Navigating The World Of Unlisted Shares And Grey Markets

Om Shukla

Om ShuklaTable of contents

KEY TAKEAWAYS

The article explains the concept of unlisted shares and grey markets, highlighting their role as alternate investments, especially during major IPOs when demand is high.

It provides a detailed guide on how to invest in unlisted shares, emphasizing the importance of choosing a trusted platform due to the unregulated nature of this market.

The article also discusses the process of buying and selling unlisted shares, including the payment and transfer mechanisms, and the potential sellers in this market.

It outlines the benefits and risks associated with investing in unlisted shares, such as liquidity risk, lock-in periods, and platform risks.

Towards the end of the blog, a list of platforms offering unlisted shares is mentioned.

I am a huge fan of equities and I generally try to follow all the major updates about IPOs, Delisting, Buybacks, Bonus Issue, Stock split etc. But If you are a regular reader of this blog, you may be confused as to how this blog suddenly turned into an equity market commentary. Don't worry, we are still your good old guide to alternate investments, it's just that today's topic intersects between the alternatives and capital market space.

Unlisted shares are a form of alternate investment, but they generally come into the limelight during major IPOs in the share market. These are also referred to as grey markets. During the IPOs when the demand for an issue is too high, and all the quotas are oversubscribed, retail investors flock to these grey markets to get a piece of the pie, before the expected listing gains are realized making grey markets kind of a benchmark to estimate the listing price/gains of the stock.

But, I guess this is too much of IPOs and a grey market for today, let's get back to our topic - Unlisted Shares. In this piece, we will look at

How to invest in Unlisted shares?

List of various platforms that offer Unlisted Shares

The risks and benefits associated with it

Finally our views on these investments.

How to Invest in the Shares

Investing in Unlisted shares is quite easy and straightforward. The only key thing to remember is to choose a trusted and genuine platform as the unlisted share space is completely unregulated and does not come under the purview of SEBI.

The process is just like buying shares from Zerodha or any other broker. You start by registering with a platform and completing the KYC. You then need to update your Demat account details on the platform. And finally, connect your bank account to the platform and you are all set.

Now, let's understand the entire process of investing in unlisted shares via a simple example.

Example

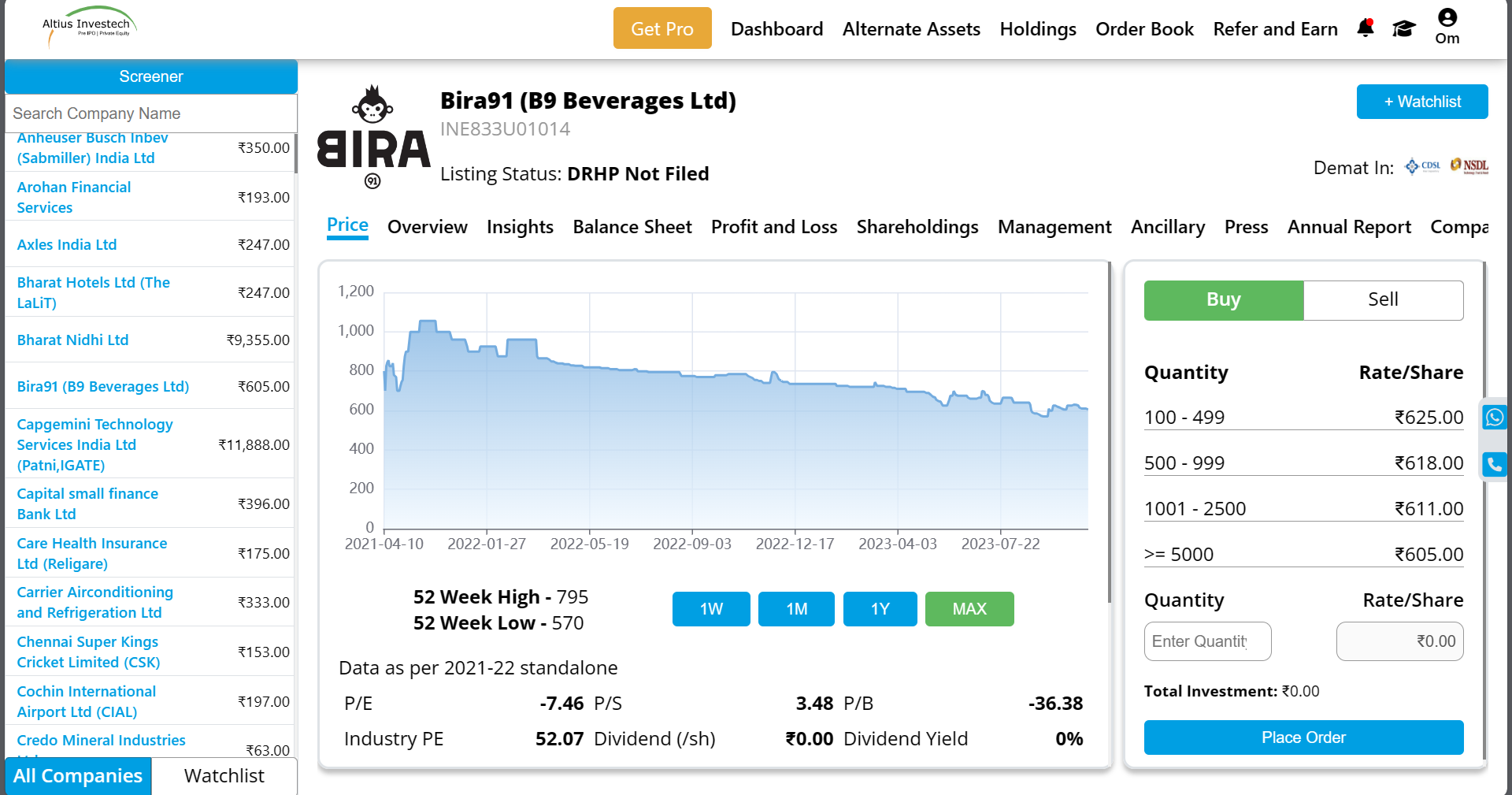

The platform that we will use for this blog is known as Altius Investech. Currently, there are sellers of roughly 50+ companies on their website. Let's take a look at the shares of Bira91, India's leading craft beer company.

The information about these companies is more or less similar on all the other investing platforms as well. As these are unlisted companies, their data is not readily available on public forums. Thus, platforms generally provide financial statements, ratios, investment analysis/thesis and other information such as shareholdings and managerial positions etc on their website.

Apart from the fundamental details, the most important data to look at is the volume of the share. The information on the number of buyers and sellers is not properly displayed on this website, but it is important to understand what liquidity to expect out of the unlisted share.

Once you are done with the analysis, let's say you want to buy this share. Given that these are unlisted shares and liquidity is low, you will have to buy the shares in specific lots. For this example order, the minimum lot size is 100 shares, so the order value comes out to Rs. 62,500 (CMP - 625)

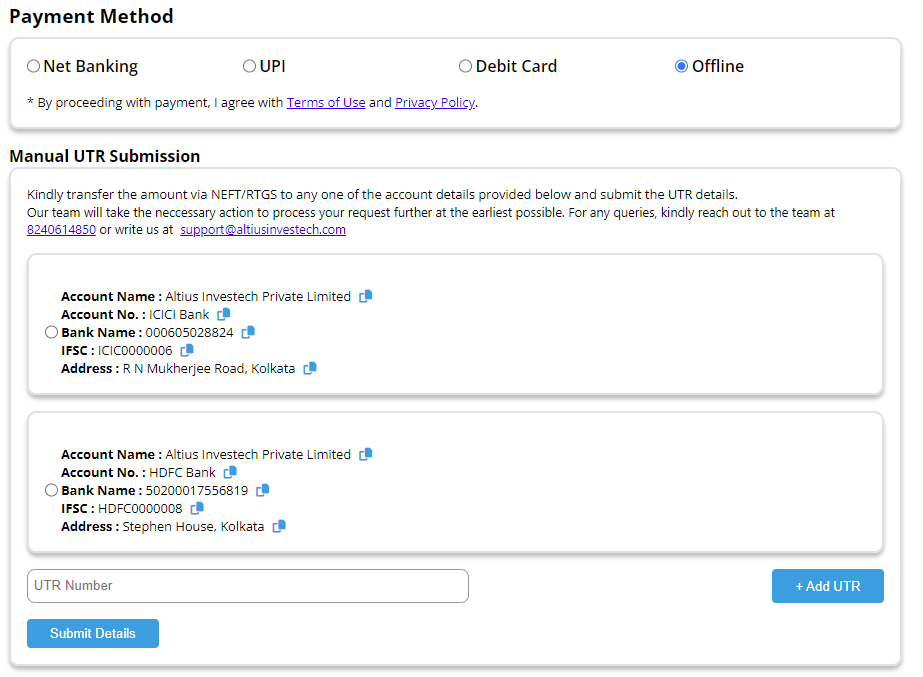

To execute the order simply click on buy and complete the payment via net banking, UPI or through your debit card. In some cases, you also have the option to complete the payment physically by mailing the platform a check for the amount.

Once the payment is done, the shares will be transferred to your DEMAT Account within 2 days.

How to Know The Transaction Is Complete

Given that the platform is unregulated and is a mere website, one needs to complete some checks to ensure that the transaction was in fact real and not a sham. So, there are two simple ways to do this -

Check Mail From Depository - You will receive a mail from NSDL/CSDL stating that share with ISIN number INxxxxxxxx and quantity xxx is being transferred to your account.

Check your securities/broking app - Open your broking app such as Zerodha or Grow and check under the portfolio/ holdings tab for new shares being transferred to your DEMAT account. Note, that the name of the company will not be visible, only the ISIN number will be mentioned. You can verify this ISIN number belongs to the same company by simply doing a Google Search.

If these two checks are done, you can relax and wait for your share to get transferred within the next 2 days post-settlement.

Charges Involved In Buying And Selling Of Unlisted Shares

There are a couple of charges that you need to be aware of before making the purchase. In most cases, while buying the shares, you will be required to pay only the quoted amount. But while selling the shares, you may have to pay other charges that may apply.

While buying the shares, the buyer may have to pay platform fees. This depends from platform to platform, but so far, I have come across very few platforms that charge this fee from buyers but some will charge 1% both to buyers and sellers like UnlistedZone.

While during the sale of shares, the seller will have to bear the cost of stamp duty and the DP charges. The platform fee may also apply during the sale, this again depends from platform to platform.

Payment And Transfer Mechanism

The payment mechanism varies from platform to platform, but there are two popular ways that platforms use for the payment and transfer of shares.

Without Escrow: the shares from the seller are transferred to the DEMAT account of the platform. The investor/buyer then transfers money to the bank account of the platform. Once this process is complete, the platform transfers the shares to the DEMAT account of the buyer, and the payment is forwarded to the seller.

With Escrow: In a different approach, the same mechanism is used, except there is an escrow involved. So, the shares are first transferred to the DEMAT of the platform or a trustee, while the payment from the buyer is in an escrow account. Once the shares are transferred to the buyer, the payment is forwarded from the escrow to the account of the seller.

Who Is The Seller Of Unlisted Shares

One of my biggest doubts while researching this topic was, who are the sellers of these unlisted shares and where did they get these shares from?

My first thought was, that these could be the early investors who must have invested in the seed round or Pre-Series A or something. This is true in some cases, but given that the lot size is so small, the possibility of this is slightly less.

The next is the founders themselves, this is possible as not all companies can provide exit via IPO or big-ticket funding round. So, the founders may decide to offload some shares in the grey market.

But in the retail category, one of the major sellers of unlisted shares are the ESOP's holders. The employees of unlisted companies who don't want to wait for a buyback can offload their shares via the grey market.

Exiting or Re-Selling Unlisted Shares

We talked about the process of buying an unlisted share and let's assume you as an investor have bought the shares of Bira91. But what if the company does not go for an IPO in the near future like you thought, and you want to sell your shares? This is where things become slightly complex, although it's quite easy, but not as straightforward as buying unlisted shares.

As I explained in the transfer mechanism, the shares are first transferred to the Platform. To transfer these shares to the platform, you will have to do this through your broker (if it provides this facility) or in most cases through your depository. CSDL and NSDL provide online facilities to transfer shares to a specific account. We won't cover the process in this blog, but you can check out the entire process here.

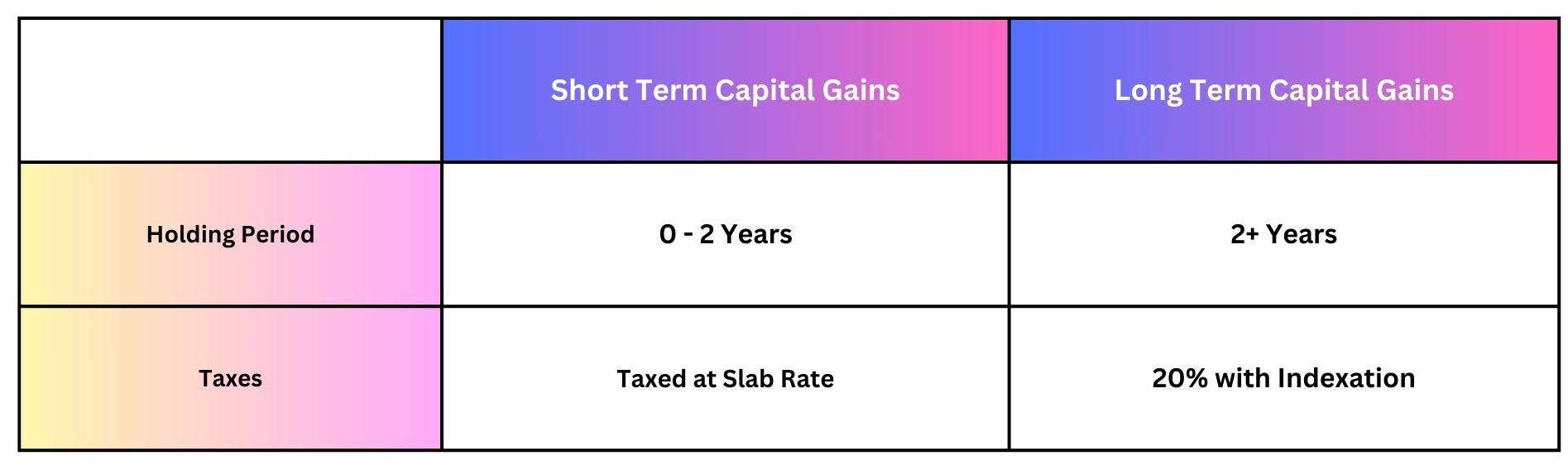

Keep in mind that this will trigger some form of tax liability (mentioned below) on you if you sell the shares at a profit.

Regulations

As I have already mentioned on various occasions, the buying and selling of unlisted shares is in the unregulated territory. Obviously, the SEBI and taxation rules will apply to the shares themselves, but the investing platforms and their functioning are completely unregulated.

The platforms are not SEBI-registered stock brokers, investment advisors or stock exchanges. Thus, before investing you need to ensure that the platforms are genuine and trustworthy.

Benefits

Pre-IPO Investing - As we discussed in the intro, unlisted markets thrive during highly oversubscribed IPOs. The investors who fear of not getting the allotment, rush to these platforms to buy the shares before the IPO closes.

Price Negotiation - As these are Over-the-counter transactions, the buyer can quote a price of their liking and the seller could demand a price depending upon how he values the company giving both sides some flexibility.

Early-stage investment - Certain companies may plan to go for an IPO after maybe 5 or 10 years. In such cases, Investors have an opportunity to invest in these companies at an early stage to hopefully reap profit after several years.

Lower Ticket Size - Investing in early-stage companies via the private equity route has generally min. ticket size of ₹2,50,000 (not considering CSOPs here which is a pure scam) but with unlisted shares you can get a similar kind of exposure based on your risk-taking appetite.

Risks

Liquidity Risk - One of the biggest risks in unlisted shares. It is very difficult to find buyers and more difficult to find one at the right price, so you have to stick with your holding for a long time.

Lock-In Period - It is important to note that unlisted shares have a lock-in of 6 months if the company does an IPO. Which means you cannot sell your shares for 6 months from the date of listing.

Price Discovery - Price discovery is an issue with limited buyers and sellers. You do not know whether the price is justified for a company. And even if you have a certain price in mind, it's difficult to find a seller at that price.

Lack Of Data - There is little to no publicly available data about the unlisted companies except the annual MCA filings, but you can't find out what's going on day to day and it may be difficult to get more context about the business without sufficient info.

Platform Risk - There are many platforms out there that act as an intermediary to create a market for unlisted shares. But as these are unregistered and unregulated entities, investors should carefully analyze the platform before conducting any financial transaction.

Arbitrage by the platform - This is a risk that you cannot really avoid, but it can be minimized using an escrow transaction. If the price quoted by the buyer is higher than the seller's, the platform can easily pocket the difference while investors and sellers lose out on a favorable deal.

Platforms in this space

Please note we haven't done any kind of extensive due diligence on any of the platforms below, there are simply too many and everyone has their own ways of doing business. Some look more credible than others but we can't really tell the difference just by judging on their UI/UX. Our team has not had a chance to do an unlisted transaction yet. This list is just for your info.

Our views

Well, recently I was looking to invest in unlisted shares of a couple of IPO-bound companies as I was certain that the grey market prices would increase due to oversubscription. However, I was hesitant to invest due to the unregulated nature of these platforms and the lack of information and reviews present on the internet.

But coming back to the topic, this could be a good opportunity for people who want to buy the shares of the early-stage company at a lower cost and hold it for the next several years to gain an exit post IPO or if an opportunity presents in an unlisted space.

For people looking to get the advantage of listing gains, remember you cannot sell the share right after the company gets listed, there is a lock-in period of 6 months post-IPO so your capital would be stuck till then.

So there are several use cases for unlisted space, but it is important to consider all the risks that come with investing through such platforms and then obviously weigh these risks against the rewards to reach the final decision.

The reason why I wrote this piece is because while I was looking for ways to invest in unlisted shares, I couldn't find any suitable resource to go about the process of investment. I hope I have covered everything in this article to help you through your investment journey in unlisted shares. If you have any questions, please feel free to comment on this article or reach out in our WhatsApp community which you can join here:

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India, and none of these views reflect those of my current employer. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.

Thank you for reading and hope to see you in the next one!

Subscribe to my newsletter

Read articles from Om Shukla directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by