Alternative Assets: What Are They And What Is The Need For Alternative Investments?

Om Shukla

Om Shukla

KEY TAKEAWAYS

Alternative investments differ from traditional stocks, bonds, and cash, offering diversification and potential for higher returns, especially for institutional investors.

In India, the alternative investment landscape began evolving in the 1980s, with significant growth following SEBI's introduction of AIF regulations in 2012.

Retail investors in India now have access to various alternative assets, including debt-based, equity-based, property-based, and crypto-based options, thanks to technological advancements and regulatory support.

The primary benefit of investing in alternative assets is diversification, as they can provide a cushion against market volatility and offer inflation-beating returns.

While alternative investments offer diversification and potential high returns, investors must be cautious of unregulated platforms and schemes, with SEBI taking steps to protect retail investors.

Alternative investments are a label for a disparate group of investments that are distinguished from publicly traded investments in stocks, bonds, and cash (often referred to as traditional investments). The terms “traditional” and “alternative” should not imply that alternatives are necessarily uncommon or that they are relatively recent additions to the investment universe.

Speaking from an institutional investor perspective, alternative investments also include non-traditional approaches to investing within special vehicles (AIFs in India), such as private equity funds and hedge funds. These funds may give the manager flexibility to use derivatives and leverage, to make investments in illiquid assets, and to take short positions. The assets in which these vehicles invest can include traditional assets (stocks, bonds, and cash) as well as less traditional assets like agricultural farms, exclusive whiskeys, art, crypto, etc. These types of funds are typically actively managed to generate an alpha over traditional instruments.

Some institutional investors in the Western world, such as pension funds, hedge funds, and endowment funds, are drawn to alternative investments. They appreciate that these options can diversify their portfolios due to their lower correlation with traditional asset classes. Plus, they offer chances for better returns by boosting the risk-return profile of the portfolio, and they might even provide higher yields for increased income.

But when did it all start in India and what alternative investment opportunities are now present for retail investors in India? Let's find out!

If you are a video person, you can watch this video instead of reading this blog!

Launch Of AIFs In India

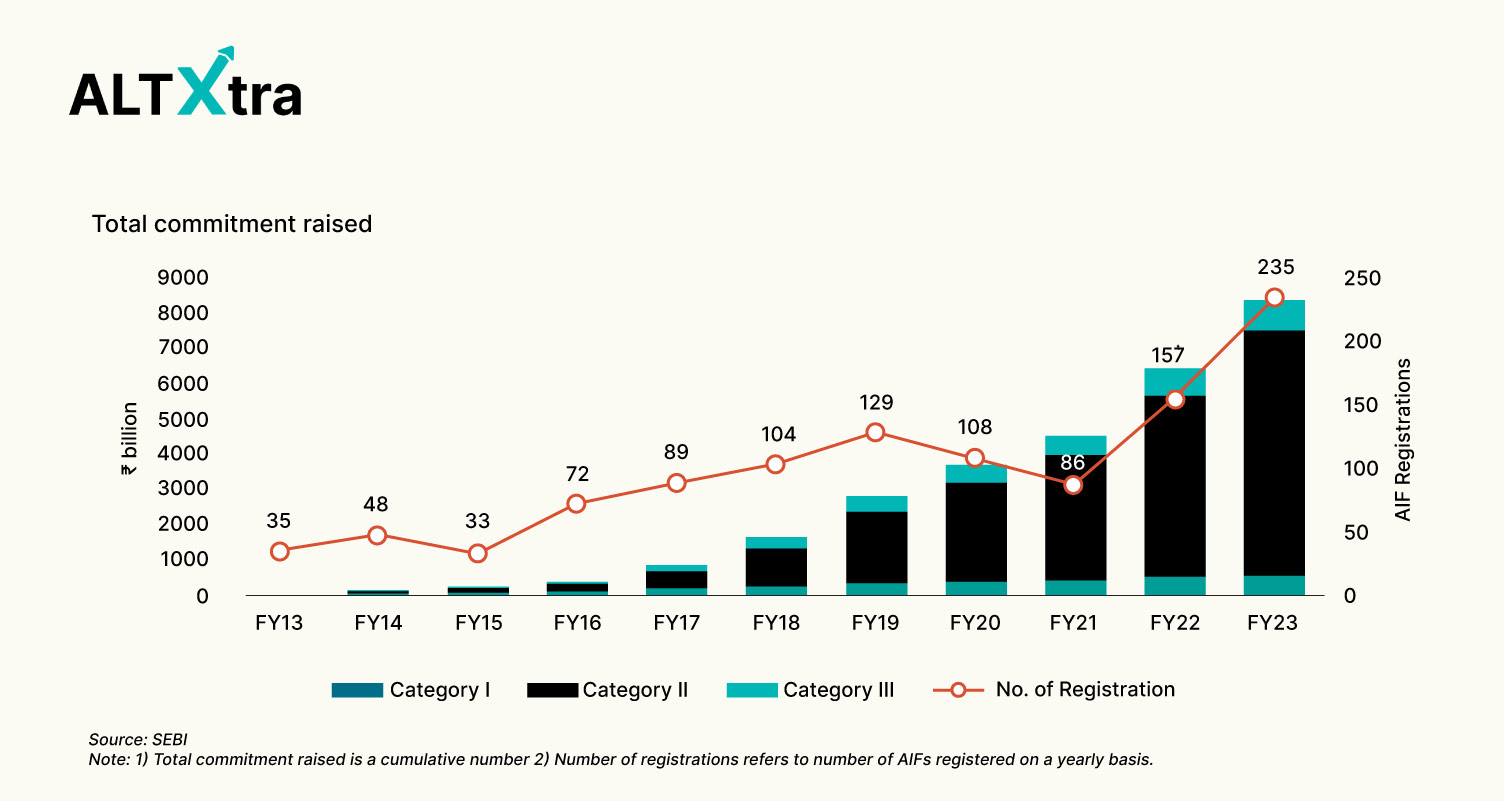

The launch of alternative assets in India can be traced back to 2012 when SEBI introduced the Alternative Investment Funds (AIF) regulations. However, the roots of an emerging alternative investment culture can be seen as early as the 1980s.

In 1988, SEBI initiated its venture capital regulations, leading to significant private equity investments in the Indian technology and BFSI sectors, primarily driven by PSUs and a few prominent industrialists. By the 2000s, the presence of angel investing and private equity was noticeable, although it remained concentrated in specific sectors. Even in the 2000s, these investments were still limited compared to broader market opportunities.

Comparatively, in the Western world, the concept of portfolio diversification has already become well-established. By 2002, alternative assets like art, collectibles, asset leasing, private equity, real estate, and strategic trading constituted approximately 10% of financial investments in the US.

Following the release of the AIF regulations in 2012, numerous institutions launched their own AIFs, investing in a diverse range of asset classes including infrastructure funding, special situation funds, real estate, corporate debt instruments, and notably private equities & venture capital. Since these regulations were established, the Assets Under Management (AUM) of AIFs have experienced rapid growth, with a Compound Annual Growth Rate (CAGR) of 20-30% over 10 years. In fact, despite being just a decade-old industry, assets under management at AIFs are now 20% of all assets under management of mutual funds (Source: SEBI, AMFI).

Source: CRISIL

If you like to learn more about AIFs in India, you can check out thisdetailed article.

Different Alternative Assets For Indian Retail Investors

Clearly, AIFs are out of reach for the normal retail investor due to a minimum INR 1 Crore ticket size, but thanks to technology and favorable SEBI regulations, newer options have come up for retail investors and this can be divided broadly into 3 categories:

Debt Based Alternatives: These can be unregulated & regulated assets like securitized debt instruments (SDIs), invoice discounting, lease financing, royalty investments, revenue-based financing, non-convertible debentures, P2P, etc. You can read a list of detailed options here.

Equity Based Alternatives: These are generally regulated structures in the form of private equity investing (via CCDs, CCPs) with a minimum ticket size of INR 2 Lakhs.

Property Based Alternatives: These are generally fractional ownership structures in which you can purchase a piece of commercial or residential property by pooling in money with other investors. SEBI also recently launched the SM REIT structure to promote this asset class. You can read about it here.

Crypto Based Alternatives: These are generally individual crypto tokens like Bitcoin, Ethereum, DogeCoin, etc. Or can be CIS like Bitcoin ETFs or Crypto Mutual Funds.

Needless to say, all the platforms across all categories have seen healthy participation across all deals they have brought in.

Why Are Indians Investing In Alternative Assets?

As we have seen, the AUM for AIFs has grown significantly. On top of that, we have regulated avenues like Corporate Bonds, SDIs, REITs, InvITs, P2Ps as well as other unregulated alternative investments that are quickly growing in size. However, this makes up only 4% - 5% of the total domestic investible market in India. So if we were to take cues from the West, the AUM has huge scope to grow here, especially in the fixed-income space.

Over the past few years, SEBI has taken active steps to regulate the various investment avenues for alternative asset classes. Such as REITs, InvITs, OBPPs etc. And the response of domestic investors has been quite good, with NFOs being oversubscribed, and AUM of such platforms soaring to new heights. But why? Why are people investing in these new asset classes, when the good old equities are giving quite decent returns?

The answer to the majority of the questions is diversification. India's exposure to financial assets is at an all-time high. But much of these financial assets are locked up in mutual funds, equities, and FDs. In the former, investors take higher risk, while in the latter they give up high returns for lower risk. And investors in India have slowly started to realize that their FD returns are not even beating inflation and they can probably make a bit more returns on similar levels of risk. To balance this conundrum, investors are actively exploring alternative assets.

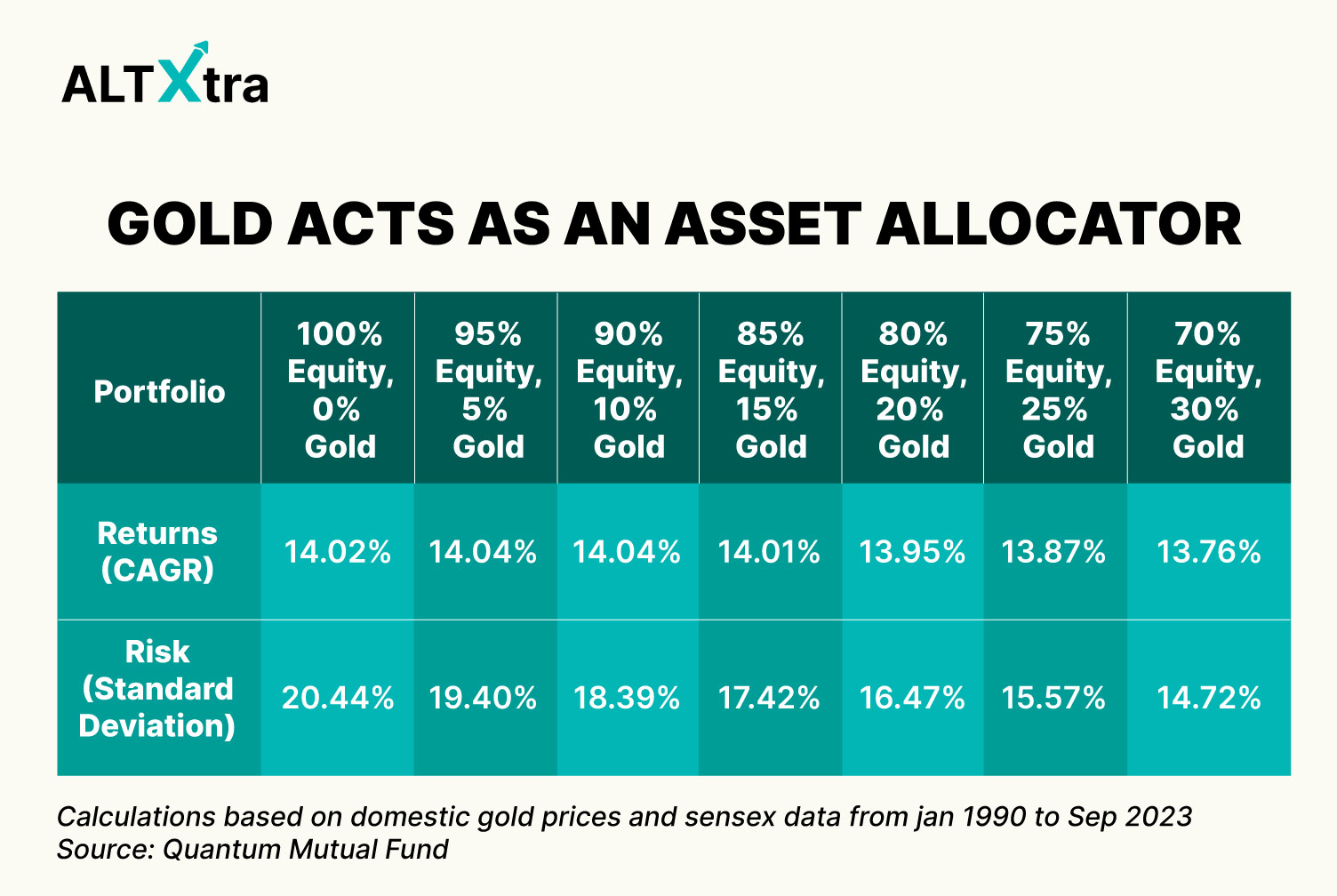

Here is simple data compiled by Quantum Mutual Fund, which shows the difference between a pure equity and a slightly diversified portfolio. The returns are more or less the same, but the important number is the standard deviation (SD). A lower SD shows how diversification helps reduce the volatility of the overall portfolio.

Alternative assets work in a similar fashion. Corporate bonds, SDIs, asset leasing, invoice discounting etc. have no direct correlation to the markets, thus during major drawdowns in the markets, they can provide a necessary cushion to the portfolio.

Are There Other Benefits Apart From Diversification?

Diversification of course is one of the biggest advocates for alternatives but some investors who have the appetite to take on more risk also prefer them. Given that these instruments are not standardized, they can be fairly customized to meet every investor's risk profile. Take PEs, VCs, angel investing, special situation funds, and litigation financing for example. These are quite risky investments, but returns are mouth-watering for most.

CRISIL tracked the returns of Indian PEs and VCs, which make up 2/3rd of the AUM of AIFs in India. They gave an alpha of a whopping 13.5% (IRR terms) from 2013 to 2023 when compared to Sensex! In fact, the overall benchmark for aggregated AIF investment in India itself is 25.8% as of 2023.

But sky-high returns are not the only definition of growth and returns. Some investors want low-risk, fixed long-term returns, but better than FD and treasury rates. So, they naturally turn to corporate bonds, SDIs, real estate and asset leasing (depending on their risk appetite).

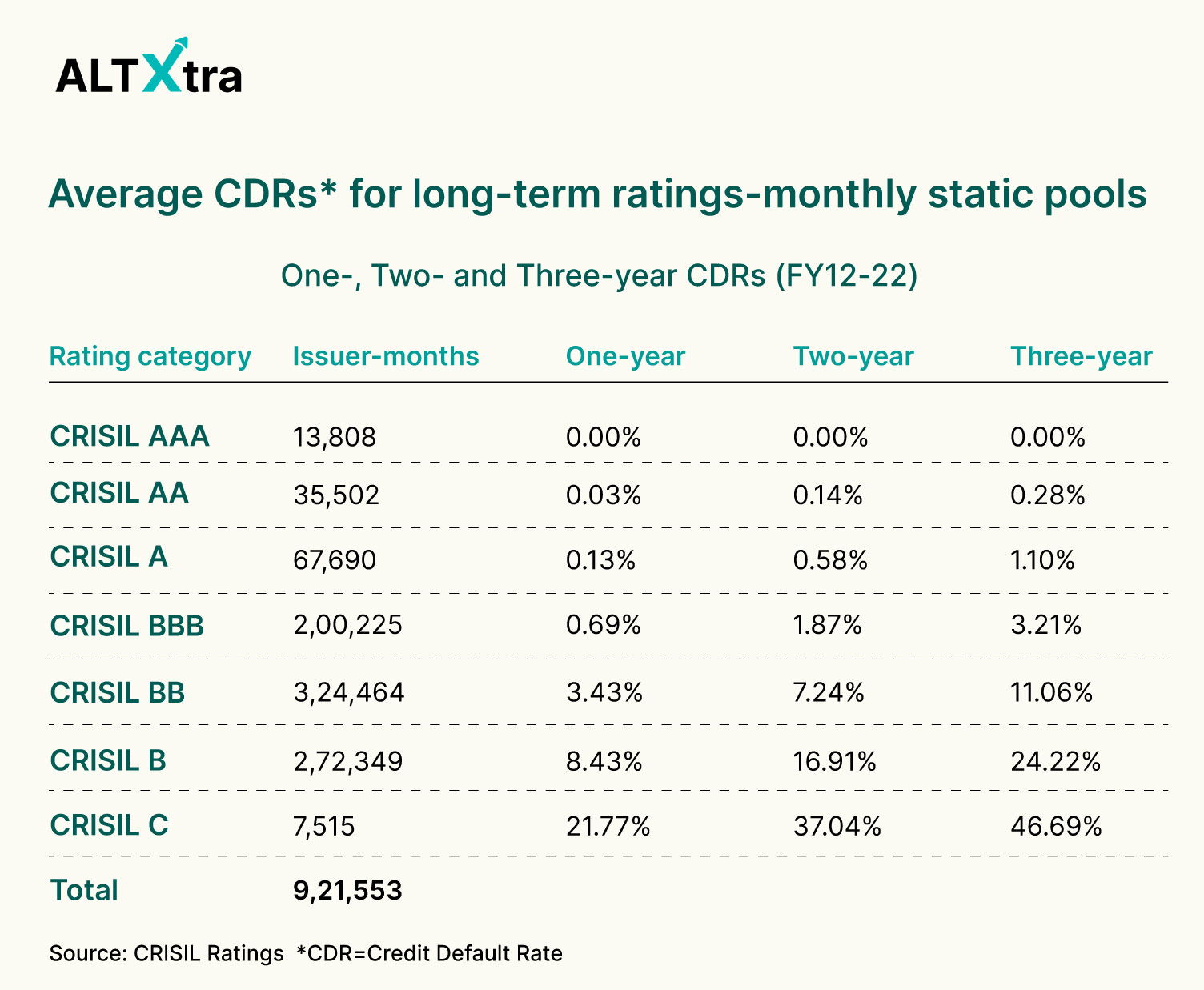

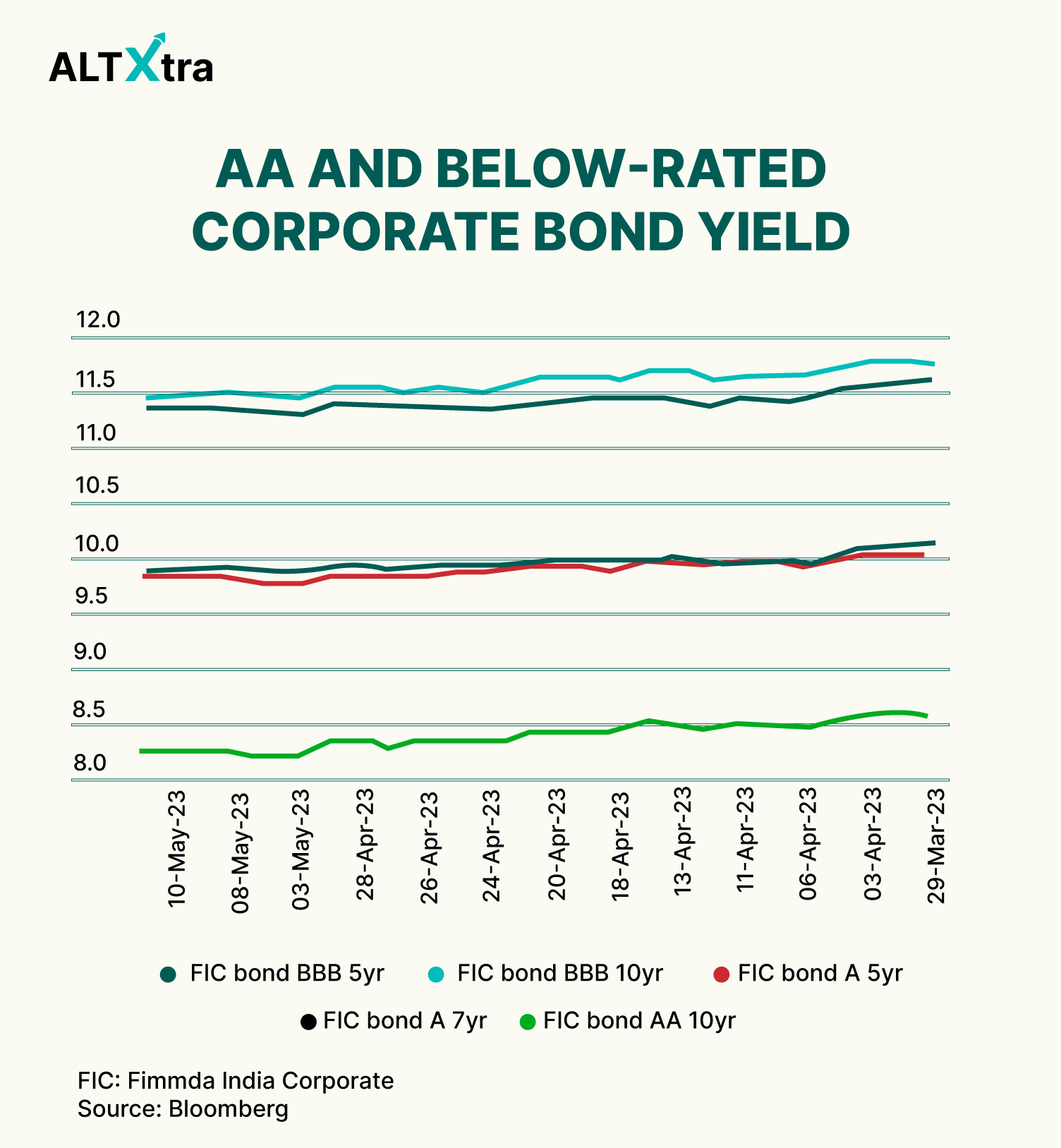

Corporate bonds are a huge market that has surged over INR 200 lakhs crore. The best AAA long-term bonds give an interest of 7-10%, while 5-year FDs are net anywhere between 6-9%. But the actual fun starts when we move slightly further down in the rating scale of corporate bonds, the returns suddenly make much more sense for a mid-rated bond.

If we look at the default occurrences and compare them to the average yields, the risk to return seems more than fair. AAA-rated 5-year bonds will give an 8% average yield, where the chance of default is 0%. If we move down to A-rated, the chance of default in the next 3 years increases to a meagre 1.10%, while the yield jumps to 11%. And if we go further down to BBB, the avg default rate is 3.21%, while the returns have now jumped to at least 12.5%.

FIMMDA: Fixed Income Money Market and Derivatives Association of India

FIMMDA is a voluntary market body for the Fixed Income, Money and Derivatives Markets. Its members represent all major institutional segments of the market.

Similarly, there is a case for real estate, especially commercial ones, which many investors are excited about. The newly launched Small and Medium (SM) REITs aim to open up the real estate investment market. The average rental yields on commercial property range between 7-11%. Not a very flashy number, but when coupled with capital appreciation, the IRR figures are not that bad for long-term secured investment products.

All of the above products obviously offer portfolio diversification but also serve the needs of many who are looking for long-term, lower-than-market risk but higher-than-FD returns.

The Major Risk In Alternatives

The bigger problem in alternatives than risk and return, are unregulated platforms and unregulated investment options.

For retail investors, AIF is out of reach due to the INR 1 Crore investment requirement. Similarly, SM REITs are also coming in at INR 10 Lakhs minimum investment.

So, to diversify their portfolios, retail investors have landed up investing in unregulated schemes or platforms. SEBI has become proactive in shutting down shady platforms to protect investors. However many of them still exist and retailers will have to be extremely careful in where they invest.

To protect investors while meeting the requirements for diversification and higher returns at smaller investment amounts, SEBI created the OBPP license for platforms in 2022. These platforms offer high-yielding, investment-grade, fixed-income investment options like corporate bonds and SDIs. On April 30, 2024, SEBI even reduced the minimum ticket size for investing in privately placed debt securities to INR 10,000 which is a big win for retail investors.

Conclusion

Alternative Investments or Alternative Assets are a new term per se in the Indian context but unknowingly every Indian household held some of them in their overall portfolio. The main purpose of holding them was simple: if everything goes down in financial markets, at least you will have some other assets to protect you (via diversification) and these assets can also appreciate over time (beating inflation).

Now the market offers various forms of alternative investments that were not available to retail investors before. Thanks to SEBI, the ticket size for certain assets is also reducing. You should consider alternative assets in your portfolio if you want inflation beating returns because your post tax returns on FDs may not be the best option for your portfolio!

That's it for this long article, thank you so much for reading and thank you to Grip Invest for powering the ALTXtra series. There are a lot more interesting pieces to come out of this and hopefully you all will enjoy them. If you have any feedback, please don't hesitate to reach out to us at ALT Investor or Grip Invest.

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/ or default in payment. The investor is requested to read all the offer related documents carefully and to take into consideration all the risk factors before subscribing to debt instruments.

This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities.

Neither ALT Investor or its associates/associated entities, assigns or affiliates takes or accepts any liability for consequences of any actions taken based on the information provided.

Subscribe to my newsletter

Read articles from Om Shukla directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by