A Comparative Analysis Of Liquid Restaking Protocols

BuildBear

BuildBear

Staking is the process by which network participants stake their native tokens to support and secure blockchain networks that use PoS. In the PoS consensus mechanism, validators are selected to validate and propose new blocks based on the amount of staked tokens. Ethereum's transition from PoW to PoS introduced staking as the central mechanism for securing the network ensuring decentralization and rewarding participants.

This article delves into a comparative analysis of some restaking protocols such as EigenLayer, Symbiotics, and Karak, exploring the implications for the blockchain ecosystem. But before that, let's first explore key concepts such as staking, liquid staking, and restaking.

From Liquid Staking to Restaking: Enhancing Liquidity and Utility

Liquid Staking allows users to stake ETH while retaining liquidity by issuing a derivative token (LST) that represents the staked assets. So they can earn rewards and use their staked assets in other DeFi applications or stake again (Restake) enhancing the overall utility of staked capital. Restaking further expands the staking process allowing users to stake ETH and LSTs to secure additional protocols and earn extra rewards for their extended participation and risk.

For Example, a user could deposit ETH to the Lido staking pool and receive stETH (staked ETH) tokens in return, then deposit the stETH to Aave to earn yield.

What is Liquid Restaking?

Liquid Restaking is a combination of the concept of liquid staking and restaking. Liquid Restaking Tokens (LRT) represent staked assets holding the value of assets that can be used in various DeFi protocols at the simultaneously. It separates rewards from traditional staking limits, offering flexibility and boosting capital efficiency. Here are the differences between Liquid Restaking from Liquid Staking:

Liquidity: Liquid staking maintains asset liquidity, enabling free use and trading. Restaking lacks inherent liquidity unless rewards are tokenized.

Asset usage: Liquid staking allows assets in multiple protocols, enhancing utility while restaking focuses on compounding rewards within staking.

Risk and Reward: Liquid staking offers higher rewards but introduces trading risks, meanwhile restaking maximizes rewards with less complexity.

Flexibility: Liquid staking allows asset management flexibility through tokenization and trading. Restaking optimizes returns within staking protocols.

Comparative Analysis of Restaking Protocols

Here we compare three competitive restaking protocols: EigenLayer, Symbiotic, and Karak. We will explore their approaches, key features, and their impact on the ecosystem.

| Property | EigenLayer | Symbiotic | Karak |

| TVL | $18 Billion | $241 million | $1 billion |

| Asset Support | ETH and ETH Derivatives | Any ERC-20 token | ETH, liquid staking tokens, stablecoins, and more |

| Restaking Options | Liquid Restaking, Native Restaking, and LP Token Restaking. | Flexible as required by vault configuration. | Liquid Staking/Restaking, and Stablecoins |

| Governance | DAO-based | Community Governance | Token Holder Governance |

| Security | Actively Validated Services | Shared Security Framework | Distributed Secure Services |

Eigen Layer

EigenLayer was the first to popularize the concept of restaking on Ethereum and is the second-largest DeFi protocol after Lido. EigenLayer’s approach to restaking enhances crypto-economic security across the network and supports new applications built on Ethereum.

Architecture

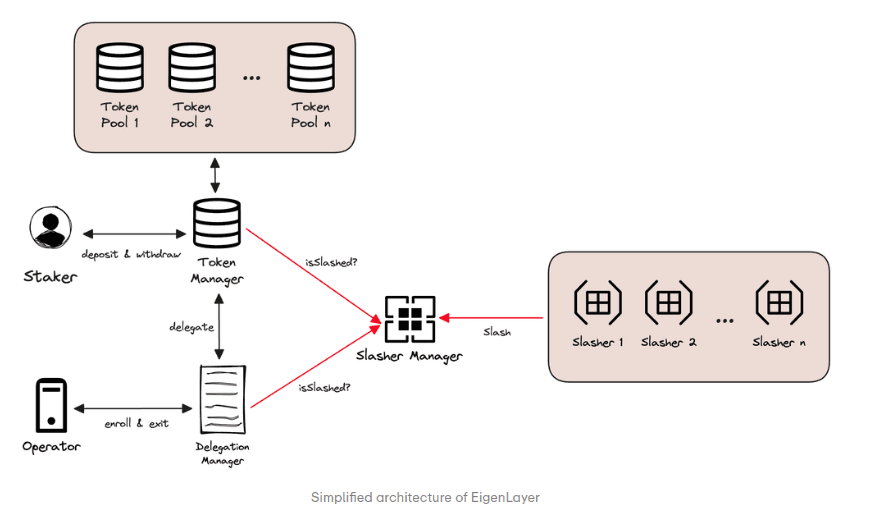

Image Source fromEigenlayerBlog

Staker can stake any token. Initially, EigenLayer supports ETH and its derivatives, which can be delegated to the token pool contract. Token Manager handles staking and withdrawals for stakers, ensuring smooth transactions.

The operator is responsible for running the AVS software accurately. They can delegate to the token pool contract and manage staked tokens. Delegation Manager allows operators to register and track their operator shares efficiently.

AVS: Actively Validated Services (AVS) are services or decentralized systems built on top of EigenLayer and run by operators. Eigen DA is one such service, anchoring external networks to Ethereum, and extending its network security to other networks through smart contracts.

Slashing Manager provides AVS developers with an interface to define and implement slashing logic. This ensures the security and integrity of the network by penalizing malicious or faulty behavior.

The architecture enables stakers to stake tokens without compromising other rewards, while AVS developers can utilize the shared security pool to safeguard new infrastructure applications. If the AVS code is not tested thoroughly, the operator might miss potential fee payments or could be slashed for all their stakes. The veto committee can be placed to be a mutually trusted party for stakers, operators, and developers as it has the power to reverse slashing resulting from non-malicious behaviors.

How EigenLayer Empowers Developers through Restaking

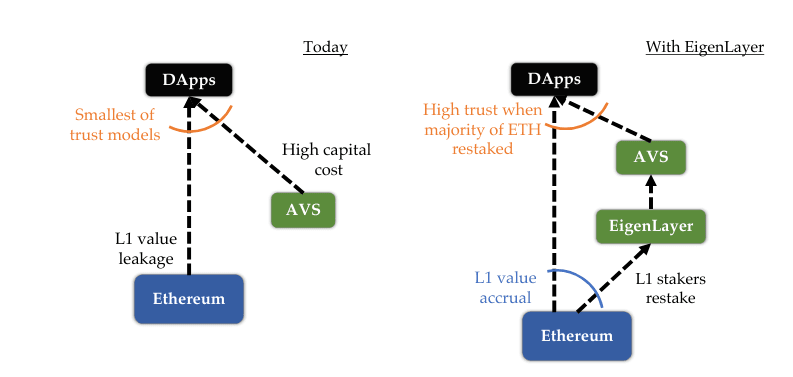

If you are building a decentralized infrastructure on Ethereum, one challenge you may run into is establishing your own crypto-economic security. Distributed networks consist of multiple nodes, and decision-making requires a consensus mechanism, with PoS being an efficient method. However, it is not easy for a developer to implement a PoS network like Ethereum.

Here is how EigenLayer helps developers address this issue:

Ease of Launch: Developers can launch chains, decentralized networks, and Proof of Stake (PoS) systems with lesser effort, increased speed, security, and distribution.

Security Reliance: Any infrastructure, regardless of its composition, can rely on Ethereum's security, mitigating the challenge of establishing its own economic security.

Extended Programmability: Integrating EigenLayer extends the programmability of Ethereum beyond EVM, enabling a wider range of dApps on the network.

Image source from EigenLayer Whitepaper

EigenLayer is complex but it prioritizes security and suits for projects valuing structured governance and security. In other words, EigenLayer empowers developers to build distributed systems by leveraging the security of the Ethereum network. It connects stakers with infrastructure developers and handles much of the architecture needed to build a decentralized network, allowing developers to focus on core protocol functionality.

Benefits for Stakers

EigenLayer also provides significant advantages for stakers:

Economic Security: Stakers can offer economic security using tokens, primarily ETH and ETH derivatives.

Restaking Options: Stakers have the option to restake their stake and contribute to the security of other infrastructures while earning native ETH rewards. This pools security instead of fragmenting it, enhancing overall network resilience.

Delegation to Operators: Stakers can delegate their tokens to trusted operators, who then manage the staking process and ensure that the network's security and efficiency are maintained.

Symbiotic

Symbiotic differentiates itself with a focus on shared security enhancing the security and functionality of decentralized networks by providing a flexible infrastructure for users.

Architecture

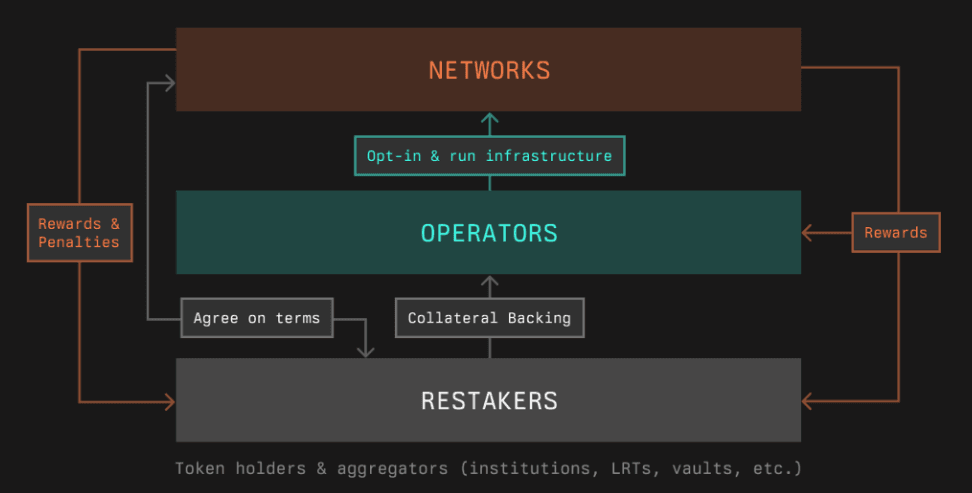

Symbiotic consists of 5 interconnected modules: Collateral,Vaults,Networks,Operators, andResolvers but the functionality revolves around three core components: networks, resolvers, and operators, each with distinct roles and interactions within the protocol.

Image fromSymbioticDocs

Users deposit their assets into the vault. These assets can include any ERC-20 tokens, depending on the vault's configuration. Vault owners or deployers determine the delegation and restaking strategies, defining how the staked assets are allocated across different operators and networks.

Networks opt into the vault's delegation and restaking strategies to participate in the staking process. Symbiotic defines networks as any protocol requiring decentralized infrastructure to deliver services, such as validating transactions, providing off-chain data, and ensuring secure cross-network interactions.

Operators are entities running infrastructure for decentralized networks. They manage the staked assets, ensuring that they are utilized effectively to support network operations.

The vault assigns stakes to operators based on predefined strategies. It manages the allocation of stakes for network epochs and ensures balanced distribution across operator-network pairs.

Networks generate staking rewards based on the performance of the staked assets. The vault collects these rewards and distributes them to the users according to their stake and the vault's policies.

Users can request to withdraw their assets from the vault. The vault processes these requests, ensuring the underlying assets are available for withdrawal.

Resolvers oversee slashing events and can veto them, ensuring fairness and preventing unjust penalties. Resolvers are determined through terms proposed by networks and accepted by vaults.

This architecture of Symbiotic allows developers to define custom logic for networks, incorporate slashing logic, and configure the operator set flexibly. The modular design of Symbiotic supports multiple sub-networks with different infrastructure roles.

How Symbiotic Enables Developers to Innovate with Modular Security

While EigenLayer focuses on restaking to enhance crypto-economic security and support new applications on Ethereum, Symbiotic offers unique benefits through its flexible and modular approach:

Customizability: Developers can launch decentralized applications by managing transaction validation and ordering, providing off-chain data, or ensuring secure cross-network interactions.

Modular Design: The protocol’s modular design allows developers to define rules of engagement for sub-networks, making it adaptable to various use cases.

Security Reliance: Developers can rely on the economic security provided by Symbiotic's decentralized infrastructure.

Operator Flexibility: Operators can acquire stakes from multiple partners without needing isolated infrastructure for each.

Non-upgradeable Core Contracts: Symbiotic’s core contracts are non-upgradeable, similar to Uniswap, reducing governance risks and potential points of failure.

Use Cases: Applications include cross-chain oracles, threshold networks, MEV infrastructure, interoperability, shared sequencers, and more.

Benefits for Stakers

Symbiotic also provides significant advantages for stakers:

Economic Security: Stakers can offer economic security using various ERC-20 tokens, providing flexibility in their staking choices.

Restaking Options: Stakers can restake their assets across different networks and sub-networks, enhancing overall network resilience and earning rewards from multiple sources.

Enhanced Security: The resolver mechanism ensures that slashing incidents are thoroughly vetted, providing additional security to stakers.

Decentralized Infrastructure: Stakers contribute to the security of decentralized applications and networks, ensuring a robust and resilient ecosystem.

Karak

Karak is introduced as a universal restaking layer providing crypto-economic security with multi-asset restaking, offering developers and stakers unparalleled flexibility and security.

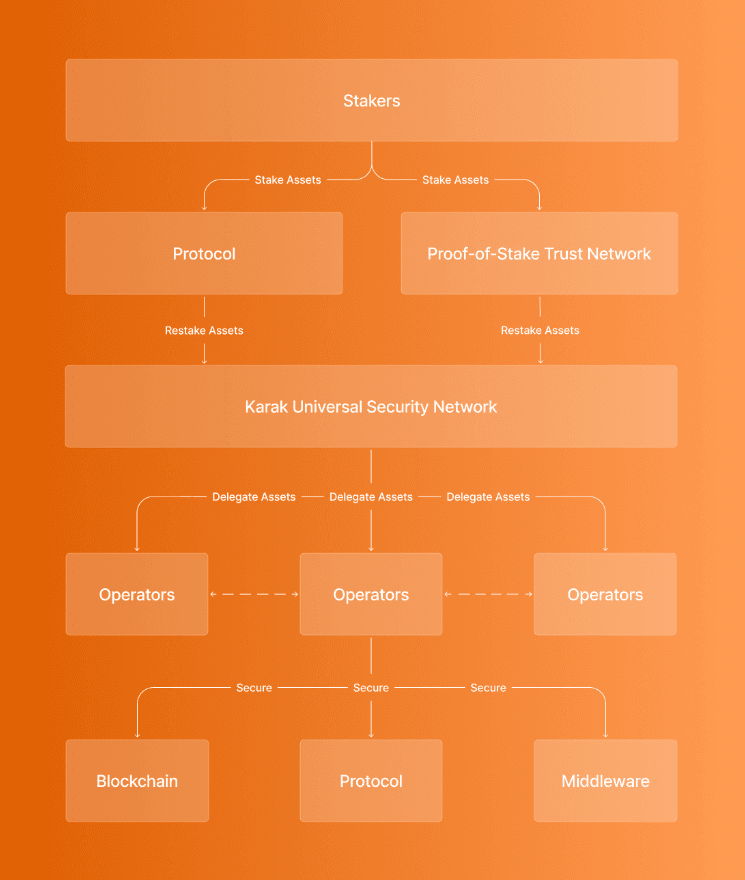

Architecture

Karak has a similar architecture to EigenLayer but instead of AVS, Karak has Distributed Secure Services (DSS). The core entities include:

Stakers/Restakers deposit assets into the protocol or trusted network. The pooled assets are allocated to various Distributed Secure Services(DSS).

DSS are Services that utilize the restaked assets to enhance security across various protocols.

DSS deploys restaked assets in securing and validating operations, reducing their operational costs while enhancing overall security.

Blockchains and rollups integrate with DSS, leveraging the pooled security resources.

Operators are entities responsible for performing essential validation and security operations for DSS. They use the restaked assets to validate transactions, secure the network, and maintain overall robustness.

Restakers receive rewards based on the performance and utilization of their staked assets.

Image Source fromKarakDoc

How does Karak provide a Universal Restaking Layer?

Karak provides a flexible and modular design that empowers developers to create secure and innovative infrastructure designs.

Multiasset Restaking: Introduces a new primitive in crypto-economic security, allowing users to restake assets like Ethereum, liquid staking tokens, stablecoins, and more.

Restake Anywhere: Developers can build and innovate across multiple blockchains without being constrained to Ethereum L1, leveraging Karak’s universal restaking infrastructure.

Lower Barriers to Entry: Karak fosters a more scalable and affordable approach to bootstrapping security for new protocols, allowing developers to avoid the need for highly dilutive reward mechanisms.

Turnkey Development: Karak offers a suite of tools and SDKs for developers to easily iterate and deploy new services secured by a robust trust network. Karak launched its own Layer 2 solution, K2, which focuses on risk management and provides a sandbox environment for DSS.

Benefits for Stakers

Karak stands out with its multiasset restaking capability, offering greater flexibility and security:

Economic Security: Stakers can contribute to the network's security using various assets, including stablecoins and liquid staking tokens.

Restaking Flexibility: Facilitates restaking across multiple blockchains, not just Ethereum, enhancing overall network security and usability.

Enhanced Security: The additional slashing conditions ensure the integrity and security of applications utilizing Karak.

Stablecoin Integration: Supports stablecoin restaking, providing a stable source of economic security and simplifying the forecasting of security needs.

Conclusion

Liquid restaking protocols are crucial for driving blockchain adoption by enhancing the liquidity and utility of staked assets. This comparative analysis highlights the unique features and approaches of EigenLayer, Symbiotic, and Karak in the liquid restaking landscape offering valuable insights from the perspectives of both developers and stakers.

About BuildBear Labs

BuildBear is a platform tailored for DApp development and testing. Developers gain the freedom to construct a personalized Private Testnet sandbox across a variety of blockchain networks. The liberty to mint unlimited Native and ERC20 tokens, coupled with rapid transaction times on BuildBear (under 3 seconds!), enhances the DApp development lifecycle manifold. The platform comes equipped with tools and plugins designed for real-time testing and debugging, ensuring developers can keep tabs on intricate blockchain transactions with unparalleled ease.

Subscribe to my newsletter

Read articles from BuildBear directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

BuildBear

BuildBear

BuildBear is a platform for testing dApps at scale, for teams. It provides users with their own private Testnet to test their smart contracts and dApps, which can be forked from any EVM chain. It also provides a Faucet, Explorer, and RPC for testing purposes.