Balanced Pending Order Strategy (Teaching Strategy)

FMZ Quant

FMZ Quant

The essence of the strategy described in this article is a dynamic balance strategy, that is, the value of the balance currency is always equal to the value of the valuation currency. However, the strategy logic is very simple when it is designed as pre-pending order. The main purpose of writing this strategy is to show all aspects of strategy design.

Strategy logic encapsulation

Encapsulate the strategy logic with some data and tag variables at runtime (encapsulated as objects).Code for strategy processing initialization

The initial account information is recorded in the initial run for profit calculation. At the initial runtime, you can choose whether to restore data according to the parameters.Code for strategy interaction processing

A simple interactive processing of pause and resume is designed.Code for strategy profit calculation

The currency standard calculation method is used to calculate the profit.Mechanism of key data persistence in the strategy

Designing mechanisms for recovering data.Code for displaying strategy processing information

Status bar data display.

Strategy code

pinevar Shannon = {

// member

e : exchanges[0],

arrPlanOrders : [],

distance : BalanceDistance,

account : null,

ticker : null,

initAccount : null,

isAskPending : false,

isBidPending : false,

// function

CancelAllOrders : function (e) {

while(true) {

var orders = _C(e.GetOrders)

if(orders.length == 0) {

return

}

Sleep(500)

for(var i = 0; i < orders.length; i++) {

e.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

},

Balance : function () {

if (this.arrPlanOrders.length == 0) {

this.CancelAllOrders(this.e)

var acc = _C(this.e.GetAccount)

this.account = acc

var askPendingPrice = (this.distance + acc.Balance) / acc.Stocks

var bidPendingPrice = (acc.Balance - this.distance) / acc.Stocks

var askPendingAmount = this.distance / 2 / askPendingPrice

var bidPendingAmount = this.distance / 2 / bidPendingPrice

this.arrPlanOrders.push({tradeType : "ask", price : askPendingPrice, amount : askPendingAmount})

this.arrPlanOrders.push({tradeType : "bid", price : bidPendingPrice, amount : bidPendingAmount})

} else if(this.isAskPending == false && this.isBidPending == false) {

for(var i = 0; i < this.arrPlanOrders.length; i++) {

var tradeFun = this.arrPlanOrders[i].tradeType == "ask" ? this.e.Sell : this.e.Buy

var id = tradeFun(this.arrPlanOrders[i].price, this.arrPlanOrders[i].amount)

if(id) {

this.isAskPending = this.arrPlanOrders[i].tradeType == "ask" ? true : this.isAskPending

this.isBidPending = this.arrPlanOrders[i].tradeType == "bid" ? true : this.isBidPending

} else {

Log("Pending order failed, clear!")

this.CancelAllOrders(this.e)

return

}

}

}

if(this.isBidPending || this.isAskPending) {

var orders = _C(this.e.GetOrders)

Sleep(1000)

var ticker = _C(this.e.GetTicker)

this.ticker = ticker

if(this.isAskPending) {

var isFoundAsk = false

for (var i = 0; i < orders.length; i++) {

if(orders[i].Type == ORDER_TYPE_SELL) {

isFoundAsk = true

}

}

if(!isFoundAsk) {

Log("Selling order filled, cancel the order, reset")

this.CancelAllOrders(this.e)

this.arrPlanOrders = []

this.isAskPending = false

this.isBidPending = false

LogProfit(this.CalcProfit(ticker))

return

}

}

if(this.isBidPending) {

var isFoundBid = false

for(var i = 0; i < orders.length; i++) {

if(orders[i].Type == ORDER_TYPE_BUY) {

isFoundBid = true

}

}

if(!isFoundBid) {

Log("Buying order filled, cancel the order, reset")

this.CancelAllOrders(this.e)

this.arrPlanOrders = []

this.isAskPending = false

this.isBidPending = false

LogProfit(this.CalcProfit(ticker))

return

}

}

}

},

ShowTab : function() {

var tblPlanOrders = {

type : "table",

title : "Plan pending orders",

cols : ["direction", "price", "amount"],

rows : []

}

for(var i = 0; i < this.arrPlanOrders.length; i++) {

tblPlanOrders.rows.push([this.arrPlanOrders[i].tradeType, this.arrPlanOrders[i].price, this.arrPlanOrders[i].amount])

}

var tblAcc = {

type : "table",

title : "Account information",

cols : ["type", "Stocks", "FrozenStocks", "Balance", "FrozenBalance"],

rows : []

}

tblAcc.rows.push(["Initial", this.initAccount.Stocks, this.initAccount.FrozenStocks, this.initAccount.Balance, this.initAccount.FrozenBalance])

tblAcc.rows.push(["This", this.account.Stocks, this.account.FrozenStocks, this.account.Balance, this.account.FrozenBalance])

return "Time:" + _D() + "\n `" + JSON.stringify([tblPlanOrders, tblAcc]) + "`" + "\n" + "ticker:" + JSON.stringify(this.ticker)

},

CalcProfit : function(ticker) {

var acc = _C(this.e.GetAccount)

this.account = acc

return (this.account.Balance - this.initAccount.Balance) + (this.account.Stocks - this.initAccount.Stocks) * ticker.Last

},

Init : function() {

this.initAccount = _C(this.e.GetAccount)

if(IsReset) {

var acc = _G("account")

if(acc) {

this.initAccount = acc

} else {

Log("Failed to restore initial account information! Running in initial state!")

_G("account", this.initAccount)

}

} else {

_G("account", this.initAccount)

LogReset(1)

LogProfitReset()

}

},

Exit : function() {

Log("Cancel all pending orders before stopping...")

this.CancelAllOrders(this.e)

}

}

function main() {

// Initialization

Shannon.Init()

// Main loop

while(true) {

Shannon.Balance()

LogStatus(Shannon.ShowTab())

// Interaction

var cmd = GetCommand()

if(cmd) {

if(cmd == "stop") {

while(true) {

LogStatus("Pause", Shannon.ShowTab())

cmd = GetCommand()

if(cmd) {

if(cmd == "continue") {

break

}

}

Sleep(1000)

}

}

}

Sleep(5000)

}

}

function onexit() {

Shannon.Exit()

}

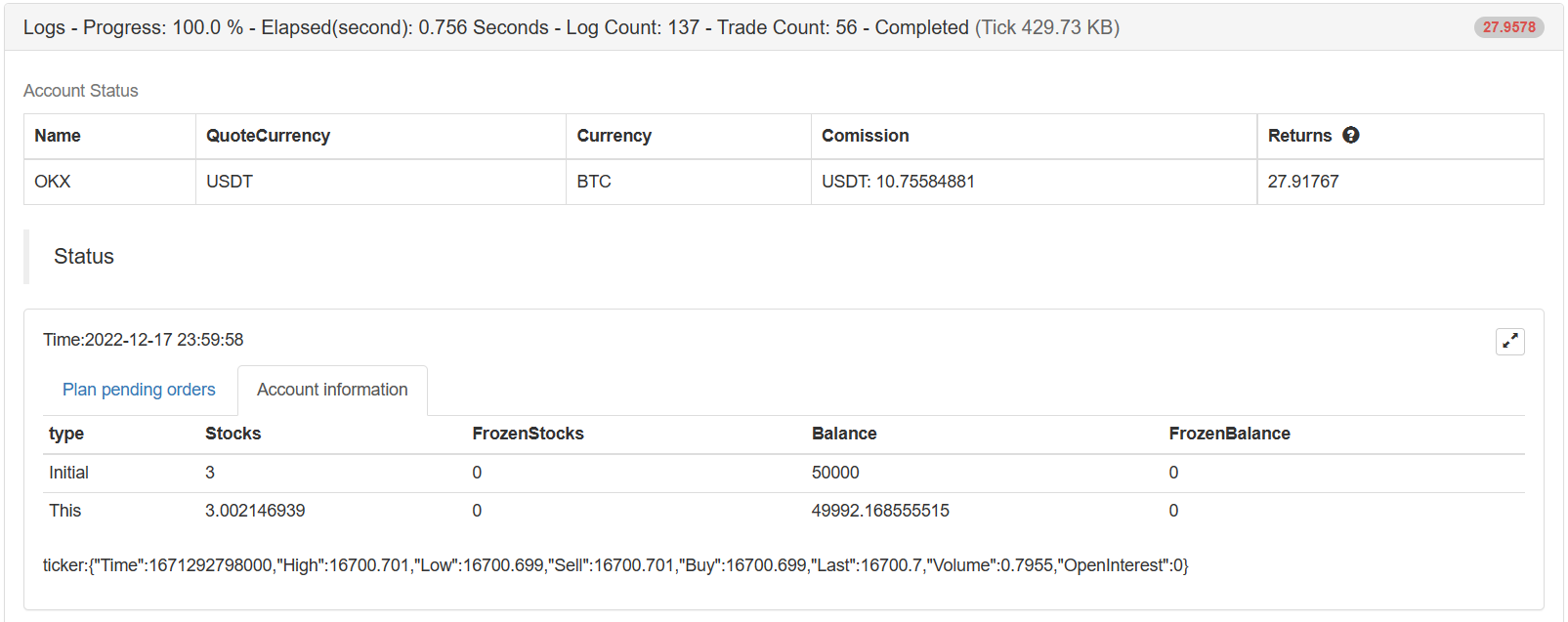

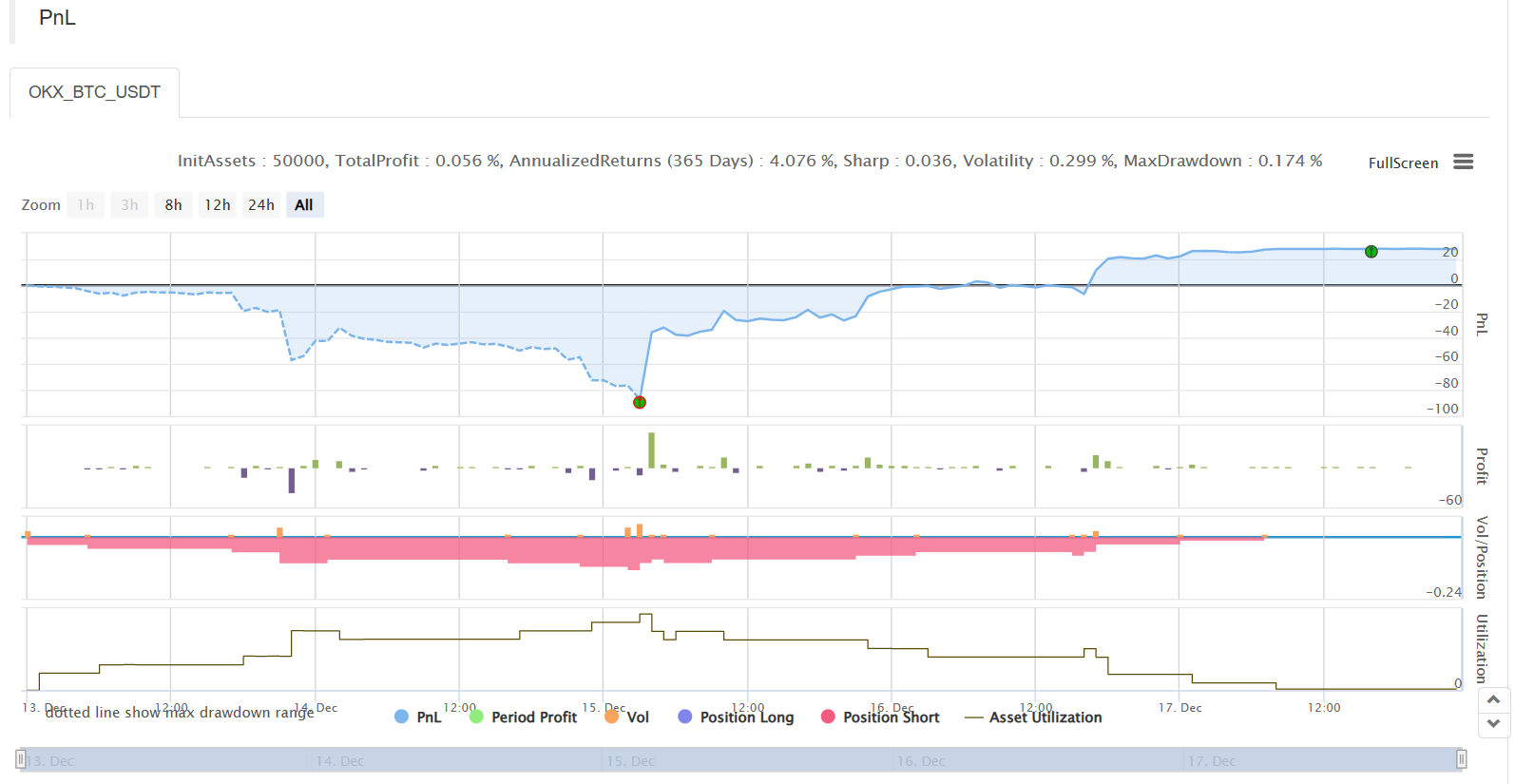

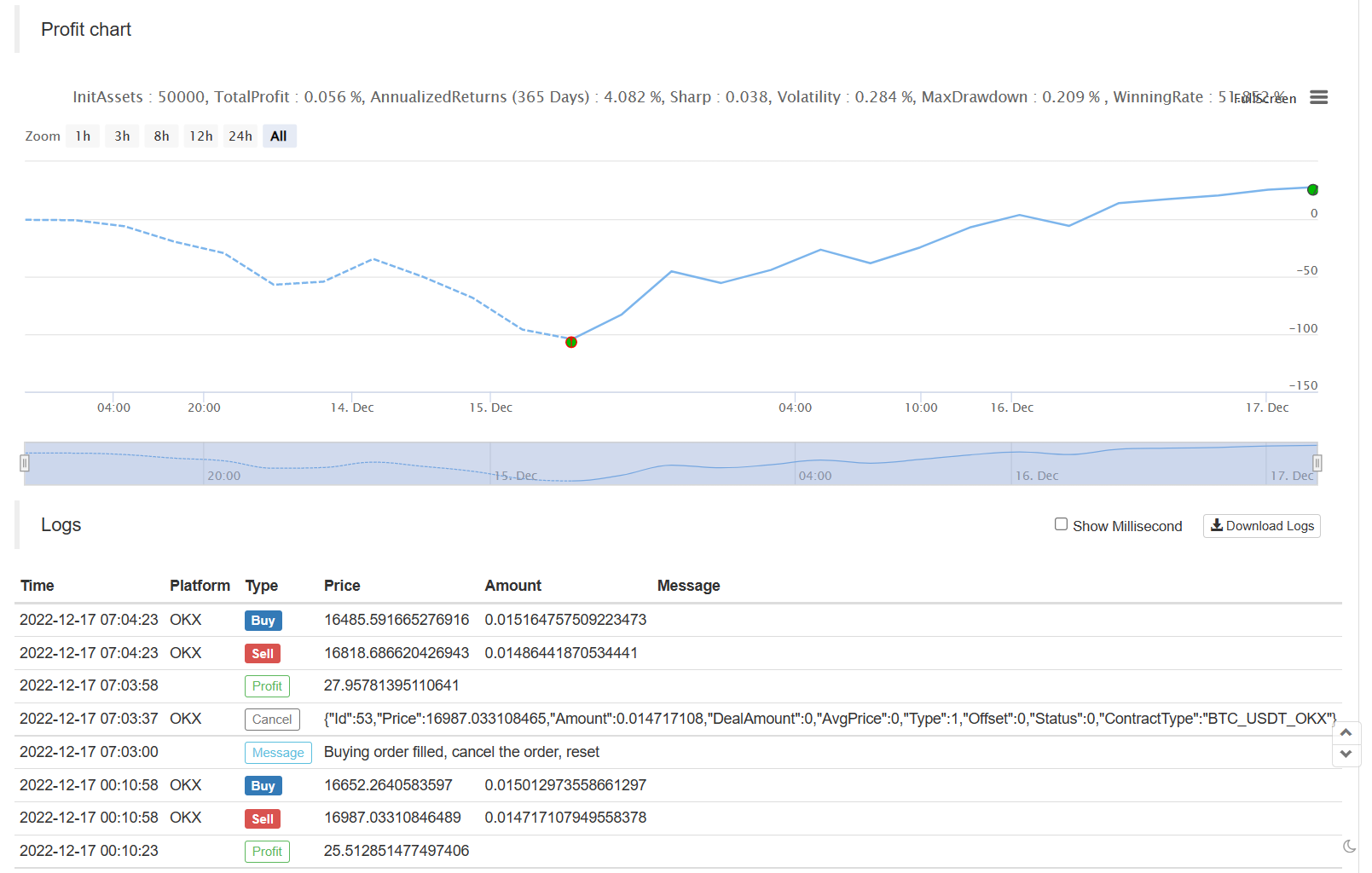

Backtesting

Optimization and extension

A virtual pending order mechanism can be added. Some exchanges have limited price on pending orders, so the order may not be actually placed. You need to wait until the price is close to the real pending order.

Add futures trading.

Expand a multi-species and multi-exchange version.

Strategies are for educational purposes only and should be used with caution in real bot trading.

Strategy address: https://www.fmz.com/strategy/225746

From: https://blog.mathquant.com/2022/12/19/balanced-pending-order-strategy-teaching-strategy.html

Subscribe to my newsletter

Read articles from FMZ Quant directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

FMZ Quant

FMZ Quant

Quantitative Trading For Everyone