Breaking Down Bitcoin: An In-depth Look at ETFs, Lightning, Layer 2s, Bridges, and Unexpected Insights

chandan

chandan

2023: A Year of Innovation on the Bitcoin Network

Noteworthy developments included:

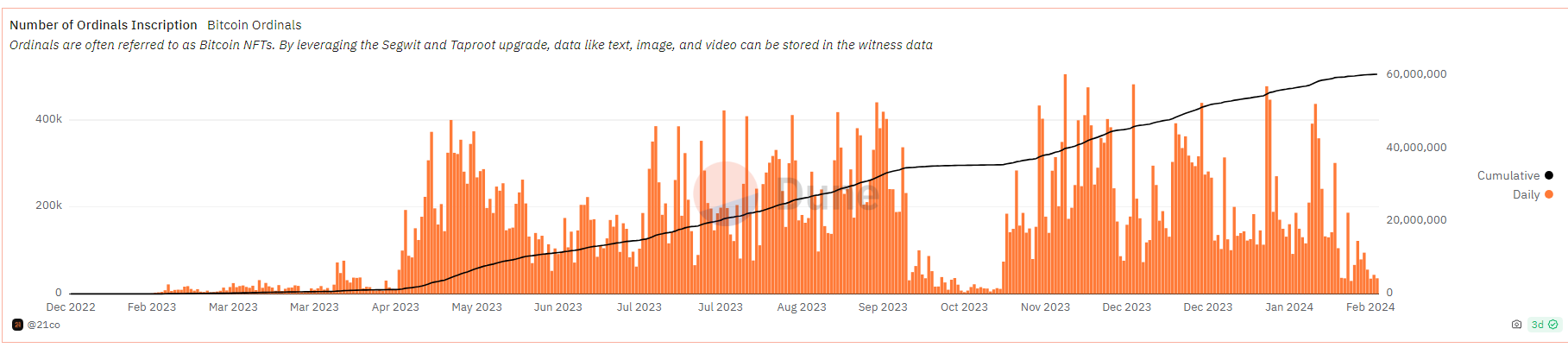

Bitcoin Ordinals: Empowering users to inscribe data directly onto the blockchain, Bitcoin Ordinals facilitated the creation of Non-Fungible Tokens (NFTs) and digital collectibles.

Bitcoin Stamps: Utilizing the Bitcoin L1, Bitcoin Stamps pioneered the minting of digital collections. The integration of the BRC-20 token standard further allowed for the creation of semi-fungible tokens on the Bitcoin network.

BRC-20 Token Standard Advancements: Enabling users to embed JSON code in an Ordinal, the BRC-20 token standard facilitated the creation of programmable assets on Bitcoin, enhancing the network's functionality.

BRC-721E Token Standard: This standard served as a bridge, facilitating the seamless transfer of NFTs from Ethereum to Bitcoin, and showcasing the interoperability between the two major blockchain networks.

RGB Protocol: Leveraging the Lightning Network, the RGB protocol introduced private smart contracts and tokenization to Bitcoin, enhancing privacy and expanding the possibilities for decentralized applications.

SRC-20 Tokens (Bitcoin Stamps): Representing digital collectibles stored as unspent transaction outputs on the Bitcoin blockchain, SRC-20 tokens, also known as Bitcoin Stamps, provided heightened security and immutability to the digital collectibles ecosystem.

Network Activity

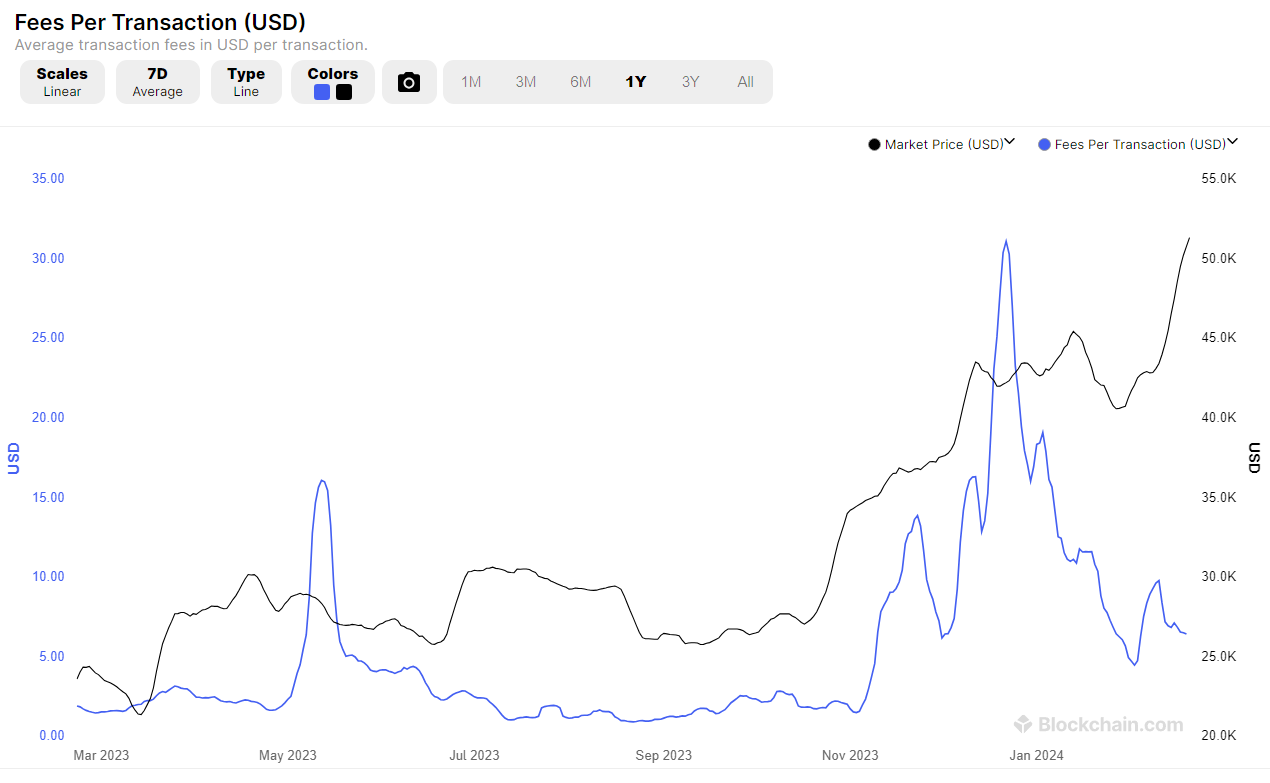

Bitcoin Network Fees Spiked in December Due to Ordinals

gas fee per Transaction

In December 2023, Bitcoin network fees surged to over $37, the highest level since April 2021. This spike coincided with the growing popularity of "Bitcoin NFTs," more accurately known as Ordinals, which leverage the Segwit and Taproot upgrades to store text, images, and video data on the Bitcoin blockchain.

While Ordinal activity has decreased, leading to Bitcoin fees currently settling between $10 and $5, the reason for the sudden drop in October remains unclear.

Daily Active Users

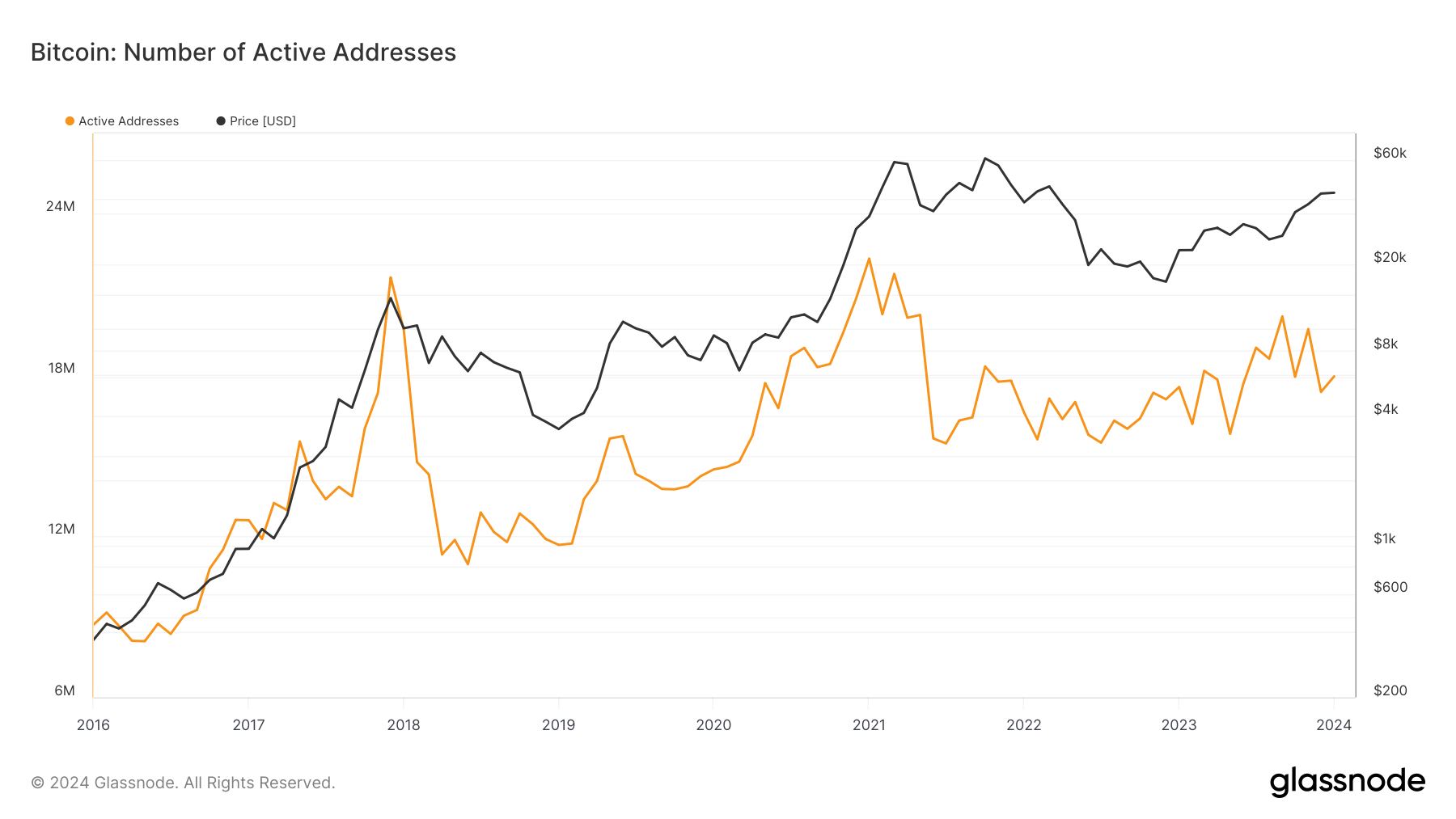

This metric counts the number of unique addresses actively involved in the network as either senders or receivers on a daily basis.

Historically, the daily active users peak occurred in January 2021, with approximately 22 million users. As of January 2024, this number has decreased to around 17 million active users.

bitcoin-number-of-active-addresses

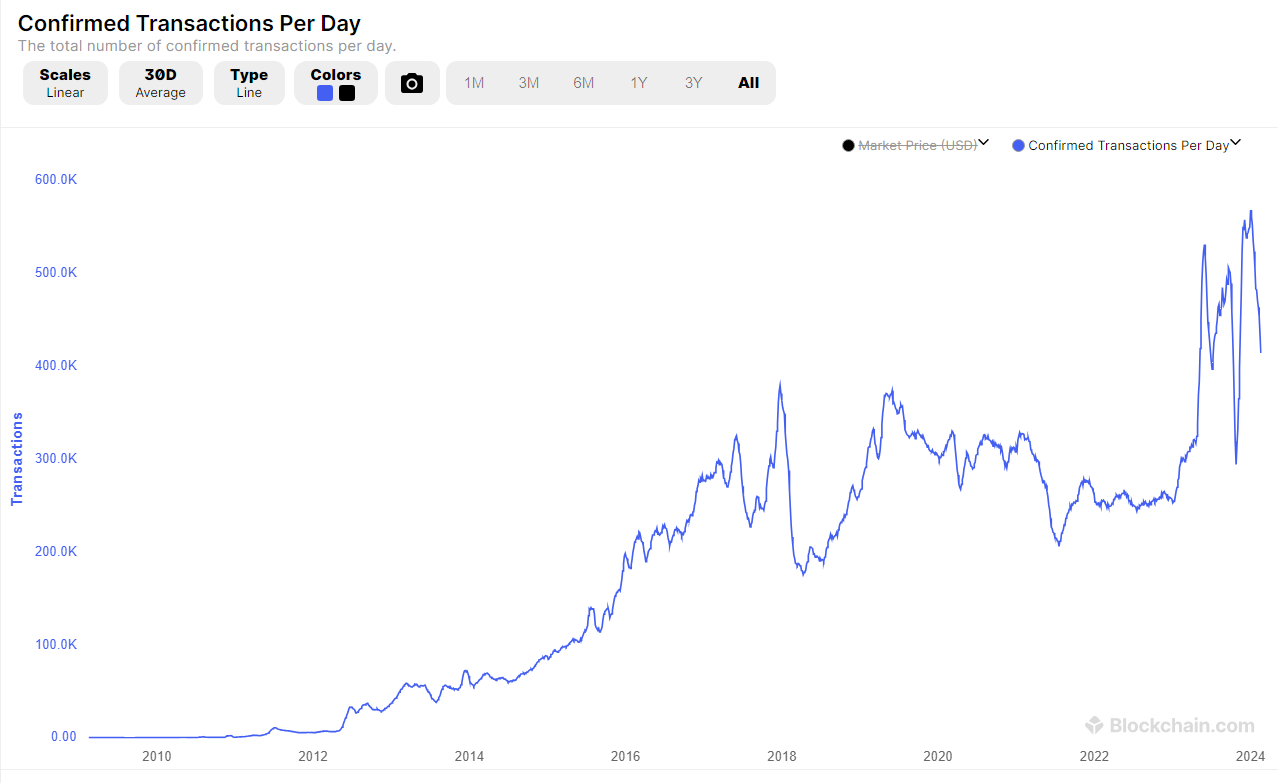

Bitcoin: Store of Value with Growing Transaction Volume

While Bitcoin is primarily viewed as a store of value, leading many users to buy and hold it long-term, we've also seen a significant increase in daily transaction volume. In 2020, the average daily transaction count was around 300,000, and it has grown to 500,000 per day in 2023. This increase benefits miners who collect transaction fees.

Transactions Count

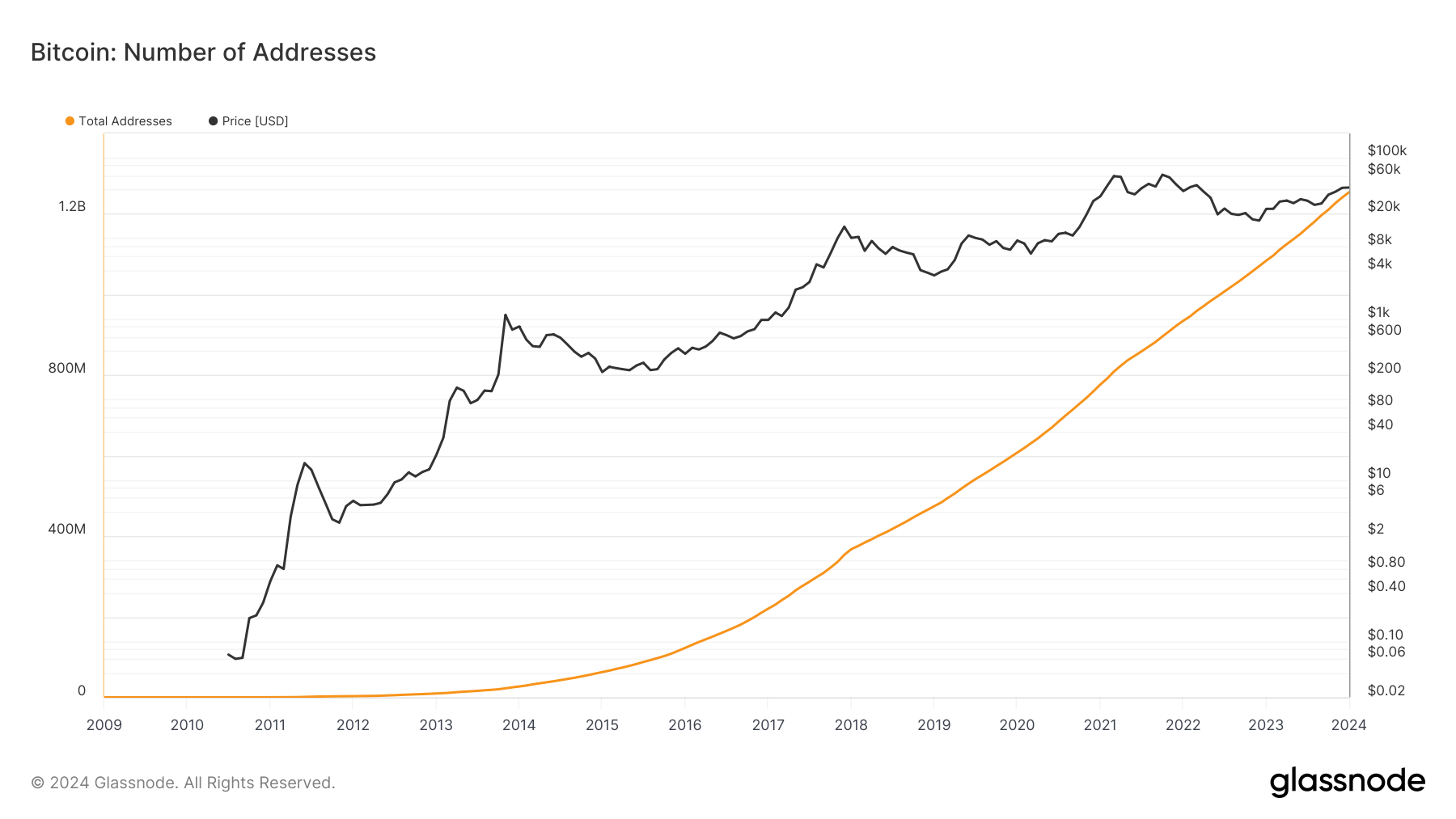

Active Addresses Paint a Growth Picture

The total number of unique addresses used in Bitcoin transactions also paints a picture of growth. Currently, there are over 1.2 billion unique addresses on the network, compared to 800 million in 2021. It's important to note that not all addresses represent unique users, as individuals can have multiple addresses.

bitcoin-number-of-addresses

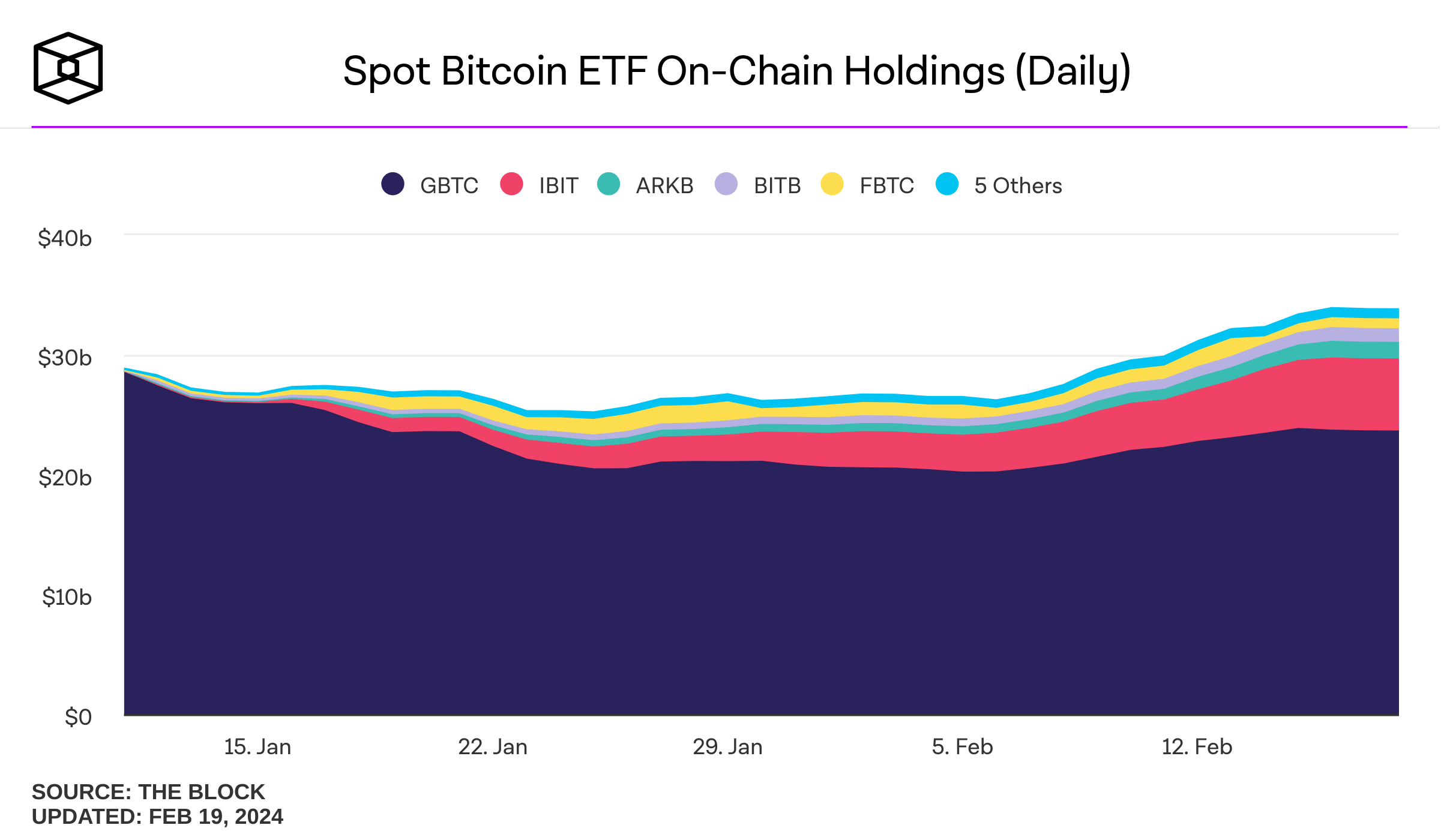

Bitcoin ETFs

It has only been a month since Bitcoin ETFs were approved, and already we have more than 33 billion dollars in holdings across these ETFs. The current market capitalization of Bitcoin is 1 trillion dollars. Grayscale Bitcoin Trust (GBTC) holds the largest market share with 23 billion dollars, followed by BlackRock (IBIT) with 6 billion dollars, and then Ark Invest/21Shares (ARKB), Bitwise (BITB), Franklin (EZBC), and others.

spot-bitcoin-etf-onchain-holdings-usd

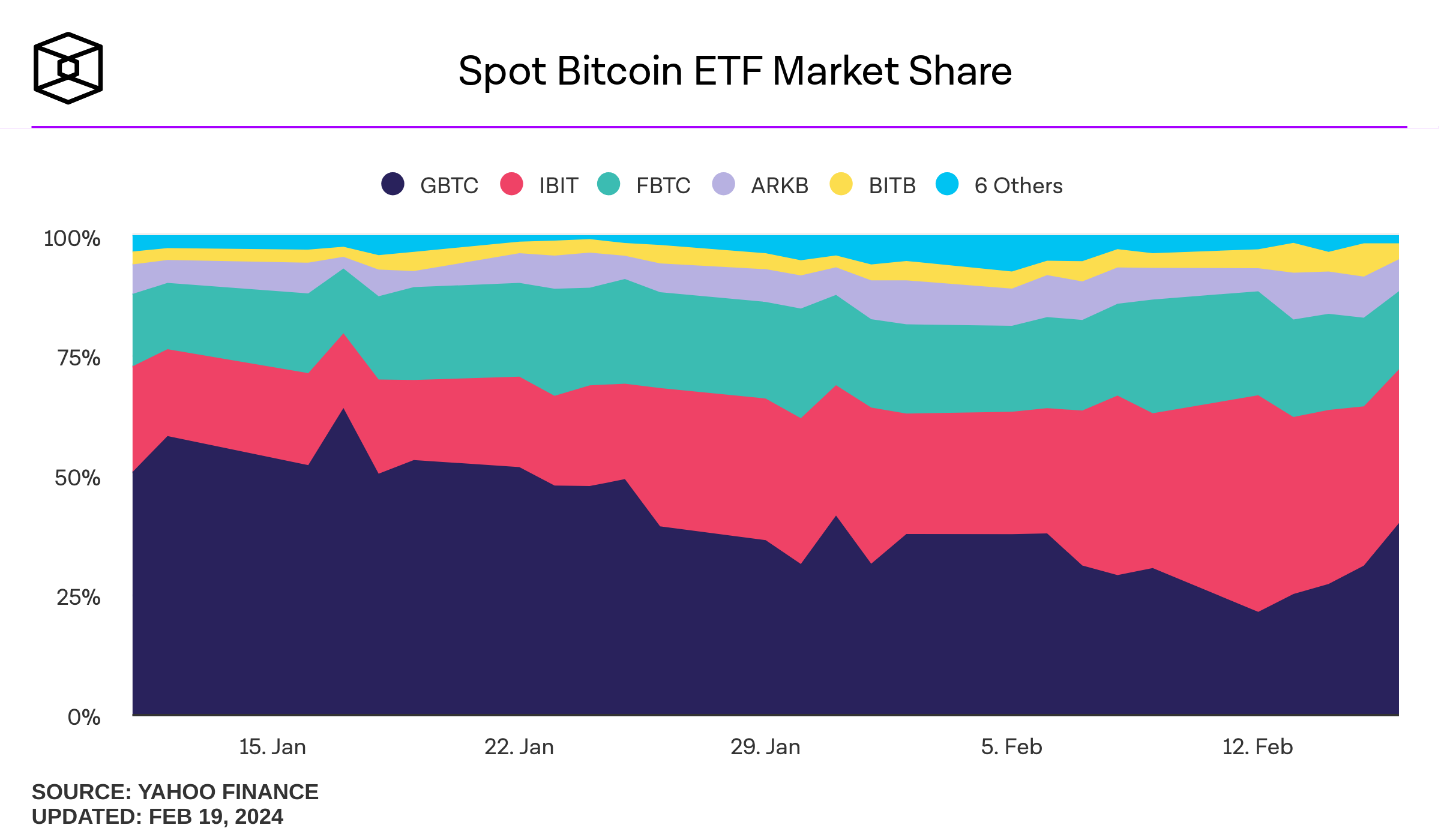

However, when looking at the daily market share by volume for spot Bitcoin ETFs, GBTC captures 40%, IBIT comes in at 33%, FBTC holds 16%, and ARKB has 8%, followed by others.

bitcoin-spot-etf-volume-market-share

Lighting Network

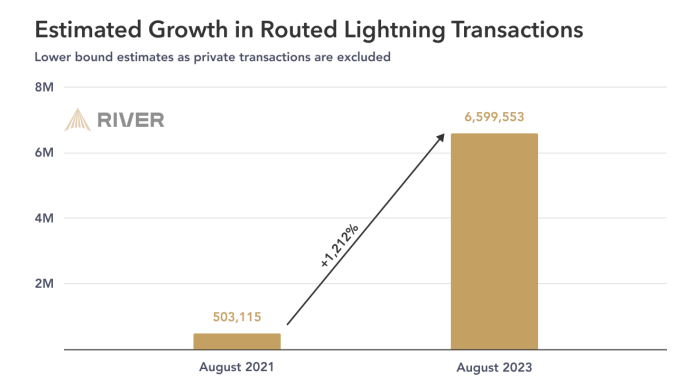

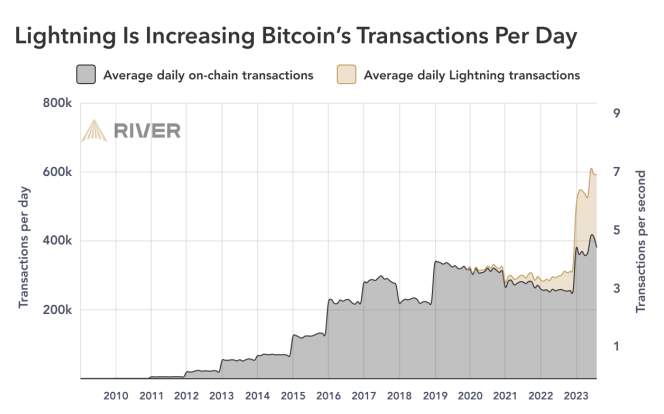

River Financial estimated a minimum of 6.6 million routed transactions on the Lightning Network in August 2023, translating to roughly 213,000 transactions per day. This translates to Lightning processing at least 47% of Bitcoin's daily on-chain transactions, equivalent to 14 days of on-chain activity in one month. Lightning transactions are seeing growth in gaming, social media tipping, Online commerce, Exchanges withdrawals and deposits, and Micropayments.

As of August 2023, Lightning processes roughly 2.5 transactions per second compared to Bitcoin's on-chain average of 4.4 transactions per second.

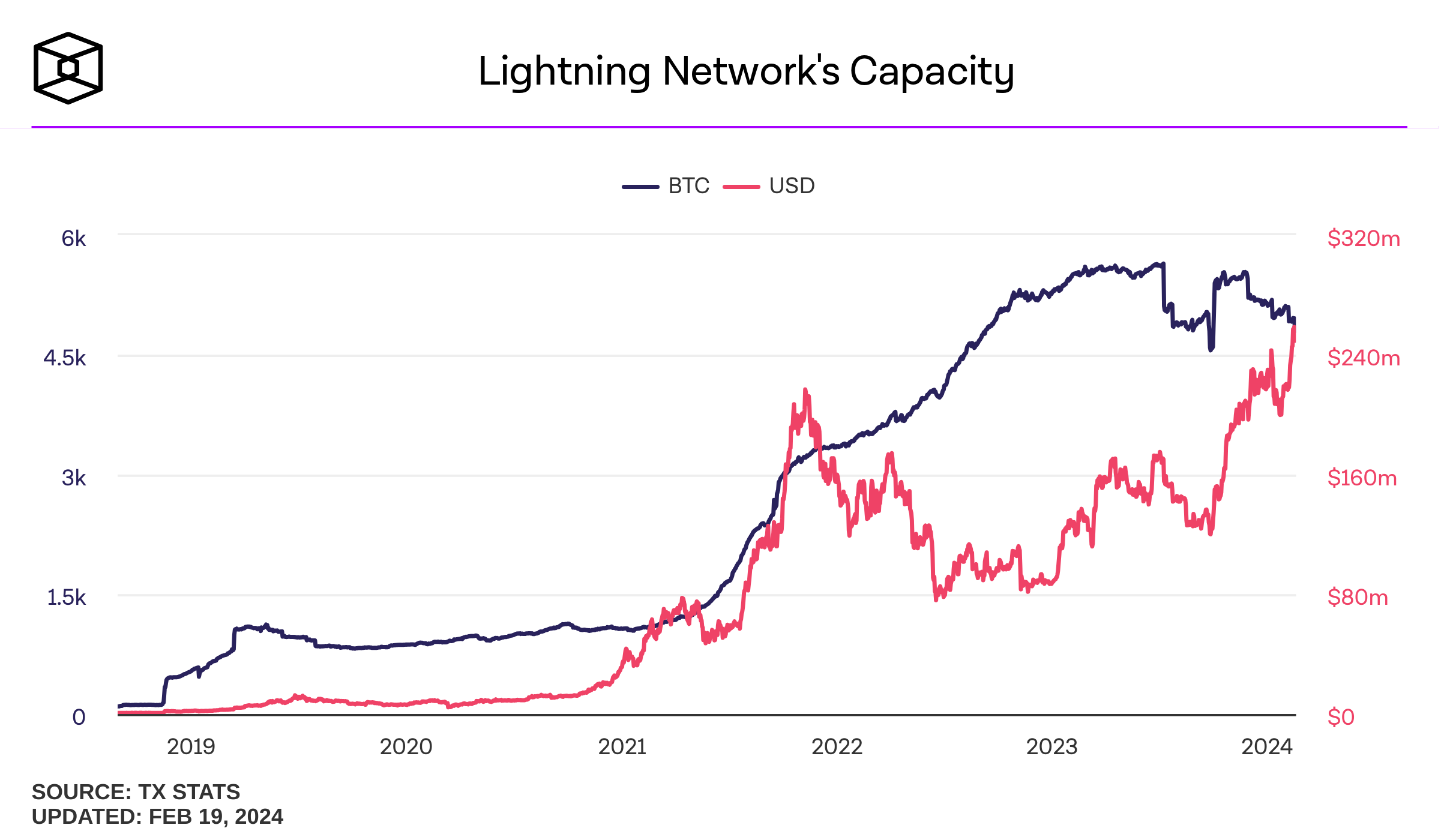

While the capacity has more than doubled in the past two years, from 3,000 in 2022 to 5,000 BTC in 2023, it decreased in 2023.

lightning-networks-capacity

Interestingly, the River Financial report suggests a ratio of 8 custodial to 1 non-custodial Lightning user, highlighting the need for further development of user-friendly and secure self-custody solutions.

Bridges

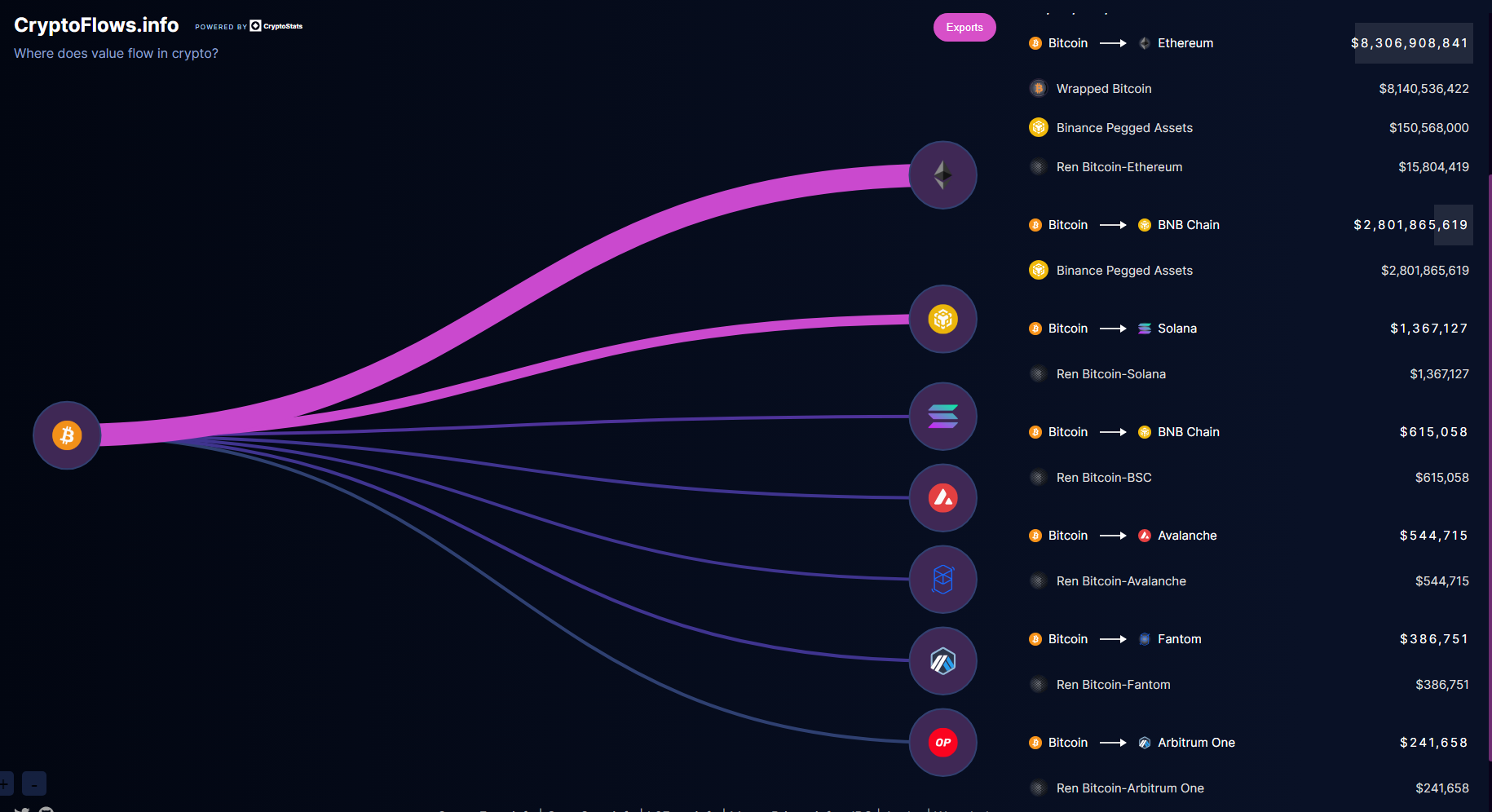

BTC Distribution to Other Blockchains

Ethereum: 160,675 BTC

BNB Chain: 54,203 BTC

Solana, Avalanche, Fantom, Arbitrum One, Optimism (less then 10K BTC)

Bridges

Wrapped Bitcoin Dominates the Bridge Landscape

Wrapped Bitcoin (WBTC) holds over 70% of the market share by bridged BTC. It functions as an ERC-20 token on Ethereum, backed 1:1 by actual Bitcoin held by Bitgo, Ren, and Kyber Network under a federated governance model.

Security Considerations for Wrapped Bitcoin

Custody: Bitgo serves as the custodian, holding the wrapped assets and controlling the minting of WBTC tokens via smart contracts. However, Bitgo does not stake any collateral.

Minting/Burning: Merchants like Kyber Network and Republic Protocol hold keys to mint or burn wrapped tokens, introducing additional trust assumptions.

Binance-Peg Token:

Binance-Peg Token (BEP2 BTC) holds over 25% of the bridged BTC market share. It represents Bitcoin held in Binance's reserves and is pegged to the value of Bitcoin. However, users must trust Binance with their funds and lose custody of their assets.

Security Assumptions:

Users lose custody and trust their funds with Binance.

Binance has no staked collateral - Users rely on Binance's reputation.

While a decentralized bridge not reliant on a centralized entity like WBTC & Binance-Peg is desirable, the entrenched position of WBTC and its widespread use in DeFi applications presents a significant challenge for any newcomer. Overcoming these network effects will be difficult for a newer bridge BTC token.

Bitcoin's Layer 2 Landscape: Challenges and Opportunities

Bitcoin's narrative as "digital gold" has led to many holders treating it as a long-term investment, rather than using it for transactions. This contrasts with Ethereum, where users can actively engage in DeFi and other applications. Layer 2 solutions seek to bridge this gap by enabling Bitcoin holders to utilize their assets without compromising security or decentralization.

While most current L2s for Bitcoin involve trust assumptions and operate as sidechains, they offer various benefits and hold potential for further development.

Key L2 Solutions in the Bitcoin Ecosystem:

Rootstock (RSK): This sidechain pioneered smart contracts on Bitcoin, allowing users to convert BTC to RBTC for faster and cheaper transactions.

Stacks Protocol: Formerly known as Blockstack, this L2 blockchain enables smart contracts and DApps on Bitcoin. It utilizes microblocks and a Proof-of-Transfer mechanism for speed and security.

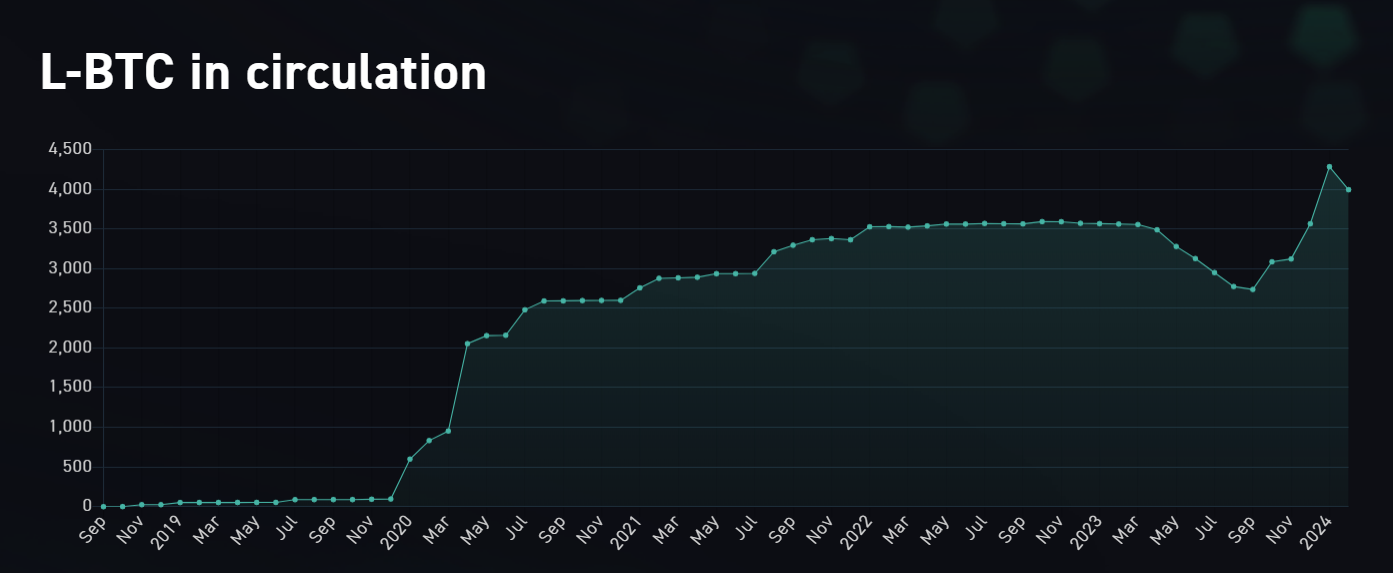

Liquid Network: This popular sidechain allows for faster and cheaper BTC transactions through a federation-controlled system built on the Elements platform.

Drivechain: This project envisions altcoins functioning on top of the Bitcoin network, offering scalability, new features, and permissionless experimentation. However, it requires a soft fork for implementation.

Data Analysis and Challenges:

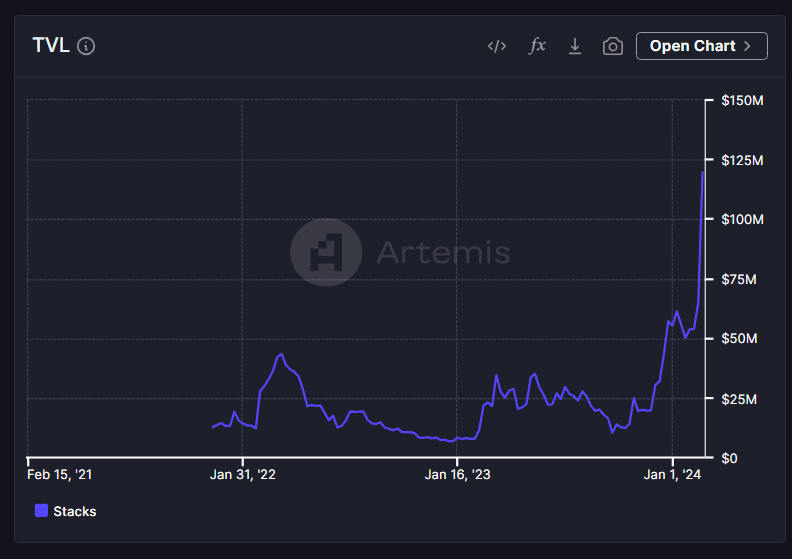

• Stacks Protocol: Total Value Locked (TVL) increased from $50 million on Jan 1 to $120 million on Feb 20, but this rise coincides with the price increase of its native token.

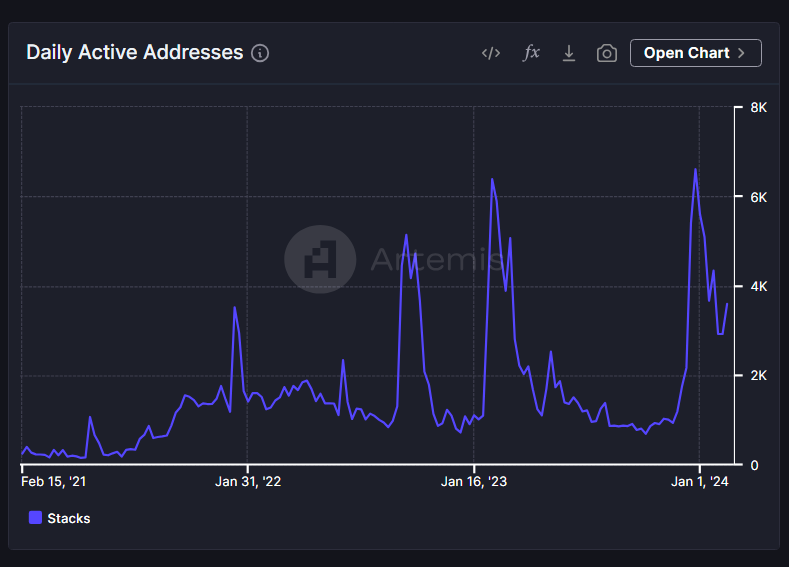

• Daily active addresses: As of Feb 12, weekly active addresses for Stacks are around 3.6k, indicating some growth.

• Liquid Network: Bridged BTC remained flat in 2022 and decreased in 2023 but started rising again at the end of the 2023 year.

While these solutions offer potential, some challenges remain:

Overall TVL: Compared to Bitcoin bridged to other blockchains, the total value locked in these Layer 2 solutions remains relatively low.

DeFi and Wallet Experience: The DeFi ecosystem and user experience on these Layer 2 solutions are currently less developed compared to mature offerings on other blockchains.

Limited Data: Data on user activity and Total Value Locked (TVL) is currently fragmented and incomplete.

Trust Assumptions: Most current Layer 2s rely on some level of trust, often through sidechains with federations.

Limited User Adoption: While some user growth is present, it is still nascent compared to other ecosystems.

Final thoughts:

The recent emergence of Bitcoin stamps, Bitcoin ordinals, BRC-721E, and RGB protocols represents a significant cultural shift towards innovation within the Bitcoin space.

In recent years, the user experience of using Lightning Network has seen phenomenal improvements. However, while transaction volume has surged dramatically, the issue of limited BTC capacity persists. Nevertheless, Lightning Network’s established mind share suggests it still possesses the potential for widespread adoption.

Spot Bitcoin ETFs are gaining increasing momentum.

Compared to Ethereum, Bitcoin's layer-2 solutions are still in their early stages of development.

Ordinals are expected to contribute to rising gas fees on the Bitcoin network in 2024.

Subscribe to my newsletter

Read articles from chandan directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by