An Electric Anomaly: A Saga of Excess Supply and Unmet Demand

Om Shukla

Om Shukla

Giving away electricity as a freebie, is an old strategy of competing in election. It was quite prominent in some states, such as in Bihar, but it was never the highlight of any manifesto. Up until 2013 Delhi assembly election, where Kejriwal stormed the streets of Chandni chowk, announcing free electricity for everyone. This led to a trend where every opponent today, promises free power out of the state government coffers. Such strategies, even though are famous today, have been deep-rooted in election tactics for years. But what these governments didn't realize is, these strategies would handicap the power sector for years to come.

The power sector in India is quite a weird story, and this is also visible in the numbers. On an average, a person in India consumes 1300 Units (KwH) of electricity per year, which is significantly less when compared to countries such as Iceland where per capita consumption is 54,000 Units, United States where it is 13,000 Units and China which consumes 6,100 Units.

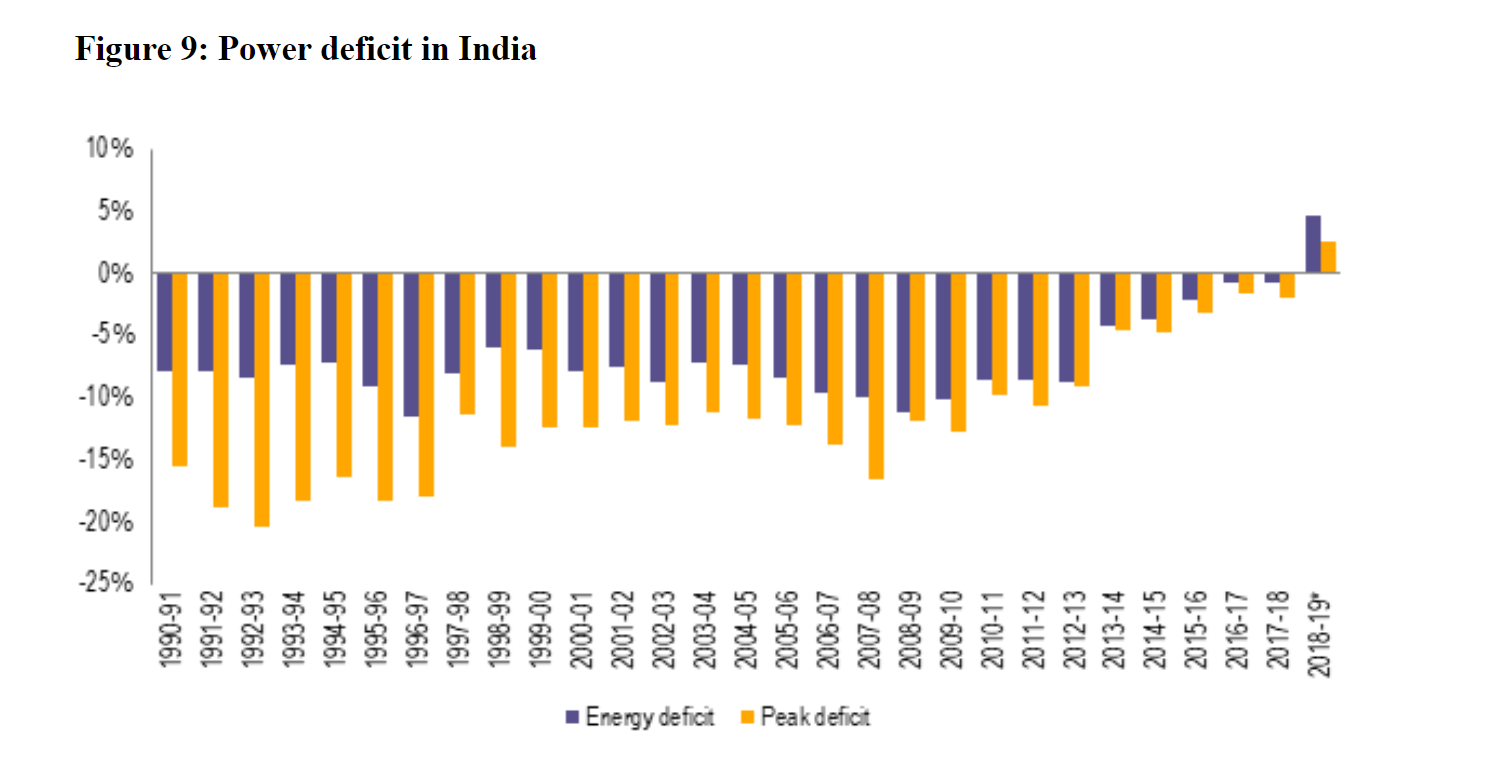

Many think, the reason for low consumption is because of low Purchasing Power of India, lower GDP than other countries and overall, a low economic activity when compared to other nations. These are obviously a contributor for low electricity consumption, but in reality, India has always been a power deficit country. Up until 2019, India's power deficit, on average has been around 10-15%! Which means, even if we did ramp up the consumption, there would have been no supply.

Source: Ministry of Power and PRS Research

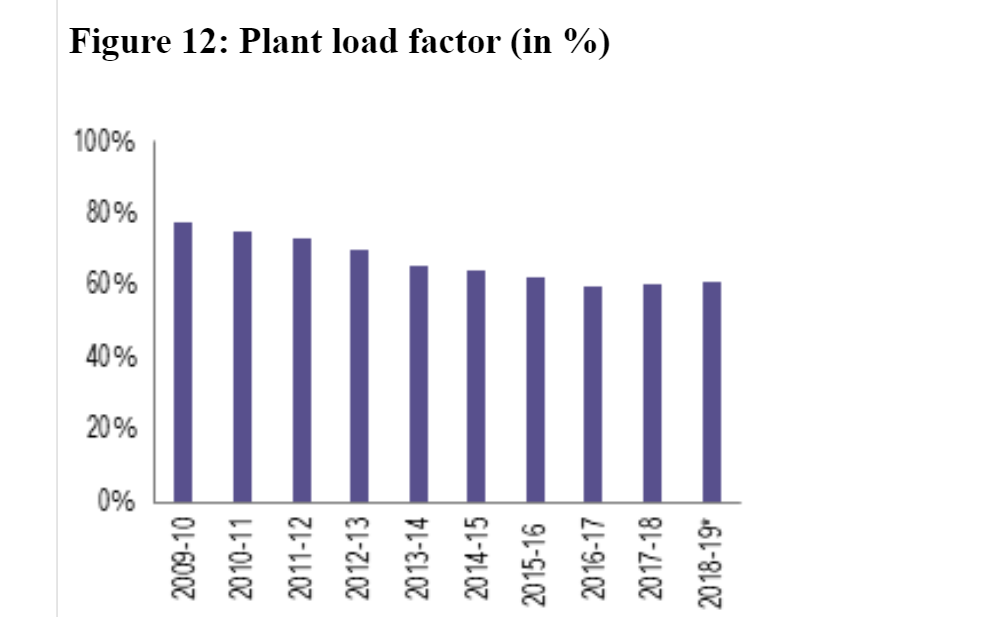

But is this the whole truth? The PLF numbers seem to tell a different story. Plant Load Factor or PLF indicates how much power is generated out of the total installed capacity of a Power unit. In an ideal world, If the demand for power is outstripping the supply, the PLF should be touching 100%, which means power generating companies are operating at full capacity. But in India, where most houses are facing energy deficit, the average PLF for past 10 years is around 61%. Which means power companies are utilizing only 61% of the actual capacity.

Source: Ministry of Power and PRS Research

The PLF and Deficit numbers are contradictory in nature, and so the natural question is why? Let's use a checklist to see which factor seems to satisfy this anomaly the best.

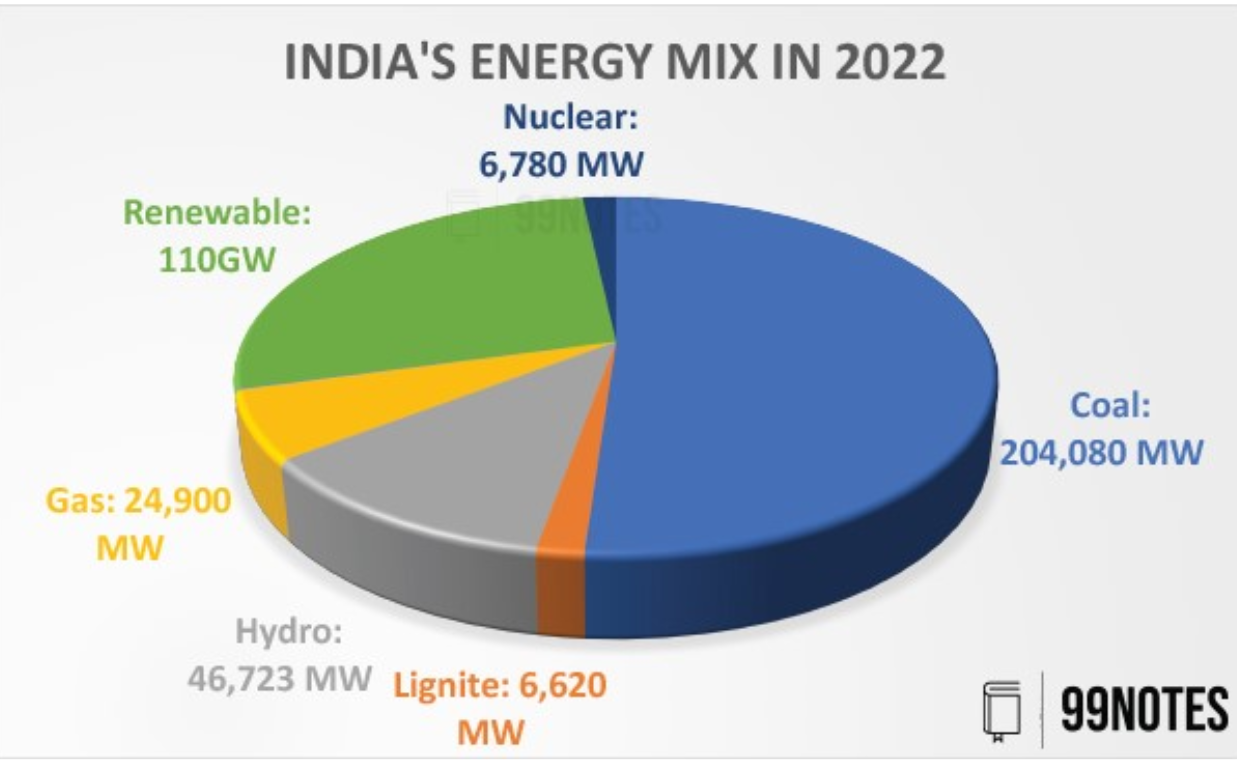

The first reason could be availability of raw materials. Power generation companies (Excluding renewable sources) need materials such as coal, lignite etc. to generate electricity. In thermal energy, roughly 87% of the energy is produced via coal, rest is through gas (LPG, CNG) and lignite (Brown coal).

According to Coal Authority of India (CIL), they have been supplying coal to power station assuming a PLF of 85%. But the distribution of coal is highly unequal, and thermal plants with lack of resources and proper cash flows, are unable to source coal for power generation. This pushes them into a vicious cycle of idleness.

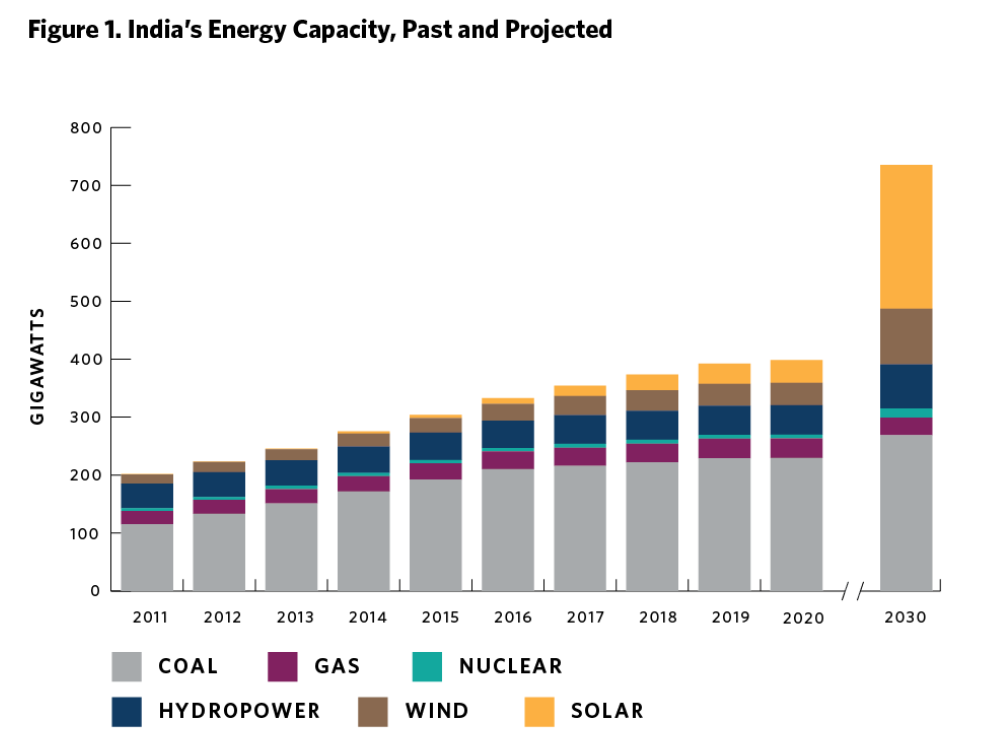

Another reason for decrease in PLF for thermal energy can be the alternate sources of energy which are coming up. For example, solar energy in India has increased at an astounding rate. The low cost and very low gestation period of solar plant, questions the economic viability of the power plant. Also, If we look at the energy mix, this could definitely be one of the reasons for decrease in PLF.

(Data taken from Ministry of Power and Presentation by Medium)

Another reason for low PLF can be the stressed assets. As we discussed, even with proper infrastructure and profitability, lack of cash-flows for sustained period of time, can result in maintenance problems, lack of raw material and expansion issues. As of 2018, 34 Thermal power plants in India were declared as stressed asset with a total debt of ₹1,60,000 Cr. This situation has improved significantly in past 6 years, as 26 of these assets have been resolved fully or partially resolved, and other 11 are being sold to strategic buyers. All of this has been possible because of increasing power demand, government policies and investor interest in this space.

And lastly, let's talk about transmission and distribution (T&D) - One of the biggest chokepoints for power sector. In India, T&D process goes something like this; Distribution Companies (DISCOMs) buy power from power generation companies and pass it on consumers. For this, they enter into long power purchasing agreement (PPA) with power companies to supply certain Megawatts of power for next 5-10-20 years. But there is another market, which is the short-term power market, one run by hidden giants such as Indian Energy Exchange (IEX) and Power Trading Corporation (PTC). When the domestic demand for power outstrips supply, the DISCOMs go to IEX or PTC to buy the additional power. These are short term transactions, but these transactions keep the lights on in our house. The power companies with short-term excess of electricity sell the residual on PTC, which is then bought by these DISCOMs.

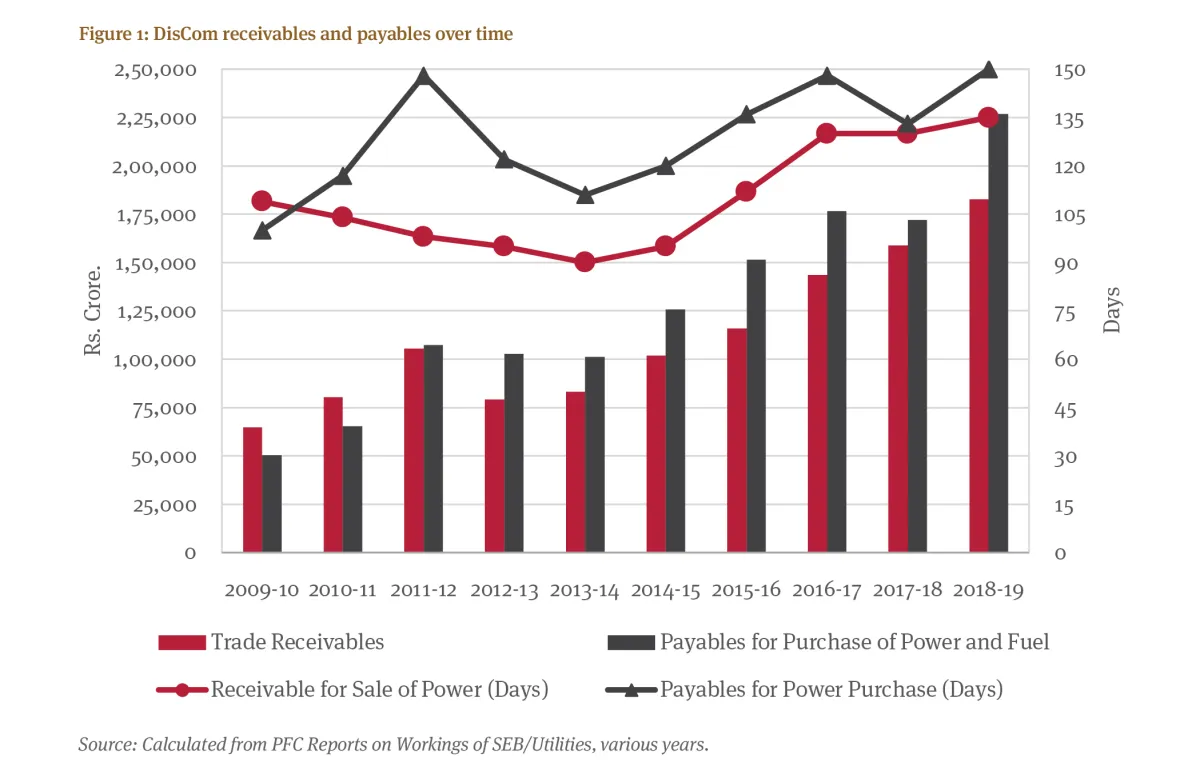

In India, DISCOMs are mostly state run, with the exception of some private ones in Mumbai and Delhi. The DISCOMs have historically been in huge debt and have been running losses for decades. Remember our Kejriwal story, when state government offer free electricity, or reduce electricity rates, it's the DISCOMs that face the losses. The state governments thus have to compensate the DISCOMs out of their own pocket. This is where the issue starts brewing; state government have kept their bills unpaid for decades. Even for expansion or major maintenance, state governments push DISCOMs to take debt. This made most of the DISCOMs in India debt-ridden, with huge issues in profitability and cash-flows. As of 2022, Indian DISCOMs of 15 states had a total debt of ₹3.6 Lakhs Cr. This was addressed by the national UDAY policy, which instructed state government to take on 75% (₹2.3 Lakhs Crore) of this debt on their books.

In such dire situations, DISCOMs find it difficult to get into long term PPAs with power generation companies and are unable to buy power in short-term markets to fulfill deficits. This results in frequent power cuts and un-catered demand. But this in turn also effects power generation companies, who have the capacity to fulfill the demand, but remain idle as there is no DISCOM to sell the power to. This is one of the key reasons for high PLF along with power deficit in India.

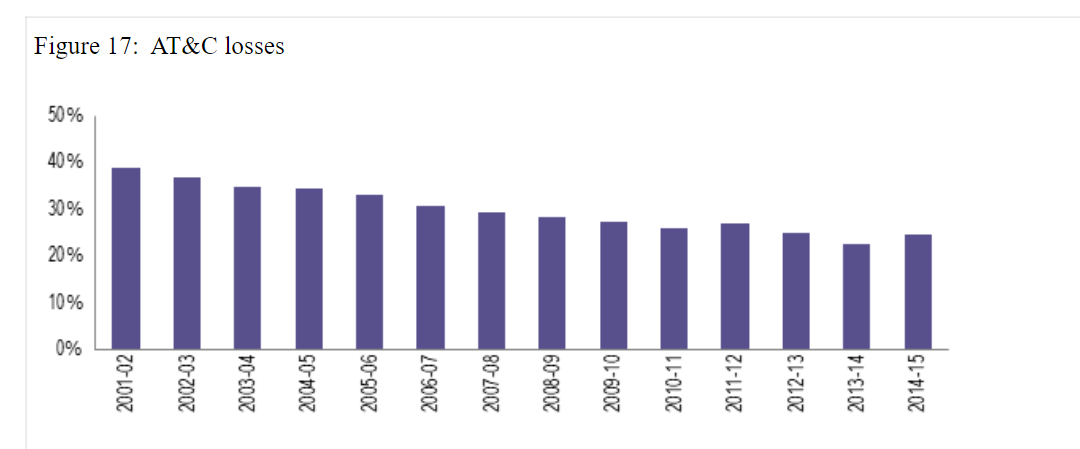

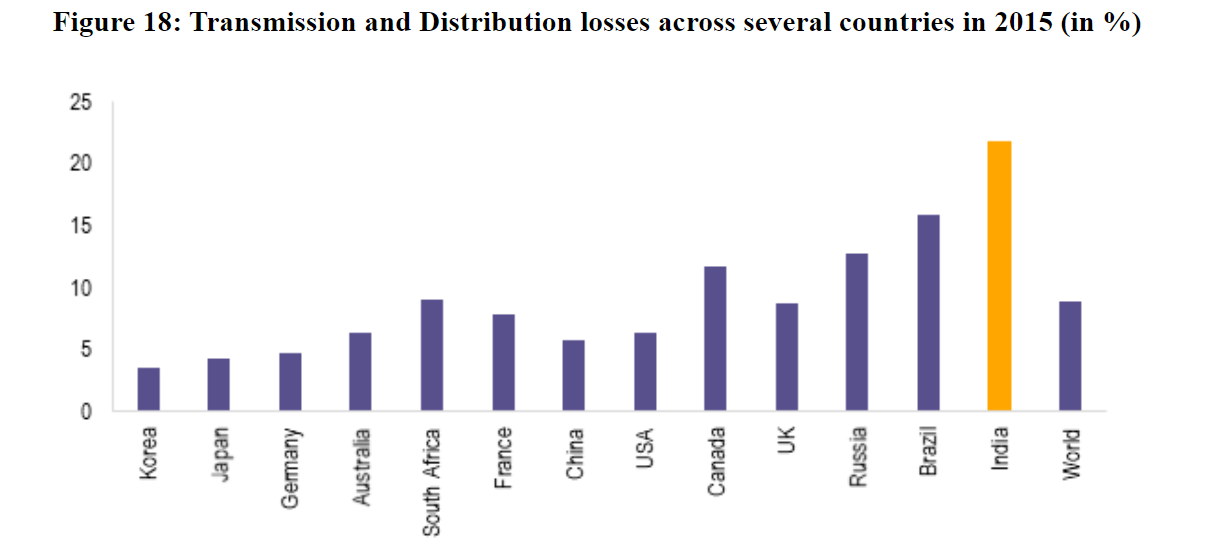

And now let's cover a small subject of transmission. Companies such as PowerGrid India run one of the world's largest transmission lines through inter and cross-state networks. These transmission networks include power grids and wires which help in transferring electricity from power generation companies to DISCOMs and from DISCOMs to households. Transmission companies help transfer power from resource rich areas to area with higher demand. If we look at the numbers, in India, transmission network has increased at roughly 4% CAGR from 2007-2018, which is much slower than the expansion in population and power generation. The transmission network penetration is also quite low, and there are several bottlenecks and quality issues. These problems result in something known as Aggregate Technical and Commercial (AT&C) losses. This represents the loss in power due to technical issues such as overload system, heat etc. and non-technical issues such as pilferage and theft.

AT&C loss in India is one of the highest in the world.

- Another problem with the power sector is actually a domestic issue. The metering problem. For a long time, most homes did not have a meter in home. This made it difficult for DISCOMs to compute how much electricity bill to charge the consumers. For example, in Bihar, until recently, villages were still charged a fixed nominal rate for electricity, regardless of how much they consumed. In India, cities like Mumbai and Delhi have 70%-meter penetration, while villages in the country have around 10% penetration. And given that 66% of Indian population comes under this 10% penetration, the collection from these areas for DISCOMs are minimal. These losses are again shown in the books of DISCOMs which are not fully compensated by the states.

All of the above stated problems have plagued the industry for decades and have disabled the power sector through core. Even if the power consumption were to increase today, we have enough power generation capacity to fulfill the demand. But the transmission & distribution network, and DISCOM's balance sheet won't support the excess power supply.

These problems are slowly being fixed, via government policies and investor interest in this area. Policies such as UDAY or the national transmission extension plans, have started cleaning up this sector to make it more efficient. And it was about time; the EV revolution, increasing purchasing power and GDP growth is likely to double the power consumption by 2030. To support such a demand, we will require all components of power sector to support the system.

The current electricity capacity of India is around 420 GW (4.2 Lakhs MW), which includes fossil (57%) and non-fossil (43%) based power generation. The government is planning to expand the capacity to 500 GW just for non-fossil power generation and 1000 GW in total. The current transmission network in India is around 4.25 Lakh Km, government is planning to spend around ₹70,000Cr to add another 25,000 Km by 2025.

All of this should give a new hope of light for the power sector, and hopefully improve the condition of our transmission networks and DISCOMs.

Ladderup Wealth since 2011 has broken the ranks and established itself as one of the most premier wealth management firms in the country. Your wealth is irreplaceable and you have acquired it after decades of hard work. It is important that it is constantly monitored and nurtured with the right approach. You might not have the right time/skills to do it yourselves, but we can help you on that journey. Improper and incompetent advice can have long term side effects on your wealth, so please choose wisely. Get in touch with us via our website today.

Subscribe to my newsletter

Read articles from Om Shukla directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by