CSID and Its Role in E-invoicing

Ajith Kumar M

Ajith Kumar M

Introduction :

Stepping into the World of CSID

Welcome! You’ve come to the right place if you're looking to discover what CSID is all about. In our increasingly digitized world, terms like CSID pop up more frequently. However, CSID's importance goes beyond just being another tech acronym; it plays a significant role in various fields, most notably E-invoicing. Let's take a closer look.

Demystifying CSID

So, what exactly is CSID? Depending on the context, CSID can stand for a few things. In cybersecurity, it can refer to a Cybersecurity ID - a unique identifier assigned to manage security protocols. In telecommunications, CSID stands for Called Subscriber Identification, typically used by fax machines or modems.

But in our discussion, we focus on CSID (Cryptographic Stamp IDentifier), an identity protection and fraud detection tool. Its advanced technology and suite of features are especially relevant in the world of E-invoicing.

E-invoicing – A Game Changer in the Economic Landscape

Having understood what CSID is, let's delve into E-invoicing. E-invoicing is the digital way of issuing, storing, and exchanging invoices. It's part of a larger drive to digitize economies worldwide, aimed at boosting efficiency, reducing fraud, and improving tax compliance.

CSID and E-Invoicing – A Powerful Duo

You might ask, "What does CSID have to do with E-invoicing?" Well, the link lies in CSID's identity protection and fraud detection capability, which are vital in an E-invoicing system where secure transactions are paramount. CSID can provide security solutions to protect sensitive data and prevent fraud, making it a crucial element in E-invoicing implementation.

The Significance of CSID in E-Invoicing Systems

As we dig deeper, let's understand why CSID holds such significance in E-invoicing systems. The crux of the matter lies in the sensitive nature of invoice data. E-invoices carry valuable information that, in the wrong hands, could cause harm.

CSID comes into play here with its advanced identity protection and fraud detection solutions. These tools ensure the secure processing of E-invoices, thus making CSID an integral part of any E-invoicing system.

Onboarding of a New EGS Unit(s)

Receiving CSID for the First Time

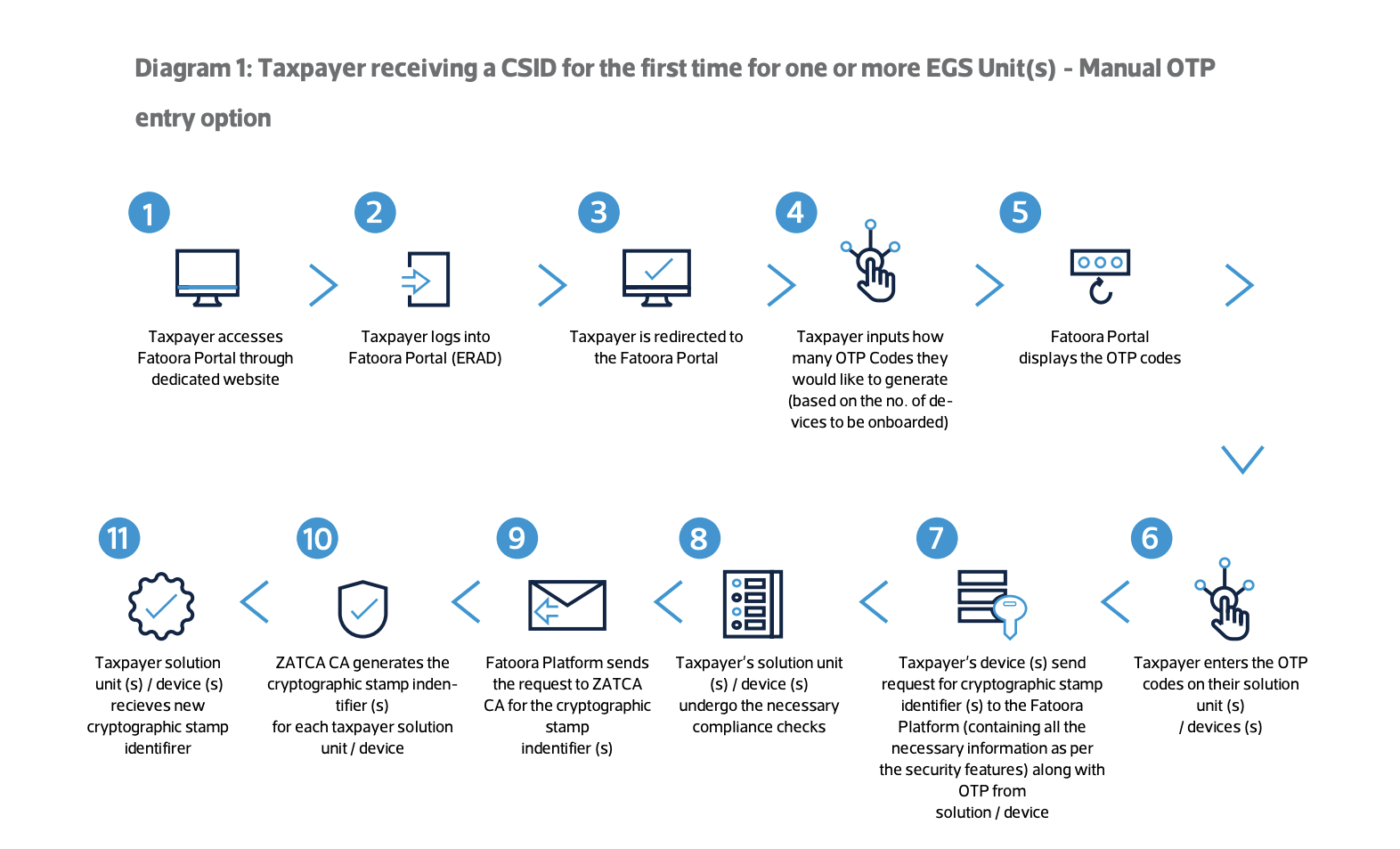

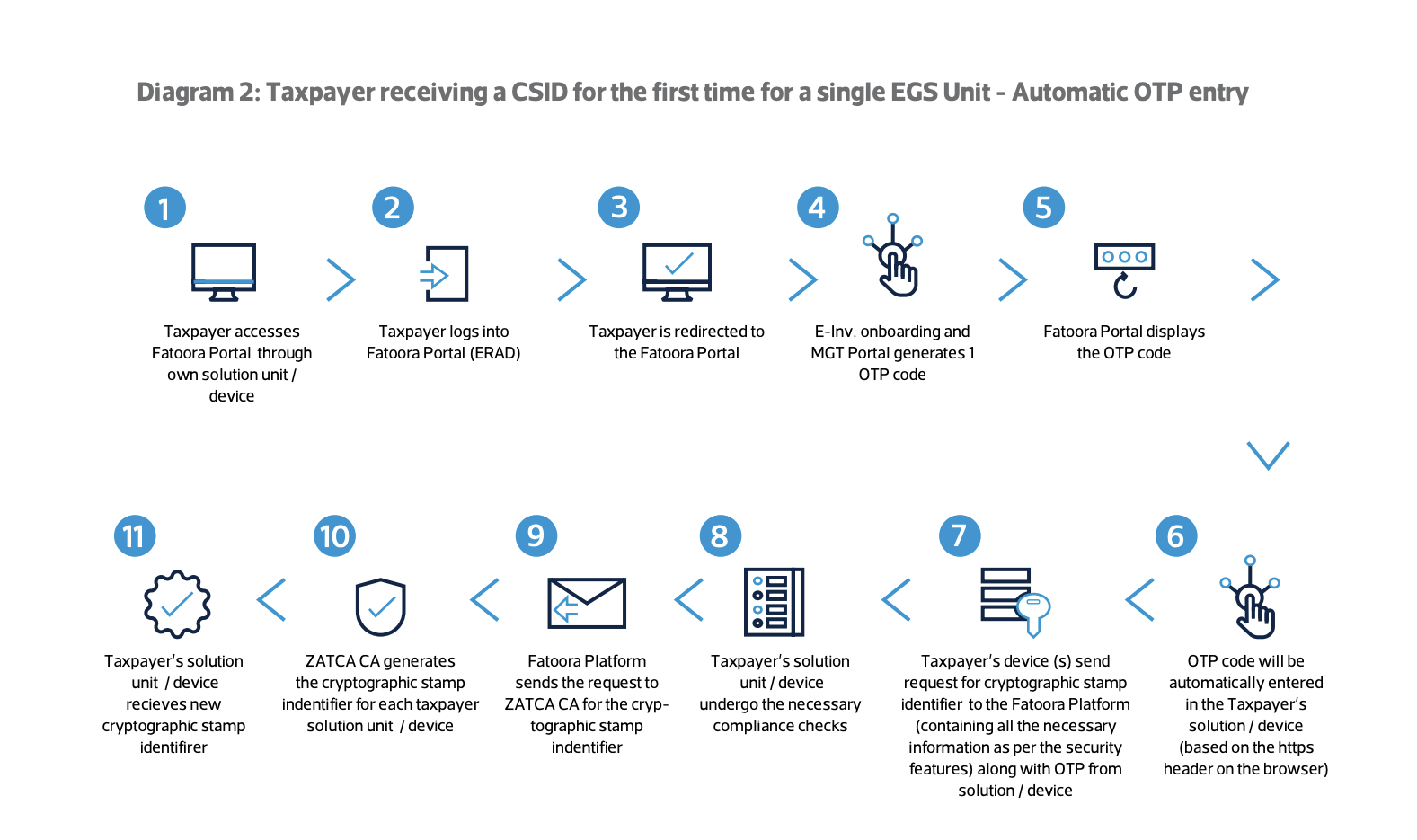

When it comes to onboarding a new EGS Unit(s) and obtaining a CSID for the first time, certain steps need to be followed. Let's break down the process into manageable stages.

Generating the One-Time-Password (OTP) The initial step involves generating a One-Time-Password (OTP) through the Fatoora Portal. This OTP serves as a unique identifier for the Taxpayer's EGS Unit(s).

Entering the OTP and Generating CSR Once the OTP is generated, the Taxpayer manually or automatically enters it into their EGS Unit(s). Subsequently, a CSR (Certificate Signing Request) is generated.

Compliance Checks and CSID Generation After the CSR is generated, the Taxpayer's EGS Unit(s) undergo necessary compliance checks. Upon successful completion, ZATCA CA (Zanzibar Tax Authority Certification Authority) generates the CSID(s) for each EGS Unit(s), which are then sent to the Taxpayer's EGS Unit(s).

Methods to Generate an OTP

Manual vs. Automatic OTP Entry There are two methods to generate an OTP for onboarding or renewing the CSID. Let's explore both options to understand their differences.

- Manual OTP Entry In the manual OTP entry method, the Taxpayer receives the OTP through the Fatoora Portal and manually enters it into their EGS Unit(s). This method allows the onboarding or renewal of CSID for single or multiple EGS Unit(s) simultaneously.

- Automatic OTP Entry In the automatic OTP entry method, the Taxpayer accesses the Fatoora Portal through their own EGS Units, and the OTP is automatically read by their EGS Unit(s). This method is limited to onboarding or renewing the CSID for a single EGS Unit.

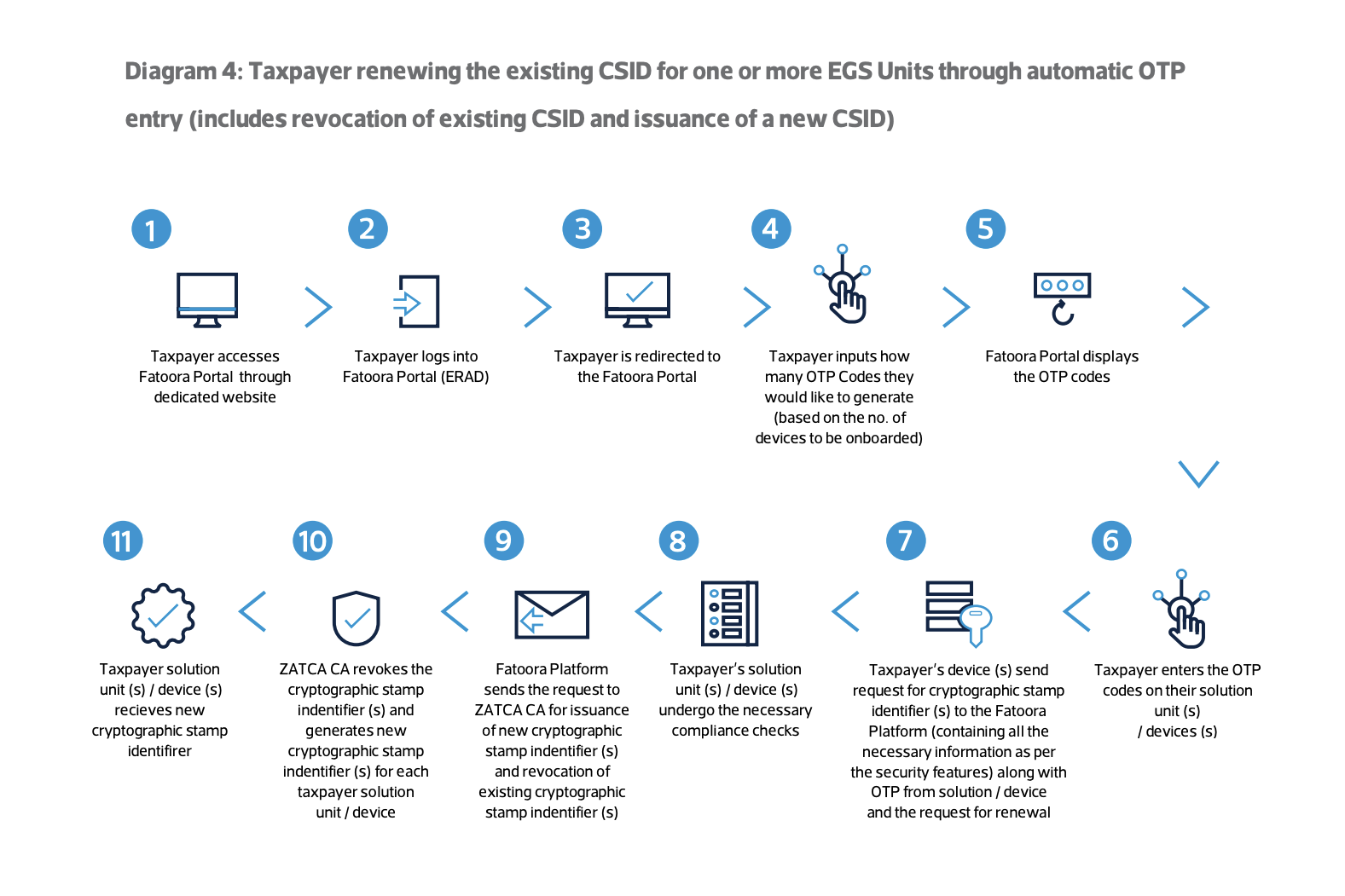

Renewal of Existing CSID(s) for EGS Unit(s)

- Streamlined CSID Renewal Process

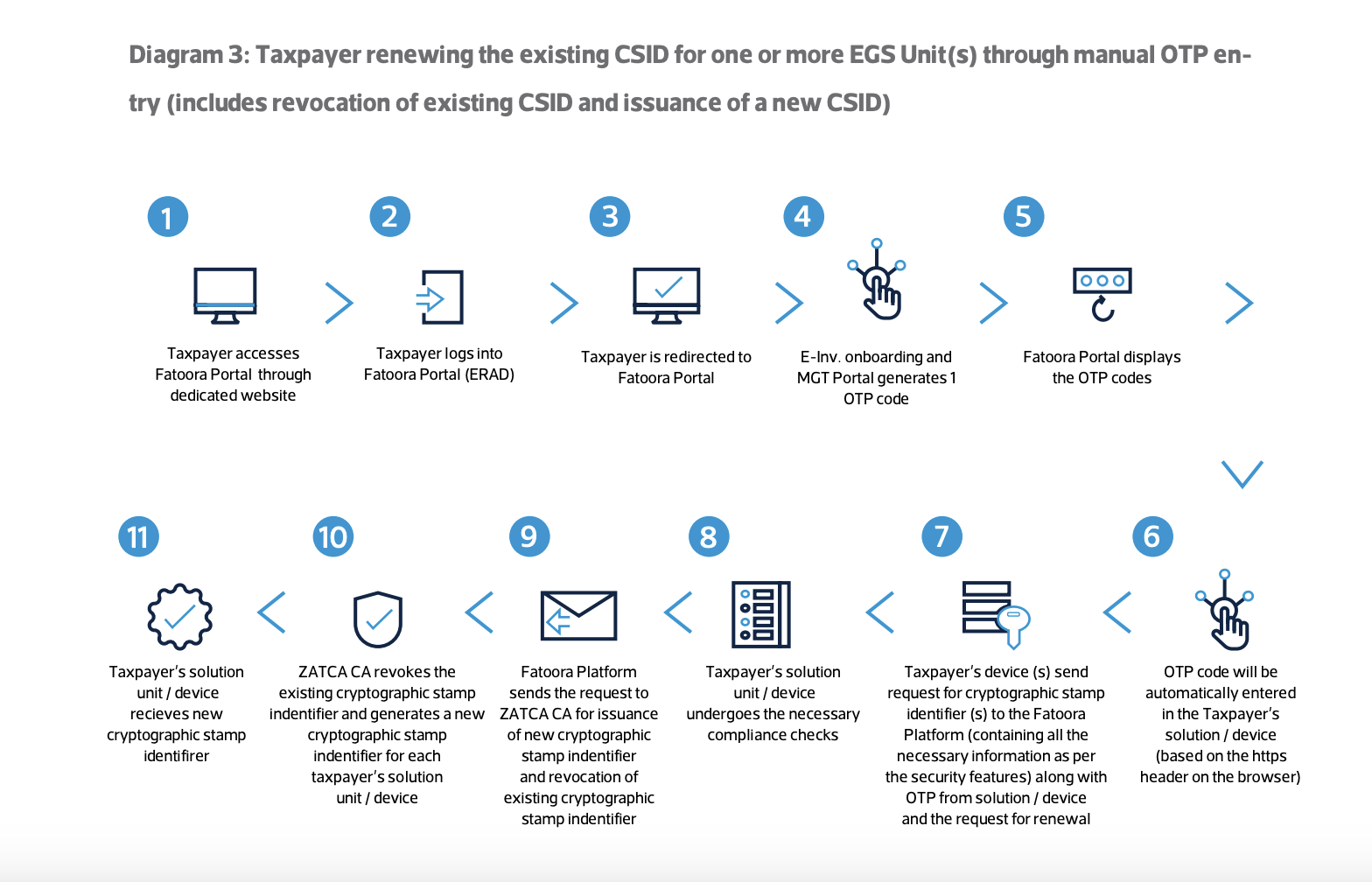

The renewal of existing CSID(s) for EGS Unit(s) follows a similar process to the onboarding procedure. However, it involves revoking the existing CSID and issuing a new one. Let's explore this process in detail.

Revocation of Existing CSID As part of the renewal process, the existing CSID is revoked before issuing a new CSID. This ensures the validity and security of the CSID.

Issuance of New CSID After revoking the existing CSID, ZATCA CA generates a new CSID for each taxpayer's solution unit/device. This new CSID is then assigned to the EGS Unit(s) for seamless continuation of operations.

Revocation of CSID(s) for EGS Unit(s) by the Taxpayer

Maintaining Control and Security Taxpayers have the option to revoke their existing CSID(s) for various reasons. Let's explore the scenarios in which revocation may be necessary and the process to initiate it.

Reasons for Revocation There are several reasons why a Taxpayer might consider revoking their existing CSID(s). These include instances of compromised private keys, discontinued EGS Units, inaccurate information in the CSID, loss or theft of the EGS Unit, unauthorized onboarding, or major upgrades.

Revocation Process Transition: To revoke existing CSID(s), Taxpayers need to access the Onboarding and Management Portal. Here, they can view a list of all their onboarded EGS Unit(s) and select the ones they wish to revoke.

Conclusion:

Envisioning the Future of CSID and E-invoicing

As we wrap up, it's clear that the combination of CSID and E-invoicing is shaping the path for the future of digital economics. As we continue moving towards a more digital world, the synergy of CSID and E-invoicing will become even more critical.

Understanding CSID and its role in E-invoicing offers insight into innovative technology and provides a glimpse into the future of digital transactions. As we part ways, keep in mind that every learning journey starts with a single step. Today, you took your first step into the world of CSID and E-invoicing. So, congratulations on this achievement and keep exploring!

Subscribe to my newsletter

Read articles from Ajith Kumar M directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by