Understanding Real Estate Investment Trusts (REITs)

Om Shukla

Om ShuklaTable of contents

KEY TAKEAWAYS

Real Estate Investment Trusts (REITs) allow individuals to invest in commercial real estate with a small amount, providing portfolio diversification, stable dividend income, and potential capital appreciation.

REITs have underperformed in recent years due to factors like low rental yields and capital appreciation, influenced by COVID-19 and high interest rates.

The structure of REITs involves a sponsor setting up a trust to pool investor money, investing in Grade-A commercial properties, and distributing 90% of net distributable cash flow to investors.

Taxation on REITs includes taxable and tax-exempt dividend income, interest income, and principal repayment, with specific tax implications for each component.

Despite historical underperformance, REITs offer consistent cash flows and asset-backed security, but require thorough research and understanding of complex taxation and investment structures.

If we look at trending real estate headlines, they are always filled with stories of rising rentals in Bangalore, Mumbai, Hyderabad, and other cities. On social media, we see long lines of buyers in front of sales offices of DLF and other luxury developers. Real estate is clearly a favorite investment for many Indians; everyone wants to own property, but only a few can afford it.

With Fractional Ownership Platforms now available, you can start investing with a smaller amount, ranging from ₹10 Lakhs to ₹25 Lakhs. If this amount is still too high for you, there are REITs (Real Estate Investment Trusts), where you can begin your real estate investment journey with as little as ₹300. There are currently 5 publicly listed REITs in India.

REITs, however, don't behave like regular stocks and aren't designed to give you high returns like mid-cap or small-cap stocks. Instead, they help diversify your portfolio and provide stable dividend income and capital appreciation. We will explore REITs in detail in this article.

Also if you prefer video format, this CFA Institute video is absolutely golden to watch.

What Are REITs?

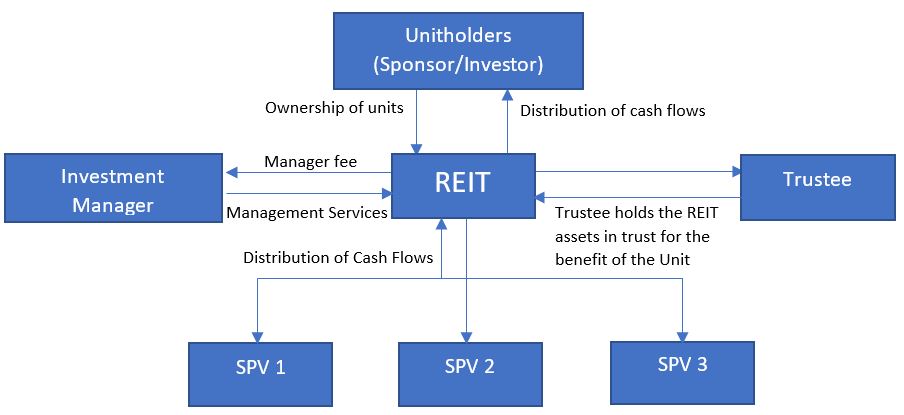

REITs are like mutual funds or ETFs for real estate. They have a similar structure to mutual funds, where the investment manager pools money in a trust and uses it to buy revenue-generating real estate properties.

REITs invest in Grade A commercial properties spread across various regions. These features address concerns about real estate investment. The commercial real estate portfolio relies less on capital appreciation, and diversifying across cities reduces the risk of geographic concentration.

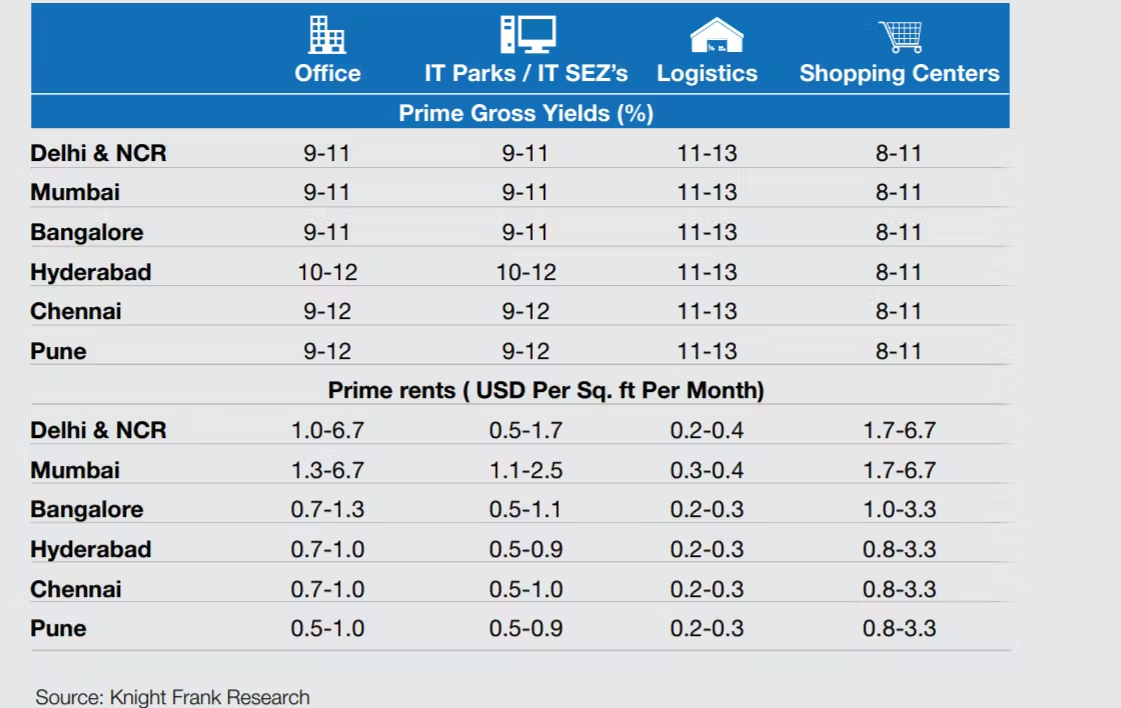

Commercial real estate has a much better rental yield compared to residential properties. Therefore, the annual dividend payouts for REITs are attractive. Combined with capital appreciation, they aim to provide higher returns in the range of 13-16%.

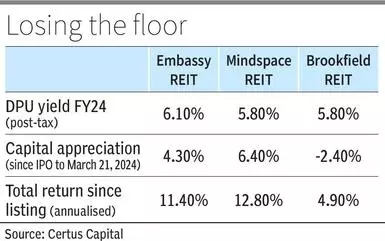

How Have REITs Performed?

Answering the favorite question on everyone's mind, "kitna return milega?". Well to be honest, REITs have underperformed in the past 3-4 years. The dividend yield has been on the lower side, while the capital appreciation is dismal. In June 2024, Businessline crunched some numbers and revealed the annualized returns of the 3 listed REITs in India.

Given the rental yields and capital appreciation numbers we estimated earlier, the actual returns are quite disappointing. However, some argue that this might be the best time to invest in these vehicles, as they seem to have bottomed out. Various factors have contributed to this performance, and in today's article, we will analyze them to help you make the right investment decision.

Before diving into the performance and analysis of some REITs, let's briefly cover their structure, cash flows, and the complex taxation involved in such investments.

Structure Of A REIT

We have covered InvITs and SM-REITs in great detail, and the structure of this investment is more or less the same.

An entity with at least 5 years of real estate experience must approach SEBI to become a REIT sponsor. Requirements include having a minimum of ₹500 Crore in assets. Once licensed, the sponsor sets up a trust to pool investors' money, issuing units and raising funds via an IPO. Subscribing to these units is similar to investing in an IPO for equity shares.

The trust, known as a Real Estate Investment Trust (REIT), invests in large-scale, Grade-A commercial properties. Each REIT sets up different SPVs for its properties. For example, a REIT with properties in Mumbai and Bangalore will have separate SPVs for each. This helps in raising debt or equity funding for each SPV and simplifies managing and financing individual assets.

The REIT hires an investment manager to manage the properties and a trustee to manage the trust's assets. The investment manager is usually a different arm of the sponsor company.

Cashflows Of REITs

It is important to understand the cash flows of REITs to grasp the taxation of payouts received from them.

The REIT injects capital into the SPV in two ways: through debt and equity. The trust receives profit from the SPV as dividends and gets periodic repayment of debt. We separate these two because they are taxed differently for investors.

REITs at the trust level generate cash from various sources:

Profits from SPVs as dividends

Interest paid by SPVs against the debt raised from the REIT

Principal repayment of loans

Capital gains from the sale of property or instruments

Interest or dividends from investments in other securities

Taxation on REIT

The taxation for REITs work very similar to InvITS which we had covered here.

Dividend Income (Taxable) - This is the dividend that is distributed by the REITs that have chosen a newer tax regime.

Dividend Income (Tax exempt) - This is the dividend which is distributed by the REITs that have chosen a older tax regime

Interest Income (Taxable) - This component represents the interest on debt received by the REITs from SPVs. It is taxed as per the slab rate of the investor.

Rent from SPV or Direct Projects (Taxable) - Taxed as per the tax bracket of the receiver.

Principal Repayment - The principal repayment component is adjusted against the purchase price when booking capital gains during the sale of REIT units. For example, if you bought one unit of REIT for ₹400 and held it for 3 years, during which the principal repayment per unit is ₹100, and you sell that unit today for ₹800, your capital gains will be calculated as ₹400 - ₹100 = ₹300 per unit. You will then pay 10% tax on ₹800 - ₹300 = ₹500. There is another technical detail explained in this Mint article.

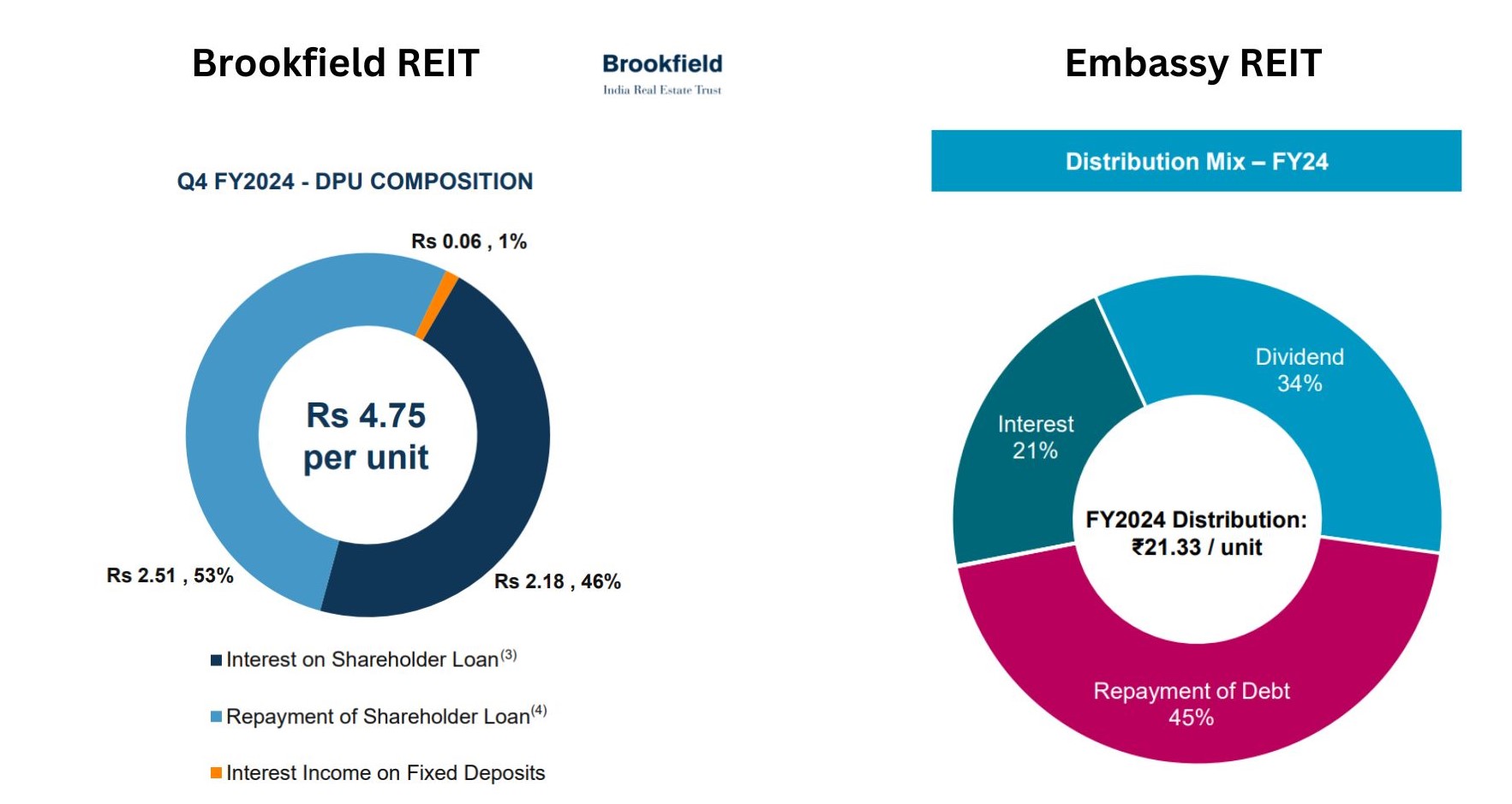

Let's look at the dividend distribution of two REITs to understand how the taxation works.

In the above cases, Embassy REIT payouts are tax exempted as it has chosen the older tax regime, while in the case of Brookfield REIT, the dividend and interest components will be taxed in the hands of the investors. As explained, the repayment of the debt component will be adjusted later when booking the capital gains.

Important REIT Regulations

Let's understand some of important regulations that investors of REIT should generally know about.

Dividend Payout - The REIT must distribute 90% of the Net Distributable Cashflow (NDCF) to investors. NDCF is the free cash flow of the trust after all expenses, fees, capital expenditures, and financing activities. It is different from the net profit of the REIT. The REIT should announce payouts at least once every six months.

* Holding by Sponsor - Each sponsor must always hold at least 5% of the units in the REIT after listing.

* Debt Ratios - REITs are allowed to maintain their net-debt figure at 49% of the total assets.

* Ownership of Assets - REITs can invest no more than 20% of their total capital in under-construction properties. The rest must be maintained in revenue-generating properties.

Shareholding of SPVs - The REIT can sell stakes in its various SPVs but must maintain at least a 26% shareholding in any SPV or property under its management.

Analyzing REITs Returns And Its Underperformance

We have now understood the basics of REITs, but why have they underperformed in the recent years? Let's break down the returns into two parts: Rental Income and Capital Appreciation.

Rental Income

The lower rental incomes are easy to pinpoint. During COVID-19, occupancy rates fell to record lows of 40-50%, compared to the usual 70-80%.

Another important metric is the lease agreements. Generally, REIT rentals are fixed for three years and are re-rated afterward. Once the older lease agreements from COVID-19 times are re-rated, rental yields should increase.

For Mindspace, in FY24, the blended rental prices per sq/ft increased by 21% for all the re-rated leasing agreements, while for Brookfield, it was 19%. (Also known as MTM lease spread in investor presentations).

REITs also use financial leverage to generate higher payouts. If they borrow at, say, 8% and generate a higher return through rentals and capital appreciation, say 11%, they will earn a spread of 3% on that debt component, significantly increasing overall returns.

However, during COVID-19, rental income dried up, while the cost of borrowing and refinancing increased, leading to negative arbitrage for REITs. This impacted their overall returns and payouts.

Capital Appreciation

Now, let's talk about capital appreciation, which makes up almost half of the expected returns of REITs. The unit value of REITs is generally determined by quarterly valuation reports, along with liquidity, investor interest, and government bond yields.

The valuation report is prepared by IBBI registered valuers. They use various valuation methods such as the cost approach, income approach, and market approach, but the Discounted Cash Flow (DCF) method is commonly used.

Using the DCF method, the future cash flows (like rental incomes) of the REIT are discounted to the present day to determine the NAV of each unit. Two main reasons why REIT valuations were affected are high interest rates and the uncertainty caused by COVID-19.

The cost of capital (WACC) used to discount the cash flows increased significantly for real estate projects. This is due to higher risk-free rates in the country and higher borrowing costs for REITs. The risk premium also increased for the real estate sector as the uncertainty of cash flows rose during COVID-19. As a result, the present value of future cash flows was lower than expected, leading to major corrections in the value of REITs.

Another issue in capital appreciation for REITs was their expected yields. These instruments are among the top-grade fixed income products, and their payout yields are often compared to other AAA and government securities.

During COVID, the quarterly payouts for REITs decreased due to lower rental income. To maintain post-tax yields at 6-6.5%, the market priced the units lower. So, even though the payouts decreased, the yield stayed the same when calculated at current market prices. This is similar to what happens in the bond market.

Should You Invest In REITs Today?

Investor interest plays a huge role in REIT returns. All the factors suggest that REITs may come back into the spotlight soon. Many financial analysts expect at least one 25-bps rate cut by the end of this year, which should gradually make REIT payouts more competitive compared to other fixed-income products.

Lower rates would also reduce the cost of capital for REITs, allowing them to use financial leverage to their advantage and help in capital appreciation with a lower discount rate.

Occupancy rates have increased significantly, with many REIT projects at 90-100% occupancy. Their floor space expansion plans are ambitious, and the adjusted valuations of REITs may provide significant potential for price appreciation of the units.

Looking at FY24 Q4 Embassy's valuation report, the NAV according to the valuer's calculations is ₹401, while the CMP today (18th June 2024) is ₹360. This shows that even though the CMP is below the real value, lower investor interest, lack of liquidity, and higher yields on other fixed-income securities are preventing capital appreciation in such REITs.

Advantages Of REITs

Consistent Cash Flows - REITs provide consistent cash flows, generally on a quarterly basis. These cash flows, although dependent on rental income, are relatively stable.

Healthy Returns - The expected long-term returns of REITs can be quite decent, typically ranging from 13-16%.

Asset-Backed Security - Investments in REITs are backed by Grade-A commercial properties, usually located in SEZs and CBDs. Therefore, the investment is relatively secure, as the properties can be easily sold at market value if needed.

Disadvantages Of REITs

Historical Performance - Historically, REITs have underperformed in both rental yield and capital appreciation. We cannot accurately predict when the returns will improve, so the investment horizon can be quite long.

No Tax Benefits - Previously, the capital repayment component had tax benefits, but these have now been withdrawn.

Complicated to Understand - Investing in REITs is quite complicated, as investors may need to study various aspects of the portfolio. The taxation and claiming of TDS can also be hectic. Therefore, a retail investor may need to consult investment and tax professionals when investing in REITs.

Conclusion

If you have read the entire article, you should have a good idea of whether REITs are suitable for your portfolio or if you should avoid them. These investment vehicles rarely become the core of any portfolio; they are more likely to serve as a tool for diversification.

REITs provide consistent quarterly income, which is almost fixed in nature. These investments are backed by real estate assets, making them secure. Given the nature of these instruments, they can protect your portfolio during market volatility and downturns.

However, thorough research is essential before investing in any REIT. You must review the property portfolio, check for geographic diversification, ensure proper debt coverage ratios, understand the background of clients, evaluate upcoming projects, and assess the renewal of lease rentals and occupancy rates. These key metrics will help you understand the current and future financial situation of the REIT.

Lastly, while the investment may seem risk-free, it does involve some risks, such as low returns or a drop in NAV due to changes in the underlying property. Therefore, you should weigh all the pros and cons and seek advice from an investment professional before investing in REITs.

We are on a mission to build out great content and community in alternative investment space in India, if you would like to join our Whatsapp Community where we regularly discuss ideas and clear doubts, please apply via the below link.

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India, and none of these views reflect those of my current employer. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.

Thank you for reading and hope to see you in the next one!

Subscribe to my newsletter

Read articles from Om Shukla directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by