Company Profile: Wint Wealth & Wint Capital

Aayush Pandit

Aayush Pandit

KEY TAKEAWAYS

Wint Wealth, formerly known as GrowFix, is a SEBI-regulated OBPP platform in India, offering retail investors fixed-income opportunities in the debt segment, with returns ranging from 8% to 12% IRR.

Wint Capital, launched through the acquisition of Ambium Finserve Pvt. Ltd., helps businesses and other NBFCs raise capital and solve cash-flow issues.

The company operates under a structured corporate framework with Wint Wealth and Wint Capital as separate entities, both housed under FOURDEGREE CAPITAL PRIVATE LIMITED.

Wint Wealth's business model includes offering corporate bonds and fixed deposits from Small Finance Banks and NBFCs, while Wint Capital focuses on B2B term loans, NCDs, and structured finance.

The article highlights Wint Wealth's transparency, zero default history, and educational efforts, while also noting areas for improvement, such as higher yield opportunities and clearer risk metrics for investors.

In November 2022, SEBI released the OBPP circular to regulate the debt investing space in India. Before this circular, most platforms operated in an unregulated category. Among the various platforms that applied for the license immediately was Wint Wealth.

Wint Wealth, previously known as GrowFix at its launch in 2020, was started with the goal to build the most trusted debt investment platform in India, focusing on educating customers and drawing their attention to instruments that were previously only available to HNIs and financial institutions.

In 2023, they also launched Wint Capital through the acquisition of an existing NBFC called Ambium Finserve Pvt. Ltd. Today, Wint Wealth, provides retail investors, with fixed-income opportunities in the debt segment, with listed bonds and Small Finance Banks FDs. These opportunities start from 8% IRR and go upto 12% IRR.

Whereas, with Wint Capital, the platform helps businesses and other NBFCs raise capital, solve cash-flows & provide other financial solutions.

As an OBPP platform, Wint needs to abide by certain rules and regulations defined by SEBI, to know more about OBPP, please check this blog.

While we haven't had a chance to do a podcast with the Wint founders yet, here is a good podcast by Rainmatter with them:

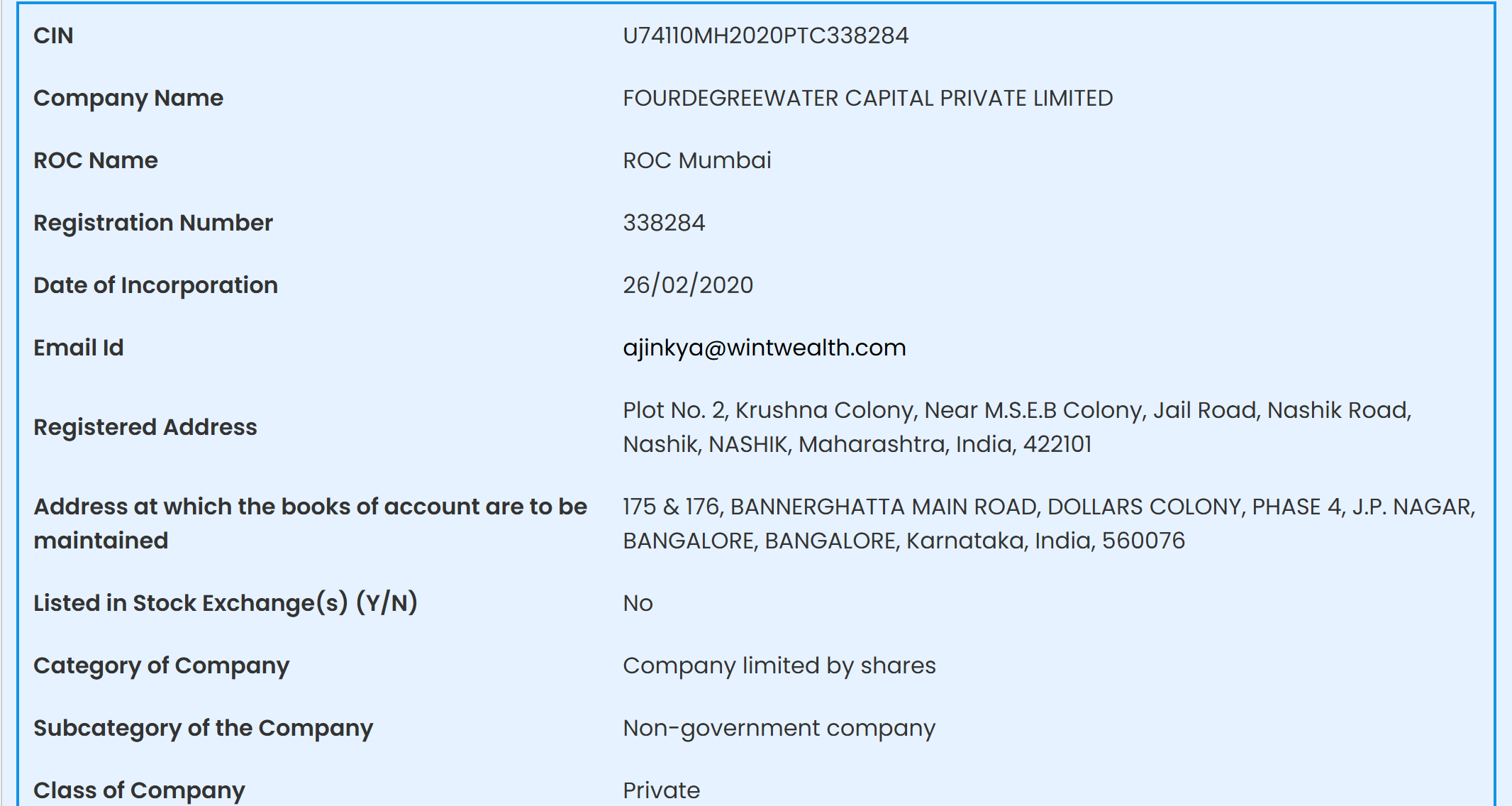

Corporate Structure & Founders

Wint Wealth (FOURDEGREEWATER SERVICES PRIVATE LTD) & Wint Capital (AMBIUM FINSERVE PVT. LTD) are setup as two different entities as one is setup as a SEBI Registered OBPP platform and the latter is setup as a Non-Deposit Taking NBFC. Their holding company which houses both the OBPP business and NBFC business is FOURDEGREE CAPITAL PRIVATE LIMITED.

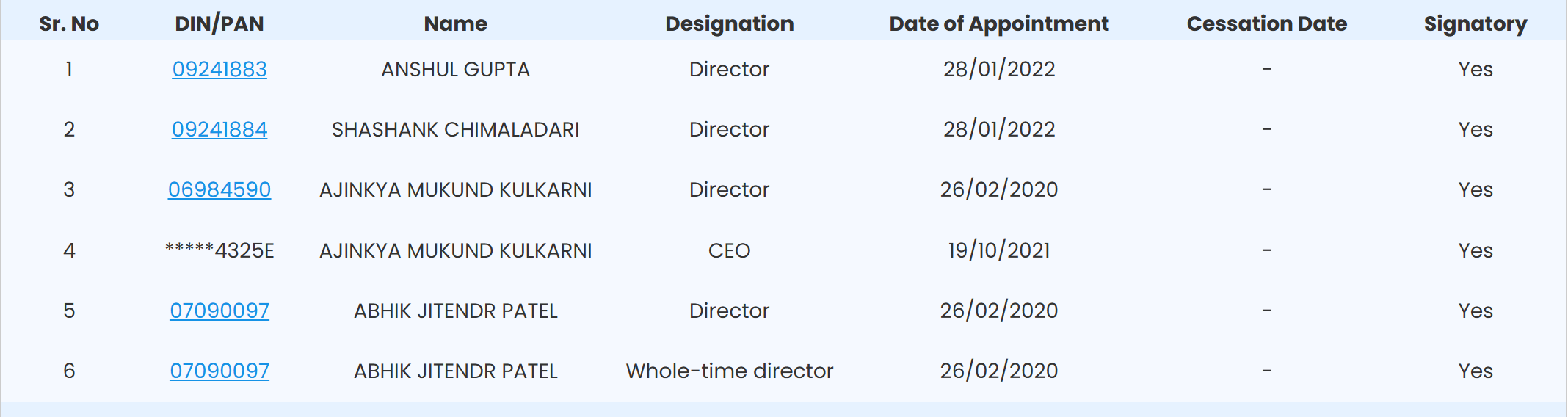

As per the latest MCA filings and their Linkedin profiles, the directors are:

Anshul Gupta (Co-Founder & CIO)

Shashank Chimaladari (Co-Founder & CTO)

Ajinkya Kulkarni (Co-Founder & CEO)

Abhik Patel (Co-Founder & CPO)

Talking about the Ajinkya Kulkarni, the CEO, he is registered as directors in multiple other Pvt. Limited companies. Although all of them appear to be related to Wint Wealth itself. The highlighted entity below (Ambium Finserve Private Limited) is related to Wint Capital which was acquired by Wint Wealth.

Wint's Business Model

To understand this, lets divide their business into two parts, the OBPP one and the NBFC one.

Wint Wealth - OBPP Platform

The retail platform is the one that most of you probably already know about, the platform primarily has 2 offerings on its platform for retail investors.

Corporate Bonds: Wint would work with other players in the market to source good bonds across the risk spectrum and earn a spread by selling those on to the platform. For example: They would get a Navi A rated bond at maybe 11% interest rate from other player or directly from Navi and then sell it to retail investors at maybe 10.5-10.75% earning the spread as commission.

Fixed Deposits (of Small Finance Banks & NBFCs): Wint has partnered with several NBFCs and Small Finance Banks (SFBs) to sell their fixed deposit products to users on their platform and make the experience seamless with tech. The SFBs and NBFCs pay certain commissions to Wint for the volume of investments they bring to them.

Wint Capital - NBFC Platform

As per Wint Capital's website, they are financing into the following avenues:

B2B Term Loans: They provide term loans to corporations or other NBFCs after assessing credit risk. A term loan is similar to what you receive from a bank. The interest rate depends on whether the loan is secured or unsecured. As per Wint Wealth, they only do secured lending.

Non-Convertible Debentures (NCDs): They participate in a company's fundraising by buying their NCDs. They can also help other NBFCs or companies raise debt through this method.

Structured Finance: They assist other NBFCs in securitizing their loan books and removing them from their balance sheets by investing in them. This securitization process results in the creation of SDIs (Securitized Debt Instruments).

After reading this, one question should come to you mind, where is Wint Capital getting all the money needed to even fund all the above investing avenues?

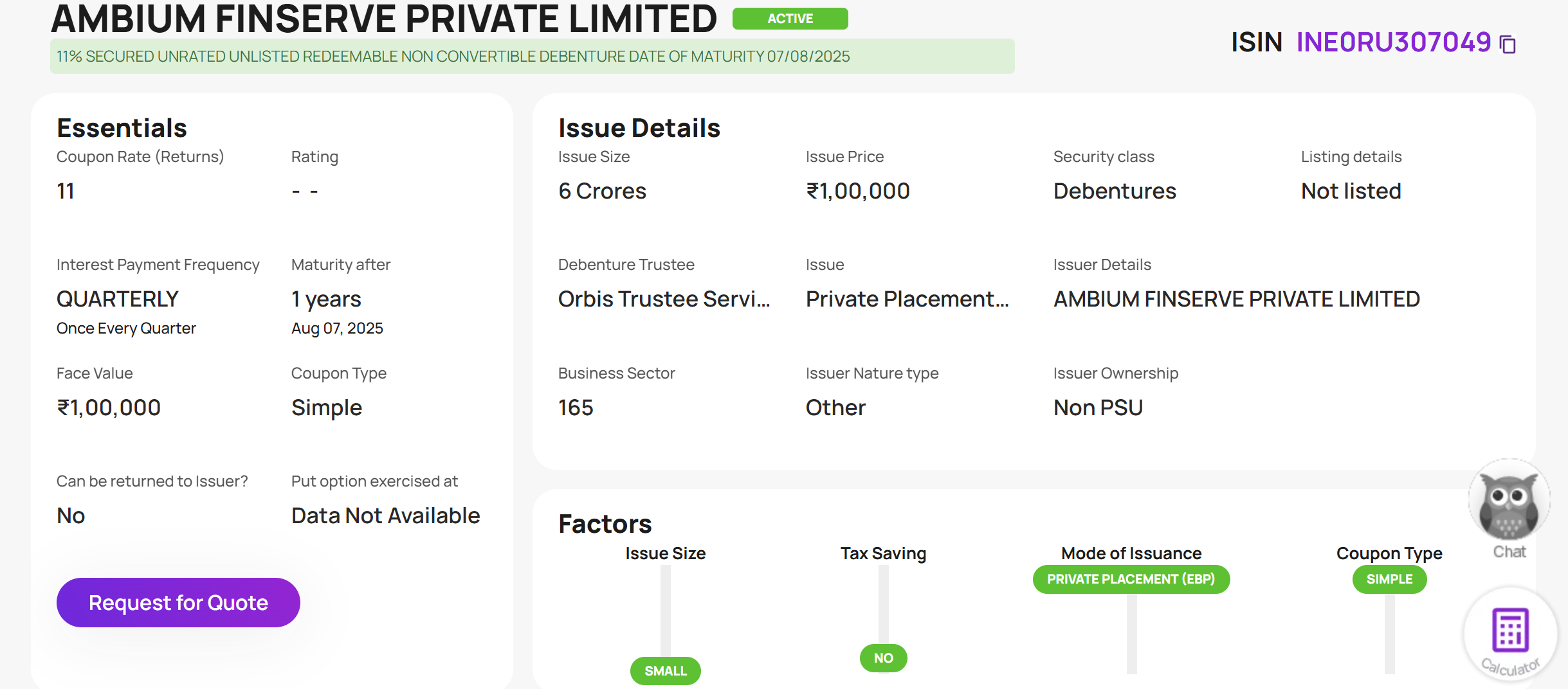

Wint Capital not so surprisingly issues its own bonds. These bonds are available only through a private issue and are sold via distributors. Below is a sample INR 6 Crore tranche done by Wint. Wint Capital has also been able to onboard institutional lenders for raising capital via term loans. These includes banks and other large NBFCs.

The interest rate difference between what Wint Capital bonds offers its investors/lenders and at the rate of interest they invest in is the NBFCs earnings. To give an example, Wint Capital Bonds might be offering 11-13% to investors and they will be investing in B2B Loans, Other Corporate Bonds or SDIs which yield atleast 15-17% interest.

Wint Capital recently got rated BBB- by CARE Ratings which puts them in the investment grade rating league. This is a big achievement and we congratulate them for that!

Can Defaults Happen?

Debt instruments in nature are less riskier than equity investments, but it highly depends on which kind of bond you have purchased. Now with so many options available in the market like NCD, MLD, Unlisted Corporate, Govt Bond, it can get very confusing on which option works best for you. But one thing which is always very helpful to know is the rating of the bond.

Source:Kundan Kishore

The higher the rating of the bond, the lower the credit risk. So in above table, if a Bond X is rated AA and Bond Y is rated BB, Bond X will be much more safer than Bond Y but will also yield less returns when compared. The beauty of debt market is there is something always available suiting the investors risk profile.

For Fixed Deposits done with a bank, any deposit upto INR 5 Lakhs is covered under the DICGC Insurance. However, any deposits done with a Deposit Taking NBFC will not be covered under this scheme and still faces a risk of default. Investors can get comfort by evaluating the credit rating of NBFCs in these cases.

Things We Like About Wint Wealth

The very first thing is they are regulated under the SEBI OBPP framework which has very clear defined rules, regulations and dispute resolution frameworks. So no dealing with ambiguous investment vehicles and structures.

Their Youtube Channel is fantastic, they have created tons of awareness via education and distribution, something my team also aims to learn from them.

They have had zero defaults so far. While past return is not a guarantee of future performance, it still gives me a lot of comfort that their risk assessment is rock solid and they will continue to maintain that.

The leadership team has the right set of credentials to run the business and understand the nuances of investing in debt securities.

They have got investment grade rating for the NBFC Wint Capital, so surely they are doing something right on that front as well.

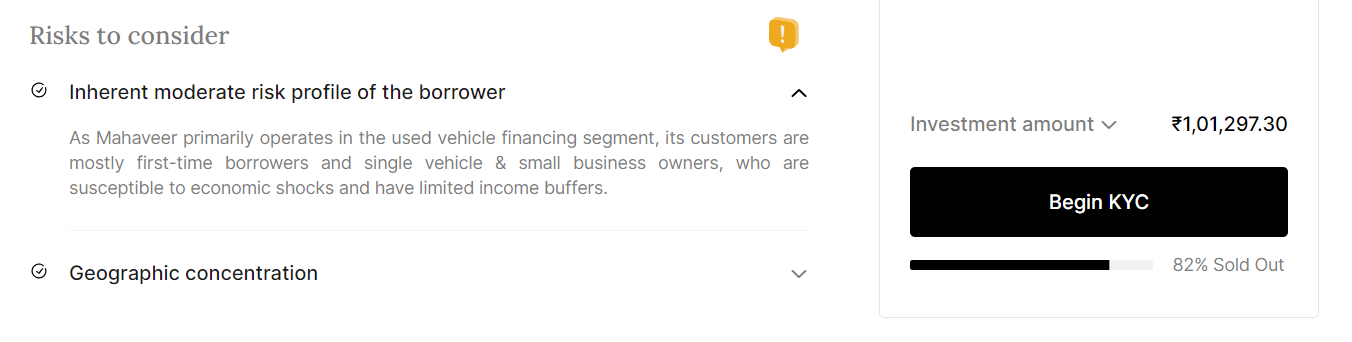

They are incredibly transparent with their investment options, presenting the investors what Wint likes and about the opportunity and the risks an investor should consider before investing.

They are not just providing a platform to invest, but in fact having their own skin in the game. Wint Wealth invests 2% of the total bond size in every bond that they bring on the platform. This helps develop an added layer of trust amongst its customers.

Things We Don't Like About Wint Wealth

Their High Yield opportunities were a bit on the lower side in my opinion, giving only about 12% returns. This might not be enough for some aggressive investors. But I am sure this is a conscious call being taken by their credit assessment team.

All opportunities are shown in IRR (Internal Rate of Return) which can be misleading for bonds as it assumes all interest payment received is reinvested at the same interest rate, which is not always true as TDS payments are also deducted and clearly can't be reinvested at same rate. To be fair this is an industry wide problem and not specific to Wint.

For a normal retail investor, ratings are a good metric to check, however what would be helpful for Wint is to show the average default rating for that rating across the overall Indian debt markets. This figure is published by rating agencies regularly and would give a fair idea to the investor on history of defaults for that rating.

Wint Wealth will open a new demat account under your name necessarily even if you already have with another broker. This maybe an inconvenience to various investors. We all know opening such accounts is very easy, but closing them is a nightmare.

Conclusion

Our regular readers might realize that this article is very similar to our Company Profile article on other OBPP platforms, that's because all the platforms are run exactly as per the same rules by SEBI and are good platforms. But Wint Wealth is widely known amongst investor base especially due to the great content they have shipped out and their zero default history, besides having their own skin the game.

We as ALT Investor are very bullish about diversification and really feel that Indians should diversify away from Fixed Deposits if their risk profile allows them to and platforms like Wint offer fantastic opportunities to do that.

Their Wint Capital NBFC play is also very interesting and they have a balance sheet of INR 200 Cr AUM in that, it will be very interesting to see how the NBFC grows and pans out.

For anyone new entering into debt markets or alternative investments market, I would recommend you to checkout Wint Wealth's offerings as they have something for everyone.

We hope this piece was helpful, we will see you in the next one. If you have any questions on this piece, please mention in comments below or join ourWhatsApp Communityto ask your questions directly where we will promptly answer them. You can join the community here.

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India, and none of these views reflect those of my current employer. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.

Thank you for reading and hope to see you in the next one!

Subscribe to my newsletter

Read articles from Aayush Pandit directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Aayush Pandit

Aayush Pandit

My work in the events & exhibitions industries has not swayed me away from my core passions, a love for the legal field and all things finance.