Company Profile: SundayGrids (Digital Solar)

Om Shukla

Om Shukla

KEY TAKEAWAYS

SundayGrids offers a unique Digital Solar service that allows individuals to invest in commercial solar projects and use the returns to offset their electricity bills, providing a solar experience without physical installation.

Projects are funded by SundayGrids initially and opened to investors post-construction. Investors earn bill credits instead of cash, with returns considered tax-free as they are utility bill discounts.

SundayGrids operates on a Power Purchase Agreement (PPA) model, where businesses use solar plants on a Build Operate Transfer basis, ensuring fixed cash flows and IRR for investors.

While the absence of an SPV/LLP structure poses risks, SundayGrids provides transparency with detailed project documents and agreements, though investors are considered operational creditors in liquidation events.

The product is ideal for environmentally conscious individuals unable to install solar panels due to logistical constraints, offering a long-term investment with the flexibility of early exit options.

The world is going green! India has set an ambitious target to go Net Zero by 2070. As per the United Nations "Net zero means cutting greenhouse gas emissions to as close to zero as possible*, with any remaining emissions re-absorbed from the atmosphere, by oceans and forests for instance.*"

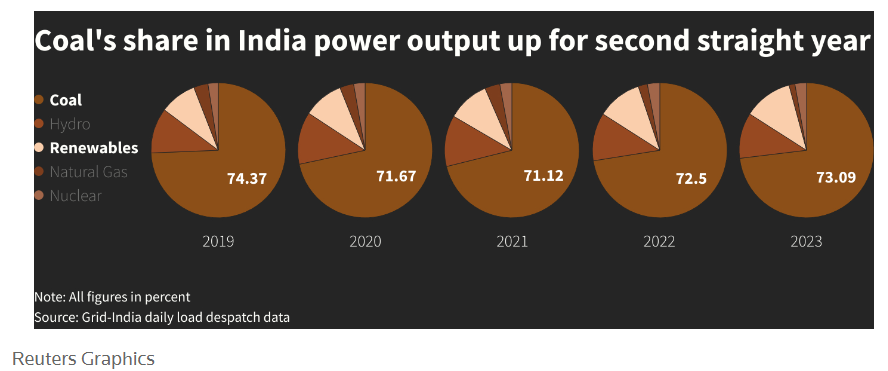

But of course, this is easier said than done, especially when ~73% of our energy needs are still fulfilled by Coal.

Speaking to a lot of people in their 20-30s for this article, I realized that a lot more people are getting conscious about the environment and want to source their electricity through renewable energy sources (like wind, solar, etc.) but are generally restricted because of the infrastructure needs!

India is a dense country and in cities like Mumbai, everyone pretty much lives in flats. As a resident of this society of flats, it may not be in your power to install a solar panel on the terrace of the building. Some societies in Mumbai even restricted people from installing charging points for their EVs (article here), think about convincing for a solar plant! It's not practical!

But then, if we cannot decarbonize our energy consumption, how can we still contribute to India's Net Zero Goals? Well, this is where SundayGrids comes into the picture with their unique Digital Solar concept. Before you get into this SundayGrids-specific article, we would recommend you to read our general Solar Investing article which can be accessed here.

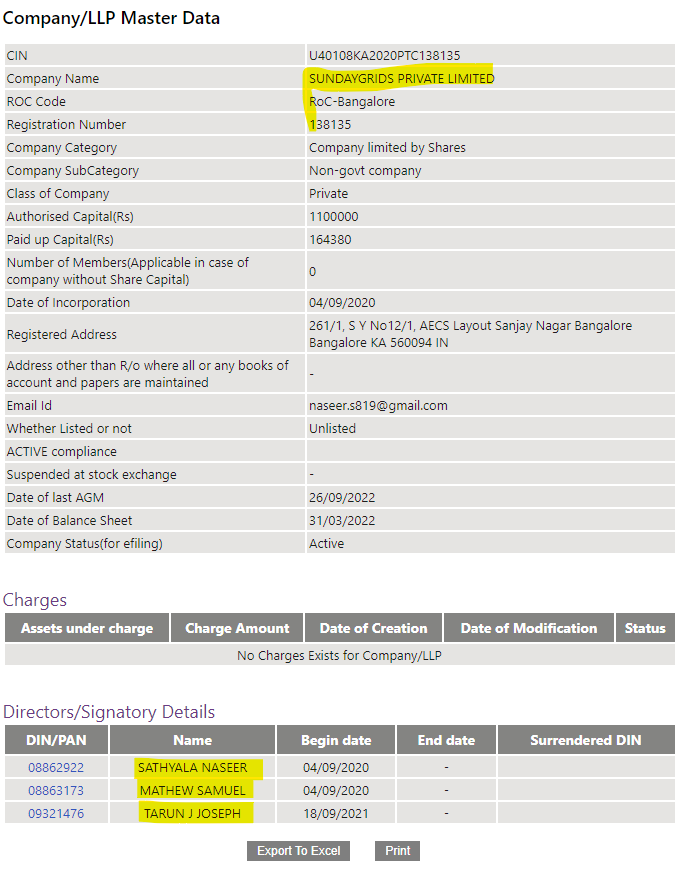

To write this article, we had a first-hand call with one of the founders (Matthew Samuel) who walked us through their investment vehicle structure and answered all questions we had. This article is based on that conversation along with our opinion on the company. It should not be construed as investment advice or any attempt to malign the name of the company.

By the way, if you are someone who prefers podcast over reading articles, you can watch our podcast with the founders here:

What is Digital Solar?

As per SundayGrids "Digital Solar is a service that enables residential individuals and groups to reserve solar capacity from commercial scale pay-for-use solar projects to trade power for bill credits, and in doing so, allows individuals to use these credits to save up on their power bills."

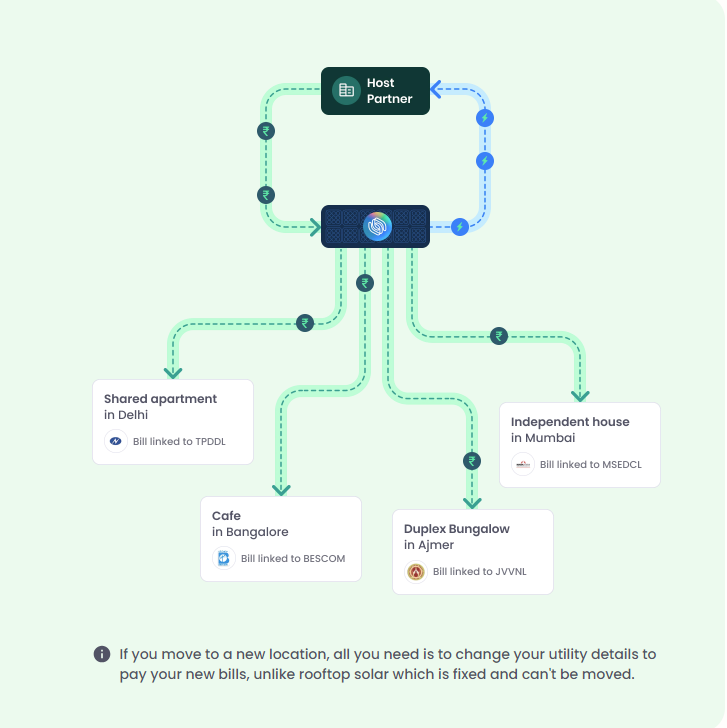

In simpler terms, purchasing Digital Solar means you acquire a portion of a larger solar plant. The electricity generated from your share is then sold to businesses, and the profits are passed on to you as an investor in your SundayGrids account. You can use these earnings to pay your monthly electricity bills in India.

The difference here, as compared to regular solar investing offered by companies like Sustvest and Pyse is that returns generated on SundayGrids can only be used to pay off your electricity bills essentially giving you the experience that you have installed solar at your own home.

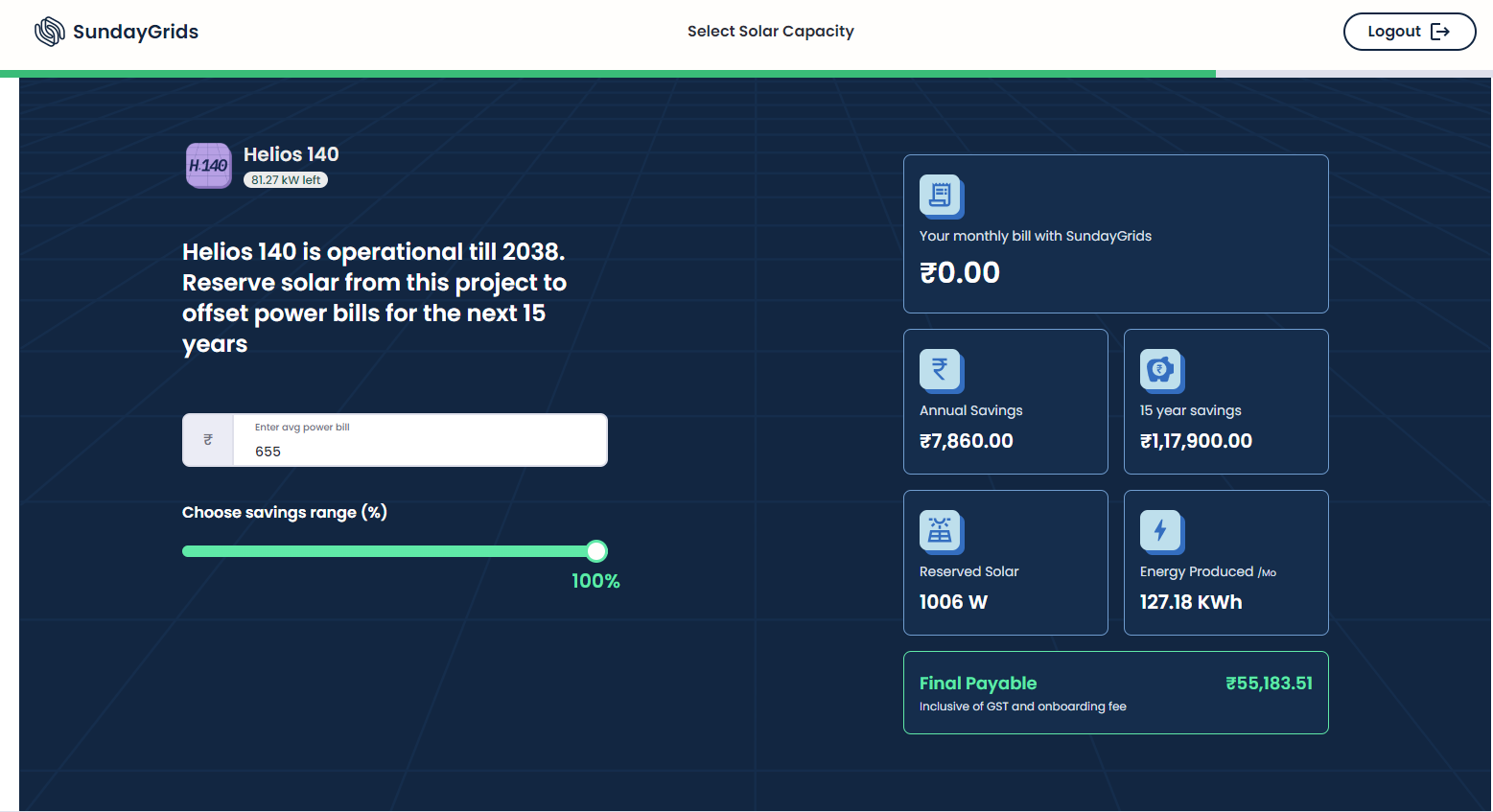

SundayGrids provides you with a calculator, to compute how much lump-sum capital you need to invest right now, to pay off your electricity bill until the maturity of the project. So for example, if you want to have ₹655 approx. as monthly credits in your account, you will need to reserve around 1.06 KWH worth of digital solar and will have to pay ₹55,184 upfront (incl. of all fees)

So the use case for this product could be of alternate investment. However, realistically, it's for the people who want to go solar for their electricity usage, but are not able to because of logistic constraints such as space, sunlight etc. usually faced by people residing in metro cities within high-rise buildings.

Check out this very useful video by them.

What happens behind the scenes?

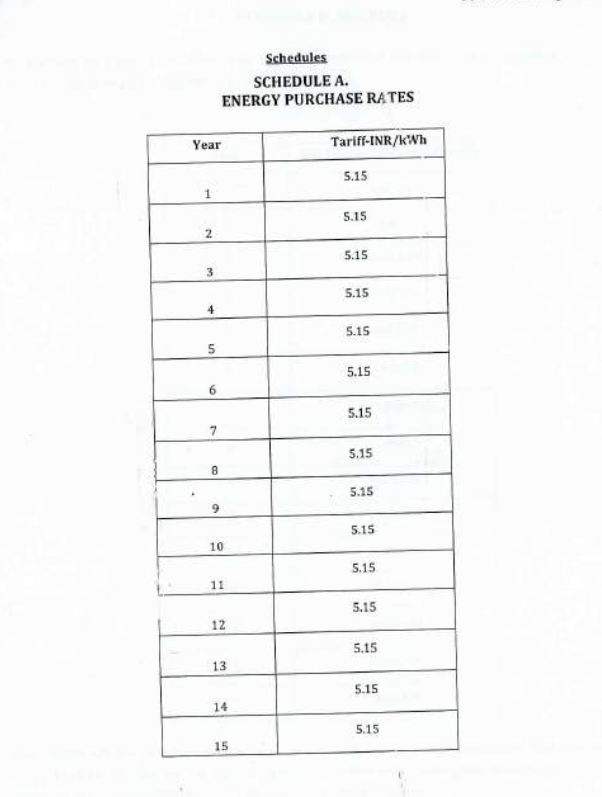

SundayGrids operates on the Power Purchase Agreement (PPA) model. We have covered this in great detail in our solar investing article. In the PPA model businesses use the plant on a Build Operate Transfer (BOT) basis. The solar plant is built and operated by SundayGrids, and at the end of the contract period, the plant is transferred to the business at a flat rate of ₹1. The business in turn agrees to buy electricity from SundayGrids at a pre-decided rate for the entire tenure of the PPA contract.

The business incurs no upfront cost, pays a fixed rate for the electricity they use and gets a solar plant after 10-15 years, while the solar plant provider (SundayGrids) gets a fixed cash flow and a decent IRR on its investment which is then passed onto investors who in turn can make their bill payments.

Sample Deal Details

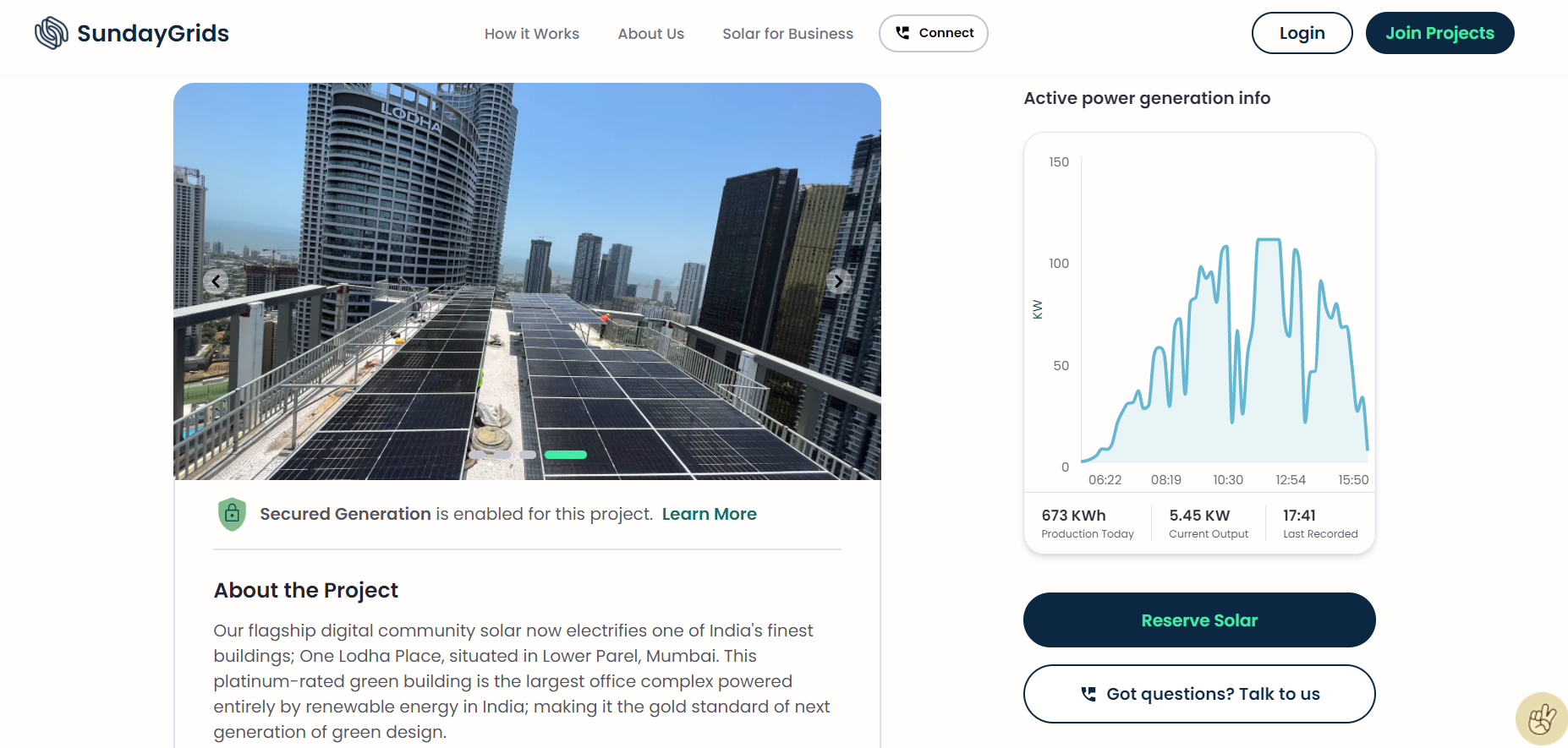

Let's dive into one of the live deals on SundayGrid's website to understand what exactly are they offering and things to consider before investing.

Every live deal that you see on the website has already been constructed and is up and running (More on this later). This gives you access to live power generation details even before investing in the project.

This snapshot is from their current project known as Helios-140. This project is based in Mumbai, at Lodha World Towers in Worli. Let me break down the process of setting up the project for you -

SundayGrids first connects with the business/ host and does their due diligence. This is done to check the viability of the solar project, the financial health of the business, and whether they can fulfill their financial obligations. Some documents given pre-investment are:

Rating of the partner where the solar plant will be installed (Access Here)

Project Insurance Document (Access Here)

Solar PPA Agreement with the Partner (Access Here)

Digital Solar Agreement (Access Here) (This is an agreement you sign with them)

SundayGrids draws a Power Purchase Agreement between them and the partner (Referred to as 'Offtaker'). We have gone through this PPA and everything seemed normal. The key highlight in the document is the payment obligations of the off-taker and the rate at which the electricity will be purchased until maturity.

SundayGrids then partners with a company for the installation of the Solar Plant. In this case, the installation has been outsourced to PeriUrja. Their previous project was installed by TATA Power Solar. The outsourcing company will be responsible for the maintenance of the project over its life.

A service agreement is then framed, highlighting the details of the project, estimated electricity generation, processes followed by SundayGrids, Instructions for users etc. We did not find anything odd with the agreement except for the Liquidation Event clause which we have covered under the Structure section.

Finally, once the project construction is completed and the plant is up and running, only then SundayGrids make the project live and start accepting investors.

After subscribing, if you ever wish to exit from the deal, you can calculate your refund value based on the project calculator, for this project, it can be accessed here.

Company Structure

This is where things get slightly interesting. Every live project that you see on the SundayGrids website is already under construction or has been completed. This is because SundayGrids does not set up an SPV/LLP to raise investors' money, thus they cannot pool the funds beforehand and then start the project construction. So the project is built using SundayGrids own capital or through debt, which is then repaid by the capital raised from investors.

Just to note, all current projects (live/sold) are housed under the SundayGrids Pvt Ltd, if the company were to go bankrupt, all existing solar projects would be liquidated and your investment would be considered an operational creditor under the Indian Bankruptcy Code, 2016. Operational creditors come after financial creditors in terms of payment priority.

Things we like about SundayGrids

For starters, I like the way they have approached the problems of solar. For people who genuinely want to switch to solar for their electricity usage, this may be the most convenient approach and even cheaper than installing physical solar at your place as per their calculator.

Investment transparency: All the documents and details for the projects have been provided beforehand. This includes service contracts, PPA agreements, project insurance and host credit ratings.

Given that they are accepting investors only after the construction is completed, Investors may feel a bit safer as the project is already up and running and live data is available for the same.

All returns mentioned in the project are tax-free as you get discounts on existing bill which is not considered as income under the Income Tax Laws.

Things we don't like about SundayGrids

For people exploring this product from the POV of pure investment, you should probably look toward other avenues. Other investments such as Invoice Discounting, Corporate Debt, and Litigation Financing may offer much higher IRR when compared to Digital Solar.

We feel that the absence of LLP/SPV structure is risky for Investors. As we have stated before, in case of liquidation of a certain project or the entire company, investors would have no right over the proceeds from the sale of Solar assets, as they are in the position of operational creditors. This risk may decrease if a project-level liquidation plan is adopted and if the investors are deemed financial creditors or given senior status during insolvency. But SundayGrids has already started working with their lawyers to sort this out.

There is no option for investors to get hard cash (even if they have to pay tax) from their investments, they would be stuck with offsetting electricity bill payments and if they use their credits within 15 years, they will expire.

Other questions we asked the founder

Please expand the questions below to see the answers.

Q1. Can investors withdraw our money before maturity?

Q2. What happens if the business (off-taker) defaults?

Q3. What if the business did not consume any electricity in a month? Do we still still get credits for that month?

Q4. What happens to the leftover credit after the project's maturity i.e. after 15 years?

Q5. Is SundayGrids associated with DISCOM (Electricity Distribution Company)?

Q6. Does SundayGrids take into account the price increase in the electricity rate faced by their investors?

Bottom Line

SundayGrids is truly a well-designed product with the best interests of our planet at heart. They have made it simple to get the experience of solar power without physically having to install one. Their model is unique and right now no one in the industry is using a similar kind of model.

From purely an investment point of view, given they offer 11% - 13% post-tax XIRR and that too locked in for straight 15 years, this is better than going down the route of normal solar financing arrangement where your post-tax XIRR would be 9% - 10% (assuming highest tax slab) but that is not to say there can't be better products in the market offering higher post-tax yields.

The product makes sense for you if:

You want to contribute towards the Net Zero and put your money to good use.

You have a long-term horizon of 12 - 15 years but also like the flexibility of getting out of the deal if required.

You are okay with offsetting your electricity bills instead of getting hard cash in your bank account.

Hope this was helpful and will help you make the right decision whether to invest in Sundaygrids or not. Just to clarify again, we didn't get any commission/payments/incentives from SundayGrids to write this piece. If you think something is factually incorrect in this article or I should add some more info, please feel free to email me at om.shukla@thealtinvestor.in

If you would like to know more about SundayGrids, there is a good video by Eco India on them, you can check this below.

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India, and none of these views reflect those of my current employer. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically, if you are a Tradewithpython subscriber, you know we don't spam.

Subscribe to my newsletter

Read articles from Om Shukla directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by