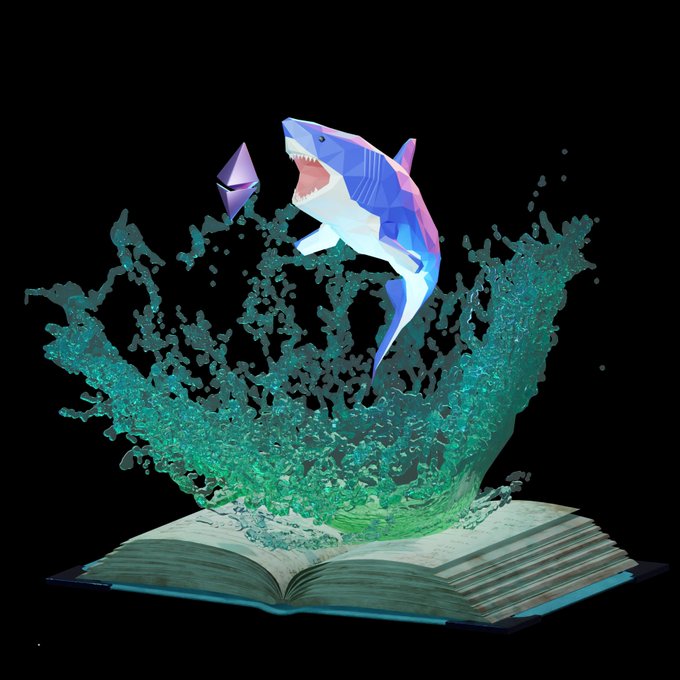

Introducing Poolshark Protocol

Gas Protocol

Gas Protocol

What is Poolshark Protocol?

Poolshark is a noncustodial directional automated market maker implemented for both Fuel and the Ethereum Virtual Machine. The Poolshark team has implemented a new mechanism different from the ubiquitous Automated Market Making model. This article explains succinctly the innovative features of Poolshark Protocol and how it is built to minimize the risk involved in providing liquidity for efficient decentralized trading activities.

How Automated Market Makers Work

An Automated Market Maker (AMM) is a decentralized exchange protocol that uses a mathematical model to provide the price of cryptocurrency assets. The common formula used in this type of pricing algorithm is x * y = k, where x is the total amount of one cryptocurrency in the liquidity pool, y is the total amount of the second token in the same pool and k is the product of x and y which must be a constant. The tradable liquidity in the pool is made available by other users known as liquidity providers to enable efficient trading activities for the tokens available. For every trading activity, a small percentage of the tokens are deducted as trading fees, most of which are earned by the liquidity providers.

Impermanent Loss

Even though the AMM mechanism is currently the most efficient way to facilitate a decentralized marketplace, there is a risk to it. An example of this potential risk involved is when there is a sharp increase or decrease in the price of any of the tokens being traded in the market after a liquidity provider has deposited their holdings into the pool. The algorithm implemented in AMMs ensures that you get the exact ratio of what you own in a pool, regardless of their price actions after you have deposited. For example, if you deposit $100 worth of ETH (when 1 ETH is $100) and $100 worth of USDT in a pool that totals 100 ETH and 10,000 USDT. This means that you have 1% of the liquidity pool. If something funny had happened in the news overnight and there was an upward price action in the market, then the value of your deposit would have been affected. Let’s say that 1 ETH now trades for $120. Since your ratio in the pool was 1% of the total, if you try to pull out your deposit, you will be able to claim 0.9129 ETH and 109.54 USDT. If you simply held your tokens without providing liquidity, at the current ETH price, your holdings would be worth 219.08 instead of $220.

This phenomenon is called “Impermanent Loss” because there is an assumption that if the liquidity provider doesn’t withdraw their deposits from the pool and the price of the tokens involved returns to their previous values, then the potential loss is annulled. Most of the time, this is not the case since you might eventually remove the liquidity provided at a different price for the same ratio of what you had deposited in the pool. Even though the loss in the example above is just about a dollar, it is very significant with higher values of liquidity.

Poolshark has created a novel model for solving this issue known as the directional automated market-making mechanism. As written in the white paper, “In comparison to its predecessors, it allows liquidity providers to adopt a buy-and-hold strategy using a closed-form solution for liquidity position tracking.” Poolshark Protocol can be regarded as a type of stop-loss trading order that can be used to minimize the potential risks that come with the regular AMM mechanism.

Directional Automated Market Making (DAMM)

Directional AMMs can be defined as a smart contract allowing for liquidity to be exclusively traded between token0 => token1 and token1 => token0. It differs from the bidirectional liquidity AMM in the sense that any trading done between a token pair is irreversible and discrete. One of the reasons for impermanent losses is the fact that swaps are recyclable using the regular AMM model. Directional automated market makers (DAMMs) are an extension of automated market makers wherein liquidity in the pool is non–recyclable and discrete liquidity curves exist for each trading direction.

The Poolshark Protocol delivers these qualities with two distinct features designated as Cover Pools and Price Pools. From the white paper, Cover Pools enable the liquidity provider to unlock liquidity as the price moves against the asset which they provided to the liquidity pool while the Price Pools allow for pro-rata price priority, where users executing liquidity swaps receive the lowest price for their chosen trading direction.

What are Cover Liquidity Pools?

Recall from the official docs that “Cover Pools enable the liquidity provider to unlock liquidity as the price moves against the asset which they provided to the liquidity pool” as this serves as the base for understanding what this section represents.

Cover Liquidity Pool is a specially designed pool that unlocks liquidity to purchase the asset affected by a change in price action. It seeks to cover any impermanent loss that might affect the portfolio of the LP. Because Poolshark ensures that tokens would not be swapped in either way by using the buy and hold strategy, the position being held is spread to purchase the token with changing values in the market.

As the price of the tokens of a depositor’s liquidity changes significantly, the protocol sells off some part of the LP’s holdings in a Gradual Dutch Auction style by periodically adjusting to the current market price per time using the TWAP oracle. The Gradual Dutch Auction helps in finding the fair market value of an asset. How this works is that over a specified period, e.g., 20 minutes, the protocol purchases the total number of tokens required to offset the impermanent loss. The time-weighted average price oracle provides the accurate pricing data needed to implement this.

What are Price Liquidity Pools?

Also from the white paper, “Price Pools allow for pro-rata price priority, where users executing liquidity swaps receive the lowest price for their chosen trading direction.” This is another kind of pool that is to be implemented in the Poolshark Protocol. It functions by providing an exit in an LP’s position after a certain token has been filled based on its average prices at particular periods in time. This feature has two benefits.

i. The users trading and swapping tokens in the pool will be guaranteed the best possible pricing of assets

ii. The LPs can receive range orders that put them in an advantageous position for profitability.

This can be summarized as the "take-profit" strategy used in normal trading.

Team

The Poolshark Protocol team is made up of alphak3y - Lead Smart Contract Engineer, 0xnexusflip - Full-stack Developer, Zach Miller - Front-end Developer, and Zach & Jarred who are the Business Development members.

Conclusion

Poolshark Protocol is still under active development and is expected to launch on the Arbitrum mainnet in March while its release on the Fuel blockchain testnet is projected to be around early April which is when the Fuel network testnet is expected to launch publicly.

Subscribe to my newsletter

Read articles from Gas Protocol directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by