Fiscal Deficits - Handle with care

Aditya Sharma

Aditya SharmaThere was a time when Governments would do anything to have a balanced budget and happy with a surplus budget. Then came the great depression of 1929 and this habit of thrift exasperated the depression until JM Keynes proved that Govt spending incurred during the slump reinvigorates the economy and since then deficit bias has existed in the budgets, especially in the developing countries, as a proof of Govt’s concern towards welfare activities in the country.

Like accident is not a problem, saving the life is. In the same manner, fiscal deficit is not a problem but financing the deficit is. The myopic or populist policies that wants minimum taxes and maximum freebies has obliterated entire country’s economy like Venezuela, Greece or made countries like Kenya, Sri Lanka surrender their ports to China or forced liberalisation of a socialist economy like it happened to India in 1991.

Also when you run persistent deficits, it largely inhibits the government’s ability to act in the times of crisis as no one lends you when you already have high debt. Southern European states like Greece, Spain, Cyprus had a tough time dealing with GFC recovery because they could not have more borrowing due to already large deficits. On the other hand, Germany, Australia since had budget surpluses for few years, it could not have much effect on their economy. This was visible again in the recent coronavirus pandemic where the countries are running generous deficits to revive their economies after nationwide lockdowns on the other hand countries such as Dominica, East Timor, Congo, Guinea-Bissau, Guyana, Kenya, Lesotho and Zambia are set to cut their deficits this year because no one is ready to lend them.

So the question arises, do countries need to go back to balanced budgets or fiscal deficit be continued. If yes then what limit is sustainable, what measures can be taken to limit and reduce it. This essay examines the current status of deficits all over the world, the problem it poses, alternatives to tackle fiscal deficit and steps being taken by the governments with special reference to India.

Historical and current outlook on fiscal deficits

Fiscal conservatism was a product of Classical economists based on the rationale of a household that you cannot spend money which you haven’t got. And fiscal deficit or expenditure by Govt to spur demand is useless because the consumer know he will be taxed higher in the future so he cut his expenditure1. Then came the great depression, fixation over balanced budget further exasperated the problem. John Maynard Keynes propounded his theories that how increased govt expenditure can solve the problem of economic slump. Since the private parties are not ready to invest, when govt will spend, people will have money by selling their services to Govt. It will kickstart the economy. China did exactly this in 2008-09 and spent $581 billion over building of infrastructure and registered a growth rate of over 9% at the time where every country was witnessing stagnation including India.

Neo classical economists contested otherwise that fiscal deficit is in fact detrimental to the country’s growth if government’s expenditure is not compensated by increase in private saving. Then if Govt borrows, it pushes up the interest rate and crowds out investment.

Coming back to the spending part. The deficit which is incurred while spending needs financing. A country either take debt or print new money. This is where fiscal deficit if unsustainable, gets ugly. If they print money to pay off the debt then money supply will increase and they run the risk of hyperinflation. Like it happened to Germany after WWI, Hungary after WWII, Zimbabwe in 2007 when its currency became worthless. Or when debt reaches unsustainable levels, countries can default like Venezuela in 2017, Greece in 2015, Argentina in 2001 etc. which makes it difficult for them to get borrowing next time. Also, the currency is devalued to reduce the debt burden which makes essential goods like food and medicines also expensive.

Only USA in the whole world can get away with printing money to pay off debt without risking inflation and for quite a while now, Federal reserve is doing this very thing to pay off debt as the debt is denominated in USD, worldwide trade happens in USD so there is always a demand. Also the US is seen as the gold standard of stability so ratings are not affected much due to people’s perception. But this is the sole privilege of USA unavailable to other economies. If Chinese RMB replaces USD as an international currency, USA too will have problem dealing with debt, although it is unlikely to happen now but no one has seen the future.

In Mahabharata, Yaksha asks Yudhisthira what is the surprise and he answers, “Day after day countless creatures are going to the abode of Yama, yet those that remain behind believe themselves to be immortal.”</p></blockquote> In the same manner, every country has been aware of pitfalls of deficits yet throw caution to the wind while incurring deficits when times are good. achieve desired growth. It looks good for politics because that is what people want, everything for free, no taxes and let govt cover the deficit through printing currency or borrowing. But when push comes to shove like Asian financial crisis or the Global Financial Crisis and countries need to spend, no one is ready to lend them the money due to risk of sovereign default or they have to borrow at a higher rate increasing their overall debt burden. It leaves less money to be spent on the essential services which fuels the citizen’s discontent. So, the fiscal prudence which was ignored for politics comes back to haunt sooner or later. Therefore, countries have actively put measures to reduce fiscal deficits through austerity measures and increased efforts to shore up tax revenues.

Analysis of fiscal deficit in major economies

US

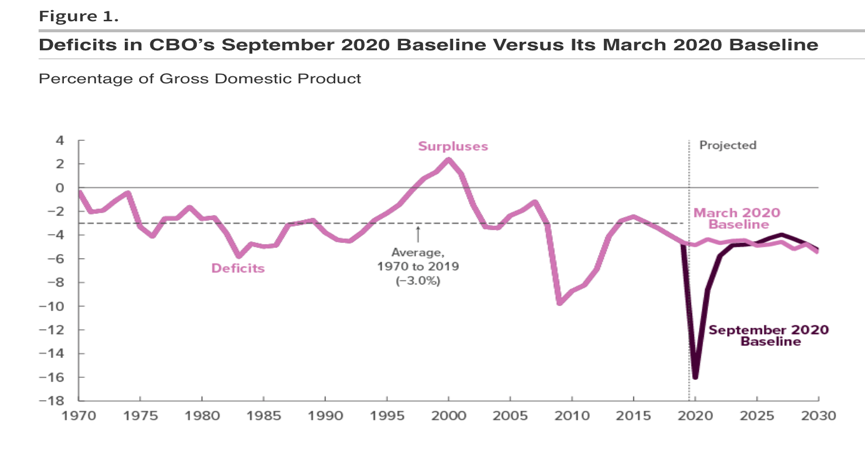

Fig.1 - US budget deficit from 1970s till present

The rise in budget deficits of USA can be attributed to its growing involvement in military expeditions after 9/11 in 2001 due to its operations in Afghanistan, Iraq and other war torn middle east countries. It has costed USA substantial amount The military budget used to be $300 billion till 2001 which reached over $700 billion in 2019. USA never had difficulty in raising debt due to USD being the global currency. It had large deficits in 2008-2012 period due to the Global financial crisis, then it normalized towards 2015 and hitting again new highs due to COVID-19. The current debt owed by USA is $27 trillion and its Debt to GDP ratio has reached to 127% by September 2020.

China

China has spent relentlessly especially during the GFC and registered a growth of over 9% during 2008-09. China has invested heavily in infrastructure not just in mainland China but also in other nations so as to achieve its new maritime silk route and Belt Road Initiative. Although the Chinese economy has grown rapidly, the deficit has not grown much despite Govt giving tax cut to corporations and individuals, reducing the import duties due to their fiscal policy being secretive. So as to contain the true deficit, the local govt borrow from outside so as to not get reflected in the official deficit.

Since Chinese debt to GDP is over 300%, the financial sector is at a high risk of collapse with most of the debt owed by households and local governments. China is betting very big on fruition of BRI but disputes with India and its neighbours in South China Sea has made its predicament, very precarious.

Europe and Rest of the world

‘Not all places are created equal’, Europe is a classic example of this adage. Northern industrialised states were very much benefited since the formation of common euro market. Switzerland, Germany, Denmark have run persistent surpluses on the other hand southern states like Greece, Spain, Hungary etc were promoted to borrow as the interest rates were real cheap. But when GFC affected the business as usual, and they were not getting loans due to already large debt bill to service they have to cut the spending during the slump, simply because of not having the means.

Hungary is a classic example of large deficit turning ugly. Even before GFC in 2008, it was in recession due to austerity measures adopted by Govt to reduce deficits. During GFC, it was bailed out by IMF, World Bank and EU for $25 Billion.

Debt burden of the poorest nations climbed to $744Billion by 2019. Between 2000 and 2017, African nations owed $143 Billion to China and when unable to pay, they had to transfer assents like ports to Chinese companies. Sri Lanka transferred Hambantota port to Chinese govt which then leased it to a Chinese company for 99 years. Although this debt-trap diplomacy was criticized everywhere but it has actually shown to the world that if you are not fiscally prudent, you can well be back to colonial subjugation of 19th and 20th century.

India and the fiscal deficit

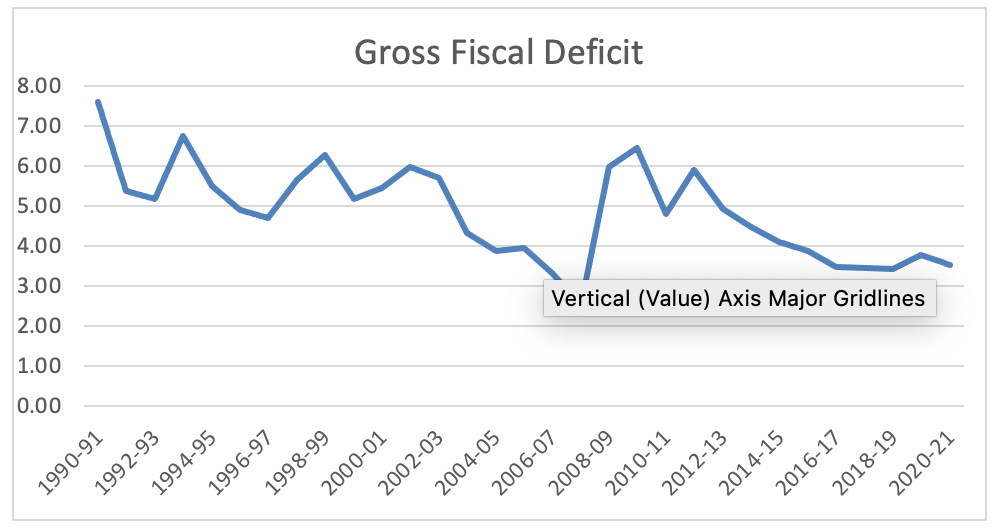

Fig.2 - India's fiscal deficit over the years

In India, although Govt was at the forefront of spending to build the infrastructure due to limited capacity of private sector, fiscal deficit was always well within control. But the oil shock of 80s, liberalisation of trade and industry and reckless populist schemes widened the deficit. The debt servicing, which was used to finance deficit, left us almost bankrupt in 1991. Therefore, fiscal consolidation emerged as key area after reforms of 1991 and Govt made progress, however this faltered again in 1997-98 in the wake of Asian financial crisis and sanctions by the US after Pokharan nuclear tests in 1998.

To keep a check on deteriorating fiscal situation, Govt introduced Fiscal Responsibility and Budgetary Management Act in 2003 to peg deficit at 3% of GDP with annual reduction of 0.3% in fiscal deficit, every financial year so that it can be eliminated completely by 2008 but could not achieved even till now. During 2008, Govt announced stimulus of $4 Billion. In the current economic survey, the finance minister projected fiscal deficit to be 6.8% of GDP.

The objective of any govt behind introducing measures such as FRBM is to reduce structural deficits of tax policy, social transfers etc as much as possible so that when there is slump in the economy, govt can use fiscal and monetary policy to revive growth. This type of borrowing is always encouraged. Fiscal deficit when used to build capacity and infrastructure improves private investment but when it is used to pay up interest means govt can spend less in capacity building, have to borrow more from the same market. Thus, it competes in the same space as private investment and crowds it out by pushing up the interest rate.

Also, high structural deficit inhibits the govt ability to ply countercyclical interventions. In simple terms, Govt spend by borrowing during bust and when economy revives, it pays up the interest from the increased tax collection. But when economy has high structural deficits, the tax revenues will not go up and govt will come to capital market for deficit financing, competing with private investment. And Govt will use other avenues to shore up tax revenues like increasing excise duty on petrol/diesel or will cut spending on salaries and social transfers which will further weaken the demand. Interest rates are already low in lieu of recession so if they inject more liquidity in a bid to prop up demand, it will raise inflation.

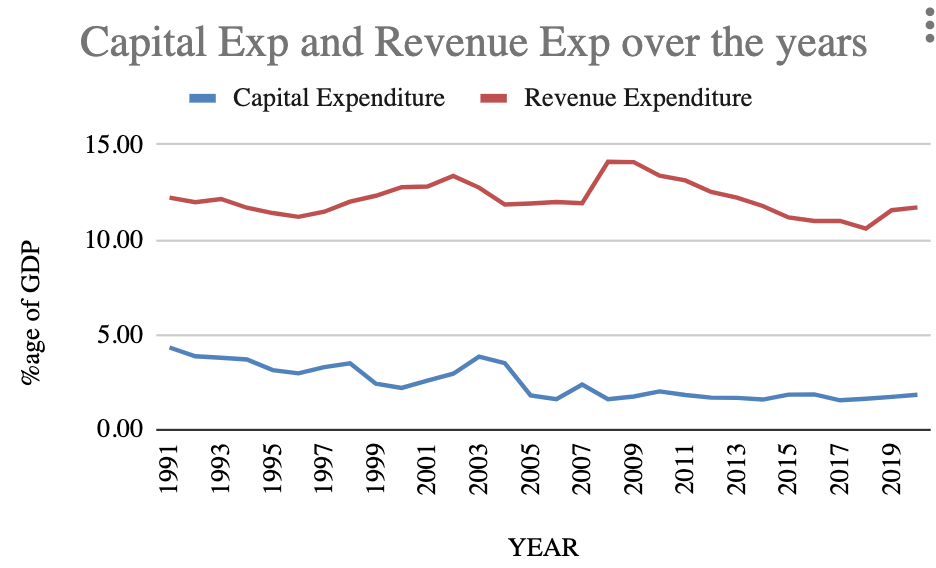

India’s fiscal deficit is largely spent on revenue expenditure of subsidies, interest payments, salaries and payments. When you have high revenue expenditure, it means that Govt is using more money to sustain itself rather than creating assets for the nation. The below chart sums up the story in which the difference between revenue and capital expenditure has diverged over 7% of GDP.

Fig.3 - Difference in capex and revex over years

23% of the expenditure of this year budget is only on interest payments meaning Govt requires almost 7 lakh crores just to pay up the interest. This leaves very little room for asset creation

Measures for fiscal consolidation

Every nation all over the world is serious about fiscal consolidation measures. It is now just a matter of timing. Countries like Venezuela, Greece, Portugal have been forced by the market as no one was ready to lend them. On the other hand countries like USA, France are yet to put a plan for fiscal consolidation despite having high debt burdens. Fiscal consolidation in layperson’s term is cutting expenses and increasing tax revenue through various measures which will least affect the growth and general welfare. India has been taking the following measures for fiscal consolidation:

Fiscal Responsibility and Budget Management Act 2003 to peg fiscal deficit at 3% of GDP for the union as well as state budgets so that the govt will not spend on its whims and fancies.

Rationalization of subsidy bill has been a top agenda in govt’s list of fiscal consolidation measures. It is given in three areas viz. petroleum, food and fertilizers. Money had been doled out in subsidies to appease public without reaching the true beneficiaries. Therefore govt measures of direct cash transfer, weeding out of frauds via linking of aadhar and bank account, decontrolling petrol price in 2012 have been steps in the right direction.

Disinvestment in a bid to raise money leaving only strategically important PSUs with them. However, they have been warned about not to spend the money on revenue expenditure but to retire the old debt which is looming over the future generation.

Govt has simplified the income tax regime to broaden the tax base like having flat rates for income tax, GST to have a single tax all over the country rather than filing multiple returns.

Use of technology to detect tax evasion and frauds in GST e-way bills, for faster resolution of tax disputes.

Also measures like Vivad se Vishwas bill to waive penalties over non-payment of tax in previous years, Income declaration scheme for non-declared assets, demonetisation of old denominations of 500 and 1000 rupee currency notes were done to curb the tax evasion and black money.

Besides that, post 2008 crisis, countries cut their expenditure on even essential services like healthcare, pension and other social security transfers. In the case of developed countries, it may not be problematic but in countries like India if govt drops expenditure on health, it will have out of pocket expense over medical bills which again lands poor people in poverty cycle.

Conclusion

The problem of widening fiscal deficit is more like ‘termites in the basement’ rather than ‘devil at the door. Nothing happens immediately when you incur huge deficits but it weakens the foundation of a country due to piling debt burden. As the country will not be able to spend much on capacity building but in servicing the debt. Also when structural deficits are present due to populist policies or careless fiscal planning, the political and civil unrest ensues.

Venezuela, the country with biggest oil reserves in the world, was a stable and growing economy until 2014 when oil prices plunged to record low. Excessive spending on social programs, low taxation, high level of corruption and sole dependence on crude oil pushed millions below the poverty line. By March 2019, 94% of Venezuelans live below poverty line.

The future is uncertain and when the economics is sound, it makes easy for an economy to prepare for the future because they have the fiscal space to experiment over what is working what is not working. Therefore laxity in rules has to be withdrawn as soon as economy recovers. This was acknowledged even in the economic survey 2020-21. Fiscal deficit is justified only till the growth rate is more than the interest rate. If this is not the case, rising fiscal deficit is a slow path to destruction.

Subscribe to my newsletter

Read articles from Aditya Sharma directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by