Asset Leasing Investment Guide For Indian Retail Investors

Chahat Porwal

Chahat Porwal

KEY TAKEAWAYS

The article introduces asset leasing as an investment opportunity, highlighting its accessibility to retail investors in India, with investments starting as low as ₹50,000.

It outlines the benefits of asset leasing, such as diversification, safeguarding of principal, and regular cash flows, while also discussing risks like default, liquidity, and limited recourse.

The article explains different asset leasing models, including Direct Leasing, SEBI-Regulated Securitized Debt Instruments (SDIs), and the Limited Liability Partnership (LLP) Model, detailing their structures, advantages, and disadvantages.

It provides information on various platforms available for asset leasing investments, such as GRIP Invest, Tap Invest, Afinue, and Leasify, each offering different models and features.

In conclusion, asset leasing can be seen as a viable investment option for those seeking regular cash flow and diversification, but is advisable to do due diligence and understand the risk and taxation implications.

After becoming a Chartered Accountant, I visited my father's office to gain insight into his daily operations. My father primarily exports textiles to countries such as Sri Lanka, Malaysia, and the UAE, and frequently requires the assistance of shipping companies. On that day, a small shipping business owner was at the office, informing my father about the expansion of his company, as he had just taken delivery of 100 new containers.

The cost of 100 shipping containers amounts to ₹2.5 Cr, and the shipping business owner wasn't financially capable of making this purchase on his own. When asked, he explained that a group of investors had bought the containers and leased them to him for the next five years, with an agreed-upon buyback rate.

This was indeed a win-win for both investors and the shipping company owner. This prompted me to research further into this area from an investment perspective. While these types of investments were previously only available to high-net-worth individuals, some startups are now entering this space, allowing you to join that pool of investors for as little as ₹50,000. Let's dive into the details!

What is Asset Leasing Investment?

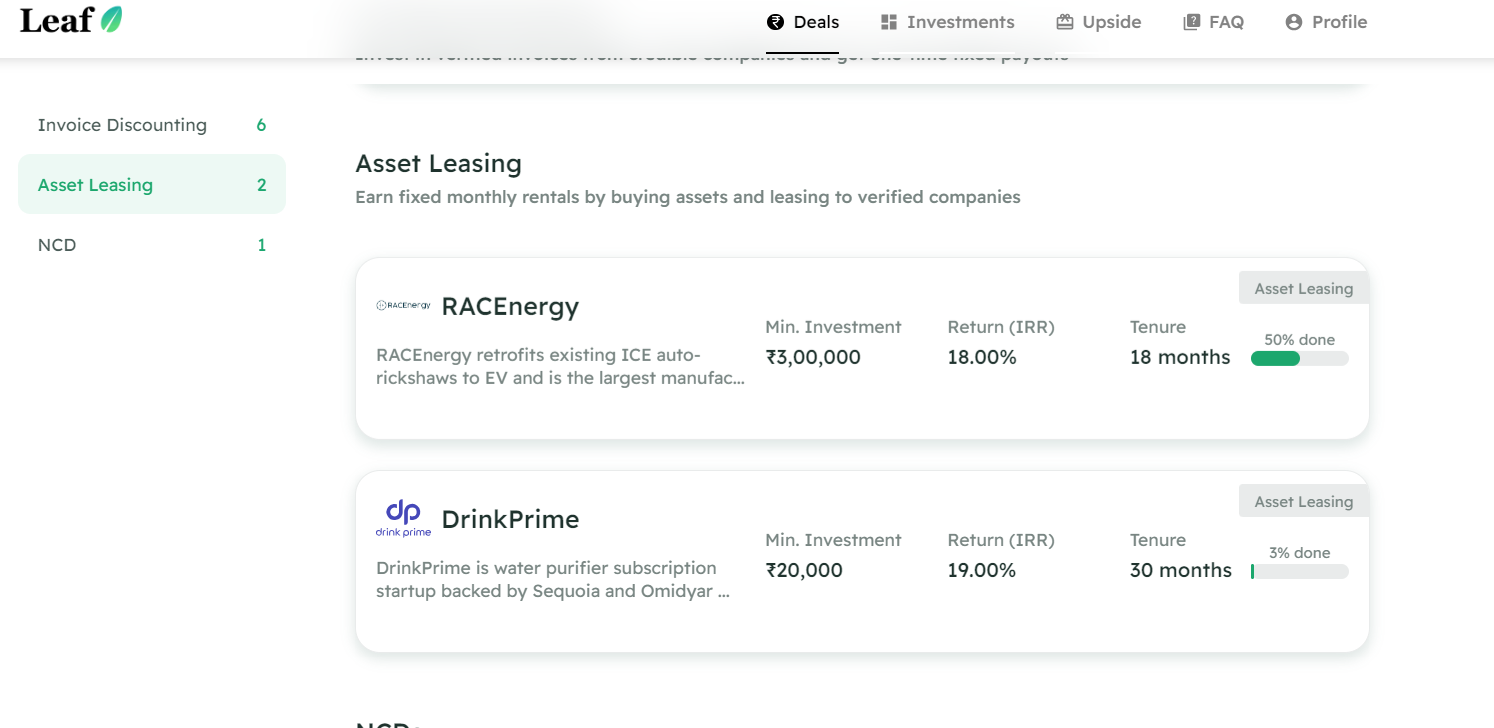

Let's talk about a real-life Asset Leasing example that's ongoing on one of the investing platforms.

Suppose you have just shifted to Bangalore and have rented a new flat that doesn't come with a water purifier, you can contact DrinkPrime who offers subscription-based water purifiers at an affordable cost of ₹1/litre. They will come and install a purifier at your home by taking a minimal refundable deposit.

Drinkprime claims to have 71,000+ subscribers at this stage, Imagine financing 71,000 water purifiers with an average cost of ₹4,000 upfront, we are talking about ₹28.4 Cr in investments. That would eat up the company's working capital easily.

But it's an innovative model and worth trying so How this operation will kickstart without purchasing water purifiers on a large scale?

This is where a retail investor comes into the picture. As an investor, you can purchase one or multiple water purifiers and lease them to the business for commencing/expanding their operation and earn periodic lease rentals. On expiry, the asset shall be repurchased from you at a resale price pre-agreed.

Thanks to Tap Invest for the above example.

Why Does Lease Financing Make Sense for Companies?

A lot of investors would think why can't the company go to a Bank/NBFC to get this kind of financing or why can't it use its own money to buy the assets?

We think there can be 3 primary reasons for this:

If the company is in the growth stage, it most likely has already utilized the credit limit given to it by banks and other traditional sources of financing have been exhausted.

Banks/NBFCs might not consider the asset being financed as a qualifying collateral for the loan. They might think it will not have much resale value.

If the company were to purchase it on its book, it would be strapped for working capital for its day-to-day operations.

Pros and Cons of Asset Leasing

Before we get into the different ways you can invest in asset leasing, let's quickly cover the pros and cons.

Benefits

Diversification: You can get non-market linked returns which diversifies your overall portfolio.

Safeguard of Principal amount: Having a beneficial interest in the assets either through an LLP/Direct Leasing (explained below) or via security enhancements to SDI(explained below). This enables you to recover some amounts in case of defaults.

Regular Cash Flows: Periodic cash flows of lease rentals to the investor until the life of the contract which can be used for other day-to-day needs.

Disadvantages

Default Risk: The most common risk in all instruments, the probability of the company defaulting during the life of the contract should be assessed.

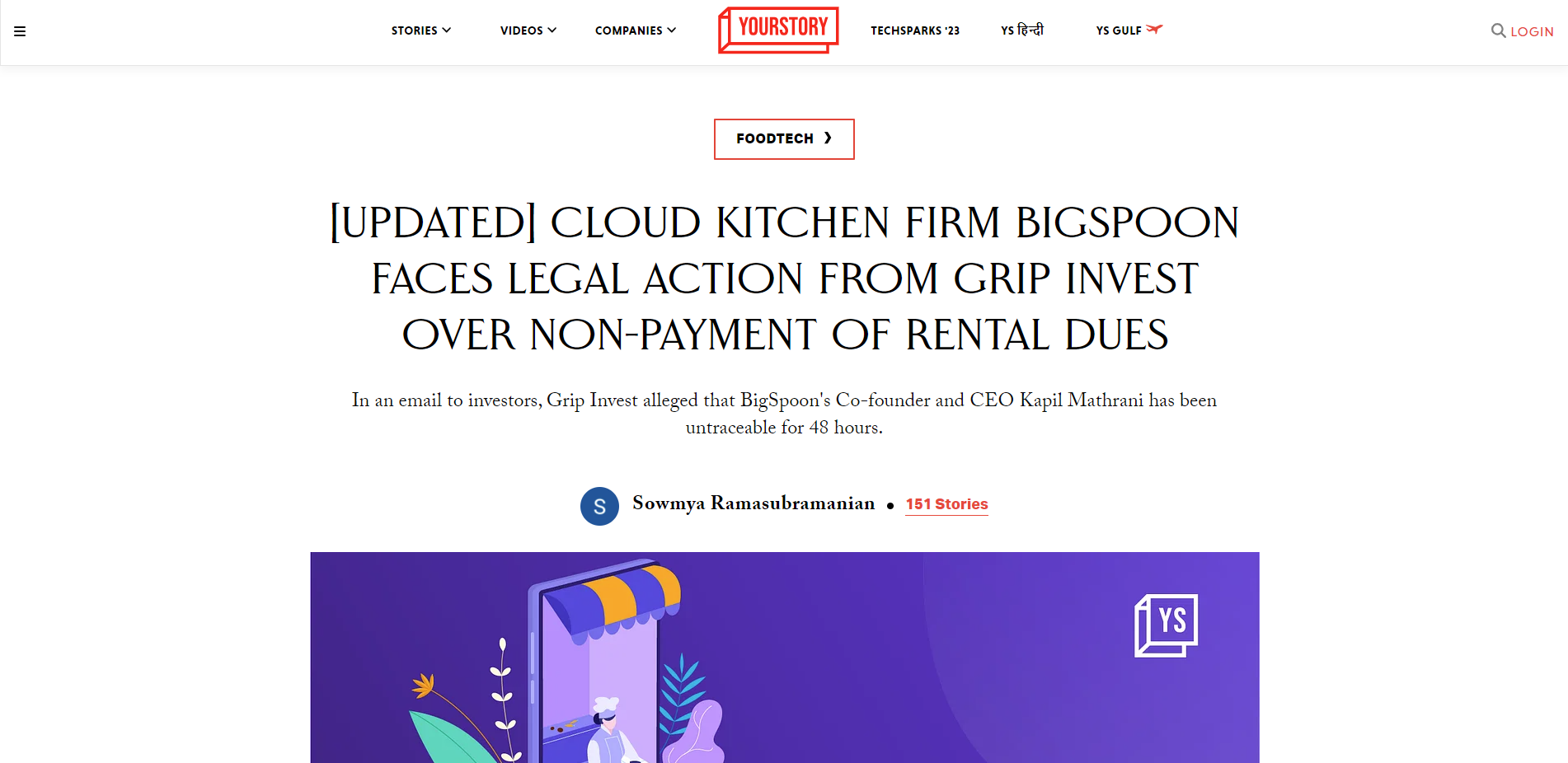

Read more by clicking the image below about a recent company defaulting in one of the LeaseX products by Grip Invest. The investors in LeaseX didn't suffer any losses as the product had sufficient cash collateral to cover but if multiple defaults happen in a short period of time, investors can face losses.

Liquidity Risk: Although platforms like Grip Invest and AFINUE (after the lock-in period) permit the transfer of interest by selling the bond or your share in an LLP, it can be practically challenging to find another buyer, thus creating difficulties in liquidating your investment.

Limited Recourse: In all models we demonstrate below, in case of default, if the company does not agree to return the asset, it can be very difficult to receive your principal back and you will have very limited options legally.

Don't get swayed by the high IRR (18% - 22%) numbers as they assume that all cashflow you receive will be reinvested at the same rate which is unrealistic. Always check what you invest and what you get in total and calculate the post-tax CAGR return to make the assessment.

Residual Risk: This risk is only applicable to the Direct Leasing and LLP model where at the end of the lease contract, your asset is sold at current market rates which might be much lower/higher than you predicted.

Asset Leasing Models

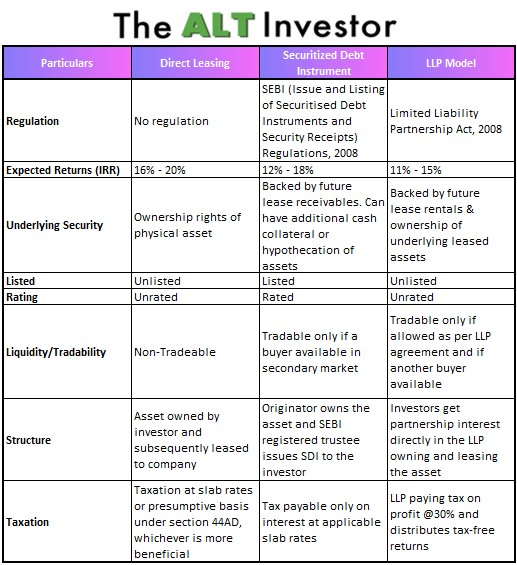

There are a couple of products in the market to give you the Asset Leasing exposure, we have outlined them one by one. Which one works best for you will depend on your conditions like preference (regulated, unregulated), tax slabs, risk profile, etc.

Direct Leasing Model

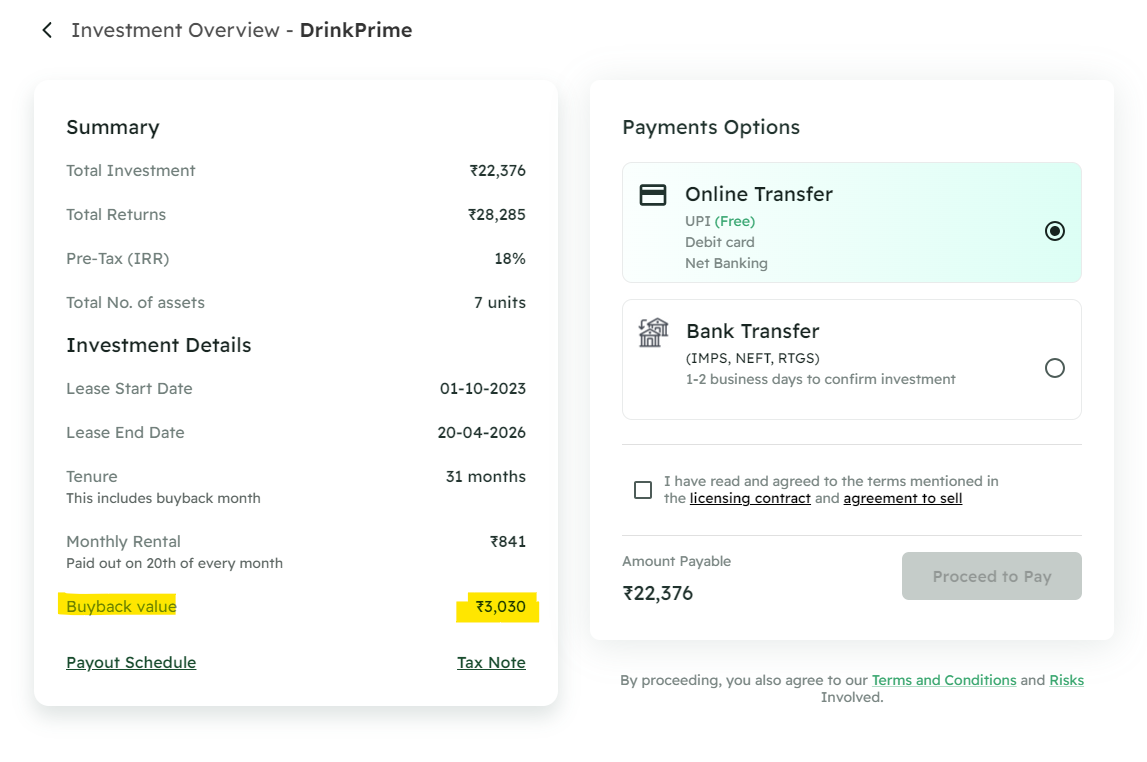

One of the simplest models out there but not very famous. This model is a normal lease agreement entered with the buying company + an agreement to sell with the platform. Let's take the Drinkprime example itself we have shown above.

We have covered Direct Leasing in great detail in a video as well, which you can watch:

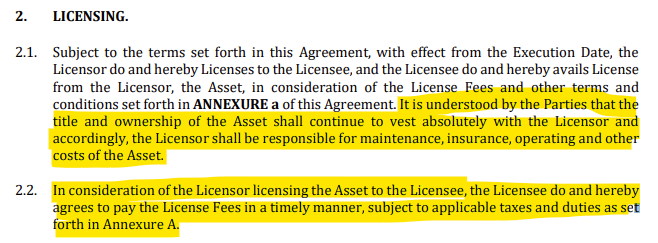

Underlying Asset: No instrument since no pooling of funds and you will be a registered owner of the physical asset. Please note this is just an agreement that can be upheld in a court of law but is not regulated investment by SEBI.

Licensor is the Investor

Licensee is DrinkPrime

You can download a copy of this agreement here.

Regular Cashflows: The Licensee will pay you regular cashflow until the life of the leasing contract.

Buyback of Asset: The platform (in this case Tap Invest) will facilitate the buyback of the asset from you at a pre-determined fixed rate. You have to agree to this before investing in the deal. You cannot get physical delivery of the asset at the end of the contract and you will have no right to sell it to someone else. You can check their agreement to sell here.

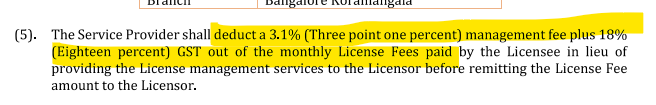

- Management Fees: The platform would generally charge you a fee every year until the contract is live. This would be mentioned in the agreement generally. Tap Invest confirms that the IRR figures on their website are after all fees.

Taxation: This is the best part about direct leasing since your post-tax returns can be higher than the other options we will discuss in this article. Income from Direct Asset Leasing is seen as "Profits and Gains from Business or Profession (PGBP)" and can be computed in 2 different ways.

Normal Tax Provisions (Section 28 to 44AB): You can keep the asset on your books and depreciate it, claim any charges you incurred in maintenance, insurance, etc. and calculate your final income where tax will be paid as per your slab.

Presumptive Income Provisions (Section 44AD): You calculate your income as 6% of the total lease rentals you have received and calculate tax on that as per your slabs.

| Particulars | Normal Tax Provisions | Presumptive Income (Section 44AD) |

| Lease Rentals Received | ₹50,00,000 | ₹50,00,000 |

| Expenses & Depreciation | (₹35,00,000) | Cannot be claimed |

| Total Income | ₹15,00,000 | ₹3,00,000 (6% of rentals received) |

| Tax Payable (assuming 30% slab) | ₹4,50,000 | ₹90,000 |

Advantages of Direct Leasing

Taxation benefits if you can choose presumptive income because in such deals maintenance, insurance, and other expenses are already all covered by the buyer so you can't reduce your total income that much under normal tax provisions.

You own hard physical assets at least until the life of the contract. If the company were to default, the platform would help you to get back your assets or re-sale them for a fee and return back capital.

Disadvantages of Direct Leasing

You don't have flexibility on who to sell back the asset to and the price at which to sell, although you do have the comfort of the platform buying it back.

If Section 44AD does not apply to you, it is not at all beneficial to get into Direct Leasing as you might end up paying much more tax than other models. Filing incorrect taxes might invite further scrutiny from tax officials.

Storage Costs Risk: In the off chance a default happens and you get the asset back (like a rickshaw), you will have to bear the costs of storing it safely until you find someone else to buy it from you.

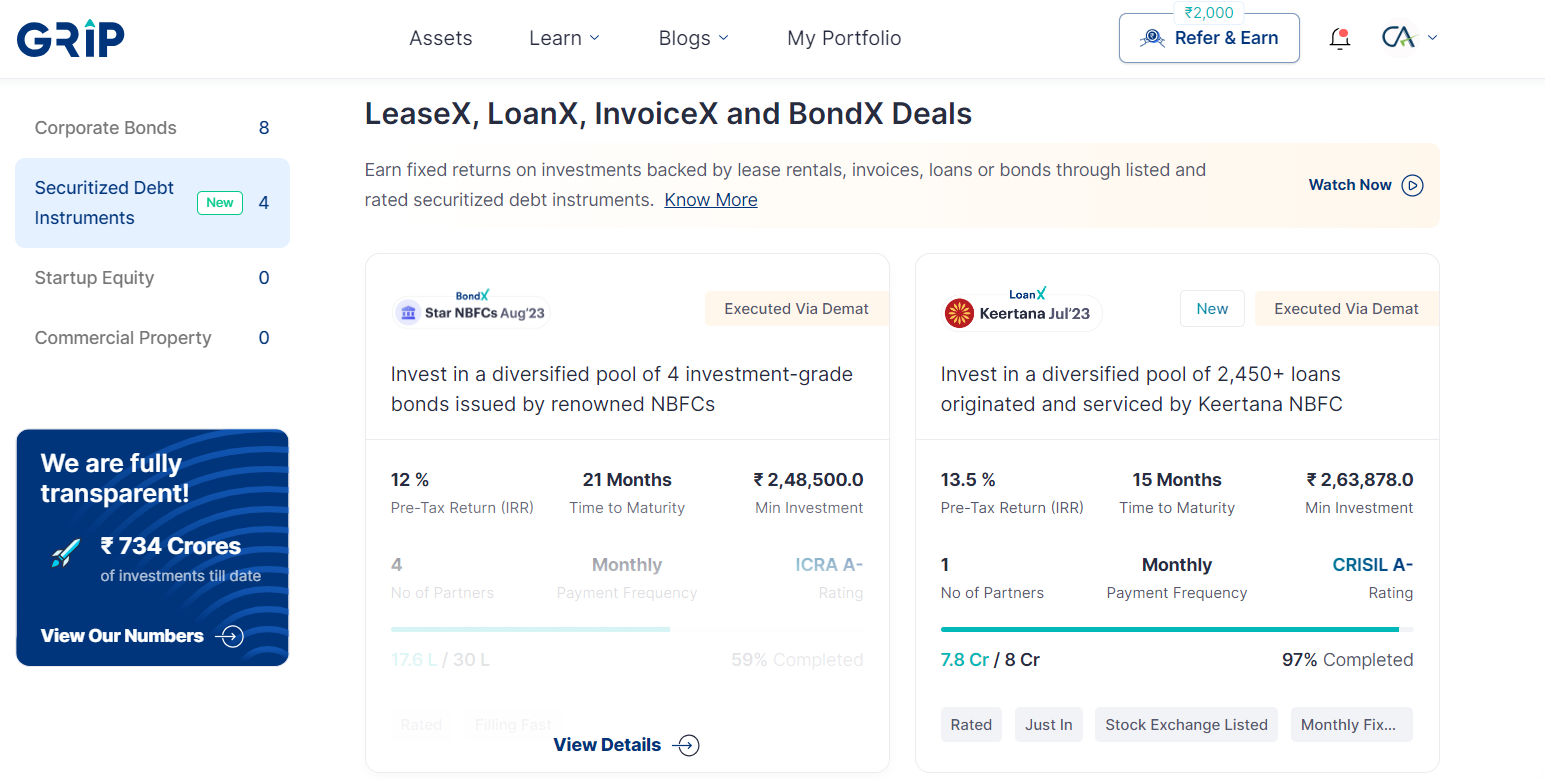

SEBI-Regulated Securitized Debt Instruments (SDIs)

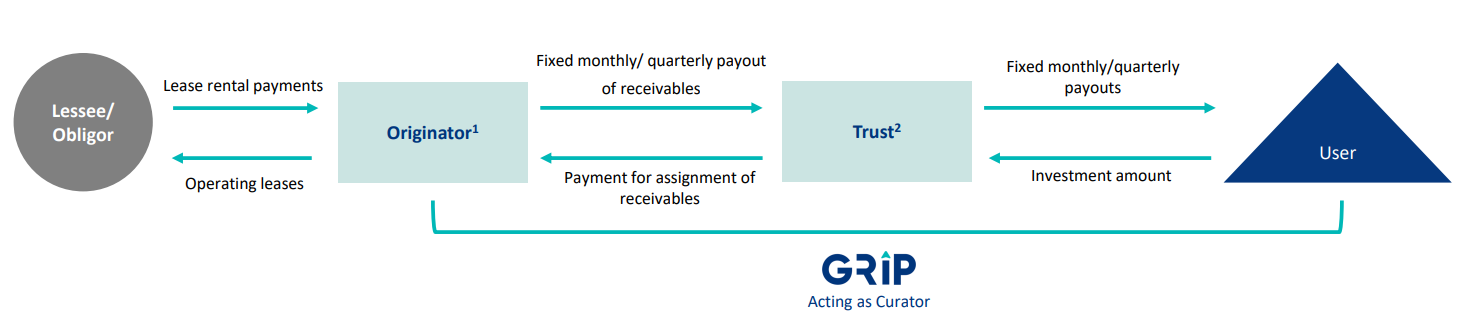

This one is perhaps a bit of a complicated structure involving a regulated debt instrument backed by the receivables of a trust. Let's take an example of one of the past deals on Grip Invest to walk you through this.

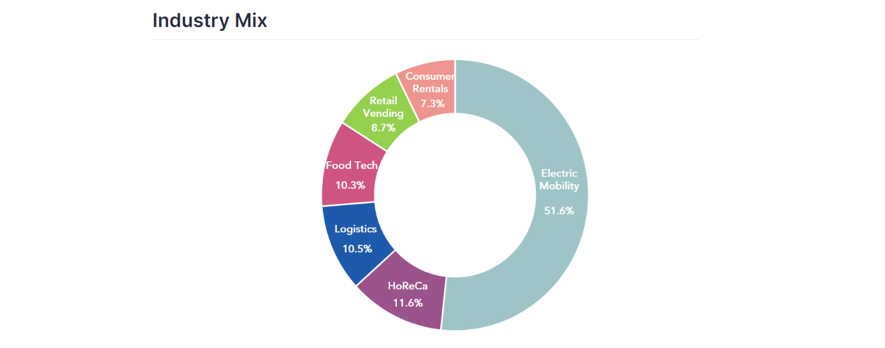

LeaseX Alpha Green was floated for a collective pool of companies requiring funds to finance assets such as EV vehicles, chartered bikes, furniture, kitchen equipment, etc. EV constituted 51% of the collective pool. Click here to access the information memorandum.

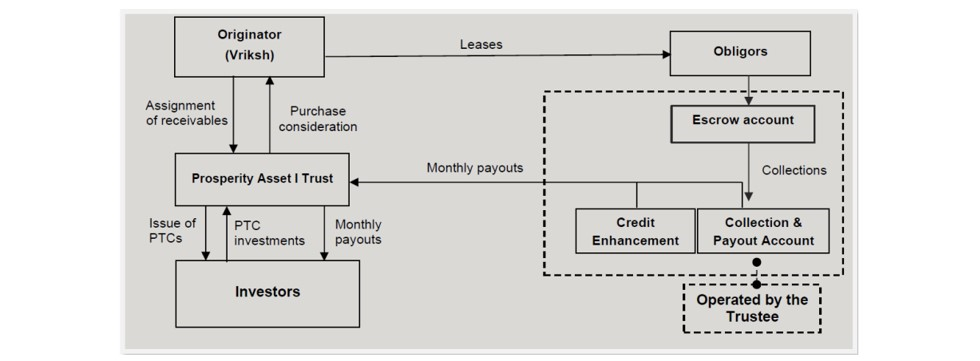

The underlying here is a debt instrument that is SEBI compliant, listed, rated and partially secured by cash collateralized bank guarantee and managed by an independent SEBI-registered trustee. The instrument is issued in the form of Pass-Through Certificates (PTCs) by a Trust that acts as a Special Purpose Vehicle. See below flow explained by Grip.

In our example, the following parties were involved

Obligor: Multiple companies as mentioned on the deal page here.

Originator: Grip Invest (Vriksh Advisors Pvt. Ltd)

Trust: Prosperity Asset 1 Trust

Investors

- Taxation: Interest income shall be taxable in the hands of the investor at slab tax rates. If you sell the bond earlier to maturity and if you realize capital gains, that will be taxed at respective rates.

Advantages of SDI

It's listed, regulated, and SEBI Compliant so your regulatory risk is to a minimum and the deal has been vetted by external rating agencies.

You get a constant income cashflow in the form of lease rentals and will recover your initial principal faster than other models here as in direct leasing and LLP models, around 25% - 30% of your money comes back when the asset is sold back.

You will have some sort of additional protection in terms of security structure, this can be different for each SDI ranging from:

Cash collateral held by the Trust

Hypothecation of assets.

Pool of different companies offering diversification

You will receive the asset in dematerialized form and is considered tradable as compared to other options on this blog.

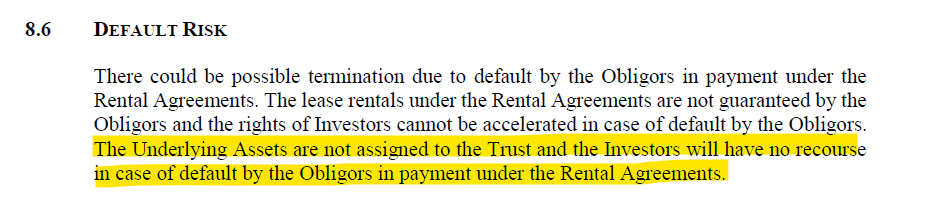

Disadvantages of SDI

Depending on the security structure of the SDI, if too many defaults happen in a short period, investors may lose money. In this specific example, the bond has cash collateral which could be used to cover any defaults but it did not have hypothecation of assets.

The above is mentioned in the Information Memorandum document shared earlier and can be accessed here.

Limited Liability Partnership Model

The LLP model will give you partnership rights in an LLP where your share shall be proportionate to the capital invested. So if you have invested ₹ 2,50,000 in a deal of ₹ 2 crores, you will have a 1.25% stake in LLP. This is quite a common model in the industry.

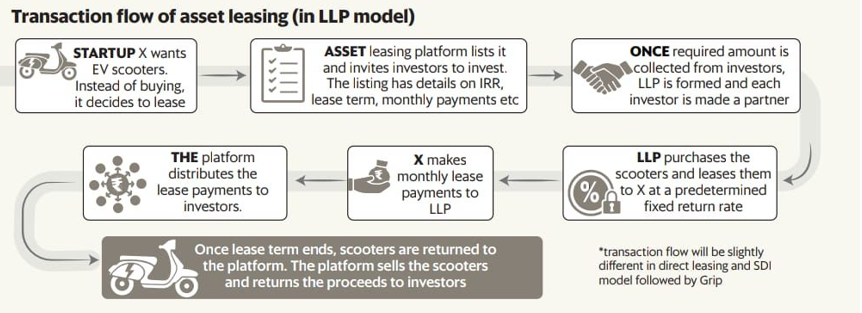

Here's a snapshot of the deal flow:

Source - Livemint

Underlying Asset: You will be a partner within the LLP which will hold the assets, this is not a regulated structure by SEBI. Any disputes within the LLP will have to be dealt with as per the Dispute Resolution Mechanism which will most likely be outlined in the LLP agreement. As a partner, you will not have any decision-making power assigned to you.

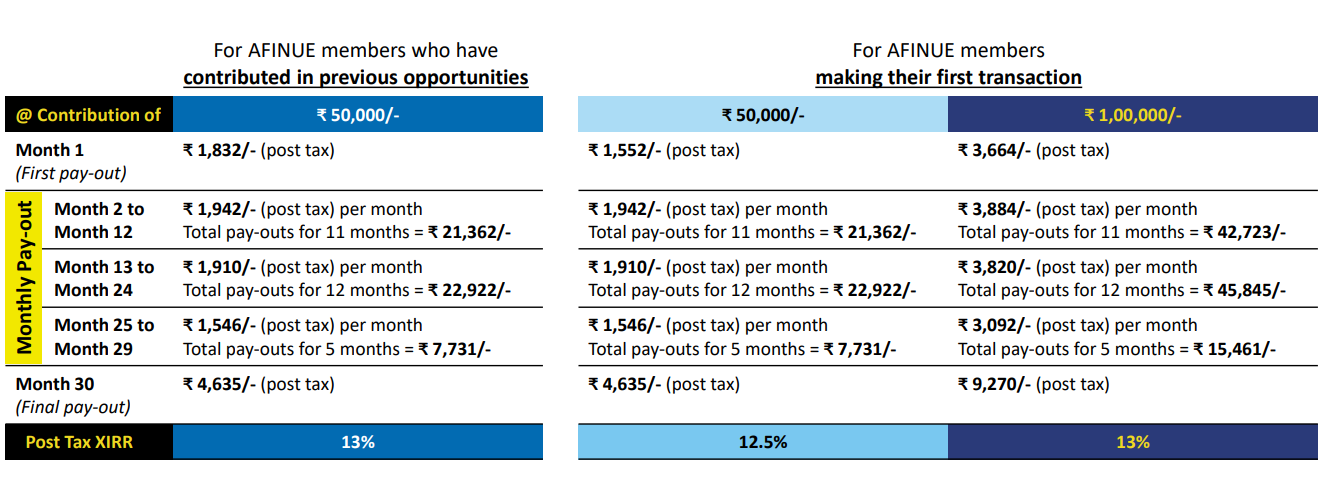

Cash Flows: Cash flows shall accrue to the LLP. You will receive a pro-rate share proportionate to your capital contribution. See the sample table below by AFINUE for one of their deals.

Taxation: The LLP will directly own the assets as long as the leasing agreement is in force and will calculate its Net Income after accounting for all depreciation, and expenses related to the asset. LLPs cannot calculate tax on a presumptive basis as per Section 44AD (mentioned in Direct Leasing above). All Net Income by LLP will be taxed at a flat rate of 30% and post-tax returns will be distributed to the partners per their share.

Management Fees: Since this structure needs to be actively managed and all compliances of the LLP need to be done, the designated partners of the LLP will be charging a management fee. Unfortunately, we couldn't access a live deal on other platforms to give you an example of this.

Advantages of the LLP Model

You don't have to worry about any compliances or management of the physical assets, you get post-tax monthly cashflows directly in your bank account.

The assets are owned by the LLP which has direct rights over it in case of any defaults. It can easily recover it, sell it and recoup some of the losses.

One LLP can sometimes finance multiple assets to different vendors which can also diversify the credit risk, but, please analyze the deal carefully to confirm this.

Disadvantages of the LLP Model

- It is not a regulated structure and you need to have some faith in the designated partner. If any fraud happens there, you will have very limited legal recourse.

Platforms available

GRIP Invest (Registered OBPP Platform): Only allowed to sell listed debt instruments. Was the first one in the market to bring a product like LeaseX mentioned above.

Tap Invest (Previously LeafRound): A relatively young company with good asset leasing deal flow. The best feature of their platform is they communicate the ROI, CAGR and IRR bringing transparency on the rate of returns to the investor. Tap Invest is the only one using the Direct Leasing model.

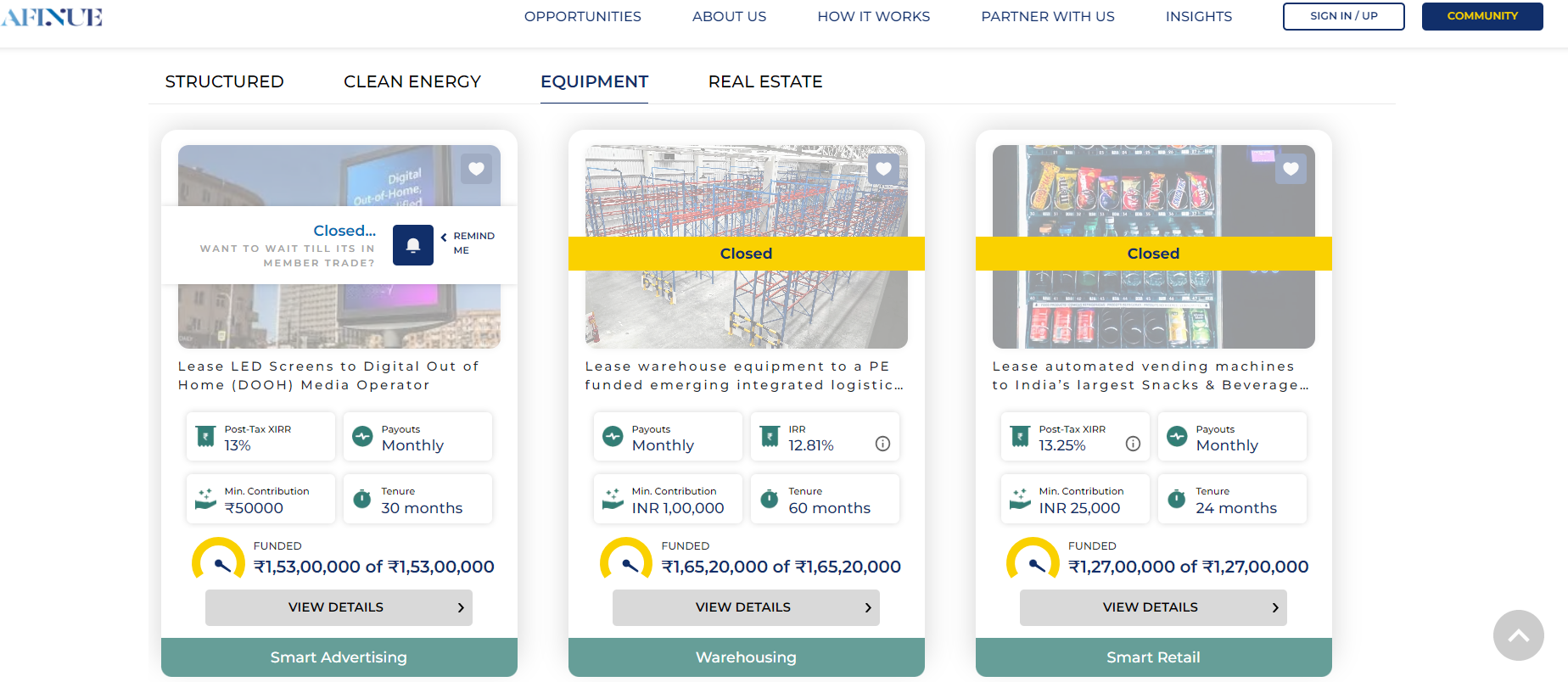

Afinue (LLP Model)

Leasify (LLP Model)

Bottom Line

Finally, my personal opinion on this is if you are someone who likes the certainty of a hard physical asset, has a 2-3 years horizon and likes to have regular cash flow to meet day-to-day needs, asset leasing can be a brilliant option for you. But like I have noted above, don't just go and subscribe to the highest IRR deals out there, understand which model works best from your risk tolerance and taxation point of view.

The ALT platforms mentioned above have certainly made investing into such assets much easier and accessible but do your due diligence before investing.

Below is a quick comparison of the three models discussed above

Hope you enjoyed the article, if you think there is something factually incorrect, please send me a message on LinkedIn.

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.

Lastly, if you like our work, please feel free to sponsor us via Hashnode Sponsors.

Subscribe to my newsletter

Read articles from Chahat Porwal directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by