Unlocking the Potential of Generative AI in Microfinance

Cladfy Blog

Cladfy Blog

Introduction:

Microfinance institutions (MFIs) are crucial lenders to hundreds of millions of SMEs in emerging markets. However, their traditional processes and the cost of technology have often exposed them to limitations in scalability, efficiency, and personalization. Generative AI (Gen AI), a type of artificial intelligence capable of creating new content, presents a transformative opportunity for MFIs to address these challenges and unlock new possibilities.

Understanding Gen AI:

Gen AI is a type of artificial intelligence that creates new content, like text, images, or code, based on what it has learned from existing data. This technology, specifically large language models (LLMs), holds immense potential for MFIs by:

Automating repetitive tasks: LLMs can handle tasks like generating loan applications, reports, and personalized communications, freeing up staff time for more complex activities.

Enhancing customer service: LLMs can power chatbots that answer frequently asked questions, schedule appointments, and provide basic financial guidance, improving accessibility and responsiveness.

Data-driven decision-making: LLMs can analyze vast amounts of data to identify patterns and trends, aiding in credit risk assessment, product development, and customer segmentation, leading to more informed decisions.

Practical considerations for MFIs:

1. Data Security:

While LLMs offer numerous advantages, data security remains paramount. Here's how Cladfy addresses this concern:

Self-hosted models: Cladfy utilizes its own, self-hosted models, ensuring data remains within the organization's control and preventing leaks to third parties.

Grounding the models: Cladfy employs techniques to prevent LLMs from generating inaccurate information ("hallucinating") by grounding them in factual data and real-world scenarios.

Open-source foundation: Cladfy leverages open-source models as a foundation, further enhancing transparency and control over the data used.

2. Choosing the right use cases:

MFIs can adopt a flexible approach to Gen AI implementation, starting with low-risk, high-impact use cases like:

Generating personalized communications: LLMs can tailor loan repayment reminders, account updates, and marketing messages to individual customer preferences.

Automating loan application processing: LLMs can streamline the application process by extracting key information from documents and verifying data accuracy.

Creating educational content: LLMs can generate informative articles and videos on financial literacy topics, empowering customers to make informed decisions.

3. Future potential:

Gen AI is still in its early stages, but its potential to transform the financial landscape is vast. As technology advances, we can expect:

Ubiquitous AI assistants: Imagine a future where everyone has a personal AI assistant aiding with financial tasks, offering personalized advice, and simplifying financial management.

Autonomous agents: These AI-powered programs could automate complex tasks like comparing loan options from different MFIs, ensuring customers get the best deals based on their needs.

Getting Started with Generative AI

Cladfy advocates for a cautious yet progressive approach to integrating generative AI:

Start Small, Scale Up: We follow a "crawl, walk, run" strategy, beginning with low-risk applications using non-sensitive data. This allows for rapid experimentation, early wins, and gradual staff buy-in before venturing into more complex use cases.

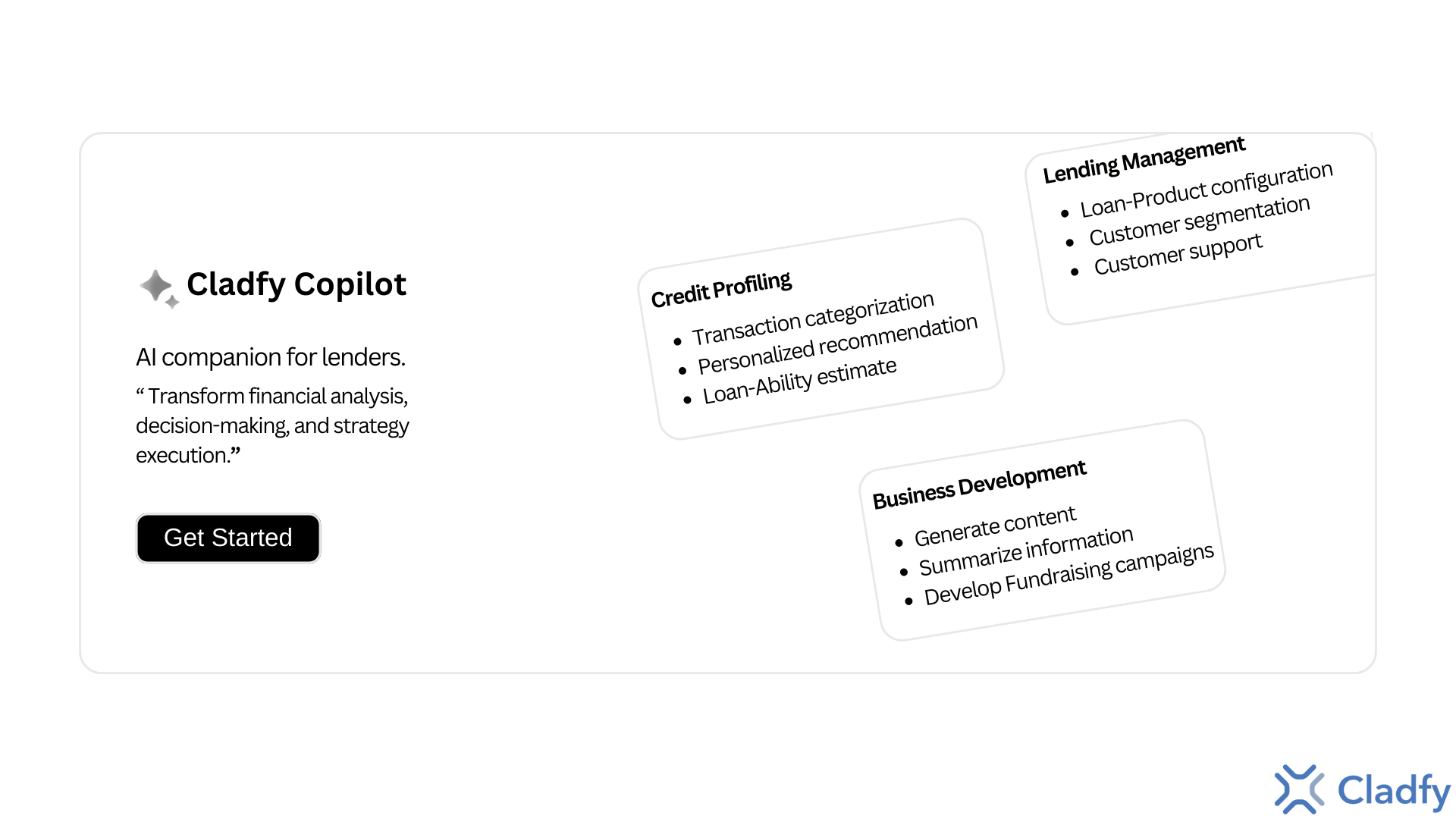

Focus on Impact: We prioritize applications with the potential to significantly improve efficiency, client experience, or decision-making. The table below outlines some potential use cases for MFIs:

| Use Case | Impact |

| Personalized loan recommendations | Increased loan uptake and client satisfaction |

| Automated creditworthiness assessments | Faster loan processing and reduced risk |

| Lending Management | Loan lifecycle tracking and insight generation |

| Borrower education materials | Improved financial literacy and responsible borrowing practices |

See it in action:

We are continuously integrating AI into our existing products that you love. Visit https://www.cladfy.com/copilot to explore our current use cases and learn more about getting started.

Conclusion:

By embracing Gen AI responsibly and strategically, MFIs can unlock a new era of operational efficiency, enhanced customer service, and financial inclusion. Cladfy is committed to exploring the responsible application of Gen AI to empower MFIs and contribute to a more inclusive financial ecosystem.

Subscribe to my newsletter

Read articles from Cladfy Blog directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by