Thermostat Strategy using on crypto market by MyLanguage

FMZ Quant

FMZ Quant2 min read

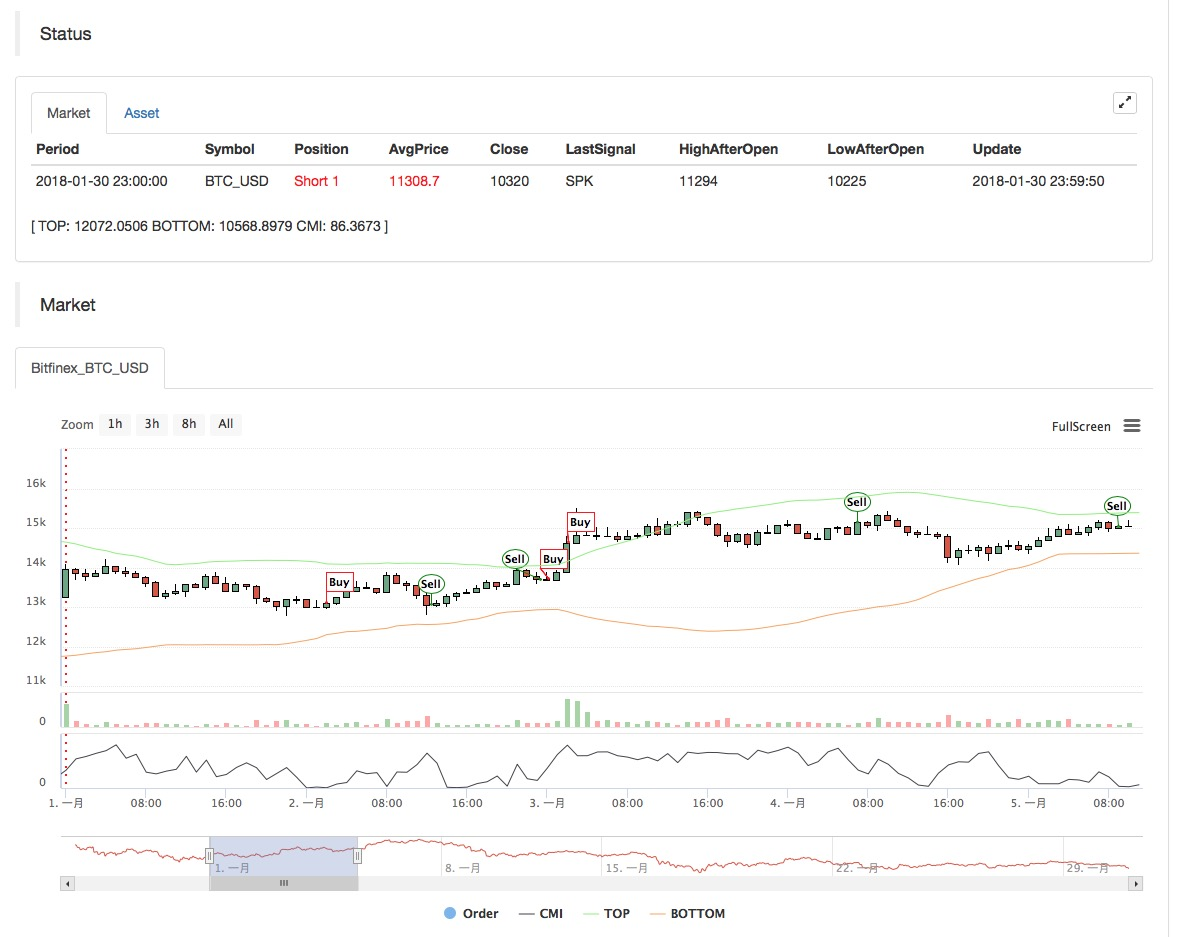

Strategy Name: Upgraded Thermostat Strategy

Data cycle: 1H

Support: Commodity Futures, Digital Currency Futures, Digital Currency Spot

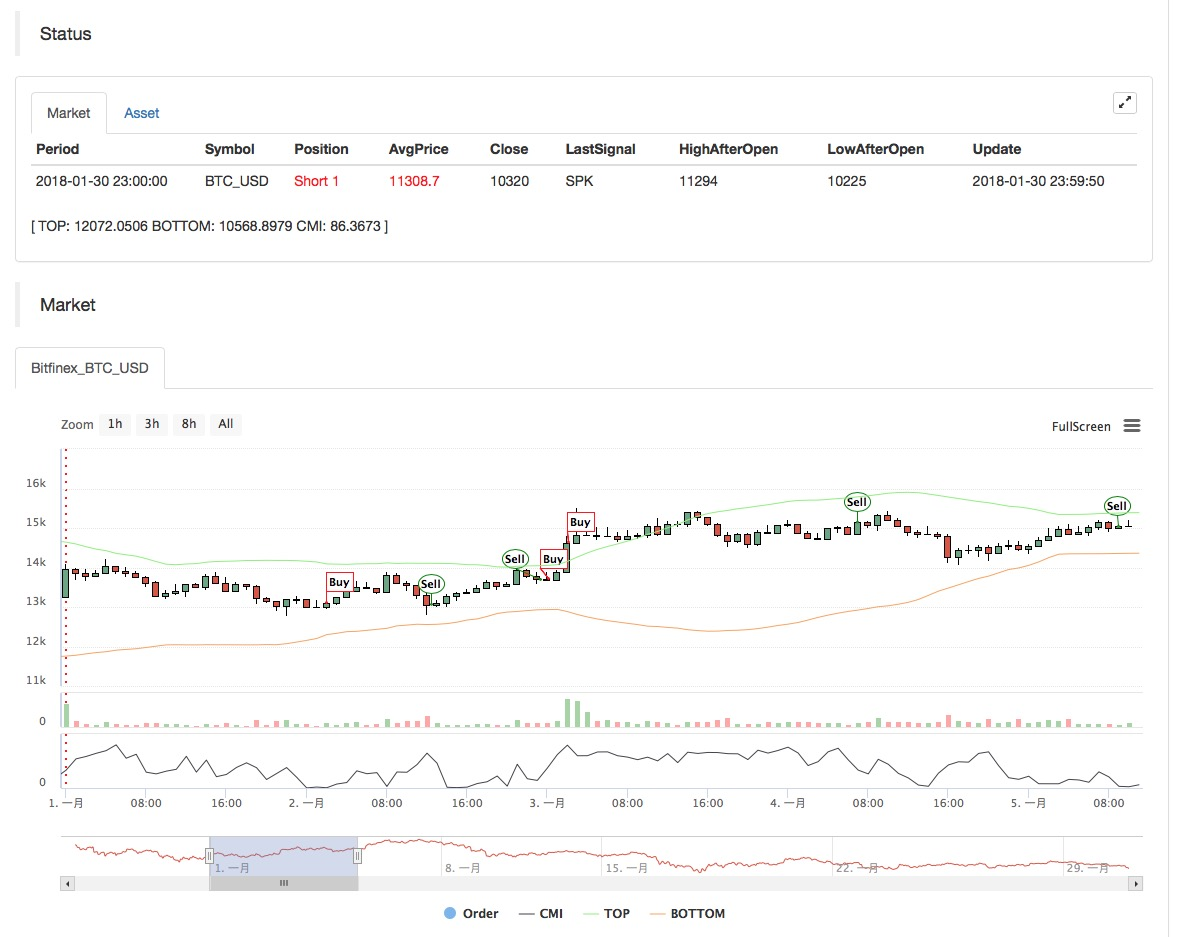

Main chart:

upper track, formula: TOP^^MAC+N_TMPTMP; / / upper track of boll

lower track, formula: BOTTOM^^MAC-N_TMPTMP;//lower track of bollSecondary chart:

CMI, formula: CMI: ABS(C-REF(C,N_CMI-1))/(HHV(H,N_CMI)-LLV(L,N_CMI))*100;

//0-100 the larger the value, the stronger the trend, CMI <20 is oscillation, CMI>20 is trend

Source code:

(*backtest

start: 2018-11-06 00:00:00

end: 2018-12-04 00:00:00

period: 1h

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

*)

MAC:=MA(CLOSE,N);

TMP:=STD(CLOSE,N);

TOP^^MAC+N_TMP*TMP;// upper track of boll

BOTTOM^^MAC-N_TMP*TMP;// lower track of boll

BBOLL:=C>MAC;

SBOLL:=C<MAC;

N_CMI:=30;

CMI:ABS(C-REF(C,N_CMI-1))/(HHV(H,N_CMI)-LLV(L,N_CMI))*100;

//0-100 the larger the value, the stronger the trend, CMI <20 is oscillation mode, CMI>20 is the trend

N_KD:=9;

M1:=3;

M2:=3;

RSV:=(CLOSE-LLV(LOW,N_KD))/(HHV(HIGH,N_KD)-LLV(LOW,N_KD))*100;

//(1)closing price - the lowest of cycle N, (2)the highest of cycle N - the lowest of cycle N, (1)/(2)

K:=SMA(RSV,M1,1);//MA of RSV

D:=SMA(K,M2,1);//MA of K

MIND:=30;

BKD:=K>D AND D<MIND;

SKD:=K<D AND D>100-MIND;

//oscillation mode

BUYPK1:=CMI < 20 AND BKD;//if it's oscillation, buy to cover and buy long immediately

SELLPK1:=CMI < 20 AND SKD;//if it's oscillation, sell to close long position and sell short to open position immediately

//Disposal of the original oscillating position under the trend mode

SELLY1:=REF(CMI,BARSBK) < 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND K<D;//if it's oscillation, long position take profit

BUYY1:=REF(CMI,BARSSK) < 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND K>D;//if it's oscillation, short position take profit

//trend mode

BUYPK2:=CMI >= 20 AND C > TOP;//if it's trend, buy to cover and buy long immediately

SELLPK2:=CMI >= 20 AND C < BOTTOM;//if it's trend, sell to close long position and sell short to open position immediately

//Disposal of the original oscillating position under the trend mode

SELLY2:=REF(CMI,BARSBK) >= 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND SBOLL;//if it's trend, long position take profit

BUYY2:=REF(CMI,BARSSK) >= 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND BBOLL;//if it's trend, short position take profit

SELLS2:=REF(CMI,BARSBK) >= 20 AND C<BKPRICE*(1-0.01*STOPLOSS) AND SBOLL;//if it's trend, long position stop loss

BUYS2:=REF(CMI,BARSSK) >= 20 AND C>SKPRICE*(1+0.01*STOPLOSS) AND BBOLL;//if it's trend, short position stop loss

IF BARPOS>N THEN BEGIN

BUYPK1,BPK;

SELLPK1,SPK;

BUYPK2,BPK;

SELLPK2,SPK;

END

BUYY1,BP(SKVOL);

BUYY2,BP(SKVOL);

BUYS2,BP(SKVOL);

SELLY1,SP(BKVOL);

SELLY2,SP(BKVOL);

SELLS2,SP(BKVOL);

Source Code: https://www.fmz.com/strategy/129086

0

Subscribe to my newsletter

Read articles from FMZ Quant directly inside your inbox. Subscribe to the newsletter, and don't miss out.

thermostatStrategyCryptocurrencyFMZQuanttrading, platformindicatorvolatilitystrategiesbollinger bands

Written by

FMZ Quant

FMZ Quant

Quantitative Trading For Everyone