Liquid Staking Protocols

Anirudh Reddy

Anirudh ReddyKey Terms

AVS - Actively Validated Services are systems which need continuous validation from multiple validator/nodes to perform correctly. Example - Oracle networks. In decentralised oracle networks price values are taken from multiple nodes, validated and then aggregated to generate price on chain. Generally AVS have a penalty structure to discourage faulty nodes. Most common penalty structure in blockchain is for nodes to stake funds which will get slashed if the nodes operate in rogue manner.

MEV - MEV stands for Maximum Extractable Value. This refers to rearrangement or inclusion/ exclusion of transactions in a block so that earnings of a validator are maximised in an AVS. The smarter the validators of AVS the higher the earnings of a validator.

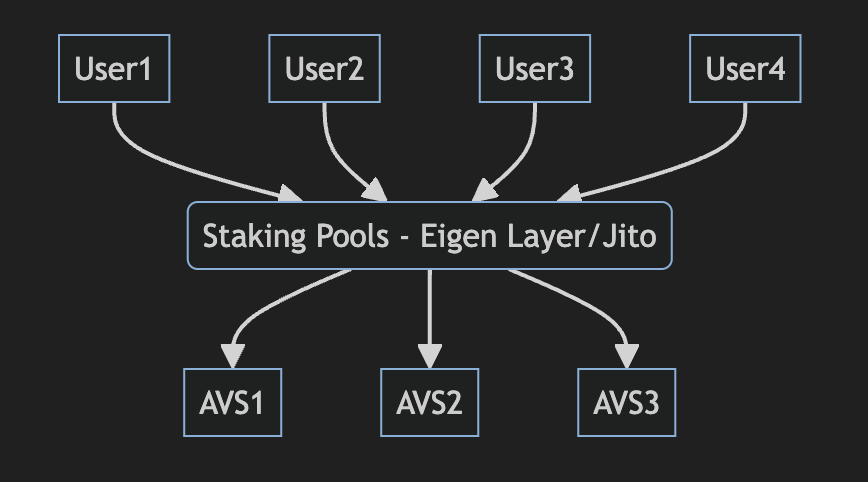

Staking protocols: In staking pool model users stake their assets in return for staking rewards. Funds staked in staking pool are used by validators/nodes in an AVS. Part of the earnings of the validator is returned as staking rewards to stakers. Yield of the staking protocol depends on how efficient the corresponding AVS are at generating the earnings. There are 2 drawbacks in traditional staking pool models

specific lock-in periods

assets being illiquid once staked.

LRT: Staking protocols introduced Liquid restaking tokens(LRTs) are introduced to overcome both problem of staking protocols.

Liquid staked assets: When a user stakes their assets in liquid staking protocol they get LRTs in return which they can use in other Defi protocols such as lending, borrowing or yield farming.

No lock-in period: LRTs also solve the problem of locking in assets for a specific period of time. Users can provide the LRT tokens and unstake their assets at any time. No need to lock-in assets for specific duration of time.

Eigen Layer vs Jito

Eigen Layer: Eigen layer is a restaking protocol on Ethereum in which users can stake their ETH and earn staking rewards. This staked ETH is used by multiple applications(AVS) to provide cryptoeconomic security. But right now the issue with eigen layer is that the yield generated is not attractive enough for stakers to stake their assets for long term. Reasons for this are

Capital inefficiency: Huge amount of Eth is staked into Eigen protocol but proportionate number of AVS are not yet present to leverage the staked Eth. Only a fraction of capital is used by AVS to generate rewards, which when distributed across all stakers leads to low APR.

AVS inefficiency: Inefficient AVS generate less amount of rewards per unit amount of capital used which leads to lower yield.

Jito: Jito is also a restaking protocol on solana which aims to solve the problems faced by Eigen layer on Ethereum.

Capital Efficiency: Jitos vault/restaking architecture is designed in such a way that there is almost negligible barrier to entry for AVS to leverage staked assets.Jitos diverse slashing methodologies support diverse range of applications. Both low barrier to entry and ability to support diverse AVS lead to greater number of AVS leveraging the staked assets which make protocol capital efficient.

AVS efficiency: AVS which want to leverage Jito’s staked asset pool need to run Jito’s MEV enhanced validator client. This AI powered validator client is more efficient at generating higher MEV compared to Eigen layer’s nodes. Hence greater amount of earnings are generated per capital

Flexibility: Jito allows users to stake assets only to be used by specific AVS. This gives users more freedom to stake their assets only in high performing AVS. With this stakers have more control over the yield they can generate.

Cap on AVS: Jito allows putting caps on amount that can be staked in an AVS. This keeps a check on amount of assets staked which makes the protocol more capital efficient.

Subscribe to my newsletter

Read articles from Anirudh Reddy directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Anirudh Reddy

Anirudh Reddy

I am a developer from India, with special interest in blockchain and AI.