Univariate vs. Multivariate Approach in Time Series Forecasting

Rohan Anand

Rohan Anand

Time series forecasting plays a pivotal role in various fields, especially in domains like power & energy consumption, stock price , weather forecasting etc. The choice of modeling approach can significantly impact the accuracy of predictions. In this blog post, we'll explore the difference between univariate and multivariate approaches in time series forecasting.

What is Univariate Forecasting?

Univariate time series forecasting involves predicting the future values of a single variable based on its past values.

In the context of power and energy consumption, this could mean predicting the future power consumption solely based on its historical data.

Advantages of Univariate Approach:

Simplicity: The univariate approach is straightforward, making it easy to implement and interpret.

Computational Efficiency: With only one variable to consider, the computational burden is reduced.

Limitations of Univariate Approach

However, the simplicity of the univariate approach comes with limitations. In situations where the target variable is influenced by multiple factors, relying solely on its historical values may lead to suboptimal predictions.

What is Multivariate Forecasting?

Multivariate time series forecasting considers multiple variables as input features to predict the target variable.

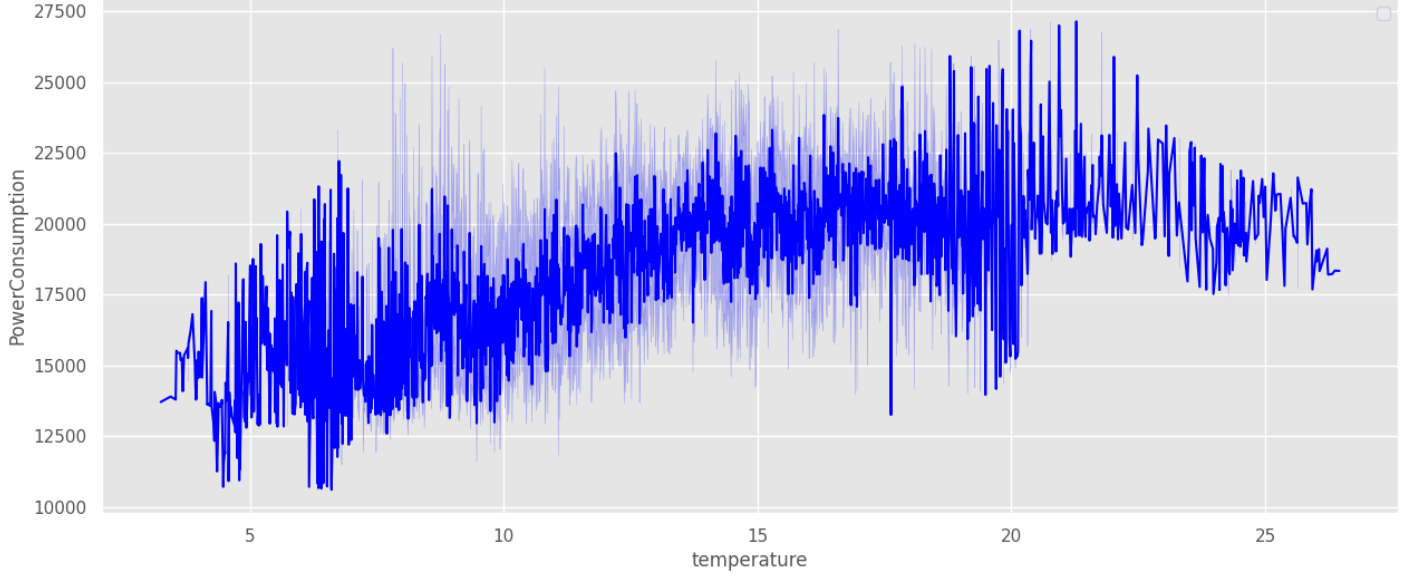

In our case, this could involve using not only the historical power consumption data but also other relevant variables like temperature, humidity, or time of day.

Benefits of Multivariate Approach:

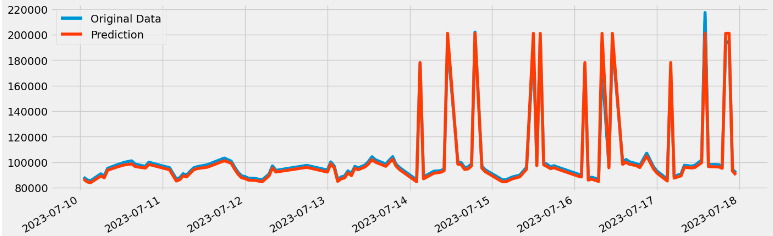

Improved Accuracy: By considering additional features, the model can capture a more comprehensive picture of the factors influencing the target variable.

Capturing Complex Relationships: Multivariate models can capture intricate relationships and dependencies among different variables, enhancing predictive capabilities.

Handling Exogenous Factors: External factors impacting the target variable can be incorporated into the model, providing a more nuanced understanding.

Enhanced Robustness: Multivariate models tend to be more robust, capable of handling variations and uncertainties in the data.

Case Study: Univariate vs. Multivariate

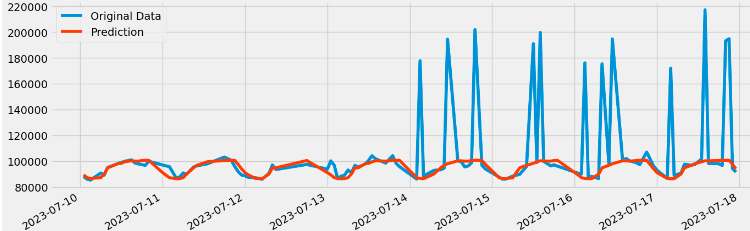

To illustrate the differences, let's consider a case study comparing the performance of univariate and multivariate models in forecasting power consumption.

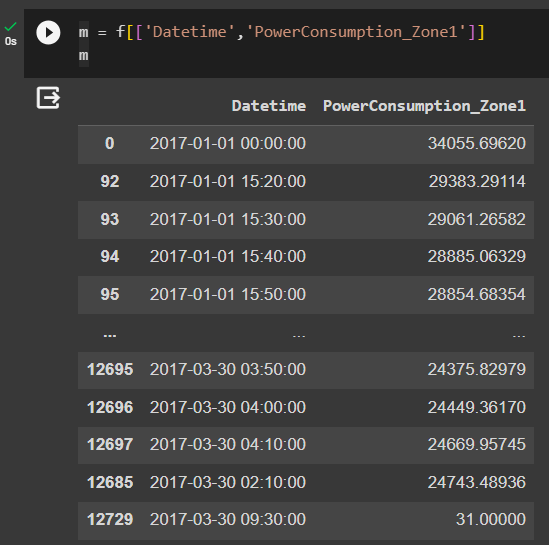

Univariate Model : To train this model I took index and one feature from my dataset.

Multivariate Model : To train this model I took 4 feature (after checking correlation) which helped to improve accuracy.

Best Practices and Considerations

Choosing between the univariate and multivariate approach depends on the specific characteristics of the data and the forecasting goals. Here are some considerations:

Data Characteristics: Evaluate the nature of the data and the relationships between variables, check correlation among/between them.

Forecasting Goals: Consider the specific goals of the forecasting task and whether a more holistic approach is necessary.

Feature Selection: In multivariate modeling, careful feature selection is crucial to prevent overfitting and improve model interpretability.

Conclusion

In conclusion, the choice between univariate and multivariate approaches in time series forecasting depends on the complexity of the underlying data and the forecasting goals. While the univariate approach offers simplicity, the multivariate approach provides a more nuanced and accurate representation of the real-world dynamics.

Understanding the strengths and limitations of each approach empowers data scientists and analysts to make informed decisions when tackling time series forecasting challenges.

Subscribe to my newsletter

Read articles from Rohan Anand directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Rohan Anand

Rohan Anand

Contributing to Open Source