns regarding, among other things, the improper handling of customer assets.

The Freezing of FTX tokens

Following reports that Bankman-Fried was looking for up to $8 billion in capital to save the exchange, the Bahamas securities commission froze the assets of FTX Digital Markets, FTX’s Bahamian affiliate, on November 10.

The California Department of Financial Protection and Innovation disclosed that an inquiry into FTX had begun the same day.

On Twitter, Bankman-Fried acknowledged the liquidity situation and apologized for FTX’s non-U.S. exchange’s inability to meet consumer demand. According to Bankman-Fried, FTX miscalculated leverage and liquidity due to “bad internal labeling.” He stated that Alameda would stop trading in the same post.

What is the Future of FTX?

As a cryptocurrency exchange, FTX’s future is in grave danger. Withdrawals are no longer possible as of mid-November 2022, and the corporation “highly advises[s] against depositing,” according to a post on the FTX website.

It will take some time before the broader ramifications of the FTX debacle on the bitcoin market become clear. Investors may already be wary because of worries about stability and security, but FTX, the most significant drop in the brief history of cryptocurrencies, may put them off even more. For example, customers on the FTX platform might be unable to retrieve their assets, which could result in legal action. In addition, the collapse of FTX may be used as justification by the U.S. Securities and Exchange Commission (SEC) and other regulators for strengthening regulatory oversight of cryptocurrencies. As a result, Congress may be more willing to intervene and enact new legislation regulating digital tokens and exchanges.

The demise of the third-largest exchange in terms of volume will cause ripple effects throughout the cryptocurrency community for some time. BlockFi, a cryptocurrency lender, halted client withdrawals on November 11, 2022, and speculations suggest that the company may face trouble in the future. On Nov. 12 and 13, 2022, there was a spike in withdrawals on Crypto.com. Customer withdrawals from Genesis Global Capital’s cryptocurrency lending unit have been suspended. And the collateral harm has probably only just begun.

About CFXN

CFXN meets its users’ banking needs. You gain complete control over what happens to your money without worrying about economic inflation or the security of your funds. The best thing about CFXN is that it introduces cryptocurrency to the general public. And because it is simple to use, even a grandmother or a kindergarten student can use it. Tom invites anyone interested in riding the wave of success in blockchain, finance, and crypto to invest in the project and share in the profits made by CFXN.

To learn more (and in case you have questions) or if you are interested in investing in the project, reach out to Tom at tdb@cfxnx.com.

Subscribe to my newsletter

Read articles from CFXN Token directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

CFXN Token

CFXN Token

CFXN Tokens is a utility token used across CFXN’s trading platforms and services.