5 Ways how Intelligent Workflows in redefining the Insurance sector

Maruti Techlabs

Maruti TechlabsTable of contents

Introduction

Insurance companies are finally pacing towards automation, one process at a time. But the real question remains: Is this pace sufficient to weather the digital storm?

Automation has always been at the heart of the industrial revolution. From the invention of the wheel to computers taking over the world, innovative machines have repeatedly changed the course of our industries.

Now that we have stepped into an era of artificial intelligence (AI), automation is once again poised to revolutionize industries in profound ways. Many sectors have already felt the metamorphic shakes brought about by AI, and insurance is no exception.

Though the insurance sector was initially slow to adopt AI, it has steadily embraced transformative technologies. Many insurance companies are leveraging big data analytics, telematics, IoT, machine learning, natural language processing (NLP), and chatbots to improve operational efficiency, precision, and cost-effectiveness.

However, much of the IT investments in the insurance sector were focused on isolated automation and localized solutions, still leaving room for manual tasks to persist. So, even after the digitalization of specific processes, the industry continues to grapple with issues like -

Cognitive overload

Operational inefficiencies

Delay in service

Non-scalability

Talent acquisition

Customer retention

Cost optimization

These challenges led to the innovation of intelligent workflows!

A McKinsey report revealed that insurers could automate 69% of data processing and 64% of data collection by leveraging intelligent workflows. Undoubtedly, Intelligent Workflows in insurance are among the top AI use cases & applications insurers must know.

But what exactly is an intelligent workflow in insurance?

Intelligent workflow uses AI, automation, and data analytics to create an integrated system that streamlines various insurance processes. It leverages machine learning (ML) tools and advanced AI algorithms to offer end-to-end optimization in the flow of work.

Megan Bingham-Walker, co-founder and CEO at Anansi Technology, stated, “Initial use of AI in insurance tended to focus on fraud detection. However, the current AI ML use cases in insurance focus more on benefitting the policyholder. A few examples would include - precise risk scoring, streamlined claims processing using computer vision, and personalized customer service via natural language processing.

Thus, adopting intelligent workflows in the insurance sector is gaining momentum as a promising approach. It will speed up the claim process, reduce errors, and save operational costs. It will also drastically enhance the customer experience of buying insurance policies and settling insurance claims. Let’s understand how.

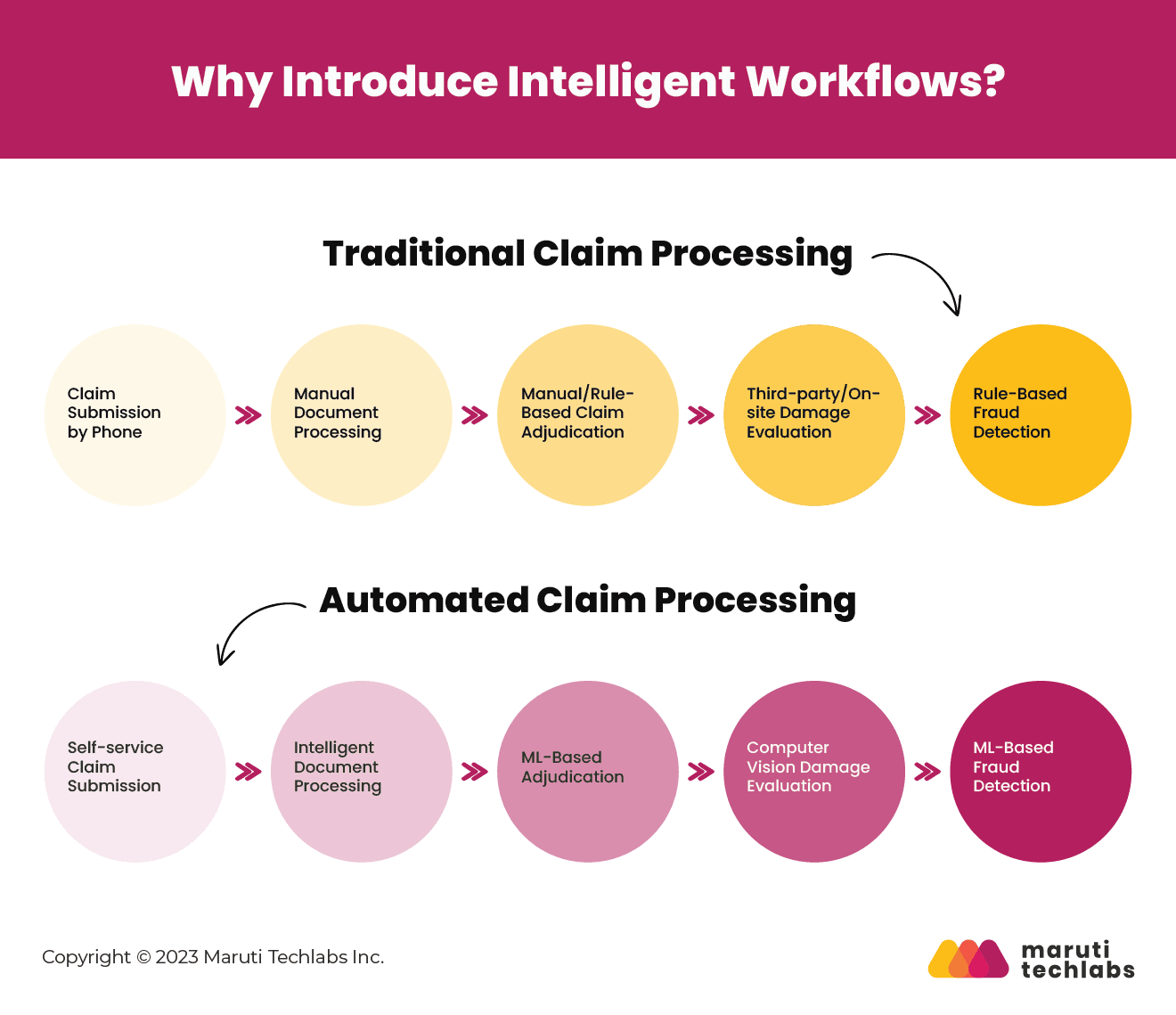

Why Introduce Intelligent Workflows?

Automation solves inefficiencies within the insurance industry, where historical processes have relied heavily on manual labor. Intelligent workflow is the ultimate way of attaining automation in insurance.

Some of the most pressing challenges plaguing the insurance sector are –

Complex Internal Processes – The traditional approach was designed along complex workflows involving multiple stakeholders. Miscommunication, negligence, and human errors often lead to inefficiencies. According to a McKinsey report, about 50 to 60 percent of insurance operations can be automated.

Customer Dissatisfaction – A Morgan Stanley and BCG report claims about 60 percent of insurance clients worldwide aren’t satisfied with their service providers. This discontent stems from tedious claim settlements, limited accessibility, poor communication, and high premiums. The report also revealed that nearly 50 percent of customers consider turning to digital insurers.

Difficulties in Attracting Young Talent – A study revealed that only 4 percent of millennials are interested in working in the insurance sector. This can be attributed to the burden of manually trawling piles of data. The sector’s sluggish pace in adopting modern technologies has deterred this tech-savvy generation from joining the insurance workforce.

Increasing Demand for Digital Capabilities – In the post-pandemic era, consumers are drawn to brands that offer robust digital features. According to a recent PWC survey, 41 percent of consumers are likely to switch insurers due to a lack of digital facilities.

Intelligent workflows present a promising solution to address these challenges, but implementing organization-wide workflow automation is a significant step.

Here are five compelling reasons that underscore the importance of transitioning to insurance claim automation:

- Enhanced Coordination Between Systems

With intelligent workflows, insurance companies can create a unified system to streamline the entire process from start to end. This eliminates the human dependency on feeding inputs at different levels, thus increasing efficiency, accuracy, and speed.

- Resource Optimization

Machine learning insurance tools can empower employees with mobile access to information. This improves their accuracy and working speed. Agents can effortlessly access policy information, submit claims through web and app interfaces, stay updated with the latest data, and address customer inquiries in real time.

- Superior Record Management

Strategically devised workflow automation can ensure seamless progression of information from one stage to another without interruptions, delays, or information loss. It will eliminate the need for human interventions, thus curbing the losses incurred due to human errors and delays.

- Improved Business Reach

Intelligent workflows drive efficiency and speed in every step of the claim processing journey, enhancing customer experience and loyalty. It further unravels insights into customer preferences, market trends, and emerging risks, enabling companies to make strategic decisions and target new customer segments.

- Reduces Business Expenses

Businesses can attain maximum cost savings by automating repetitive tasks, digitizing paperwork, and curbing errors. According to a Harvard Review, optimization and digitization through intelligent workflows can result in as much as 65% cost savings and up to 90% reduction in turnaround time.

In short, intelligent workflows can streamline operations by automating tasks, reducing manual labor, and eliminating inefficiencies. This results in increased efficiency, enhanced productivity, higher speed, and, most importantly, greater customer satisfaction.

Read the Full Article: 5 Ways how Intelligent Workflows in redefining the Insurance sector

Subscribe to my newsletter

Read articles from Maruti Techlabs directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Maruti Techlabs

Maruti Techlabs

Maruti Techlabs is an award-winning product strategy, design, and development partner. We bring the strategic value of product development consultants, the technical expertise of product engineers, data and systems architects combined with the UX-first approach to early-stage startups and established ventures. With a rich & varied experience of 13+ years in software development & a global clientele, we do everything from materializing your ideas through rapid application development & improving processes via RPA and AI to streamlining customer support via chatbots. We believe that the best business comes from long-term relationships, and it’s why we strive to build long-term partnerships with our customers. Our team of highly skilled & experienced developers, designers, and engineers understand the market's pulse & specific business needs to provide custom product development solutions. Service Offerings: Product Development Rapid Prototyping Low Code/No Code Development MVP Development Data Engineering Computer Vision Machine Learning Natural Language Processing DevOps Cloud Application Chatbot Development Robotic Process Automation Business Intelligence Data Analytics Quality Engineering Awards & Recognition: Great Place to Work Top B2B IT Company - By Clutch Best Company to Work With - By GoodFirms India’s Growth Champion - Statista & Economic Times Most Reviewed AI Partners - By The Manifest We provide a people-centric work environment that enables our employees to: Enhance their professional & personal growth Use the latest technologies to make a positive impact Experience collaborative innovation with a focus on diversity & work-life balance Discover global opportunities to work & learn with industry leaders Our mission is to help our clients build future-proof and intuitive digital products while guiding them with the best processes & practices that help them undergo a successful digital transformation and scale sustainably.