Raydium - Solana's DeFi Future DEX?

Shivank Kapur

Shivank Kapur

TL;DR

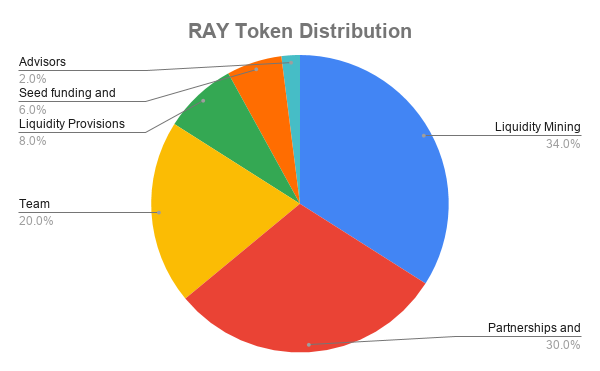

Raydium is designed to address issues that conventional Ethereum automated market makers (AMMs) frequently face, such as expensive fees and sluggish transaction speeds during peak network traffic.

Through its yield farming framework, Raydium, in collaboration with Serum DEX, enables more easily accessible in-protocol liquidity via liquidity providers (LPs).

With its AcceleRaytor launchpad platform, Raydium intends to enable LPs to partake in future token offerings and invest RAY tokens in return for incentives. The Raydium cryptocurrency network uses its own utility token, RAY, for governance and other ecosystem activities.

Introduction

The decentralised finance (DeFi) ecosystem depends on decentralised exchanges (DEXs), which allow users to swap digital assets across peer-to-peer (P2P) networks. Because the majority of DEXs run only on the Ethereum blockchain, they are frequently vulnerable to increased petrol prices and shortened transaction times brought on the demand-based congestion on the Ethereum network.

Moreover, platform-specific liquidity pools are the only places where DEXs can normally access liquidity, which can be expensive and ineffective. In order to overcome these inefficiencies, the Raydium crypto protocol was created. It consists of an automated market maker (AMM) and DEX that is based on Solana.

Low costs and high transaction throughput were given first priority in the design of the Solana blockchain platform. With its comprehensive DeFi service, Raydium hopes to leverage these benefits. The Raydium DEX is intended to provide accessible yield farming, more liquidity, and almost immediate token swaps.

In addition, Raydium offers a money market where liquidity providers (LPs) can stake their tokens in return for tokenized rewards, creating new opportunities for LPs to earn passive income. Raydium's connection with the Serum DEX, a stand-alone organisation on the Solana blockchain that provides a central limit order book (CLOB) that is essential to Raydium's service, enables it to accomplish these characteristics.

Raydium x Serum

The crypto protocol Serum is also a DEX, just like Raydium. Serum is a fast and inexpensive transaction platform that utilises an on-chain central limit order book to access liquidity from all points in the Solana DeFi ecosystem. Additionally, Raydium has fully capitalised on the Serum DEX's capacity to enable Solana-based projects to integrate and compose new functionalities. Several significant benefits that are present on some Solana DEXs can be accessed by users of both platforms thanks to the integration between the Serum and Raydium DEXs. Among these are:

Enhanced speed and lower costs: Raydium can execute trades and token exchanges almost instantly and affordably thanks to Solana's high throughput and quick transaction times. Similar to Ethereum's ERC-20 token standard, Raydium is a Solana-based token standard that enables any user to supply liquidity for any SPL asset.

Liquidity across the ecosystem: Serum's central limit order book is used by the highly integrated Raydium and Serum DEXs to distribute tokenized assets, on-chain liquidity, and other features. Raydium may now take advantage of the robust liquidity and order flow present throughout the Serum cryptocurrency ecosystem.

Non-custodial and trustless: Since the Raydium DEX is neither custodial nor trustful, an intermediary is not needed to take on the role of custodian for user assets.

Raydium Ecosystem

The broader Raydium crypto ecosystem consists of three primary products and services that are utilised by Raydium. Among them are:

Yield farming, liquidity pools, and the Raydium money market: The Raydium cryptocurrency platform provides yield farming and liquidity pools that can be utilised to establish separate money markets. Raydium farms and Raydium fusion pools are the company's two primary products. By offering liquidity rewards and rewarding liquidity providers with Raydium's native RAY asset and a percentage of trading fees, the Raydium farms architecture is the standard AMM yield farming platform. Further, by enabling liquidity providers to get project-specific tokens in return for bootstrapping liquidity to launch new projects, Raydium fusion pools go above and beyond.

Raydium AMM, DEX, and token swaps: Without the need for extra market makers, users can perform token swaps by utilising liquidity pools through the Serum central limit order book on the Raydium AMM platform. Users on Raydium can now exchange assets within token pools because to this innovation. Both Serum and Raydium users have access to order flow and liquidity on the Serum DEX. Additionally, Raydium can decide whether consumers buying tokens through a Raydium liquidity pool or transacting individually through the Serum central limit order book would receive a better exchanging rate.

Raydium AcceleRaytor: By utilising Raydium's user base, Raydium AcceleRaytor is the Initial DEX Offering (IDO) platform that enables token sales for Solana projects. Raydium and Solana share accountability for the verification processes that guarantee projects that launch on AcceleRaytor adhere to particular requirements. The platform's goal is to assist early-stage Web3 firms in bootstrapping their first liquidity and achieving economic viability as they expand.

Raydium LaunchPad- AcceleRaytor

The native launchpad for Raydium, AcceleRaytor, facilitates decentralised capital raising and initial liquidity driving for businesses. It is a component of Raydium's initiatives to lead and encourage ecosystem growth in the Solana. On the Raydium platform, this is often accomplished by launching an initial token offering. Before listing a project's tokens on the launchpad, the Raydium team carefully considers and evaluates it to make sure it aligns with the values of the platform.

On AcceleRaytor, participation in token offers is determined using a lottery mechanism. To be eligible to invest, customers must enter the lottery and win tickets. You have a better chance of obtaining an allotment in the IDO the more tickets you own. Users typically need to stake at least 100 RAY tokens for at least seven days prior to the snapshot date in order to be eligible for tickets. You win more tickets the longer you stake.

Raydium Fees

For each swap that is executed in Raydium's liquidity pools, the maker and taker orders incur an additional fee of 0.25%. The following is how this 0.25% fee is divided and allocated:

In order to compensate liquidity providers, 22% (88% of the cost) is refunded into the liquidity pool.

In order to compensate RAY stakers, 03% (12% of the cost) is utilised to purchase RAY and distribute it to the staking pool.

The transaction fee for orders filled through the Serum DEX is paid to Serum and is based on the quantity of SRM tokens staked. Serum generally levies fees that vary according to the quantity of SRM kept, with an average of 0.22%.

In addition to the fees that Raydium charges for the usage of its platform, users also need to consider network expenses. Transactions using Solana usually cost between 0.0001 and 0.001 SOL.

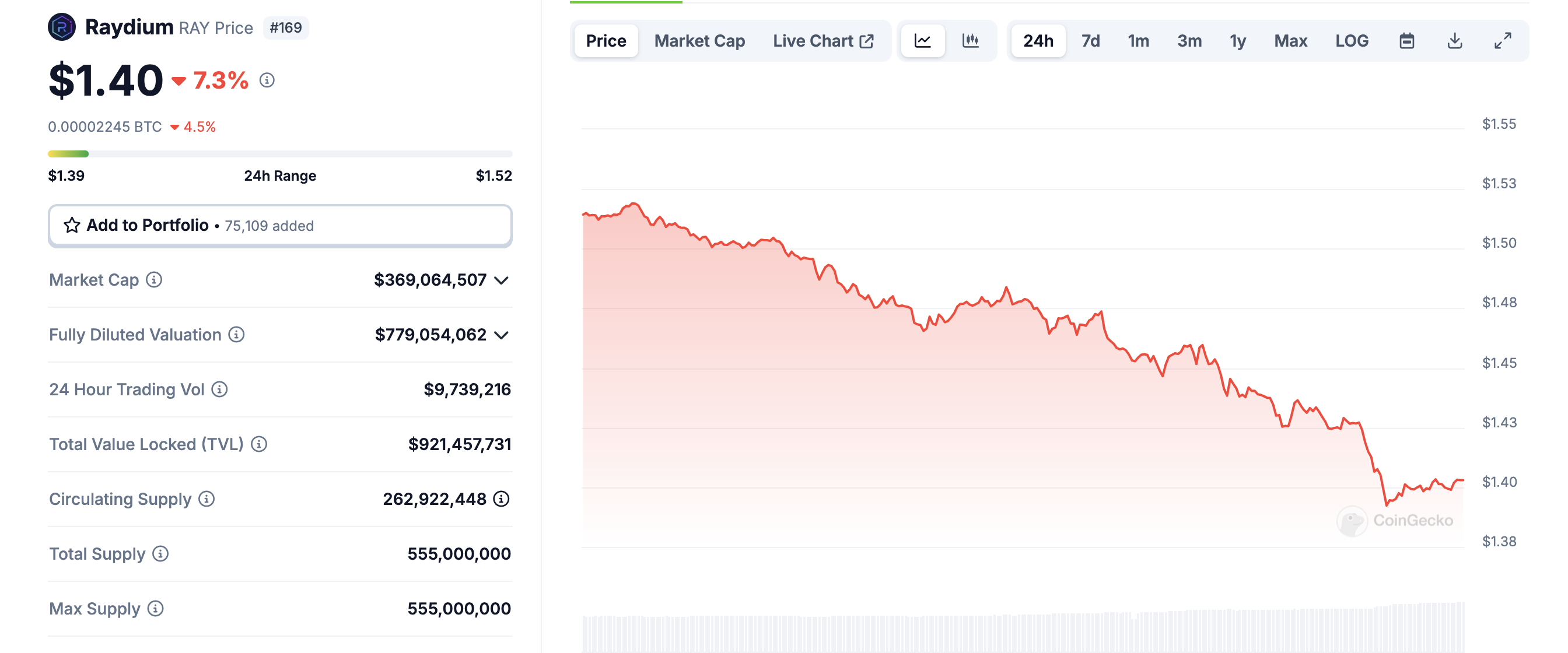

RAY Token & Tokenomics

The Raydium platform's native asset, RAY token, is utilised to perform a number of in-protocol ecosystem functions. As an illustration, users can engage in yield farming to gain RAY and other project-neutral assets by contributing to different liquidity pools. On the AcceleRaytor launchpad, users that stake their assets in return for IDO tokens also receive RAY. Lastly, stakeholders and other network users employ RAY tokens as a governance participation token to help with platform administration.

Tokenomics

550,000,000 RAY have been minted at the genesis and will become accessible over the course of 3 years. The initial 3-year allocation is as follows:

34% airdropped to liquidity providers over the course of 3 years.

30% for partnerships and expanding the Raydium ecosystem with up to 3-year lockups.

20% for team members and future employees with a 1-year lockup and 2-year unlock afterward.

8% for liquidity provisioning (initial pools liquidity bootstrapping and providing liquidity on other DEX and CEXs).

6% for seed funding and community pool with 1-3 year lockups.

Founding Team

The development of Raydium was initiated in the summer of 2020 by AlphaRay, a pseudonymous developer, and their crew. When DeFi was first beginning to gain traction, experienced trader AlphaRay was searching for a way to address Ethereum's exorbitant gas expenses. He so got in touch with the FTX group and shared his vision with them. FTX, in turn, introduced AlphaRay to two projects they had worked on and were closely involved with: the Serum protocol and the Solana blockchain.

After realising Serum DEX's potential, AlphaRay and the rest of the crew started developing Raydium, which debuted in February 2021. The team at Raydium has more than 20 years of expertise in high-frequency trading, arbitrage, and market creating in both traditional and cryptocurrency markets.

Raydium's general strategy, operations, product direction, and business development are under AlphaRay's control. Although he started out in commodity algorithmic trading, he switched to creating markets and providing liquidity for cryptocurrencies in 2017.

Subscribe to my newsletter

Read articles from Shivank Kapur directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Shivank Kapur

Shivank Kapur

I'm a FullStack Developer currently working with Technologies like MERN Stack, BlockChain, GraphQL, Next.js, LLMs, and a plethora of other cutting-edge tools. I'm working as a Developer Relations Engineering intern at Router Protocol and also as a Contributor at SuperteamDAO. My journey also encompasses past experiences at Push Protocol, where I orchestrated seamless community management strategies. I help Communities by Bridging the Gap between Developers and Clients. Crafting, launching, and meticulously documenting products fuel my passion, infusing every endeavor with purpose and precision. Beyond the binary, I find solace in the pages of self-help and spirituality, honing both mind and spirit with each turn of the page. phewww... I love a cup of coffee ☕ while writing code. So let's connect and have a meet over something you wanna discuss. I'll be more than happy to have it. Drop me a line at shivankkapur2004@gmail.com