Commonwealth: The Capital Model

Brandon Thorn

Brandon Thorn

While I prod the identity portion of the toy DAO of DAOs forward, I decided I'd switch gears a bit and try to capture the other portion of Commonwealth better: The Capital Model

Elevator Pitch

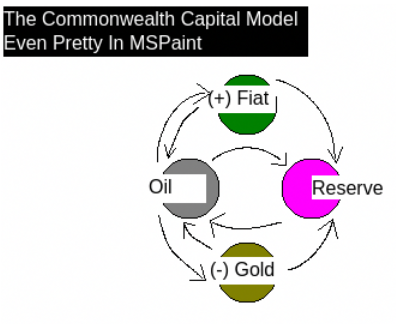

"The Capital Model" is an experimental model for a DAO-governed Fiat asset underwritten by a Reserve, 3 other asset classes, and some fractions that allows the DAO to set monetary policy. It was first prototyped/captured at Fractional.Foundation.

Description

The Capital Model is a microcosmic economy comprised of 4 assets of different classes: 1 core burn token acting like the energy commodity driving the economy, and 3 derivatives that are minted according to a set of fine-tuneable fractions. The objective of the model is to underwrite the relative stability of the Fiat asset using the DAO-determined fractional tunings and the multi-asset class Reserve. This Reserve would then also allow the DAO to expand assets under management to better diversify and stabilize it through market fluctuations, and will be used as part of the social insurance and social-good investment fund element of the DAO captured at the SI2 repo.

TL;DR: like our real economy, energy is a commodity that is burnt to produce currency and capital, while the "tax man" (ie: Reserve) takes their cut to underwrite the value of said currency... ie: this crude picture.

The Assets

CommonOil

This is the core burn token, acting like the energy commodity of the microcosmic Commonwealth economy. Its activity is the driver of all generated derivatives, and tuning decisions will be made in large part based on its activity trends against the targeted stability measurements of the Fiat. It exists to be burnt, using that "work" as the driver for the broader Commonwealth Economy, just like real oil is burnt for work and has underpinned our global economy.

Total/Max Supply: 10.8 billion (projected peak population)

Decimals: 18

CommonFiat

This derivative asset is the highest priority of the 4 classes, having the objective to maintain a relative measure of inflation stability against its level of usage. This measure will need to be defined, as will the KPIs that feed into it. It is an inflationary asset targeting an inflation rate determined by its demand/usage as a Fiat currency.

Its purpose will be to act as a proper currency, acting as the unit of exchange for commerce, and will be supported in that goal by SDKs and integrations made for vendors/marketplaces. In regions of highly volatile, or high-inflation national currencies, it aims to act as a "lingua franca" of commerce, providing a means to retain value and maintain commerce through periods of socio-economic variability by becoming more stable and more accessible/utilizable over time with adoption. It also aims to expand markets to become increasingly useful to world travellers, offering a way to avoid exchanging currencies by serving as a borderless currency. Experiments enabling regionalized currencies to be launched atop it are in consideration.

Initial Supply: 1 trillion

Decimals: 6

CommonGold

This derivative has a simple mandate: be scarce and get scarcer over time. It too can have its scarcity tuned by the DAO to incentivize/disincentivize activity as needed, but will get exponentially scarcer as the core tax rate lowers, while also enforcing long-term scarcity through enforced difficulty increases over time (curve tbd).

Initial Supply: 0

Decimals: 18

CommonShare

This derivative is minted as the result of the pooled CommonOil, and is an indivisible asset representing a share of the Reserve. In the early phases, it will remain unused, simply floating on markets. As the DAO-of-DAOs and subsequent social insurance and social-good investment fund components are launched, CommonShares will enable early, premium, or potentially exclusive access to the investment vehicles they're comprised of. To ensure clarity, these "Shares" are in no way tied to governance. Governance is tied to Identity and social capital via reciprocal social-proofs.

Initial Supply: 0

Decimals: 0

The Fractions

All fractions are tuneable by the DAO governing monetary policy. The Litepaper captures the mechanics/math in more detail, and the Capital Model Dashboard (which will be used to track monetary policy, forward guidance, and relevant charts/indicators) contains a calculator to help assess the transaction volume required. All numbers are likely to change ahead of launch.

Core Fractions

taxFraction: 10, for 1/10

brintFraction: 2, for 1/2

opsFraction: 2, for 1/2

shareFraction: 10, for 1/10

entropyFraction: 5, for 1/5

fiatFraction: 100, for 100/1

Reserve Fractions

XCO: 2, for 1/2 of tax value (remainder burnt)

XCF: 3, for 1/3 of brinted XFF

XCG: 2, for 1/2 of brinted XFN

Governance

To bring it back to the part that's got me blogging to begin with, this model is rooted in not just a DAO, but one that aims to be a DAO-of-DAOs, or a "commune of communes".

Critical to the idea of this model is that governance should not in any way factor in access to capital or use a count of investment-oriented assets to determine influence. This should be the goal of any DAO IMO, since importing a capital-derived caste system seems counterproductive to the decentralized ethos, but is especially important for a DAO that will be managing its own economy, and which has responsibilities to the "Citizens" of the network. Reputation implementations will be able to be chosen per DAO, providing for flexibility and regionalization, but the Reputation implementation overseeing the monetary policy and asset management-related decisions will be the most critical for ensuring long-term viability by negating elite capture and using a very data-driven approach in relevant social-proofing strategies.

Wrap-Up & Next Steps

While the Capital Model exists as its earlier prototype and a partially started release candidate refactoring it with ERC2535, for the moment it's less of a dev concern, and more of a theoretical/analytical one. To that end, next steps will for now remain trying to collect feedback from any willing econ-minded participants who can either destroy the model, or help firm up the case for its viability.

In the meantime, with the toy identity package, complete with Org-of-Org membership support now passing its first round of tests, I'm a hop, skip and jump away from integrating it with the dao package, and being able to start toying with the Reputation construct and its related social-proof/reciprocity mechanics :)

Subscribe to my newsletter

Read articles from Brandon Thorn directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by