Letting Bun & TypeScript do my VAT numbers (Moms til SKAT Erhverv)

Lukas

Lukas

I am trying to build something on the side and so I've gotten my company number together with VAT registration. That means I can make purchases with VAT reverse charge. In Denmark, VAT is 25%. Excluding that means 1/4th cut in price which for a self-funded hustle is very appreciated.

Pre history

When I first registered, I was using a bank that supported holding balances in both DKK, EUR and USD. That made it a pain to do proper book keeping because of mixed currencies. I tried Dinero.dk which was nice but it freaked out when I tried setting currencies other than Danish Krone. Their support referred me to VISMA, the more serious platform. However I quickly found that it was prohibitively complicated and demanding for my very simple case.

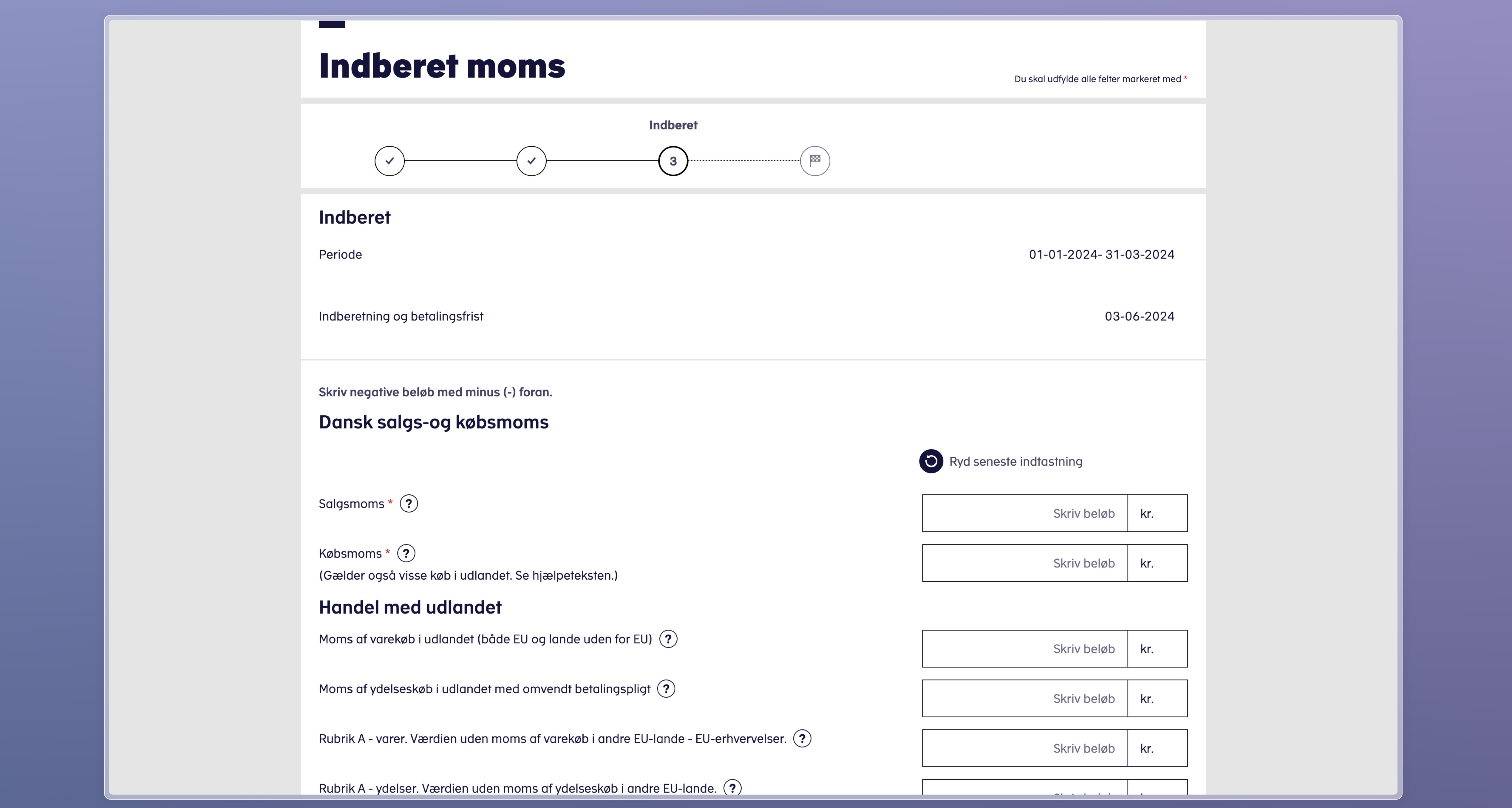

As time proven, I settled for an Excel sheet. Basic columns such as total paid, vat amount, currency etc. Then I did my first submission of VAT, it is called Moms in Danish. I made some formulas and got what I wanted. But it was too much hassle than I would have preferred. I did it again and with the turn of 2024 I knew I will automate this as every real developer would do.

Code

Something that changed is that this year, 2024, I decided to pay using Danish Krones no matter the destination currency (aka, to leverage the perks of credit cards). This removed the previous challenge and made it even simpler. Then I wrote the following code to fetch the csv of my records in Google Sheets and calculate.

More fluff of mine

Ironically enough, even though I am better versed in English than in Danish at the time being, I find certain explanations in Danish easier to understand. Speaking of which, I got to really acknowledge how great Denmark is for making it easy to understand the taxes.

Both the documentation on the website provided in multiple languages and the helpful phone line, is what makes me pay taxes with the smile. Seriously good job by SKAT and that's one of places Denmark really stands out.

Finally the code

So all in all, this is the script I came up with.

import { parse } from 'csv-parse/sync';

const { SHEETS_CSV_URL, FROM_DATE, TO_DATE } = Bun.env;

if (!SHEETS_CSV_URL) {

console.error('SHEETS_CSV_URL is required');

process.exit(1);

}

if (!FROM_DATE) {

console.error('FROM_DATE is required');

process.exit(1);

}

if (!TO_DATE) {

console.error('TO_DATE is required');

process.exit(1);

}

const csvString = await (await fetch(SHEETS_CSV_URL)).text();

const records = parse(csvString, {

cast: true,

cast_date: true,

columns: true,

skip_empty_lines: true,

});

type Record = {

invoiceId: string;

date: Date;

name: string;

type: 'A - Services' | 'A - Goods' | 'B - Services';

inEu: boolean;

inDk: boolean;

grandTotal: number;

vatRate: number;

baseValue: number;

vatValue: number;

};

// filter records from January 1st, 2024 to March 31st, 2024

const filteredRecords = records.filter((r: Record) => {

const date = r.date;

return date >= new Date(FROM_DATE) && date <= new Date(TO_DATE);

});

// console.log(filteredRecords);

// process.exit(0);

// Caclulate

// https://skat.dk/en-us/businesses/vat/vat-on-international-trade/reporting-your-international-trade

// https://skat.dk/erhverv/moms/moms-ved-handel-med-udlandet/indberet-din-handel-med-udlandet

const tax = {

'vat-in-dk': 0, // Moms i DK til Købsmoms (Input VAT) (VAT deductible)

// VAT on goods purchased outside Denmark (both the EU and third countries).

'vat-on-goods-purchased-outside-denmark': 0,

// VAT on services purchased outside Denmark subject to a reverse charge

'vat-on-services-purchased-outside-denmark-subject-to-a-reverse-charge': 0,

// to calculate Købsmoms (Input VAT) (VAT deductible)

'vat-on-services-purchased-outside-denmark-outside-eu': 0,

'eu-sales-with-vat': 0,

'eu-sales-without-vat': 0,

'vat-paid': 0, // Købsmoms

'vat-collected': 0, // Salgsmoms

// Boxes (base value here excl. VAT)

'box-a-services': 0,

'box-a-goods': 0,

// Not relevant for my business

'box-b-services': 0,

'box-b-goods': 0,

'box-c-services': 0,

};

tax['vat-in-dk'] = filteredRecords

.filter((r: Record) => r.inDk)

.filter((r: Record) => r.type === 'A - Services' || r.type === 'A - Goods')

.reduce((acc: number, r: Record) => acc + r.vatValue, 0);

let vatOf25estimatedForReverseCharge = 0;

// Moms af varekøb i udlandet (både EU og lande uden for EU)

// VAT on goods purchased outside Denmark (both the EU and third countries).

// Enter the VAT payable on services purchased outside Denmark during the VAT period (both EU countries and third countries).

// You calculate the VAT as 25% of the invoice value of the services purchased during the period.

tax['vat-on-goods-purchased-outside-denmark'] = filteredRecords

.filter((r: Record) => !r.inDk)

.filter((r: Record) => r.type === 'A - Goods')

.reduce((acc: number, r: Record) => {

let value = r.vatValue;

if (r.vatRate === 0) {

value = r.grandTotal * 0.25;

vatOf25estimatedForReverseCharge += value;

}

return acc + value;

}, 0);

// Moms af ydelseskøb i udlandet med omvendt betalingspligt

// VAT on services purchased outside Denmark subject to a reverse charge

tax['vat-on-services-purchased-outside-denmark-subject-to-a-reverse-charge'] =

filteredRecords

.filter((r: Record) => !r.inDk && r.inEu)

// Only report the value of the EU services you purchased in box A - services.

.filter((r: Record) => r.type === 'A - Services')

.filter((r: Record) => r.vatRate === 0)

.reduce((acc: number, r: Record) => {

let value = r.vatValue;

if (r.vatRate === 0) {

value = r.grandTotal * 0.25;

vatOf25estimatedForReverseCharge += value;

}

return acc + value;

}, 0);

tax['vat-on-services-purchased-outside-denmark-outside-eu'] = filteredRecords

.filter((r: Record) => !r.inDk && !r.inEu)

.filter((r: Record) => r.type === 'A - Services')

.reduce((acc: number, r: Record) => {

let value = r.vatValue;

if (r.vatRate === 0) {

value = r.grandTotal * 0.25;

vatOf25estimatedForReverseCharge += value;

}

return acc + value;

}, 0);

// Print the manually added 25% on reverse charge

console.info({ vatOf25estimatedForReverseCharge });

// Købsmoms // Input VAT (VAT deductible)

// You may include amounts from the following fields:

// - VAT on goods purchased outside Denmark.

// - VAT on services purchased outside Denmark subject to a reverse charge.

tax['vat-paid'] =

tax['vat-in-dk'] +

tax['vat-on-goods-purchased-outside-denmark'] +

tax[

'vat-on-services-purchased-outside-denmark-subject-to-a-reverse-charge'

] +

tax['vat-on-services-purchased-outside-denmark-outside-eu'];

// Box A - goods

// VAT on goods purchased outside Denmark (both the EU and third countries).

// You should report the value of your purchase of goods from other EU countries in box A - ‘goods’ on your VAT return.

// KISS: Hardware that I bought from the EU but not in Denmark

// Rubrik A - varer. Værdien uden moms af varekøb i andre EU-lande - EU-erhvervelser.

tax['box-a-goods'] = filteredRecords

.filter((r: Record) => r.inEu && !r.inDk)

.filter((r: Record) => r.type === 'A - Goods')

.reduce((acc: number, r: Record) => acc + r.grandTotal, 0);

// Rubrik A - ydelser. Værdien uden moms af ydelseskøb i andre EU-lande.

// Box A - services

// You should report the value of your purchase of services from other EU countries in box A - ‘services’ on your VAT return.

// KISS: Services that I bought from the EU but not in Denmark, the base value w/o VAT

tax['box-a-services'] = filteredRecords

.filter((r: Record) => r.inEu && !r.inDk)

.filter((r: Record) => r.type === 'A - Services')

.reduce((acc: number, r: Record) => acc + r.grandTotal, 0);

// Box B - services

// The value of certain sales of services exclusive of VAT to other EU countries. To be reported under ‘EU-salg uden moms’ (EU sales exclusive of VAT)

// Rubrik B-ydelser. Værdien af visse ydelsessalg uden moms til andre EU-lande. Skal også indberettes til systemet "EU-salg uden moms".

// KISS: Services that I sold to the EU without charging VAT (reverse charge) (typically B2B)

tax['box-b-services'] = filteredRecords

.filter((r: Record) => r.inEu && !r.inDk)

.filter((r: Record) => r.type === 'B - Services')

.reduce((acc: number, r: Record) => acc + r.grandTotal, 0);

// EU sales with VAT

// The value of certain sales of goods and services exclusive of VAT to other EU countries. To be reported under ‘EU-salg med moms’ (EU sales with VAT)

// KISS: Sales of goods and services to the EU where I charged VAT (typically B2C)

tax['eu-sales-with-vat'] = filteredRecords

.filter((r: Record) => r.inEu && !r.inDk)

.filter((r: Record) => r.type === 'B - Services')

.filter((r: Record) => r.vatRate > 0)

.reduce((acc: number, r: Record) => acc + r.grandTotal, 0);

// EU sales without VAT

// The value of certain sales of goods and services exclusive of VAT to other EU countries. To be reported under ‘EU-salg uden moms’ (EU sales exclusive of VAT)

tax['eu-sales-without-vat'] = filteredRecords

.filter((r: Record) => r.inEu && !r.inDk)

.filter((r: Record) => r.type === 'B - Services')

.filter((r: Record) => r.vatRate === 0)

.reduce((acc: number, r: Record) => acc + r.baseValue, 0);

// No sales for me... yet :)

// console.log(

// `

// Report the value of your sale in two different places in E-tax for businesses:

// In your VAT return within the normal deadlines that apply to your business.

// Under ’EU-salg uden moms’ (EU sales exclusive of VAT) by the 25th day of each month.

// `.trim(),

// );

// Round to no decimal places

Object.keys(tax).forEach((key) => {

tax[key] = Math.round(tax[key]);

});

// Add Danish labels, it is easier to know where to put the numbers in the tax form

const dansk = {

'Moms af varekøb i udlandet (både EU og lande uden for EU)':

tax['vat-on-goods-purchased-outside-denmark'],

'Moms af ydelseskøb i udlandet med omvendt betalingspligt':

tax[

'vat-on-services-purchased-outside-denmark-subject-to-a-reverse-charge'

],

Købsmoms: tax['vat-paid'],

'Rubrik A - varer': tax['box-a-goods'],

'Rubrik A - ydelser': tax['box-a-services'],

'Rubrik B - ydelser': tax['box-b-services'],

'EU-salg med moms': tax['eu-sales-with-vat'],

'EU-salg uden moms': tax['eu-sales-without-vat'],

};

console.dir(dansk);

I like TypeScript for how easy it is throw something together and just run the code. I like Bun that it allows me to execute TypeScript with no need to transpile first.

This script will print all the numbers that I need to fill out in the SKAT form and that is soo so nice. If you're doing the same, you're welcome to use it too. Just make sure to match the columns.

On GitHub

I also put it up in the repo here https://github.com/flexchar/bun-scripts/tree/main/skat. I haven't figured out the ultimate structure for these seldom used scripts.

PS. If you notice that something is not quite right, please do let me know. At the end of the day, it is a little challenge to interpret the taxation rules. :)

Subscribe to my newsletter

Read articles from Lukas directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Lukas

Lukas

I've discovered coding back in 2013 and three years later I spent all my summer building my first Laravel app which is still in production by the non-profit I've built for. Now I'm struggling to find the balance between enjoying the power of "I can build this myself" and not chocking myself to death trying to build everything myself. As it is common for developers to be less articulate, I decided to leverage writing about my endeavours, to keep me up.