High-Yield Asset Leasing: Race Vault Deal Overview

Aayush Pandit

Aayush Pandit

KEY TAKEAWAYS

The article discusses Race Energy's efforts to electrify auto rickshaws and two-wheelers in Mumbai, highlighting the benefits of reduced pollution and lower vehicle costs through battery swapping technology.

Race Energy offers a high-yield asset leasing investment deal called RACE Vault, with returns ranging from 17.6% to 27.7%, but it comes with significant risks for retail investors.

The investment is unregulated, lacks third-party oversight, has no additional security cover, zero liquidity, and carries the risk of company bankruptcy.

Investors are advised to thoroughly understand the risks, check the agreement for clauses related to default and insurance, and only invest money they can afford to lose.

The article also emphasizes the importance of informed decision-making and encourages investors to join the ALT Investor community for discussions on alternative investment options in India.

It's June 2024, and thankfully, Mumbai has started experiencing rainfall, cooling temperatures to around 30 degrees. But just last month, when it was around 44-45 degrees, it was unbearable. I have to take rickshaw rides as part of my daily commute, and the dust, pollution, and heat from other nearby vehicles in peak traffic were just too much to bear. Thankfully, Mumbai has seen great adoption of electric vehicles (thanks to zero road tax), which do not emit any pollution on the road. But what if 10 lakh auto rickshaws running daily in Mumbai also went electric? That would surely make an impact, right?

In this article, we will review a company called Race Energy, which is working to electrify auto rickshaws and two-wheelers. They also offer an attractive asset leasing investment deal for retail investors called RACE Vault. The IRR on this deal starts at 17.6% and goes up to 27.7%. Of course, it comes with various risks. We will discuss the pros and cons of this deal in detail.

About Race Energy

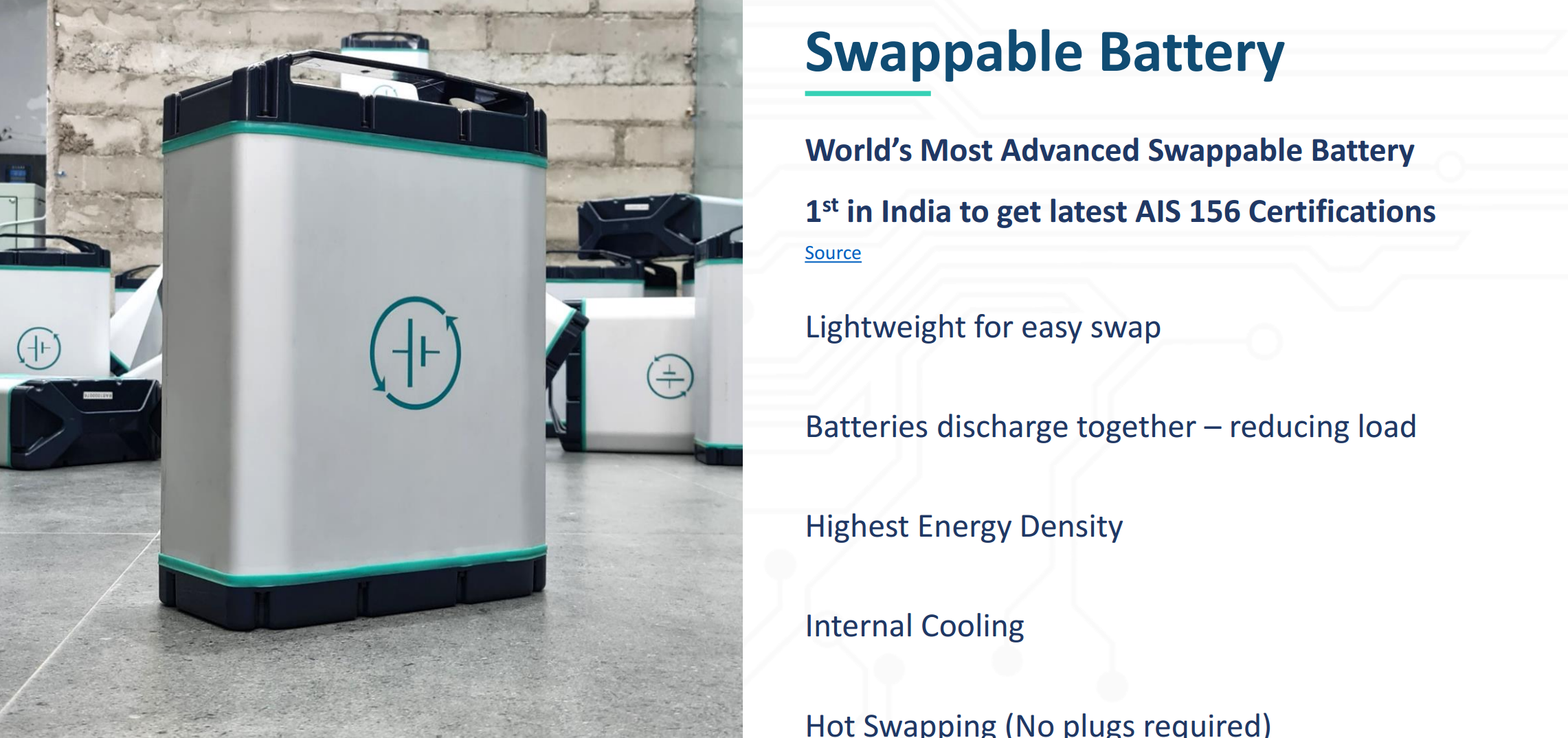

RACE is a deep-tech battery swapping company that builds advanced swappable batteries and a smart swapping network for all segments of EVs.

It was founded in 2019 by Arun Sreyas Reddy and Gautham Maheswaran, both graduates of BITS Pilani. They recently received the Forbes 30 Under 30 award.

The RACE Vault deal we will discuss is not an equity investment in RACE, so we won't cover the company's specifics. However, let me quickly explain the problems they are solving:

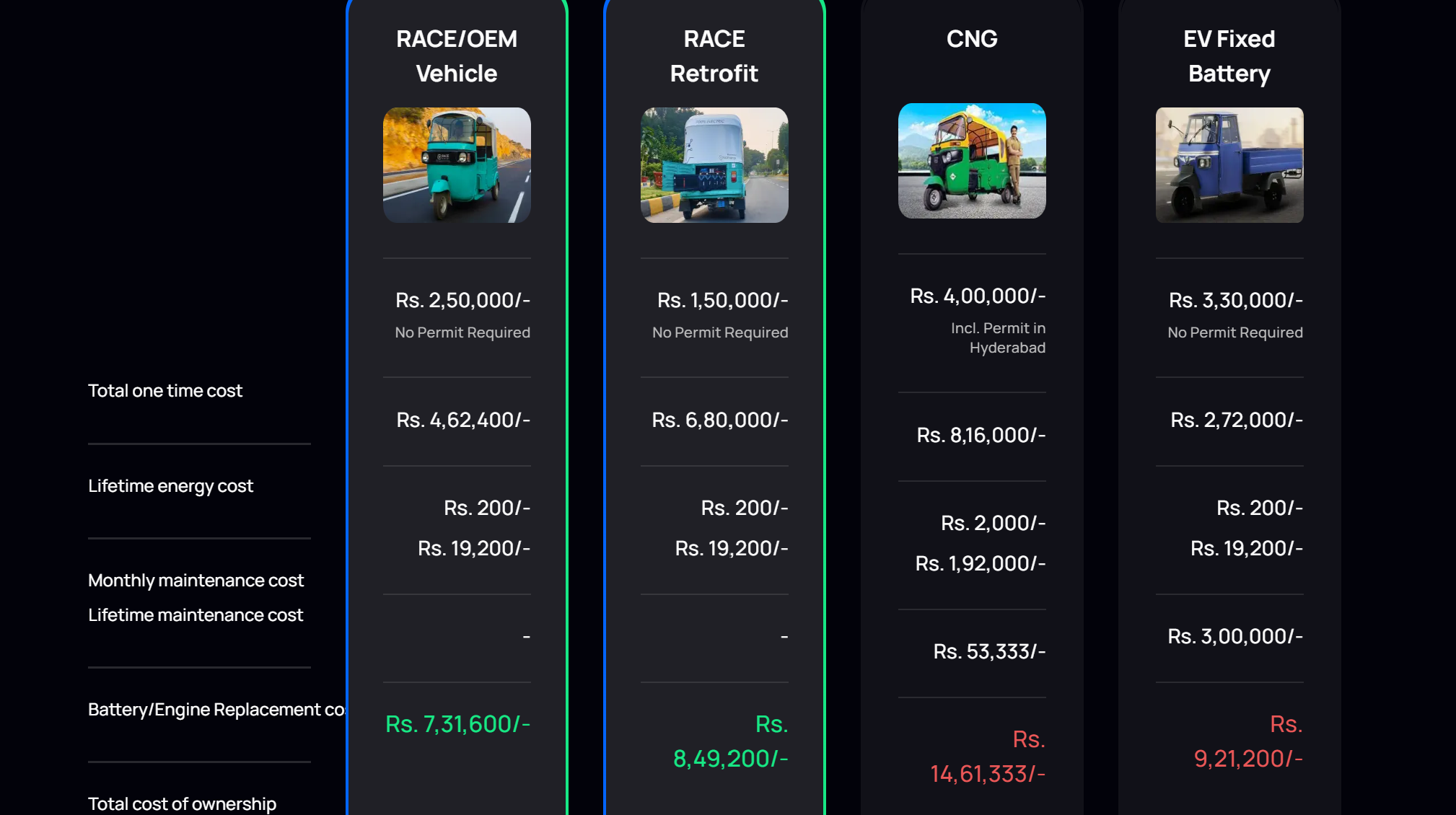

RACE realized that the high upfront cost of buying an electric vehicle is discouraging wider adoption. For example, choosing between a 12L Nexon Petrol and a 20L Nexon EV shows a significant price difference.

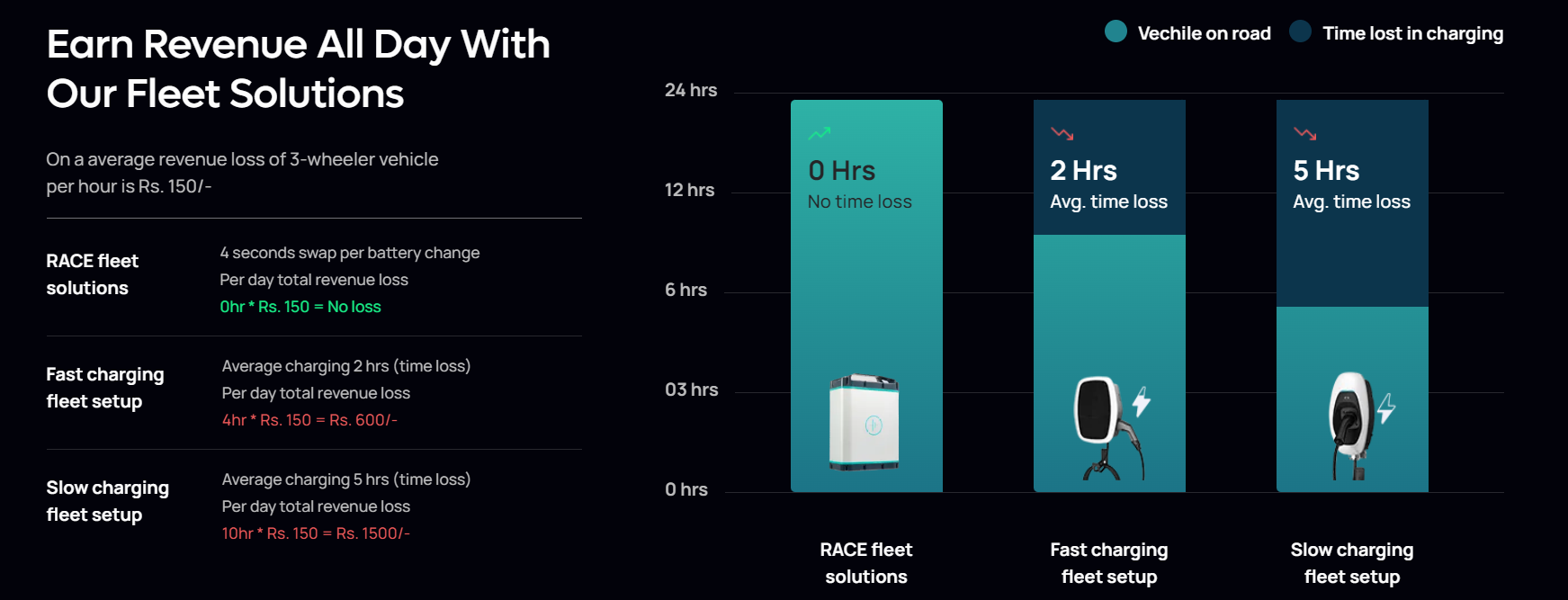

RACE also recognized that the time required to charge these EVs is not practical for commercial use. For instance, an auto rickshaw in Mumbai operates 22 out of 24 hours with different drivers for day and night shifts. They can't afford to spend hours waiting for the vehicle to charge.

How is RACE Energy solving the problems?

Solution 1

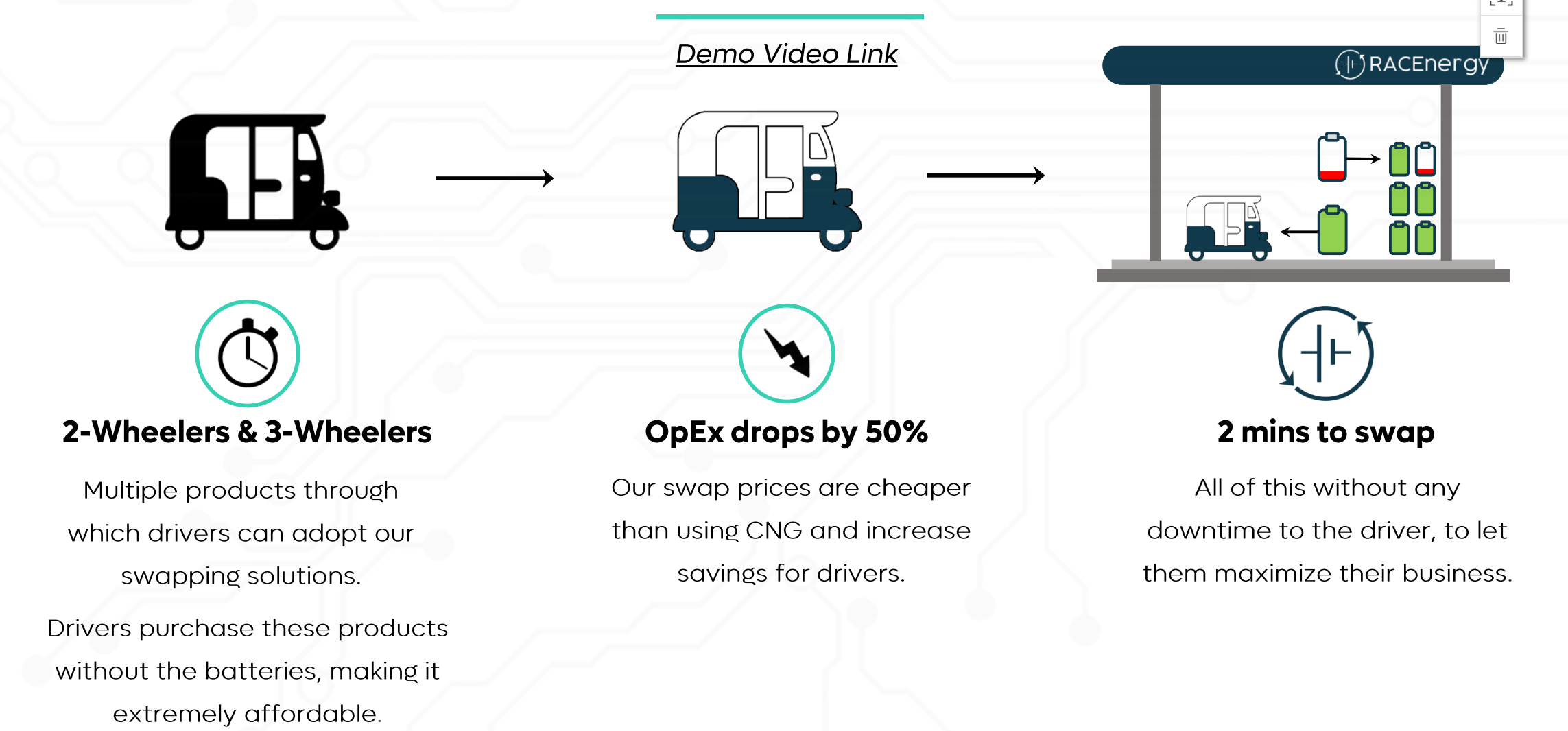

They began selling vehicles without batteries, which are the most expensive part of an electric vehicle. Instead, they created durable swappable batteries that can be exchanged at nearby stations. This significantly reduces the initial cost of owning the vehicle, making it more affordable for buyers.

Solution 2

Because the batteries are swappable, you don't have to wait for them to charge. There is zero downtime. Just go to a swapping station, change the batteries, and you are good to go again. Repeat this process, and there is never any downtime.

Neat and innovative solutions, indeed. I must admit, I quite like them as well. But now, let's understand where you, as a retail investor, fit into Race Energy's world.

About Race Vault Leasing Deal

Asset leasing is a type of debt financing that capital-intensive companies can choose. This article assumes you understand the concept of asset leasing. If not, please check out this detailed article on it.

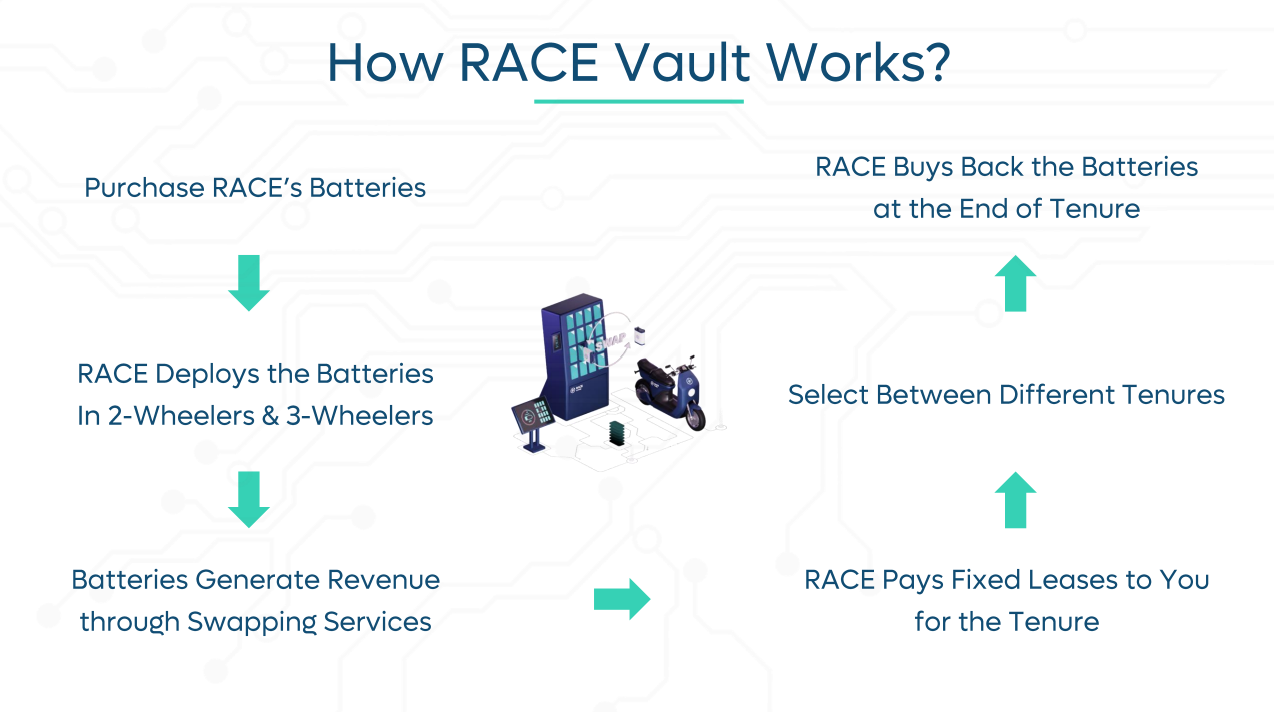

Now, let's talk about RACE Vault. Remember how we mentioned that EV buyers don't need to purchase the batteries, which lowers the upfront cost? If RACE Energy doesn't get that money from the buyer, it has two options: either use its own money to manufacture the batteries or ask external investors to buy the batteries and then lease them out for a fixed period.

It's much better for RACE to choose the second option because using their own money would mean diluting a lot of their stake in the company and tying up working capital. Instead, they create a win-win situation for everyone in the Race Vault ecosystem.

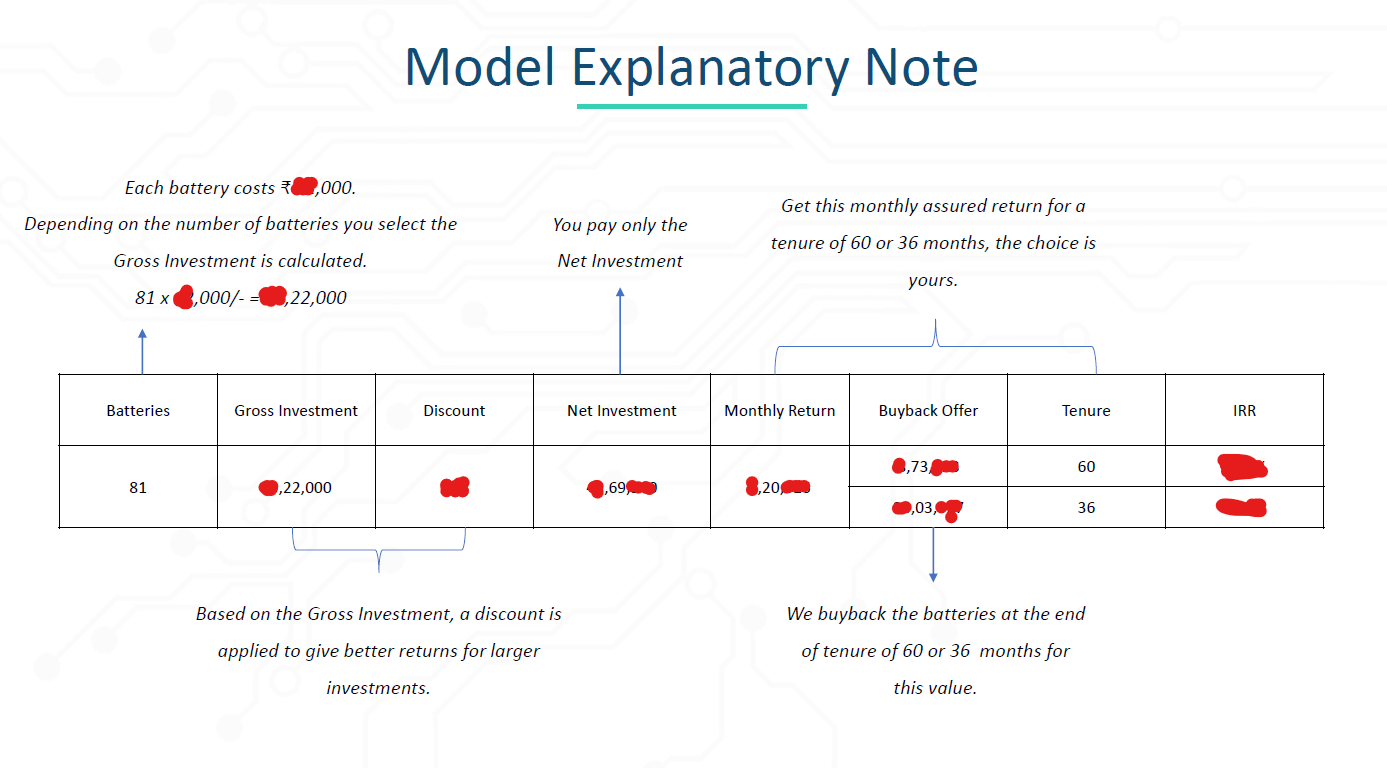

Checkout Race Energy's Model Explanatory Note, explaining the overall lifecycle of this investment opportunity.

A non-market-linked investment offering high returns sounds very attractive, right? From a return perspective, it is. Even if you buy just one battery for a 3-year term, a 17.6% return is quite good. However, as we always say, higher returns come with higher risks!

Risks in Race Vault Opportunity

So, what exact risks will you be facing in this opportunity? Well, many clues are present in the legal agreement. Unfortunately, we can't share a copy of this agreement because it's sensitive, but you, as an investor, can request a copy from Race Energy before making your investment. Here are some risks according to us:

Unregulated Investment: This is clearly an unregulated investment. If something goes wrong, SEBI or RBI cannot protect you.

Lack of Trustee: There is no third-party trustee appointed to oversee this leasing transaction. Your money goes directly to Race Energy, but without oversight, the chances of fraud or misappropriation of funds may increase.

Security Cover: There is no additional security cover in the form of cash collaterals or personal guarantees by the founders. If the company does not do well, you may stop receiving your lease rentals. This is something we have seen with a startup named Exa Mobility as well.

Zero Liquidity: Once you lock in your investment for a 3-year or 5-year term, you cannot exit it. If, due to exceptional circumstances, you still want to exit, Race will only pay you 5% of the initial investment amount back.

Bankruptcy: Race is an early-stage, high-growth startup that may need more funds to survive. If they are unable to secure that, they may go bust and not pay any lease rentals.

Other FAQs for Race Vault Opportunity

Answering, some common questions which came to my mind when we were evaluating the deal. Please click on questions to see the answer.

Does the agreement mention what happens in case of a default?

Do these batteries have any secondary resale market?

Are these batteries insured against natural calamities, terror attacks?

What are the chances of default? How can I assess that?

Is the agreement executed on stamp paper?

Is this investment option right for me?

Do I need a GST License to invest in this deal?

Can depreciation on batteries be claimed for tax benefits?

Conclusion

In conclusion, while the RACE Vault asset leasing investment offers high returns, it comes with significant risks. The investment is unregulated, lacks third-party oversight, has no additional security cover, zero liquidity, and there is a risk of company bankruptcy.

Investors must fully understand these risks and only invest money they can afford to lose. For those willing to take on high-risk debt-based opportunities, this could be an option, but caution and thorough research are essential.

Always check the agreement for clauses related to default, insurance, and payout delays. I hope this article provides enough information to help you make an informed decision.

Thanks for reading. If you are not part of our community, feel free to join here. We regularly discuss various alternative investment options available to retail investors in India.

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India, and none of these views reflect those of my current employer. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.

Subscribe to my newsletter

Read articles from Aayush Pandit directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Aayush Pandit

Aayush Pandit

My work in the events & exhibitions industries has not swayed me away from my core passions, a love for the legal field and all things finance.