Company Profile: LegalPay (Litigation Financing Platform)

Om Shukla

Om Shukla

KEY TAKEAWAYS

LegalPay is pioneering litigation financing in India, a practice well-established in Western countries, by funding legal expenses for lawsuits in exchange for a share of the settlement.

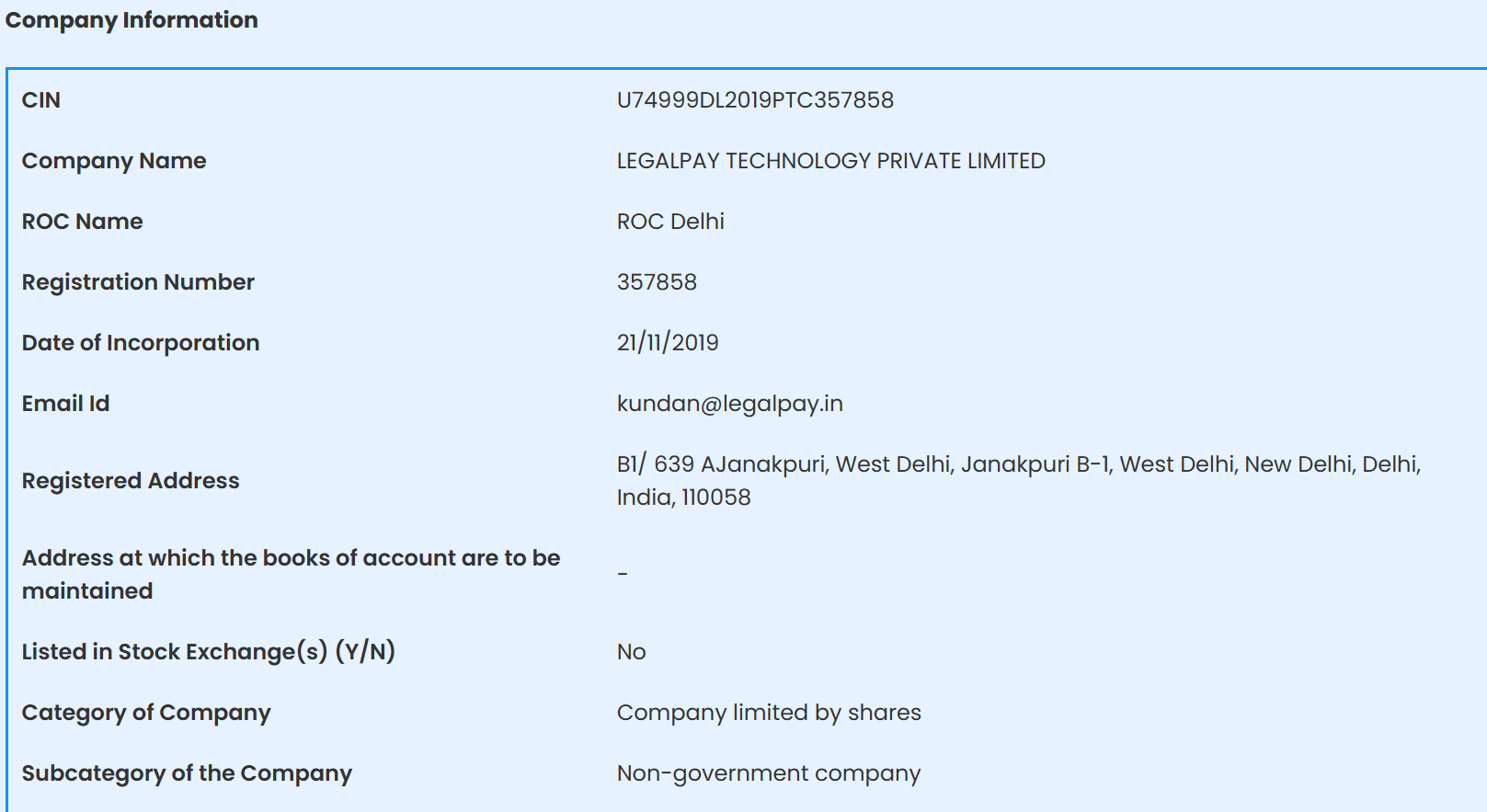

LegalPay, founded by Kundan Shahi in 2019, operates with a team of directors and has raised funds from notable investors, though it is not registered with SEBI or the Bar Council of India.

LegalPay offers litigation and interim financing through SPVs, targeting high returns for investors by funding legal cases and companies in bankruptcy, with a fee structure of 2% management and 20% success fees.

The company uses a robust underwriting process involving technology and expert evaluation to select cases, maintaining a diverse portfolio to manage risk and ensure returns.

LegalPay offers high returns but requires a long-term investment commitment, making it suitable for investors with a high-risk appetite and the ability to invest significant amounts over several years.

Litigation Financing is pretty old and established model of investment in western countries. Major players in Australia, UK and US are already minting money by funding legal expenses of lawsuits and taking home a portion of settlement amount.

In India though, Litigation Financing has always been a grey area. Until recently, when supreme court set the precedence for this investment practice in a major ruling.

But a crucial question remains, What is the role of a Litigation Financier in the legal ecosystem? The answer is simple, India in general including corporates have the mindset of "Tu Jaanta Nahi Mera Baap Kaun Hai" types. So for e.g. if you are a small distributor for a multi-national FMCG company and you have a dispute with them, the FMCG company will have deep pocketed lawyers who can game the legal system and get the case dismissed, but what if you had a backer who could fund your legal expenses after analyzing the merit of your case and help you win only with the premise of sharing around 25%-30% of your settlement wins. Sounds good right?

And so, Kundan Shahi (The founder of LegalPay) began the work of establishing a market for this product, in the process becoming the biggest player in India for litigation financing.

According to companies operating in this space, the precedent for such a practice was set in Bar Council Of India vs A.K Balaji & Ors, where the supreme court observed - (Highlighted text) “38. In India, funding of litigation by advocates is not explicitly prohibited.... but would strongly suggest that advocates in India cannot fund litigation on behalf of their clients. There appears to be no restriction on third parties (non-lawyers) funding the litigation and getting repaid after the outcome of the litigation...”

We recently did a podcast with Tanya Prasad (CIO at LegalPay), check it out here.

Corporate Structure And Founders

LegalPay (LegalPay Technology Private Limited) was incorporated in 2019 by Kundan Shahi, but they truly became operational in 2021 when they raised their first round of funding.

As per the MCA records of December - 2023, the company has 3 directors -

Kundan Shahi (Founder and CEO)

Chandan Shahi (Director: LegalPay)

Ambarish Narayan Gupta (Founder of VC Firm - Basis Vectors, Funded LegalPay in 2022)

The company has raised funds from various angel investors, venture capitalists and private equity over several rounds of funding. Some of the big names include 9Unicorns, Venture Catalyst etc.

It is also important to note that the company is not registered with SEBI or Bar Council of India in any capacity. The pooling of funds is done via traditional SPV-LLP routes. Recently, LegalPay acquired a minitory stake in an NBFC named Padmalya which gave them full operational rights to deploy funds for interim financing and litigation financing projects as well.

Talking about Kundan Shahi, surprisingly, he himself is not a lawyer! He worked in EXL (A global analytics and digital solutions company) for about 9 years before starting Advok8.in where he was testing the idea of legal insurance in India but soon dropped it due to the intense capital requirements needed to run the business. Kundan is also the founder of Bharat Dispute Resolution, a subsidiary of LegalPay and it is a tech platform providing Online Dispute Resolution, it helps LegalPay expedite the case outcome as both parties opt for alternative dispute resolution through online mode instead of going to court, so it reduces the timelines. Roughly 10 % cases of in our portfolio go through BDR. This model is 100 % acceptable and being endorsed by the government and other regulators.

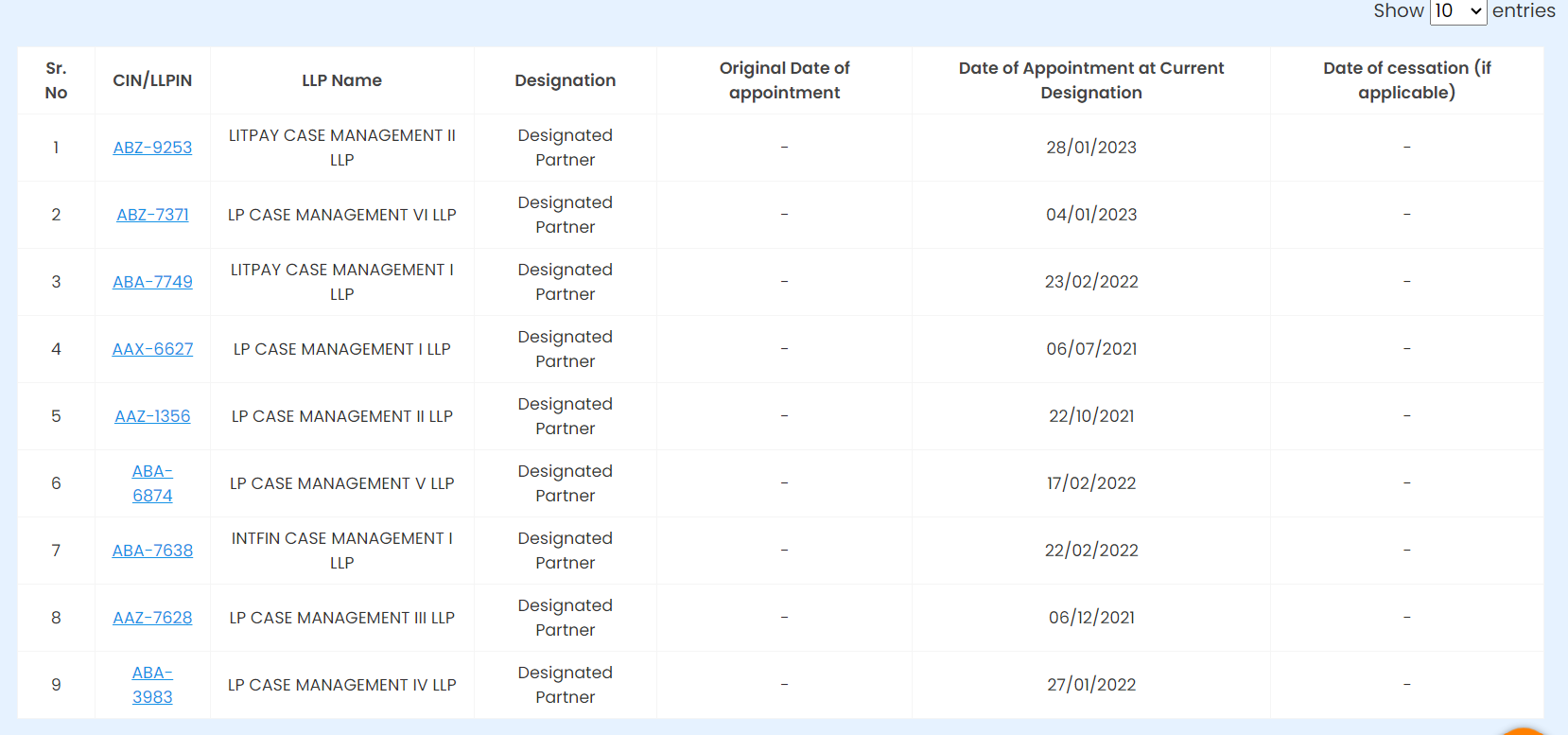

Kundan is also a designated partner in multiple LLPs that have been setup for pooling in money to fund litigation financing cases.

A Little Back Story

As per Kundan, before starting LegalPay, Kundan consulted several top law firms, lawyers and even tested the concept to understand the structure and process. However, this move was met with backlash as the concept of Litigation Financing was considered or was perceived to be illegal. But after the SC decision, Kundan's idea was validated and could be practiced legally. LegalPay wasn't alone in this journey though, many big guys such as Omni Bridgeway, Phoenix Advisors saw this as an opportunity to enter Indian markets.

And why wouldn't they, Litigation in India is a huge industry. According to Kundan, In India there are roughly 2cr litigation cases filed each year. Average cost to pursue the case will be roughly ₹1.5 Lakh. This makes the litigation industry in India to be roughly around 3 Lakh Crore or $30Bn. In terms of total legal expenses, India is in 3rd position after US and UK. And according to Kundan, the industry is growing at a rate of 10%.

Products On Offer and Business Models

Mainly, LegalPay has 2 types of products on offer for us retail investors:

Litigation Financing (SPV Route)

Interim Financing (SPV Route and Bonds)

LegalPay also has a product specifically dedicated for lawyers, which is in the field of financing legal expenses through EMIs, but it is does not involve the participation of investors.

Litigation Financing

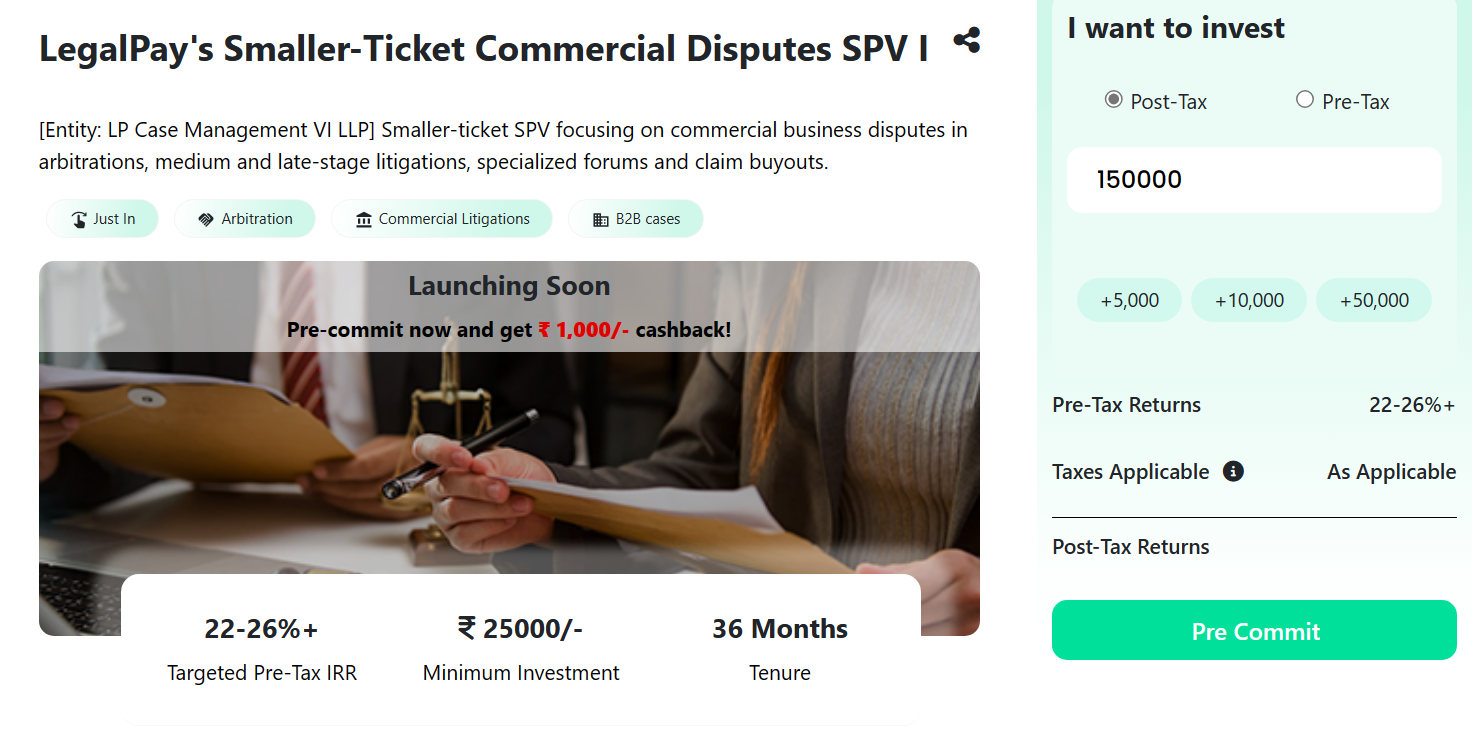

The business model of LegalPay is quite simple. In the above deal, LegalPay raises money from investors and pools it in an SPV - a LLP in this case. The investors are made partners in this LLP and LegalPay becomes the designated partner. This capital is then utilized by LegalPay / LLP over a period of time to fund a basket of legal cases. As we can see from the title itself, the SPV will fund small commercial disputes mostly from MSME sector. And as the cases are resolved, if the litigant wins, the claim amount will be transferred to the LLP. The profits from the LLP will then be transferred to the partners (Investors) net of taxes at 30%, management fees and success fees.

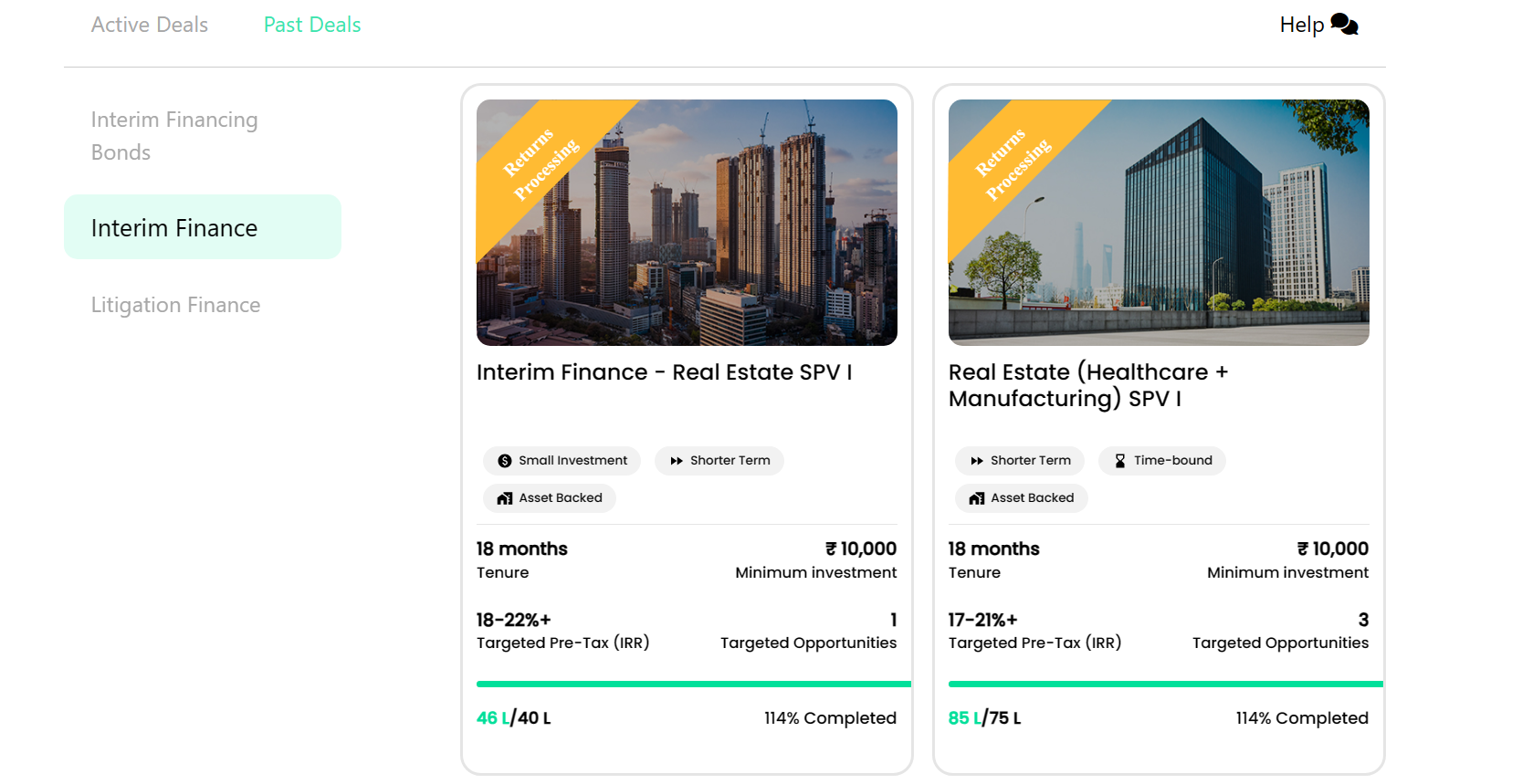

Interim Financing Via SPV Or Bonds

The same structure is followed for Interim financing as well, we won't get too much into the details of Interim Financing as there is a lot to unpack, but you can check our detailed blog on this here. Essentially, in Interim Financing, investors fund a company or a project which is on the verge of bankruptcy. When a company files for bankruptcy under IBC 2016, the company is placed under Corporate Insolvency Resolution Process (CIRP). Wherein the company is given 330 days to either get the business back on track or to liquidate the assets and repay the creditors (In most of the cases the timeline is extend by NCLT).

So now coming back to our topic, basically any financing raised during the CIRP is called interim financing. These loans, taken during CIRP, are super senior and secured in nature. Which means they are backed by assets and have the highest priority in terms of repayment.

Similar to the above case, LegalPay pools money from investors through an SPV (LLP) and utilizes this amount to provide Interim financing.

Companies can also choose to raise interim financing via bonds. In such cases, LegalPay gets a tranche of these instruments to sell it to its investors. In such cases, investors can participate in interim financing by simply purchasing interim finance bonds.

Fee Structure

LegalPay follows the PE/VC standards of 2-20. They charge a 2% management fees on the amount invested in the SPV and a 20% success fees on the returns generated. LegalPay sets a hurdle rate, which is a pre-decided level of return. If the returns of SPV is more than the hurdle rate, LegalPay keeps 20% of the above-hurdle-rate profits as success fees.

How Does LegalPay Conducts Underwriting Of Legal Cases

And now coming to the crux of the process, the underwriting of litigation cases. Just like in banking we have NPAs, litigation financing has winning rates. The quality of these cases (Assets) and the winning rates, determines the actual returns of the SPV. If too many of these cases are stretched for long or if they do not deliver a favorable result, the IRR could change drastically.

According to Kundan, 80% of their cases are through inbound requests. Lawyers can submit their client's case on LegalPay's portal which are then vetted by the company. The rest 20% is outbound where LegalPay reaches out to businesses and corporates to fund their cases. Usually, these 20% of the cases become legacy clients and bring in large ticket size repeat business.

The process of case filtration starts with help of proprietary tech. According to Kundan the first round of elimination happens when the lawyer enters the details of the case, things like nature of case, claim amount, lawyer fees etc. Their system automatically segregates the cases depending upon the quality of the case and requirement of the current financing deal.

The next round is done manually where LegalPay's underwriting team of CAs, CFAs and Lawyers, go through each case and evaluates it on several parameters. The key parameters on which these cases are vetted are -

Quality and nature of our case.

Financials (Claim value and Time Value of Money)

Capacity of the opposition party to pay the claim.

Analyzing litigants and opposing party lawyers.

Lastly, if required, cases are sent to the CIO - Tanya Prasad or Kundan himself if the ticket size is quite large. After all of these processes, each SPV is allotted cases depending upon their nature. Currently LegalPay is funding around 60,000 cases across its portfolio.

According to Kundan, each SPV maintains a certain ratio of duration of cases. The cases are sorted in 3 timeframes:

Expected Closure/Settlement in <18 Months (30% of the cases)

Expected Closure/Settlement in 3 - 5 years (40% of the cases)

Expected Closure/Settlement in 7 - 10 Years (30% of the cases)

This arrangement allows LegalPay to understand the duration and expected returns for the SPV.

Risk And Returns Matrix

So now let's talk about the returns on these products. In short, its quite high. The returns on litigation financing SPVs are very attractive, as they offer 23-26+% IRR over 3-5 years. But you may be thinking, that such high returns will obviously come with very high risk. Well, it's true to some extent, but according to the data provided by Kundan, the picture is not so gloomy.

According to Kundan, in order to generate returns, the total win rate across an SPV's portfolio of cases should be roughly 20%. To put some numbers to it, for every 6 cases, even if 1 case is successful, it will be enough to generate good returns for the SPV.

On an average, LegalPay would spend ₹30 on 6 cases for a period of 3 years. And even if they win 1 case, they will be able to generate a return of Rs.100 on the SPV level. So after the tax, management fees and success fees, investors would easily net 20%+ IRR. According to Kundan, their current success rate is roughly 70% but ALT Investor is not able to verify this number independently. Now I'll leave the rest of the math to you, to figure out the returns these investors are expecting.

Currently LegalPay is managing around ₹150Cr in AUM, but according to Kundan, the Claim Under Management (CUM) in more important than the AUM figures, given the high margins in this business. LegalPay claims to have a CUM of roughly ₹3,000Cr. Their target is to reach a CUM of ₹7,000Cr by end of 2024 and ₹50,000Cr by 2025.

Talking about Interim financing, it also offers quite high returns somewhere in the range of 18-23% depending upon the risk and investment route. The risk is obviously quite high across the portfolio, as the companies are on the verge of bankruptcy. But the risk is also minimized as the financing is asset-backed and super senior in nature.

What We Like About LegalPay

Transparency - The platform is quite transparent with the investment process. They provide the sample service and LLP agreements before-hand.

Strong Underwriting Process - The entire basis of any investment is the underlying asset you are putting your money on. In this situation, it is the litigation cases which are the underlying asset. LegalPay has a strong underwriting process, and they are able to maintain the quality across the SPVs. This is a great news for investors as they will be able to generate higher returns due to good asset quality.

Great Returns - LegalPay is able to consistently provide great returns across investment products and SPVs. These returns range in the IRR of 18% to whopping 26+%.

What We Don't Like About LegalPay

I want to reiterate that we are not biased towards LegalPay or funded by them, but the truth is, there is hardly anything to dislike about this platform. If I had to force myself to write something, it would be the lack of focus on retail investors. The platform obviously wants to achieve scale and quick growth, and participation of retail investors doesn't fit into their equation.

According to Kundan, LegalPay is building a premium investment product, which requires stable and big-ticket size money. Basically, the platform is looking for higher investment amount (atleast 10L) for a longer duration of 5-7 years. Retail Investors do not fall under this bracket as they are eager for liquidity and lower investment amount. So LegalPay has shifted it's focus to elsewhere, i.e. the bigger sharks such as HNIs, DIIs etc.

The last thing which I dislike about the platform is their disclosure related to SPVs. Investors obviously know the sector a SPV is targeting to, but we do not get the list of cases they are planning to fund or the company they are planning to finance. All of this is available post investment, but not before, thus you have to trust the platform that they are choosing the right opportunities to invest your funds. Kundan suggests that case details including the parties names are confidential and bound by attorney-client privilege, these details can also affect the outcome of the case so we cannot disclose the name to our investors and it is standard practice across the globe.

Our Conclusion

So would we invest? If someone would have asked me this question, my answer would have been an astounding yes. But in reality, it depends upon the appetite of investors. investors that need a consistent cash-flow, want to take low risk and want an option to liquidate should stay away from the product as the purpose the product is quite different.

But if you are someone who can:

Stay invested for atleast 4-5 years, i.e. be patient

Can invest atleast ₹10L (Kundan's preference)

Don't care about cash flows or liquidity

Then this product is perfect fit for you in the longer run. But it's a complicated product, so do analyze your preferences and requirements and then see if you can really adjust with the above requirements.

For us, over a 4-5 year horizon, we will definitely give it a try, it's a unique concept with an evergreen market and backed with the right team, you have more chances of being successful in making money.

That's it for today from our side, if you like this article and want to invest in LegalPay, reach out to Yash Roongta (Whatsapp) so he can understand your requirements and speak to LegalPay. For any other queries, feel free to join our Whatsapp Community here.

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India, and none of these views reflect those of my current employer. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.

Subscribe to my newsletter

Read articles from Om Shukla directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by