Python version of Commodity Futures Intertemporal Bollinger Hedge Strategy (Study purpose only)

FMZ Quant

FMZ Quant

The previously written intertemporal arbitrage strategy requires manual input of the hedging spread for opening and closing positions. Judging the price difference is more subjective. In this article, we will change the previous hedging strategy to the strategy of using the BOLL indicator to open and close positions.

class Hedge:

'Hedging control class'

def __init__(self, q, e, initAccount, symbolA, symbolB, maPeriod, atrRatio, opAmount):

self.q = q

self.initAccount = initAccount

self.status = 0

self.symbolA = symbolA

self.symbolB = symbolB

self.e = e

self.isBusy = False

self.maPeriod = maPeriod

self.atrRatio = atrRatio

self.opAmount = opAmount

self.records = []

self.preBarTime = 0

def poll(self):

if (self.isBusy or not exchange.IO("status")) or not ext.IsTrading(self.symbolA):

Sleep(1000)

return

insDetailA = exchange.SetContractType(self.symbolA)

if not insDetailA:

return

recordsA = exchange.GetRecords()

if not recordsA:

return

insDetailB = exchange.SetContractType(self.symbolB)

if not insDetailB:

return

recordsB = exchange.GetRecords()

if not recordsB:

return

# Calculate the spread price K line

if recordsA[-1]["Time"] != recordsB[-1]["Time"]:

return

minL = min(len(recordsA), len(recordsB))

rA = recordsA.copy()

rB = recordsB.copy()

rA.reverse()

rB.reverse()

count = 0

arrDiff = []

for i in range(minL):

arrDiff.append(rB[i]["Close"] - rA[i]["Close"])

arrDiff.reverse()

if len(arrDiff) < self.maPeriod:

return

# Calculate Bollinger Bands indicator

boll = TA.BOLL(arrDiff, self.maPeriod, self.atrRatio)

ext.PlotLine("upper trail", boll[0][-2], recordsA[-2]["Time"])

ext.PlotLine("middle trail", boll[1][-2], recordsA[-2]["Time"])

ext.PlotLine("lower trail", boll[2][-2], recordsA[-2]["Time"])

ext.PlotLine("Closing price spread", arrDiff[-2], recordsA[-2]["Time"])

LogStatus(_D(), "upper trail:", boll[0][-1], "\n", "middle trail:", boll[1][-1], "\n", "lower trail:", boll[2][-1], "\n", "Current closing price spread:", arrDiff[-1])

action = 0

# Signal trigger

if self.status == 0:

if arrDiff[-1] > boll[0][-1]:

Log("Open position A buy B sell", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 2

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A buy B sell", "Positive")

elif arrDiff[-1] < boll[2][-1]:

Log("Open position A sell B buy", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 1

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A sell B buy", "Negative")

elif self.status == 1 and arrDiff[-1] > boll[1][-1]:

Log("Close position A buy B sell", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 2

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A buy B sell", "Close Negative")

elif self.status == 2 and arrDiff[-1] < boll[1][-1]:

Log("Close position A sell B buy", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 1

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A sell B buy", "Close Positive")

# Execute specific instructions

if action == 0:

return

self.isBusy = True

tasks = []

if action == 1:

tasks.append([self.symbolA, "sell" if self.status == 0 else "closebuy"])

tasks.append([self.symbolB, "buy" if self.status == 0 else "closesell"])

elif action == 2:

tasks.append([self.symbolA, "buy" if self.status == 0 else "closesell"])

tasks.append([self.symbolB, "sell" if self.status == 0 else "closebuy"])

def callBack(task, ret):

def callBack(task, ret):

self.isBusy = False

if task["action"] == "sell":

self.status = 2

elif task["action"] == "buy":

self.status = 1

else:

self.status = 0

account = _C(exchange.GetAccount)

LogProfit(account["Balance"] - self.initAccount["Balance"], account)

self.q.pushTask(self.e, tasks[1][0], tasks[1][1], self.opAmount, callBack)

self.q.pushTask(self.e, tasks[0][0], tasks[0][1], self.opAmount, callBack)

def main():

SetErrorFilter("ready|login|timeout")

Log("Connecting to the trading server...")

while not exchange.IO("status"):

Sleep(1000)

Log("Successfully connected to the trading server")

initAccount = _C(exchange.GetAccount)

Log(initAccount)

def callBack(task, ret):

Log(task["desc"], "success" if ret else "failure")

q = ext.NewTaskQueue(callBack)

p = ext.NewPositionManager()

if CoverAll:

Log("Start closing all remaining positions...")

p.CoverAll()

Log("Operation complete")

t = Hedge(q, exchange, initAccount, SA, SB, MAPeriod, ATRRatio, OpAmount)

while True:

q.poll()

t.poll()

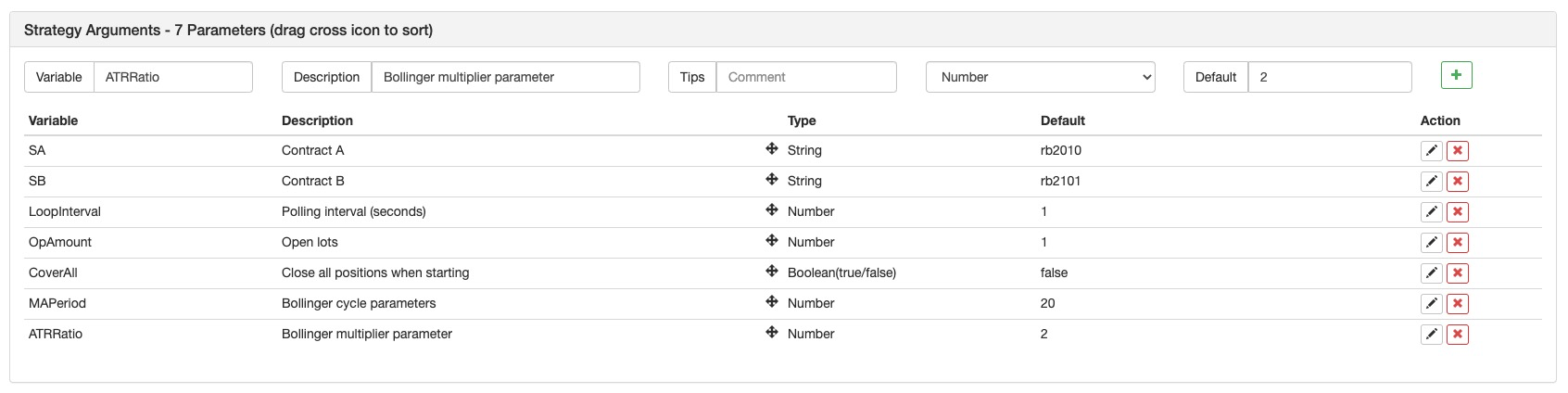

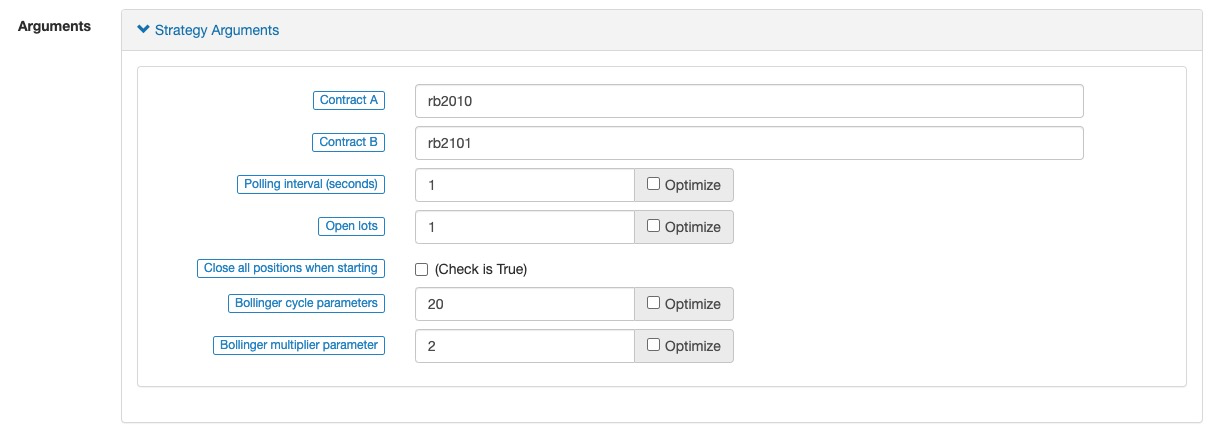

Strategy parameter setting:

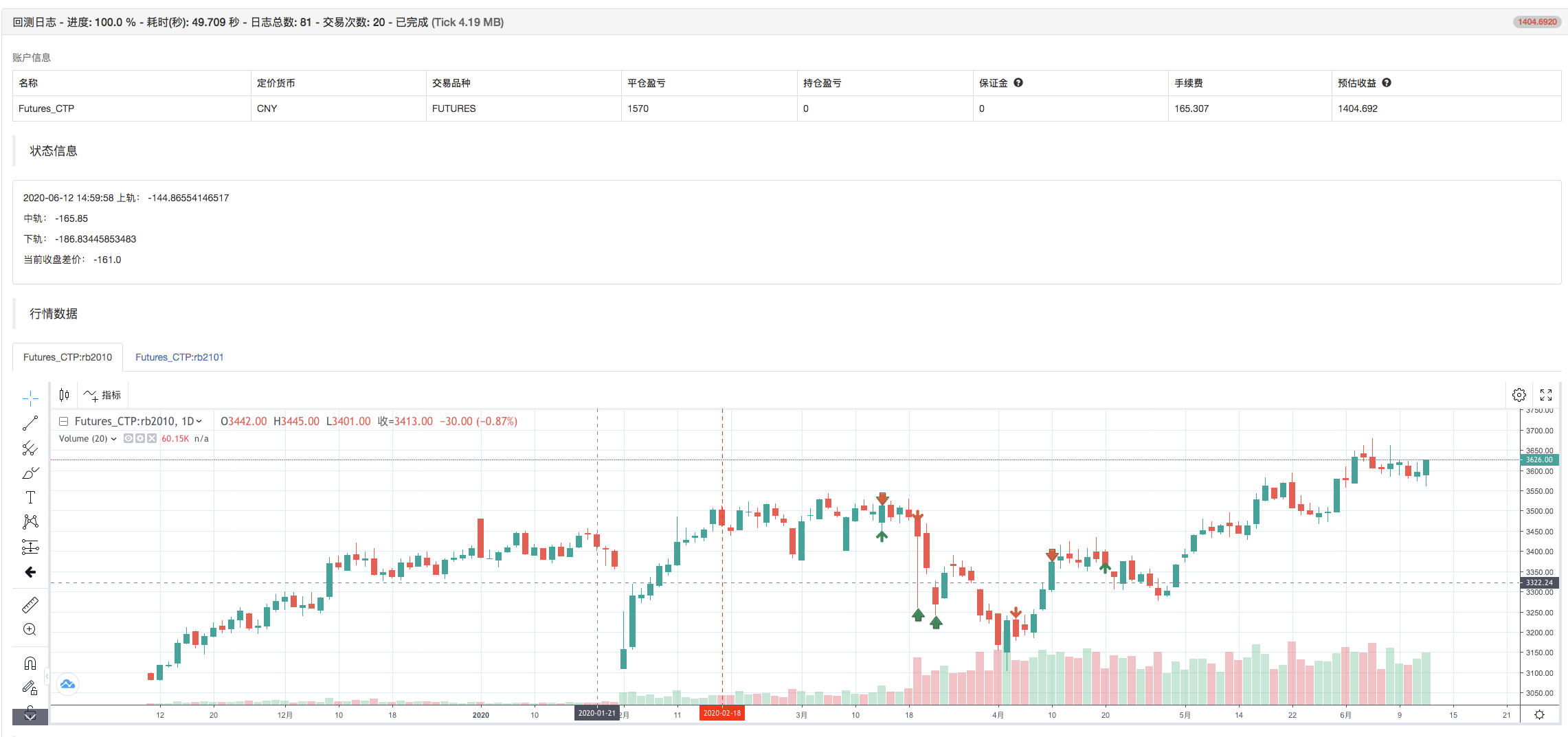

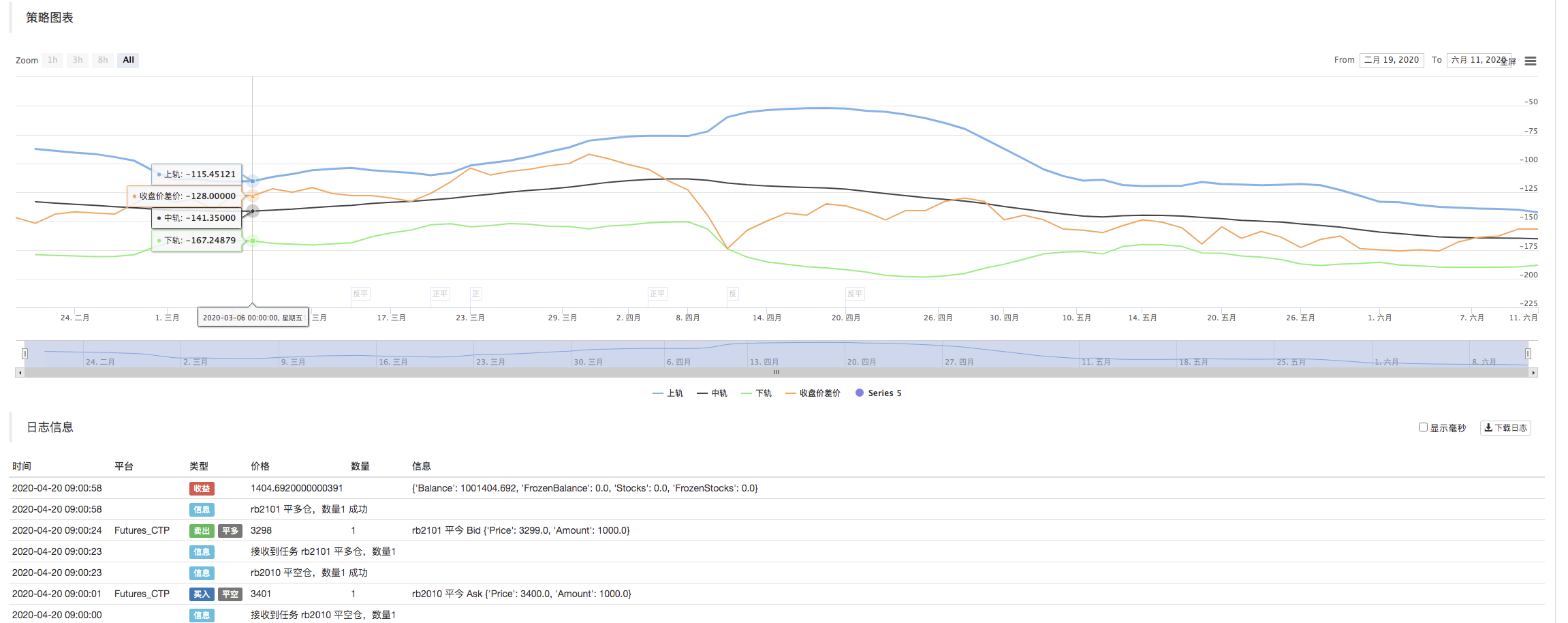

The overall strategy framework is basically the same as the Python version of commodity futures intertemporal hedging strategy, except that the corresponding BOLL indicator parameters are added. When the strategy is running, the K-line data of the two contracts is obtained, and then the price difference is calculated to calculate the spread. The array is used as data of the TA.BOLL function to calculate the Bollinger Bands. When the spread exceeds the Bollinger Band's upper rail, it will be hedged, and when it touches the lower rail, it will be opposed operating. When holding a position, touch the middle rail to close the positions.

Backtest:

This article is mainly used for study purpose only.

Complete strategy: https://www.fmz.com/strategy/213826

Subscribe to my newsletter

Read articles from FMZ Quant directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

FMZ Quant

FMZ Quant

Quantitative Trading For Everyone