Understanding Payment Processing System

Subhash Gedam

Subhash Gedam

Now a days in our day-to-day life we have been using online payment services like Google Pay, Paytm, PayPal, PhonePe etc... almost everywhere and it's conveniency and robust nature for making payment requires a lot of processing and security measures behind the scenes.

In this era of rapidly growing technology where everything is going online like commerce, education, business, etc.. through the medium of internet, Let's understand the digitalization of payments in Finance Sector and it's main functioning in the nutshell.

To familiarize with the terminologies involved in the blog,

Payer: The individual who initiates the transaction.

Payee: The recipient of the payment.

PSP (Payment Service Provider): Intermediaries providing applications for customers to initiate or receive transactions.

Bank: Financial institutions where users hold accounts, interacting with PSPs through NPCI for payment transactions.

NPCI (National Payments Corporation of India): A non-profit organization established by the Reserve Bank of India that operates all payment procedures through its central repository, interfacing with various banks and PSPs.

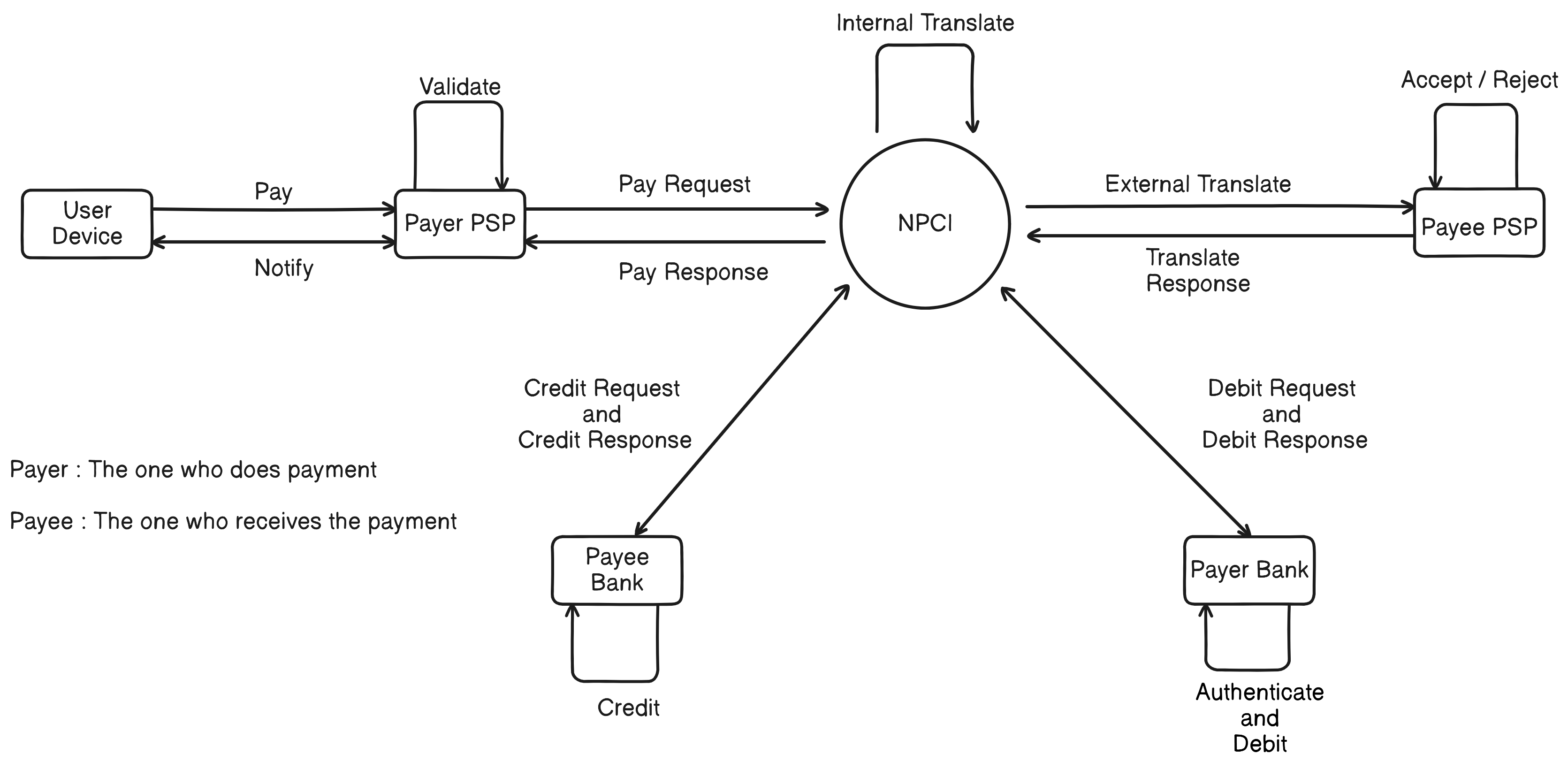

Understanding Payment Procedure Workflow

Step-by-Step Process

1. Initiation of Payment : The payer initiates a payment using their device, sending a payment request to their PSP.

2. Validation by Payer PSP : The payer's PSP validates the payment details to ensure the request is legitimate and funds are available. Once validated, a pay request is sent to the NPCI.

3. Internal Translate by NPCI : The NPCI translates the request internally and routes it to the appropriate payee PSP, ensuring the request is formatted correctly for the receiving end.

4. External Translate by Payee PSP : The payee PSP receives the translated request and determines whether to accept or reject it based on the payee's account details and other criteria.

5. Credit Request to Payee Bank : If the payee PSP accepts the request, the NPCI sends a credit request to the payee’s bank.

6. Credit Response from Payee Bank: The payee bank processes the credit request, credits the amount to the payee's account, and sends a response back to the NPCI.

7. Debit Request to Payer Bank: Simultaneously, the NPCI sends a debit request to the payer’s bank.

8. Authenticate and Debit by Payer Bank: The payer’s bank authenticates the transaction and debits the necessary amount from the payer’s account, then sends a debit response back to the NPCI.

9. Completion of Transaction: The NPCI sends a final pay response back to the payer PSP, which notifies the user device of the successful transaction.

10. Notification to User: The payer PSP notifies the user device, confirming the completion of the payment.

Subscribe to my newsletter

Read articles from Subhash Gedam directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by