Explained: The Basics of Payments

Jalaj gupta

Jalaj gupta

Introduction

If you have transferred money online and have wondered “what happens ??”, you have come to the right place .In this series of articles,we will learn about the backbone of the fintech industry - Payments.

Let’s begin ....

What is a payment?

It is the transfer of monetary value from one party to another. How is it achieved?It's done by using ,what is known as "payment instruments". Many things that we take for granted today would simply not exist. Payments instruments are without a doubt a great invention. They facilitate payments and make fund transfers easy between the end parties involved. Cash payment instruments are Banknotes and coins. Non-cash payment instruments are Cheques, Cards, Credit Transfers, Cryptocurrencies, and so on.

Well , there are a lot of ways under which payments can be classified:

Electronic vs Non-electronic

High value vs Low value

Domestic vs International

Customer vs Bank

Push vs Pull etc....

In this article, we will look mainly into E-payments. Stay tuned for the rest and don't forget to like and share in your network

What are Payment Systems?

A payment system consists of a set of instruments, banking procedures, and typically, interbank funds transfer systems that ensure the circulation of monetary value it could be

between two financial institutions

between two people

Now, as the user of payment systems, you might already be familiar with some of the obvious parties like Banks, Customers, etc. but there are also some not-so-obvious ones, how do you track them?

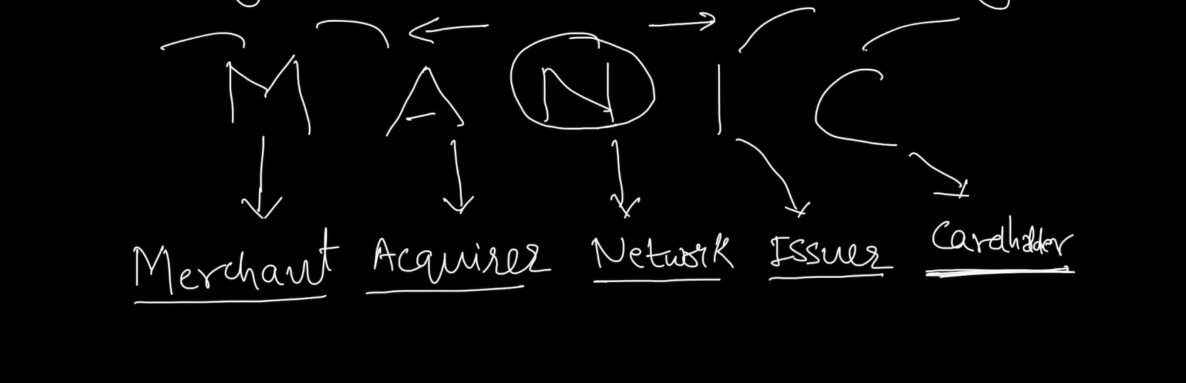

MANIC comes to rescue ....

One - Owner of a payment instrument, like cash, cheque, credit transfer, or a debit card.

Two -Acquirer which consist of rules that define the procedures, practices, and standards agreed upon between the payment services providers that join the system like Firstdata , Worldpay.

Three- Network, A transfer mechanism to move the funds from one party to another like visa ,mastercard, UPI.

Four- Merchant, A legal framework to guarantee irrevocable and unconditional finality, that is the discharge of the obligation between the debtor and the creditor. Like Bank accounts

Five- Issuer which issues cards like Banks , NBFCs etc.

Anatomy of a Payment System

To understand how the money moves, it is important to understand how the settlement happens. There are three types of settlement let's have a look

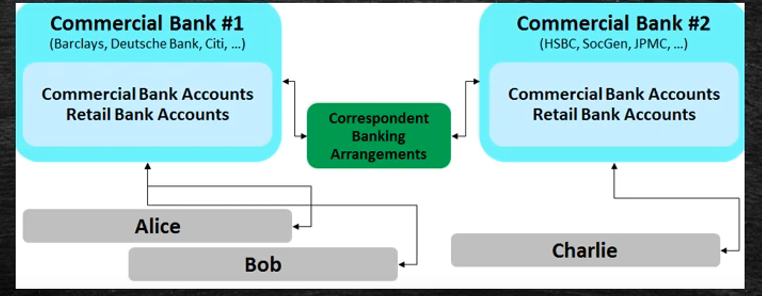

Ever wondered how your bank manages to seamlessly handle transactions across borders? Well, that's where correspondent banking steps in, making it all happen behind the scenes.

It refers to the relationship between two financial institutions, typically banks, where one (the correspondent bank) provides services on behalf of the other (the respondent bank) in a different location or country.

Picture this: You're traveling abroad and decide to use your debit card to pay for dinner. Your bank, let's call it YourBank, might not have a branch in the country you're visiting. But fear not, because YourBank has a trusty ally in the form of a correspondent bank in that foreign land. BankX acts as the middleman, ensuring that your payment goes through smoothly, and making sure the funds reach the restaurant's bank account.

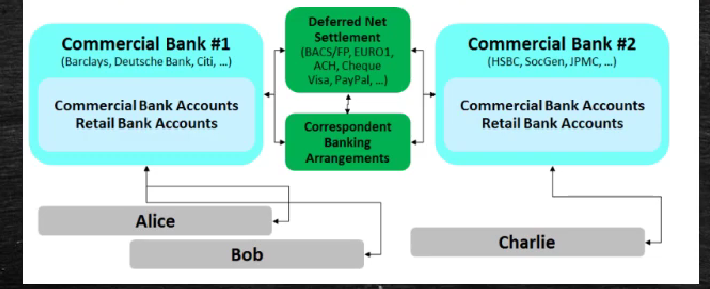

The next is Net Settlement, when multiple parties engage in transactions with each other, they keep track of what they owe or are owed. Instead of exchanging funds for each individual transaction, they settle the net amount owed at specific intervals, like the end of the day.

Let's say Bank X and Bank Y are engaged in numerous transactions throughout the day. Bank X owes Bank Y $100 for some transactions, but Bank Y owes Bank X $80 for others. Rather than exchanging $100 and $80 separately, they settle the net amount, which is $20 in favor of Bank X, at the agreed-upon settlement time.

Net settlement simplifies the process, reduces the number of transactions needed, and minimizes the associated costs and risks.

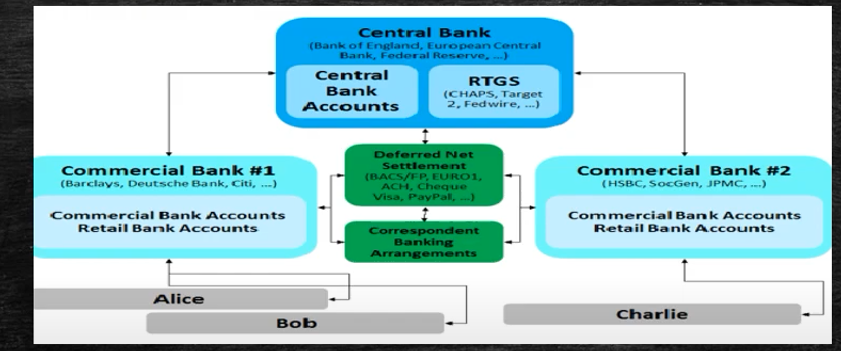

The last is RTGS, or Real-Time Gross Settlement, is like the Flash of electronic funds transfer.When you initiate the transfer, your bank immediately debits your account by the amount you're sending. Simultaneously, in real-time, the recipient's bank credits their account by the same amount.Your account mirrors the decrease in balance due to the outgoing transfer, while the recipient's account mirrors the increase in balance from the incoming transfer. This process happens instantly, ensuring that the transfer is settled in real-time.

Payment Messages

Payment messages serve as the digital envelopes that contain crucial information about financial transactions, ensuring they reach their intended recipients securely and accurately. These messages come in different formats, each with its own unique features and purposes.

ISO 20022: Think of ISO 20022 as the gold standard in payment messaging. It's a universal language that enables clear and consistent communication between financial institutions worldwide. ISO 20022 messages allows for detailed information about payments, from basic details like amount and currency to more complex data such as invoice references and payment terms.

SWIFT MT messages are a legacy messaging format developed by the Society for Worldwide Interbank Financial Telecommunication (SWIFT).SWIFT MT messages follow a predefined structure and format, providing a standardized way for banks to exchange various types of financial messages, including payments, securities, and trade finance.

XML Formats: XML (extensible Markup Language) formats offer a flexible and customizable approach to payment messaging. Banks and financial institutions can design their own XML schemas to suit their specific needs, incorporating additional data fields and business rules as required.

Congrats !! You have learned the basics. However we still have not addressed the most important question. How is the actual money transferred from one bank to another?? Does a bank employee carry a suitcase full of cash to the other bank?? And what about the desi magic - UPI?

As we navigate through the world of payments, it becomes apparent that the transfer of money involves intricate processes and technologies working behind the scenes to ensure smooth and secure transactions.

Stay tuned for more insights into the fascinating realm of payments in future articles....

Subscribe to my newsletter

Read articles from Jalaj gupta directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by