JavaScript version SuperTrend strategy

FMZ Quant

FMZ Quant

There are many versions of the SuperTrend indicator on the TV. I found a relatively easy-to-understand algorithm and transplanted it. Compared with the SuperTrend indicator loaded on the TV chart of FMZ trading platform backtest system, I found a slight difference and did not understand the reason for the causes, I'm looking forward to the guidance of our readers. I will first show my understanding as follow.

SuperTrend indicator JavaScript version algorithm

// VIA: https://github.com/freqtrade/freqtrade-strategies/issues/30

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

// The main function for testing indicators is not a trading strategy

function main() {

while (1) {

var r = _C(exchange.GetRecords)

var st = SuperTrend(r, 10, 3)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

Sleep(2000)

}

}

Test code backtest comparison:

A simple strategy using SuperTrend indicator

The trading logic part is relatively simple, that is, when the short trend turns into a long trend, long positions are opened.

Open a short position when the long trend turns into a short trend.

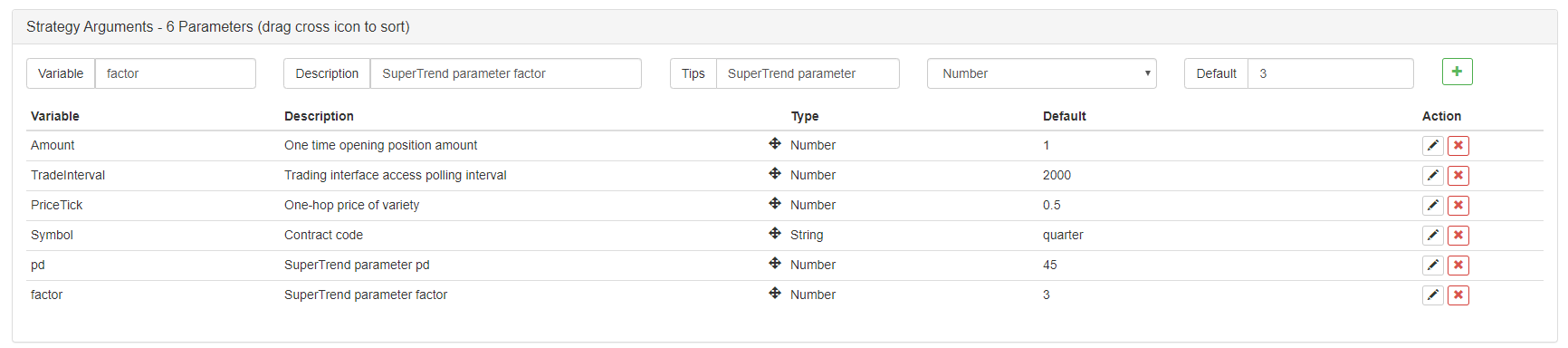

Strategy parameters:

SuperTrend trading strategy

/*backtest

start: 2019-08-01 00:00:00

end: 2020-03-11 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

*/

// Global variables

var OpenAmount = 0 // The number of open positions after opening

var KeepAmount = 0 // Reserved position

var IDLE = 0

var LONG = 1

var SHORT = 2

var COVERLONG = 3

var COVERSHORT = 4

var COVERLONG_PART = 5

var COVERSHORT_PART = 6

var OPENLONG = 7

var OPENSHORT = 8

var State = IDLE

// Trading logic part

function GetPosition(posType) {

var positions = _C(exchange.GetPosition)

/*

if(positions.length > 1){

throw "positions error:" + JSON.stringify(positions)

}

*/

var count = 0

for(var j = 0; j < positions.length; j++){

if(positions[j].ContractType == Symbol){

count++

}

}

if(count > 1){

throw "positions error:" + JSON.stringify(positions)

}

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType == Symbol && positions[i].Type === posType) {

return [positions[i].Price, positions[i].Amount];

}

}

Sleep(TradeInterval);

return [0, 0]

}

function CancelPendingOrders() {

while (true) {

var orders = _C(exchange.GetOrders)

for (var i = 0; i < orders.length; i++) {

exchange.CancelOrder(orders[i].Id);

Sleep(TradeInterval);

}

if (orders.length === 0) {

break;

}

}

}

function Trade(Type, Price, Amount, CurrPos, OnePriceTick){ // Processing transactions

if(Type == OPENLONG || Type == OPENSHORT){ // Handling open positions

exchange.SetDirection(Type == OPENLONG ? "buy" : "sell")

var pfnOpen = Type == OPENLONG ? exchange.Buy : exchange.Sell

var idOpen = pfnOpen(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idOpen) {

exchange.CancelOrder(idOpen)

} else {

CancelPendingOrders()

}

} else if(Type == COVERLONG || Type == COVERSHORT){ // Deal with closing positions

exchange.SetDirection(Type == COVERLONG ? "closebuy" : "closesell")

var pfnCover = Type == COVERLONG ? exchange.Sell : exchange.Buy

var idCover = pfnCover(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idCover){

exchange.CancelOrder(idCover)

} else {

CancelPendingOrders()

}

} else {

throw "Type error:" + Type

}

}

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

var preTime = 0

function main() {

exchange.SetContractType(Symbol)

while (1) {

var r = _C(exchange.GetRecords)

var currBar = r[r.length - 1]

if (r.length < pd) {

Sleep(5000)

continue

}

var st = SuperTrend(r, pd, factor)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

if(!isNaN(st[0][st[0].length - 2]) && isNaN(st[0][st[0].length - 3])){

if (State == SHORT) {

State = COVERSHORT

} else if(State == IDLE) {

State = OPENLONG

}

}

if(!isNaN(st[1][st[1].length - 2]) && isNaN(st[1][st[1].length - 3])){

if (State == LONG) {

State = COVERLONG

} else if (State == IDLE) {

State = OPENSHORT

}

}

// Execution Signal

var pos = null

var price = null

if(State == OPENLONG){ // Open long positions

pos = GetPosition(PD_LONG) // Check positions

// Determine whether the status is satisfied, if it is satisfied, modify the status

if(pos[1] >= Amount){ // Open positions exceed or equal to the open positions set by the parameters

Sleep(1000)

$.PlotFlag(currBar.Time, "Open long positions", 'OL') // mark

OpenAmount = pos[1] // Record the number of open positions

State = LONG // Mark as long

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2 // Calculate the price

Trade(OPENLONG, price, Amount - pos[1], pos, PriceTick) // Placing Order function (Type, Price, Amount, CurrPos, PriceTick)

}

if(State == OPENSHORT){ // Open short position

pos = GetPosition(PD_SHORT) // Check positions

if(pos[1] >= Amount){

Sleep(1000)

$.PlotFlag(currBar.Time, "Open short position", 'OS')

OpenAmount = pos[1]

State = SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(OPENSHORT, price, Amount - pos[1], pos, PriceTick)

}

if(State == COVERLONG){ // Handling long positions

pos = GetPosition(PD_LONG) // Get position information

if(pos[1] == 0){ // Determine if the position is 0

$.PlotFlag(currBar.Time, "Close long position", '----CL') // mark

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1], pos, PriceTick)

}

if(State == COVERSHORT){ // Deal with long positions

pos = GetPosition(PD_SHORT)

if(pos[1] == 0){

$.PlotFlag(currBar.Time, "Close short position", '----CS')

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1], pos, PriceTick)

}

if(State == COVERLONG_PART) { // Partially close long positions

pos = GetPosition(PD_LONG) // Get positions

if(pos[1] <= KeepAmount){ // The position is less than or equal to the holding amount, this time the closing action is completed

$.PlotFlag(currBar.Time, "Close long positions, keep:" + KeepAmount, '----CL') // mark

State = pos[1] == 0 ? IDLE : LONG // update status

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1] - KeepAmount, pos, PriceTick)

}

if(State == COVERSHORT_PART){

pos = GetPosition(PD_SHORT)

if(pos[1] <= KeepAmount){

$.PlotFlag(currBar.Time, "Close short positions, keep:" + KeepAmount, '----CS')

State = pos[1] == 0 ? IDLE : SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1] - KeepAmount, pos, PriceTick)

}

LogStatus(_D())

Sleep(1000)

}

}

Strategy address: https://www.fmz.com/strategy/201837

Backtest performance

Parameter setting, K line period, reference: homily SuperTrend V.1--Super trend line system

The K-line period is set to 15 minutes, and the SuperTrend parameter is set to 45, 3. Backtest the OKX futures quarter contract for the most recent year, and set a contract to trade at a time. Due to the setting to trade only one contract at a time, the utilization rate of funds is very low and you don’t need to care about the Sharpe value.

From: JavaScript version SuperTrend strategy (fmz.com)

Subscribe to my newsletter

Read articles from FMZ Quant directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

FMZ Quant

FMZ Quant

Quantitative Trading For Everyone