Integrating Graph Databases with GenAI to Identify Fraud in Transactions

Code Sky

Code Sky

Introduction

Fraud detection in financial transactions is a critical concern for businesses and financial institutions. Traditional methods often struggle to keep up with the sophisticated techniques used by fraudsters. However, by integrating graph databases with Generative AI (GenAI), we can enhance our ability to detect and prevent fraudulent activities. This blog explores how these technologies can work together to improve fraud detection.

Understanding Graph Databases

Graph databases are designed to handle complex relationships and interconnected data efficiently. Unlike traditional relational databases, graph databases store data in nodes (entities) and edges (relationships). This structure makes them ideal for identifying patterns and connections that might indicate fraudulent behavior.

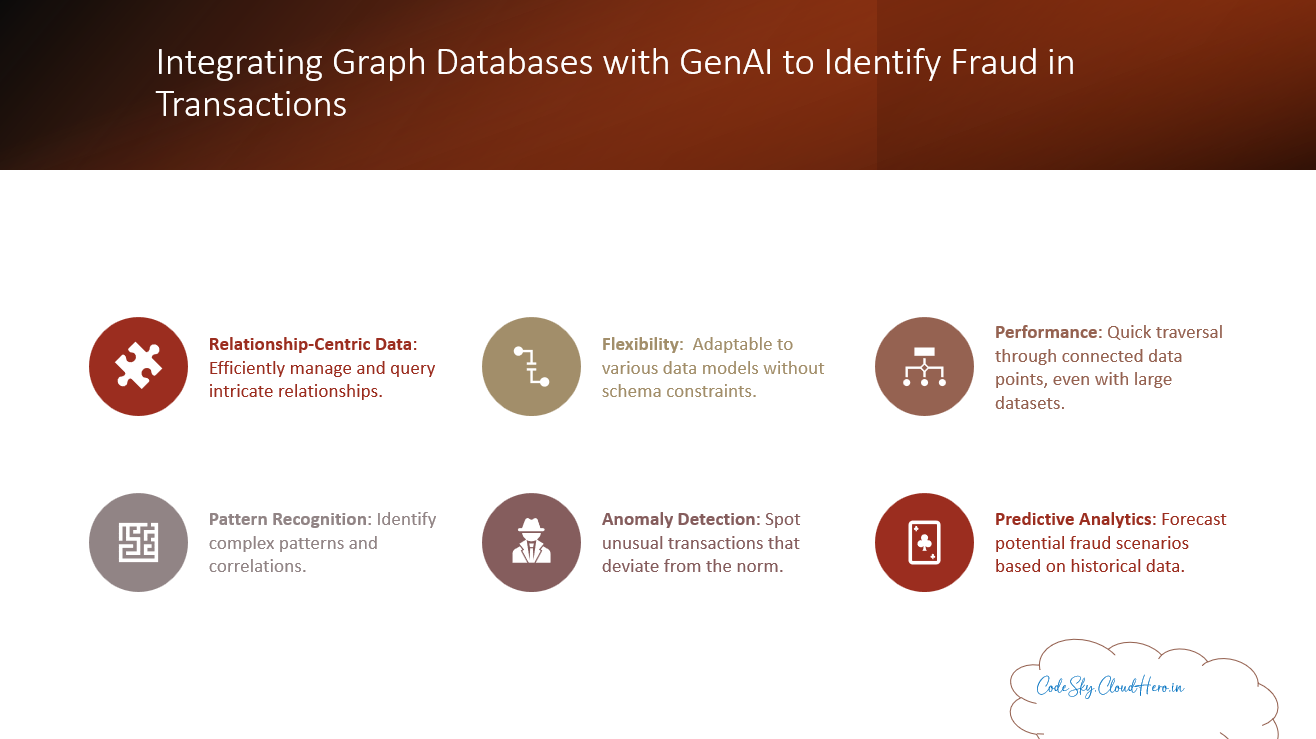

Key Benefits of Graph Databases:

Relationship-Centric Data: Efficiently manage and query intricate relationships.

Flexibility: Adaptable to various data models without schema constraints.

Performance: Quick traversal through connected data points, even with large datasets.

Introducing Generative AI

Generative AI encompasses algorithms that can generate new content, such as text, images, or even predictive models. In fraud detection, GenAI can analyze vast amounts of transactional data to identify anomalies and generate hypotheses about potential fraudulent activities.

Key Benefits of Generative AI:

Pattern Recognition: Identify complex patterns and correlations.

Anomaly Detection: Spot unusual transactions that deviate from the norm.

Predictive Analytics: Forecast potential fraud scenarios based on historical data.

Integrating Graph Databases with GenAI

Combining graph databases with GenAI leverages the strengths of both technologies to create a robust fraud detection system.

Step-by-Step Integration Process:

Data Ingestion:

Collect transactional data from various sources.

Load data into a graph database, structuring it as nodes (e.g., customers, transactions) and edges (e.g., relationships between transactions).

Pattern Analysis:

Use GenAI to analyze historical data and identify common fraud patterns.

Train the AI model on these patterns to recognize potential fraud.

Real-Time Monitoring:

Implement real-time data feeds into the graph database.

Continuously monitor transactions using the trained GenAI model.

Anomaly Detection:

GenAI flags transactions that deviate from normal patterns.

The graph database helps trace connections between flagged transactions and other entities, uncovering hidden fraud networks.

Investigation and Response:

Analysts review flagged transactions and relationships.

Take appropriate actions to prevent fraud, such as blocking transactions or alerting customers.

Example Use Case: Credit Card Fraud Detection

Data Ingestion: Collect credit card transaction data, including transaction amount, location, time, and merchant details.

Graph Database Setup: Create nodes for each customer, transaction, and merchant, and establish edges representing the relationships.

Pattern Analysis with GenAI: Analyze past fraud incidents to identify patterns such as frequent small transactions followed by a large purchase.

Real-Time Monitoring: Continuously feed new transaction data into the graph database and apply the GenAI model to detect anomalies.

Anomaly Detection: GenAI flags a series of transactions that fit the fraud pattern.

Investigation: The graph database reveals connections between the flagged transactions and other suspicious activities, allowing analysts to take action.

Conclusion

Integrating graph databases with Generative AI offers a powerful approach to fraud detection in financial transactions. By leveraging the relationship-centric nature of graph databases and the pattern recognition capabilities of GenAI, businesses can detect and prevent fraud more effectively. As fraudsters continue to evolve their techniques, this combined approach provides a robust defense, ensuring the security and integrity of financial transactions.

Future Directions

As technology continues to advance, further improvements in graph database algorithms and GenAI models will enhance fraud detection capabilities. Additionally, integrating other emerging technologies like blockchain and advanced encryption methods can provide even greater security and transparency in financial transactions.

References

Subscribe to my newsletter

Read articles from Code Sky directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Code Sky

Code Sky

Tech Enthusiast | 15+ Years in IT | Security, Coding, Trends With over 15 years of experience in the ever-evolving world of Information Technology, I’m passionate about staying ahead of the curve. From mastering secure coding practices to exploring the latest trends in AI, cloud computing, and cybersecurity, my mission is to share valuable insights, practical tips, and the latest industry updates. Whether it's about writing cleaner, more efficient code or enhancing security protocols, I aim to empower developers and IT professionals to excel in their careers while keeping pace with the rapidly changing tech landscape.