Market Linked Debentures: A Comprehensive Guide for Retail Investors

Om Shukla

Om Shukla

KEY TAKEAWAYS

Market Linked Debentures (MLDs) are complex financial instruments that offer a balance between equity and debt, providing exposure to both with varying structures based on the issuer's design.

MLDs are linked to underlying assets like the Nifty 50 Index, offering potential returns based on the performance of these assets, but they do not pay regular coupons and are settled upon maturity.

The popularity of MLDs was initially driven by favorable tax treatment, but recent changes in taxation have reduced their appeal, as gains are now taxed as Short Term Capital Gains.

MLDs offer high returns and personalization options, but they come with disadvantages such as complex structures, potential default risk, and limited liquidity until maturity.

Retail investors can now access MLDs through platforms like Incred, BondsKart, and others, but should carefully consider the risks, cash flow implications, and their own financial situation before investing.

Moving to a new house is always a difficult journey. I still remember, back in 2014 I was shifting from Navi-Mumbai to the western suburbs of the city. The entire process of house hunting was an exciting but extremely tiring procedure. For me, a house had to tick off many boxes, location from the workplace, open areas, parking, ventilation, sunlight, interiors, and most importantly the rent. Basically something that fits right in the sweet spot.

Well, so is the case with a lot of investment portfolios, allocating resources in your portfolio to hit the sweet spot between risk, returns and other considerations you might have, could be a frustrating task. So, If you somewhat relate to the above scenarios, let me introduce you to Market Linked Debentures. A rather complex product offering nectar from both equity and debt instruments, which may provide you the balance you need between risk and returns.

What Are Market-Linked Debentures?

I don't know where to start, as there is no perfect answer for it. MLDs tend to vary depending on how the issuer has decided to structure them. But as I said, think of these instruments as a sweet spot between equity and debt securities, giving you exposure to both worlds.

MLDs are linked to an underlying asset, usually the Nifty 50 Index or a basket of stocks. The MLDs may provide an assured return just like plain vanilla bonds, but if the underlying index performs above (or below) a certain threshold, your returns start to increase (or decrease), just like in derivatives. But remember, they do not pay regular coupons like bonds, all of it is paid at once upon maturity.

First Example

Let's start with a simple one, say a company XYZ issues 11% MLD linked to the Nifty 50 Index, which matures after 2 years. The condition is, if, at any time during the 2 years, Nifty 50 falls below 50% of the level at which the MLD was issued, the return will be 0% and you will only get back the principal upon maturity. In all the other cases the issuer will pay 11% p.a. on the face value of the instrument, upon maturity. To put it simply, If the MLD was issued when Nifty was at 18000, your return would be 0% if Nifty hits 9000 anytime during the 2 years, or else you get 11% p.a on the principal amount.

Generally, this type of MLD comes with two primary features:

Principal Protected - Your return can be 0% but your principal is safe even in adverse market conditions.

Payment On Maturity - All the returns will be paid upon maturity at once.

Second Example

Let's take another example, and this time let's make it a bit more spicy. Say, a company ABC issues non-principal protected 0% MLD linked to Nifty 50, which matures in 2 years. Here, the condition is, that the issuer will record the closing level of Nifty 50 on 7 pre-decided dates during the 2 years. The highest nifty level among these 7 dates will be considered to calculate the coupon. Say the MLD was issued when Nifty was at 18000 points. If the highest level among these 7 days was recorded as 22000, it would translate to a coupon of 22.2%. [(22k-18k)/18k]. So you will get a return of 22.2% over 2 years.

But there will also be a ceiling to this, say 25%, so if the index increases by 30%, your return will be capped at 25%.

There are many MLDs in the market with this sort of structure, but one of the things to remember about such instruments is:

- Non-Principal Protected - Let's say due to COVID, the index falls, so the highest value recorded is -20%, this means you will only get back 80% of your principal upon maturity!!

Please don't worry if this was too difficult to understand, we will cover this again using the offer letter of an actual MLD.

Why Do these Instruments exist?

Generally, the answer to this question in alternative investment space would be to provide high returns, for taking a higher risk. In this case, returns could be one of the reasons, but in reality, MLDs were popular amongst HNIs and corporations because of their taxation. Noticed how I used 'were', well it's because, before the 2023 budget, MLDs enjoyed the benefits of taxation of listed debt instruments. Also popularly known as taxation arbitrage.

But post-budget, the craze for MLDs has cooled down a bit. This is because all the gains from MLD will be deemed as Short Term Capital Gains (Even after 36 Months). Thus all the gains will be taxed at your slab rate, and in case of any loss, you won't be able to set it off with your other profits as it is STCG.

Pros (Advantages)

High Returns - Obviously, with higher risk comes high returns. Generally, the returns on even the most conservative MLDs are higher than that of corporate bonds.

Variety/Personalization - You will surely be able to find an MLD of your liking, given the diversity of these instruments. They can offer exposure to gold, bonds, equity markets, and various other underlying assets while ranging from very conservative returns to highly aggressive ones

Cons (Disadvantages)

Taxation - If you look at any article on MLD published in 2022 and before, the biggest talking point used to be taxation benefit. But now the 'absurd taxation' is the negative of this instrument.

Complex - MLDs are highly complex instruments, and there could be risks that are simply not visible to the eyes of retail investors. It's very important to read and understand the offer letter of the issue before investing.

Default Risk - This is one of the major problems of MLDs. Corporations unable to raise money through general debentures are likely the ones who issue such MLDs. Thus there is a possibility that the issuer may default or go insolvent. So your principal protection goes in the bin as well.

Cash Flow and Liquidity - Firstly there is no cash flow, the only incoming payment is upon maturity. And even though MLDs are listed securities, the availability of a buyer is quite low. Thus it's possible your capital may be illiquid until maturity.

Offer letters of some of the MLDs

To practically understand what an MLD looks like and how it works, let's look at some offer letters of some actual MLDs.

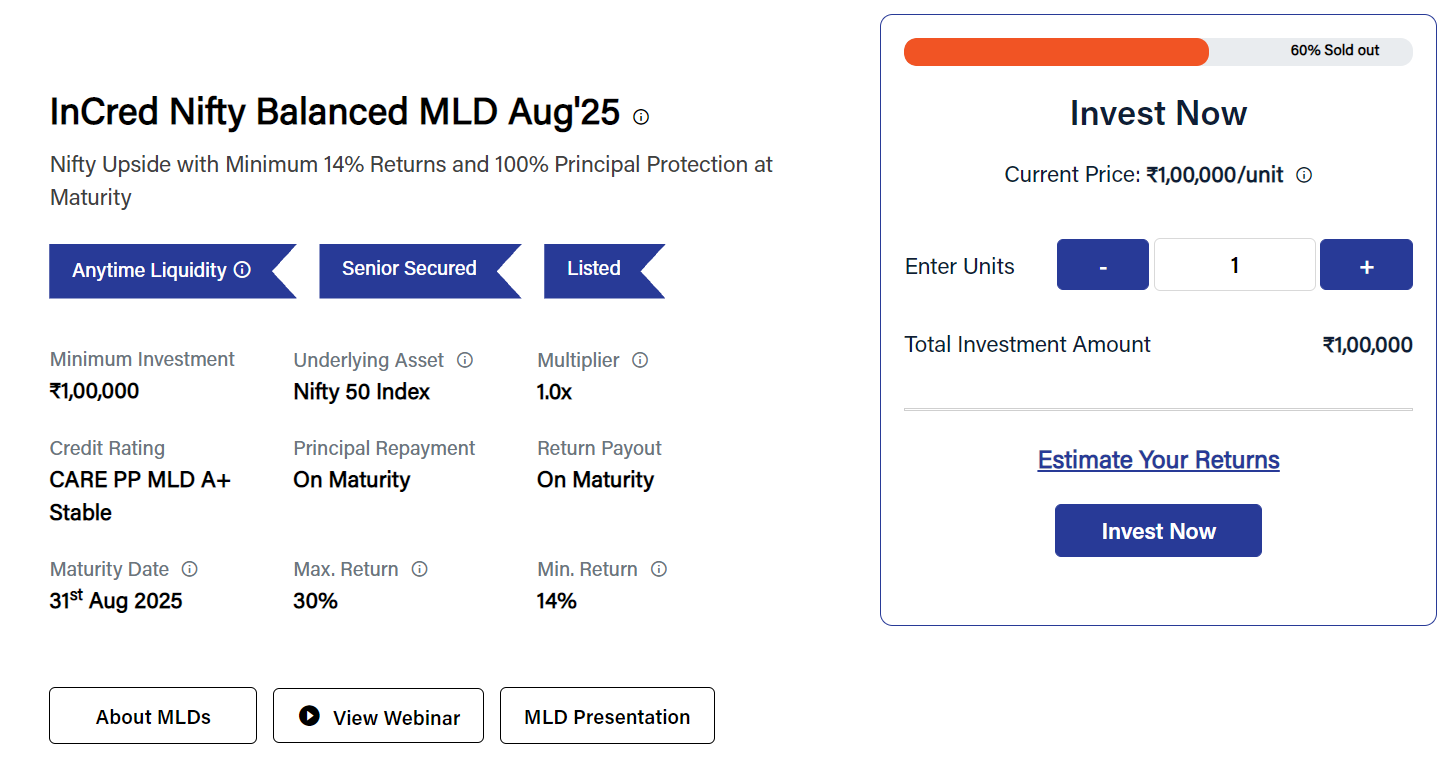

Incred Balance MLD

This is the recently issued MLD of Incred Finance. The MLD is principal protected and the underlying asset is the Nifty 50 Index.

Here, the minimum investment is ₹1,00,000 per unit, maturity is 2 years, assured returns of 14% and maximum return of 30%. (Which translates to 7% and 15% return on the face value per annum)

What this means is, that for every unit, you are guaranteed ₹7,000 every year and principal repayment of ₹1,00,000 upon maturity, even if the Nifty 50 goes to 0.

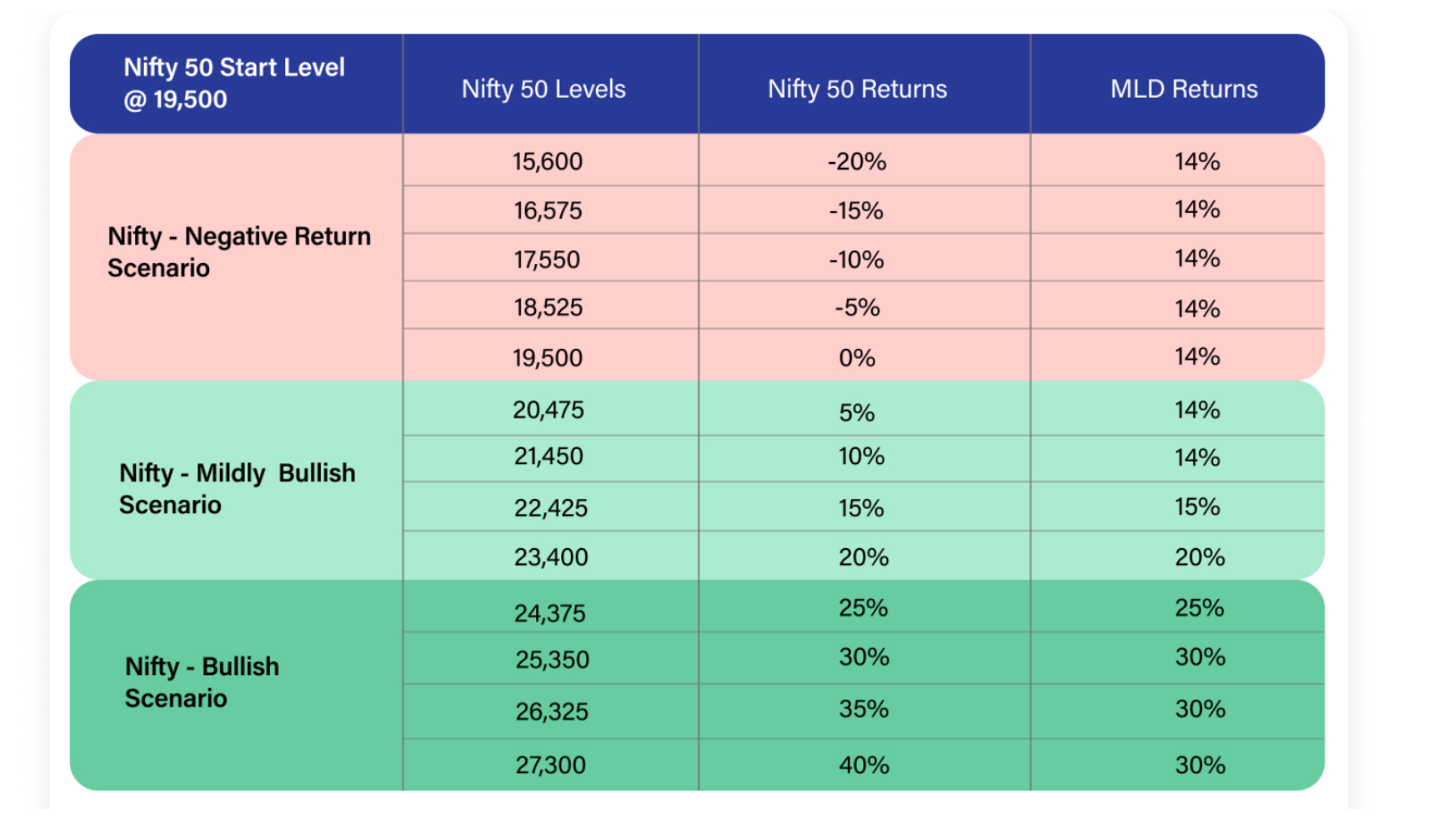

But if the Nifty increases to a certain threshold, your returns start to increase. Take a look at the below table that reflects the movement of the Nifty v/s Return

As seen in the above table, if the Nifty increases by 19%, your MLD will yield 15%, and if the Nifty increases by 21%, your MLD will give a return of 20%... and so on.

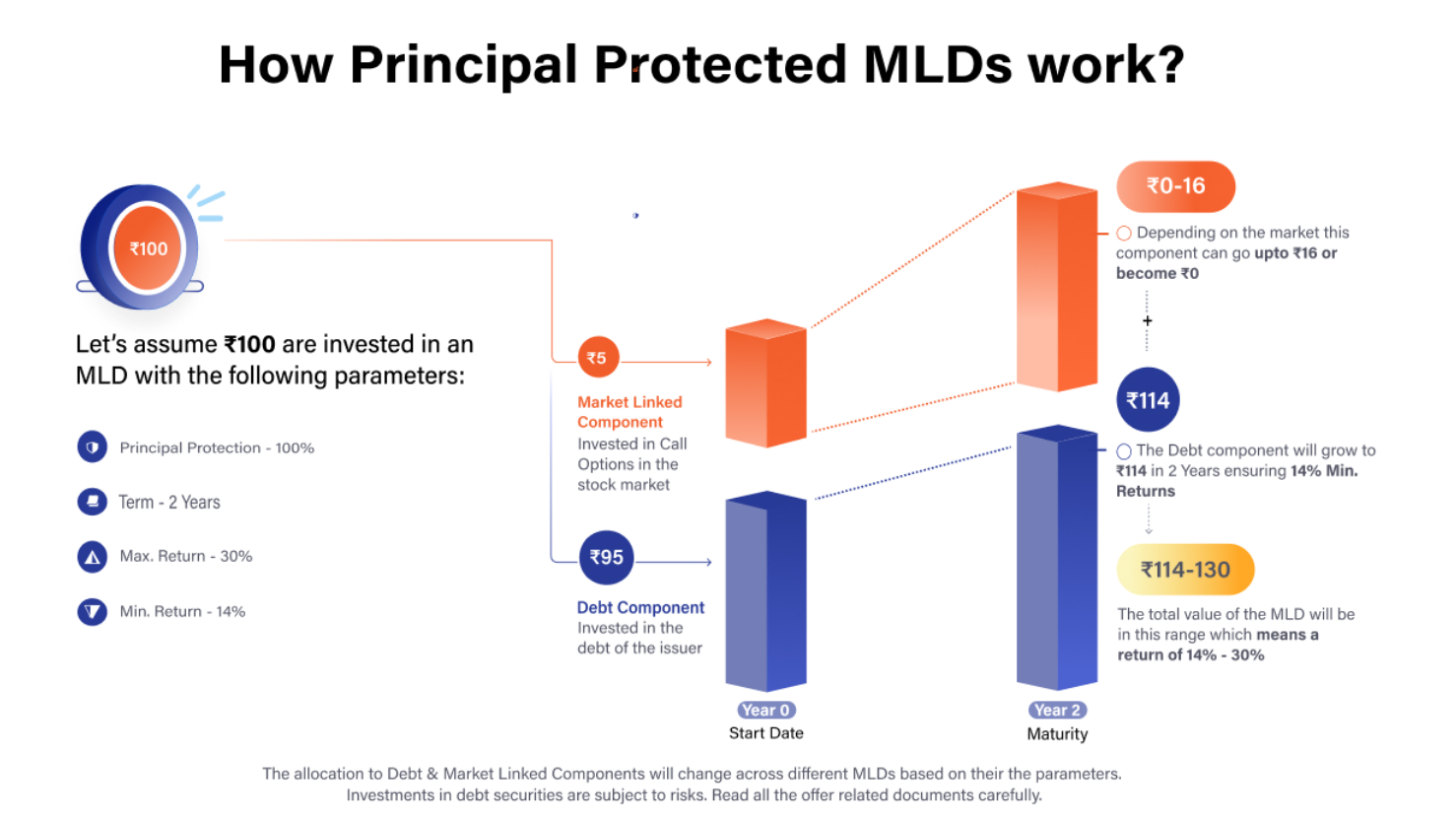

How does this work? Essentially, out of the ₹1 Lakh invested, the issuer will use ₹95,000 for its own purpose (like giving out loans) and service it such that upon maturity, the principal + interest will equal ₹1,14,000 (14% return on ₹1,00,000). The remaining ₹5000 is used to buy Call Options for Nifty 50 Index. And hence the return as shown in the table is achieved.

We will not get into how buying call options will achieve that return as that would be a separate article itself, but if you want to learn more about call options, you can check the Zerodha Varsity Article by clicking here.

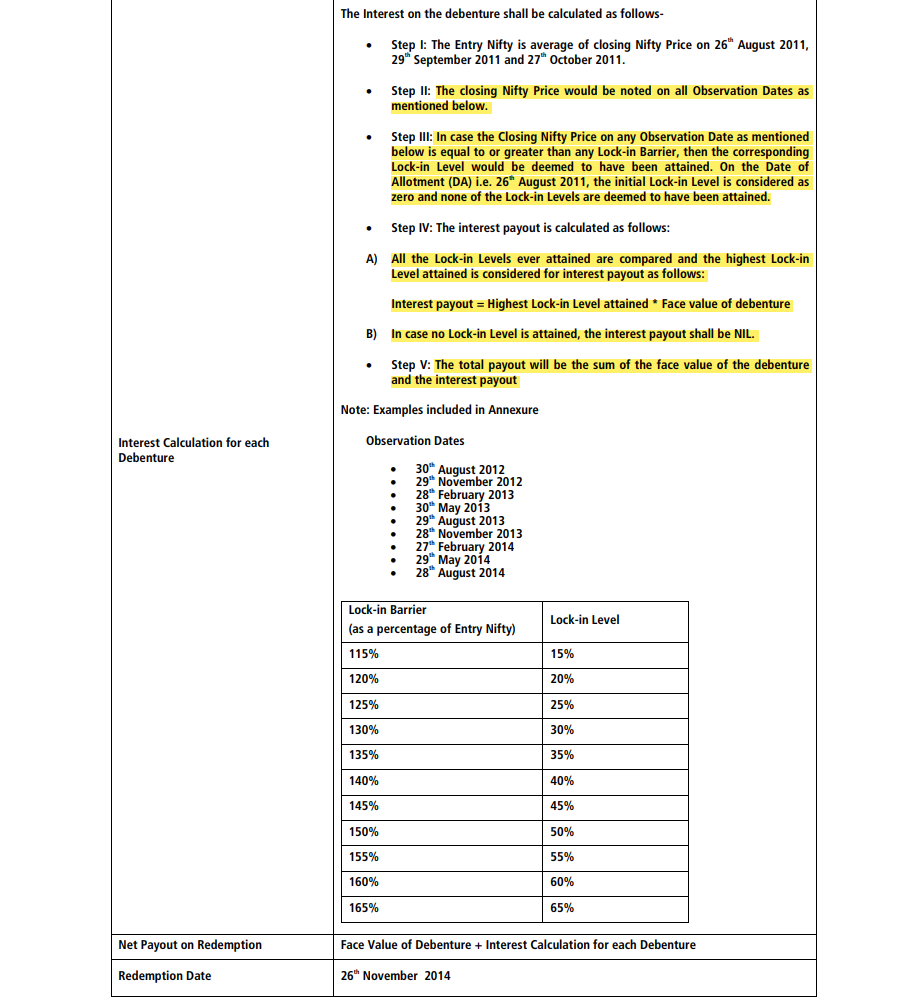

Kotak MLD

On similar lines, let's look at another MLD, issued by Kotak Securities in 2011. Recall the 'Second Example' from above, this is based on a similar structure.

Here, the maximum return is 65% over 3 years. So if Nifty increases by 80% in 3 years, your returns will hit 65% and will be capped. Also if the Nifty falls to 0, your principal will be protected by the issuer (Kotak Securities).

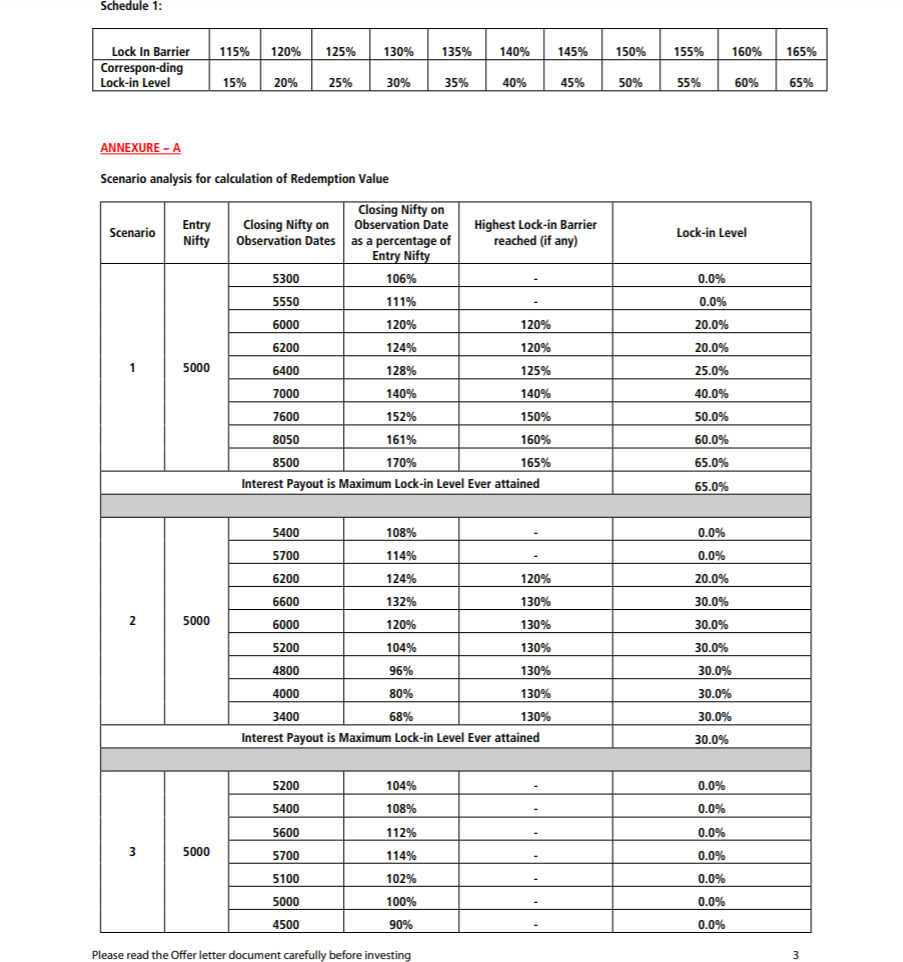

As seen in the below table, the issuer has decided on 11 observation dates on which the Nifty will be recorded. The highest level from these 11 dates will be used to calculate the returns of the MLD. They have also mentioned the calculation of the opening level of Nifty at which the MLD was issued (1st point - an average of 3 pre-decided dates).

But the devil is in the details, let's look at how the returns are calculated, to understand what the issuer gains from this instrument. There is something called a lock-in level, which is essentially the percentage that is locked to calculate the returns on face value.

Look at the below table, the lock-in starts from 15% and is a multiple of 5% thereafter. This means, that if the highest recorded increase in Nifty is 14%, your returns would be 0%, as the lock-in of 15% hasn't been achieved. Similarly, if the highest recorded increase is 24%, the return would only be 20%, as the next lock-in level of 25% is not achieved.

Now to give you the final report card of this MLD, the instrument turned out very lucrative, as the market increased by 70% over the maturity period. Thus, investors got the highest return possible ie. 65% over 3 years.

How to Invest in MLDs?

MLDs are usually issued through private placements, available to UHNIs and Large Corporations. This is simply because of the very high face value and complexities of these instruments. Before the 2023 Budget, the minimum face value for an MLD was ₹10 Lakh now this has been lowered to ₹1 Lakh to allow retail participation.

Platforms such as Incred, BondsKart, Dezerv, Wint Wealth, and Indiabonds allow retail investors to subscribe to public issues of MLD, the minimum investment being ₹1 Lakh on the issue date. Just like any other issue, MLDs come with a prospectus that highlights the following:

Books Of Accounts of the Issuer

Status of previous debt instruments issued by the Issuer

Structure of the MLD

Where will the funds be utilized

Credit Rating of the debenture.

Let's Take A Look At Some Platforms

- Incred Money is designed exclusively for commercial bonds and MLDs. It is advertised as an Alternative Investment Platform for retail investors looking to gain exposure to high-risk, high-return products.

Pros - All the documents related to MLD are available, Simple explanation about the instruments, provides graphical representation of returns.

Cons - For the time being only offering tranches of Incred Finance MLDs.

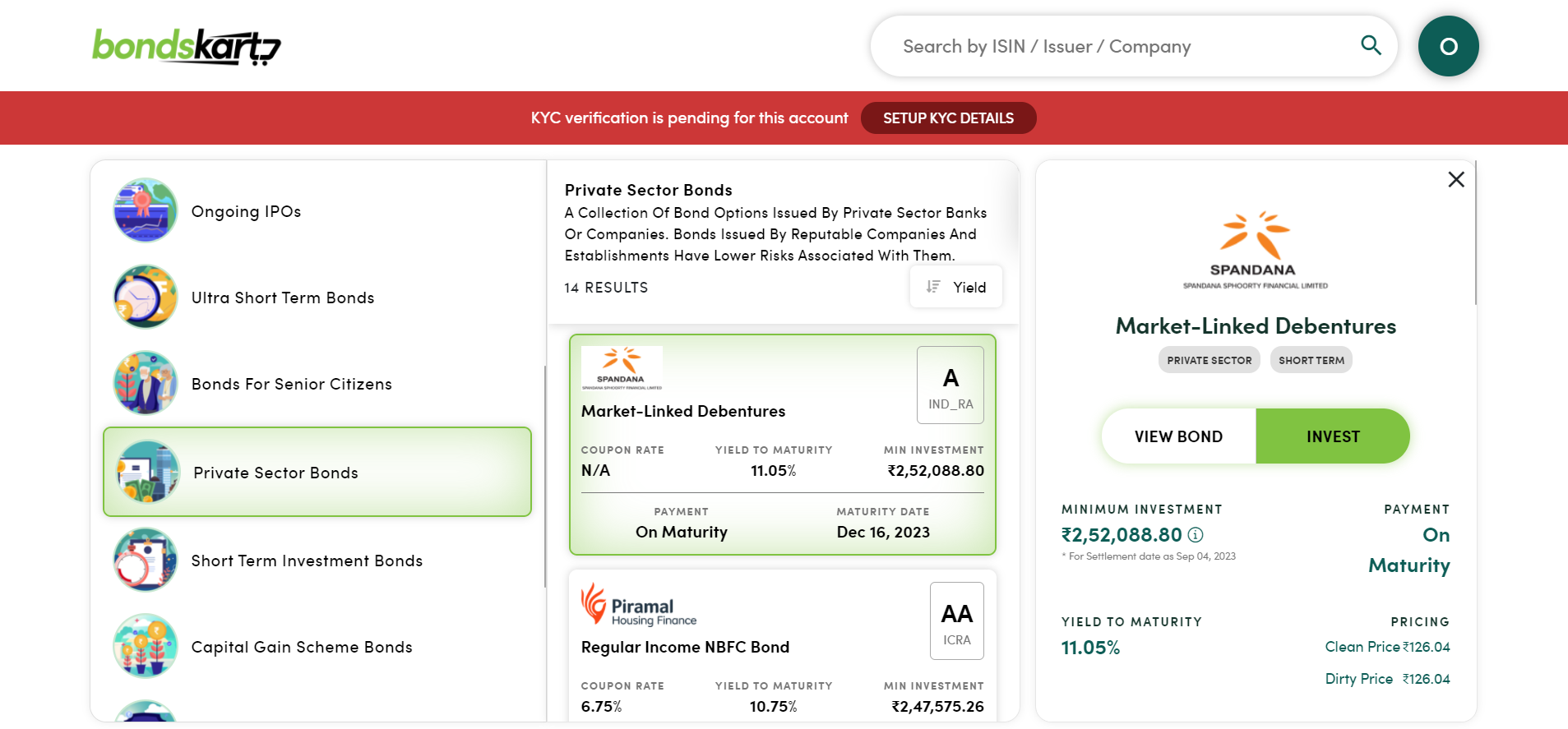

- Bondskart: is quite popular amongst fixed-income securities investors. It is a primary and secondary market platform for corporate and PSU bonds along with MLDs and various other instruments. You will be able to find all the currently trading MLDs under 'Private Sector Bonds' or here.

Pros - Huge Inventory of MLDs, Offer documents available on most of the MLDs, detailed and simple explanation about the instruments.

Cons - Nothing as such.

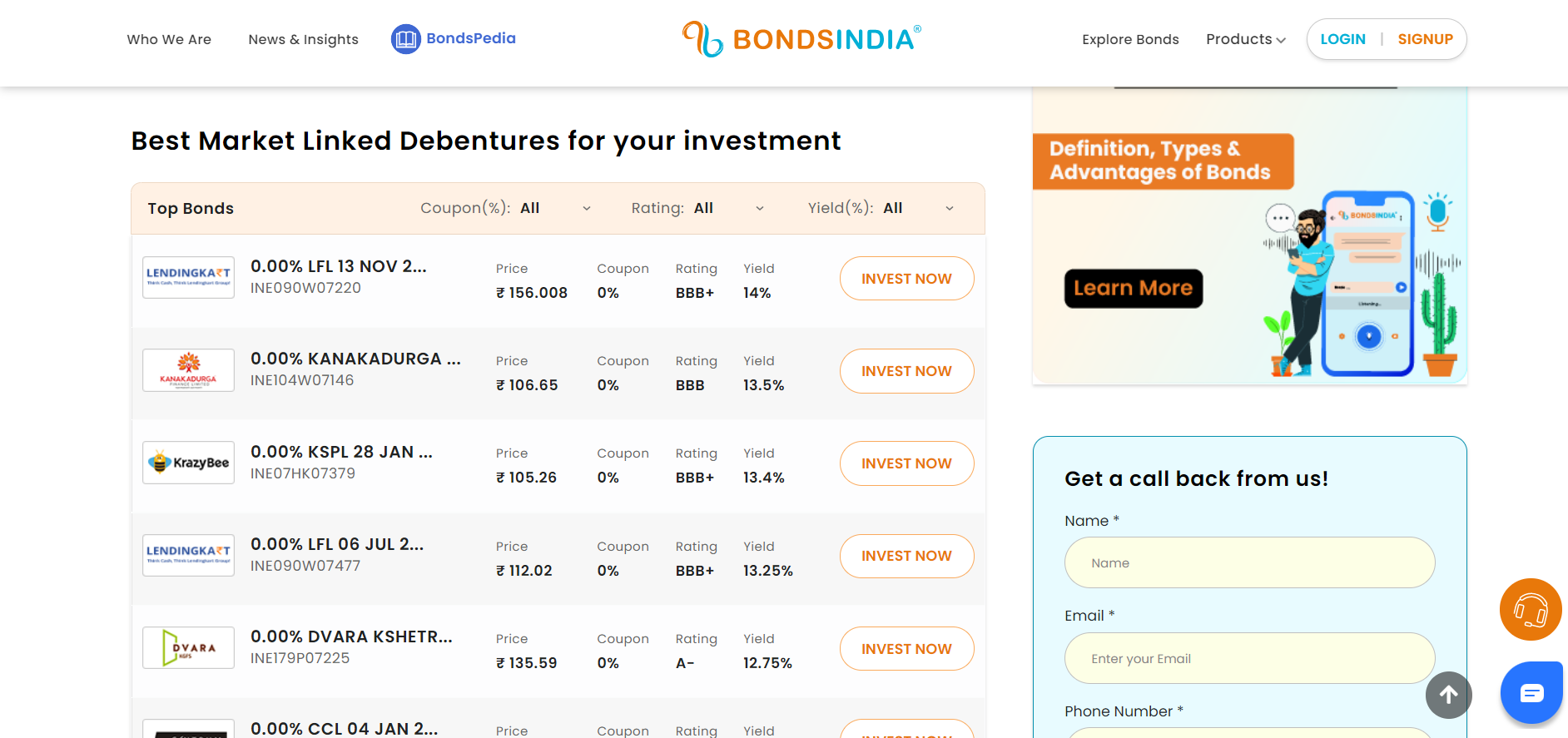

- BondsIndia: One of the largest platforms to buy and sell corporate bonds and MLDs in India. For some reason, it is a bit difficult to find MLDs on their platform if you do not have the ISIN code of the instrument. You should find all the currently live trading MLDs here.

Pros - Large collection of MLDs, detailed explanation of the instruments, shows cash flows and returns expected from the instruments.

Con - Difficult to navigate on the website, No document available for any MLD.

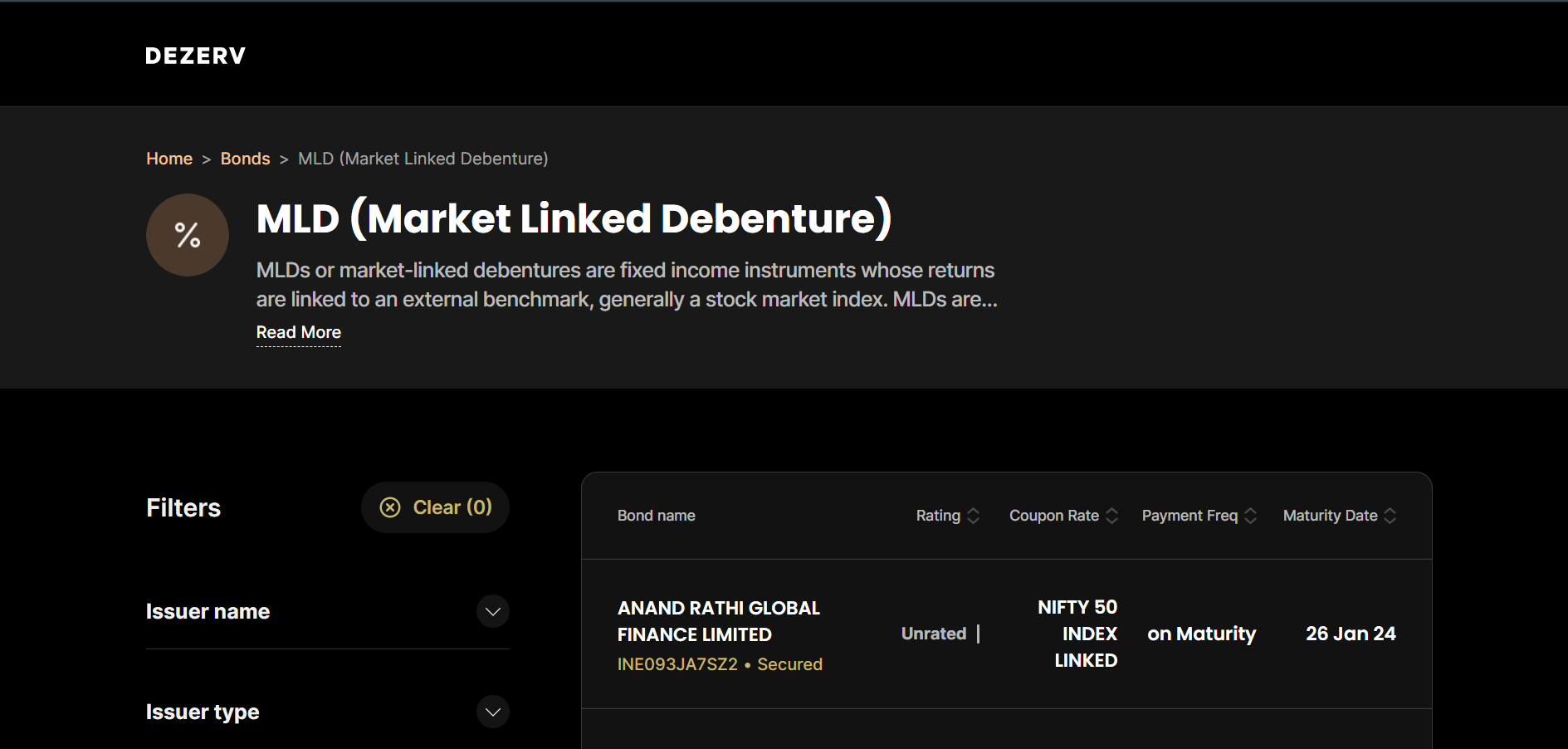

- Dezerv: This company needs no introduction, after all, Sandeep Jethwani is in our LinkedIn feeds daily. You can use this platform to get information on all the live MLDs, but cannot invest through Dezerv.

Pros - Shows all the live MLDs currently live in the market, Shows cashflows and other data for some of the MLDs, Aesthetic of the website looks good if you are into those vibes.

Cons - Very little information is provided for many MLDs, No documents are available about the Instruments.

- Indiabonds: One of the oldest online bond platforms in India where you can buy all sorts of debt instruments including govt., corporate bonds, MLDs, etc.

Pros - Has a comprehensive selection of bonds and has all relevant details including offer documents available on a single page.

Cons - Difficult to find MLDs directly, you have to add the issuer name or ISIN to specifically find them. Also once you register they will continuously spam you with calls, so we have warned you.

Bottom Line

MLDs, as an investment were never really explored in retail space as they were available or in reach of only the HNIs or Institutional Investors. The purpose of the MLDs was also not to gain abnormal returns, but rather to get the benefit of taxation arbitrage available to such instruments. Only now, given the minimum face value has been decreased, retail participation might pick up.

Now coming to, Should you invest?

These are complex instruments, so only invest if you fully understand the risk of the instrument, in my experience, a normal retail investor wouldn't have the appropriate knowledge to invest so seek help.

High probability of zero cash flow until maturity, so only invest if you have that sort of liquidity preference.

Chances of default or no principal protection, thus before considering investing in MLDs, take note of your risk appetite and bank balance.

Hope you enjoyed the article, if you think there is something factually incorrect, please send me a message here or email me at om@thealtinvestor.in

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.

Lastly, if you like our work, please feel free to sponsor us via Hashnode Sponsors.

Subscribe to my newsletter

Read articles from Om Shukla directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by