Stablecoins and How to Use Them

WildFlower.Eth🌺

WildFlower.Eth🌺

Everyone and their grand aunt have come into crypto through stablecoins, if you have been in the web3 space long enough, I am sure you must have heard about 'stablecoins'.

There are so many in-depth articles about stablecoins, that this article simply answers the most common questions about stablecoins in an interview-like manner. The answers here will demystify misconceptions you have about these types of cryptocurrencies

what are Stablecoins

Stablecoins are cryptocurrency coins that are pegged to a fiat Currency. i.e they do not necessarily derive their value from the demand and supply in the market, but rather on the value of the currency pegged to them

True To Their Names, do they stay stable?Stablecoins are relatively more stable than most cryptocurrencies. stablecoins derive their stability from stable assets, most stablecoins are backed 1:1 by fiat currency reserves held with a bank or a trusted custodian. This means, for every 1 USDT being sold, there is a reserve of 1 dollar with which it is backed with

If they do not significantly increase in price, what then is their use?

Imagine you want to buy Bitcoin with a very volatile currency, let's say Naira. Bitcoin is being traded for NGN 109 million today, and NGN 120 million in a few hours, due to the volatility of the Naira. this typically makes it difficult for traders buying cryptocurrency with fiat to protect themselves from Market fluctuations. Stable coins, provide a balance between when a coin is bought and sold.

Stablecoins also make it easier to buy crypto through trading pairs, providing liquidity for less common fiat currencies that may not have enough volume enough to be trading pairs.

What types of stablecoins are out there?

stablecoins are categorised based on the way they derive their stability.

When they are backed by other cryptocurrencies, they are called -Crypto-Collateralized Stablecoins

When algorithms are used to maintain their stability they are called Algorithmic Stablecoins

When they are backed by physical assets, such as gold or real estate, they are called Commodity-Backed Stablecoins

The most common types of stablecoins are backed by fiat currency reserves, they are called Fiat-Collateralized Stablecoins, examples of these are Tether (USDT), USD Coin (USDC), and TrueUSD (TUSD).

How are USDT and USDC difference?

USDC and USDT are the most common stable coins used in crypto trading and decentralised finance but that does not make them the same

while USDC is issued by Circle and Coinbase, that is regularly audited to ensure that it is backed by fiat currency

USDT which was created by Tether, was the earliest stable coin to be created, it is less transparent but mostly preferred for is fast, low cost transfers when sending from one exchange to another

Are Stable Coins on Different Blockchain Networks the Same?

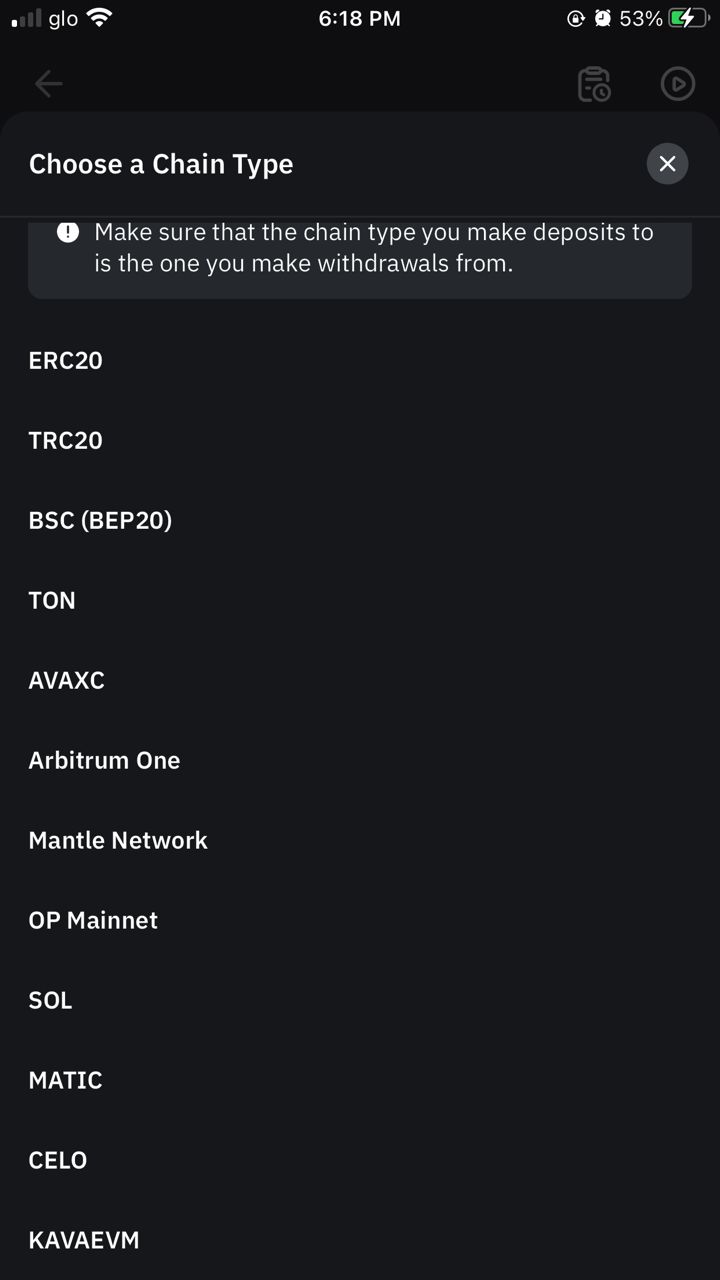

Stablecoins like USDC and USDT operate across multiple blockchain networks. Blockchain networks are simply put - blockchains that allow transactions to be recorded on their ledgers. These stablecoins have to operate understand certain standards, for ethereum, they have to operate under the ERC20 standard, under the Tron Blockchain, they have to operate on the TRC20 standard.

How Do I Make Sure I'm Sending My Stablecoins Through The Right Network

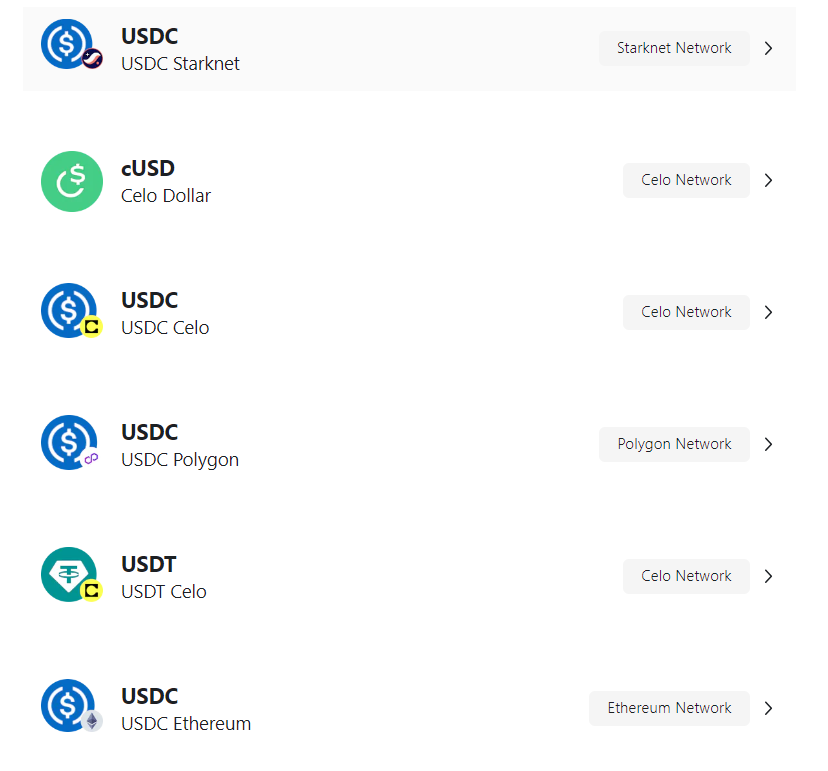

As more solutions are being developed, more blockchains are creating their own standard that accommodates stablecoin transactions. some of the new stablecoins standards include cUSD, USDC celo, USDC starknet. USDC operates on Algorand, Stellar, and other blockchains, providing faster and cheaper transactions

Stablecoins like USDC and USDT represent the same value across different networks, but they are not directly interchangeable.

For example, USDC on Ethereum (ERC20) is not the same as USDC on Tron (TRC2), and moving funds between networks requires bridging or swapping mechanisms. Therefore, if you want to send USDC to someone, ensure you are sending and receiving on the same network. i.e USDC (ERC 20) to USDC (ERC 20)

Look out for the code that is used to represent USDT Tokens on said network e.g ERC-20 for Ethereum, BEP-20 for Binance Smart Chain

How Do I Use Stable Coins

Stablecoins can be used for store profits - if you sold a coin, and you want to buy it back when it is lower, then you can save your profit in stablecoins

Stablecoins are the cheapest means of transferring cryptocurrency - if you want to avoid fees, you can send stablecoins and buy directly from an exchange

le coins?

How Can I purchase Stable Coins?

There are so many platforms that allow you to trade stablecoins with fiat. you can purchase stablecoins from DEXs and CEXs such as Uniswap, Binance, Noones, and Coinbase.

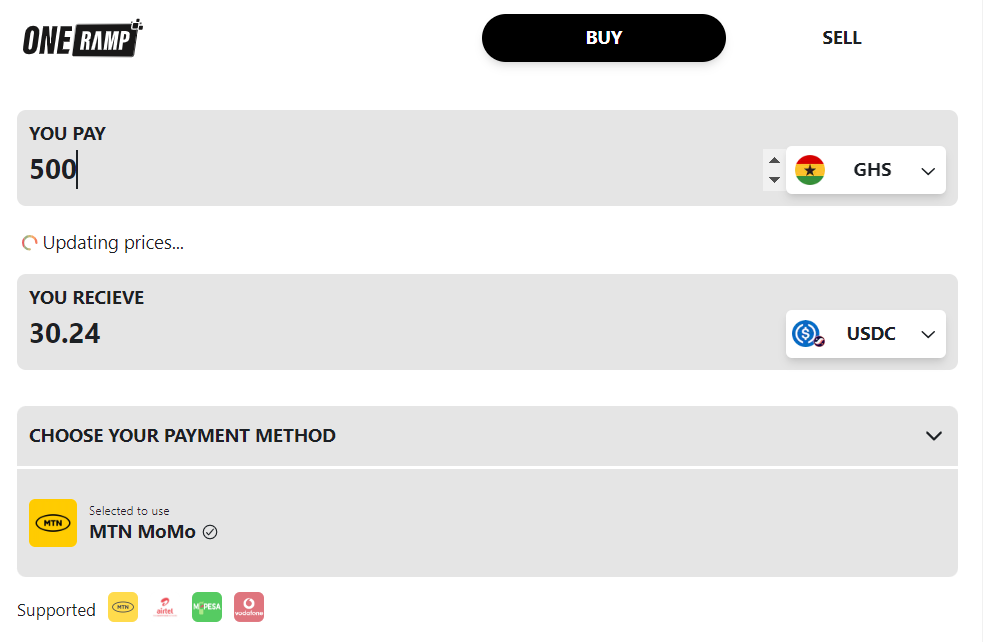

However, if you want to buy quickly without the typical KYC and website registration required from most dApps, I highly recommend One Ramp. One Ramp allows you to purchase stable coins with your fiat money, The best part is how it seamlessly integrates with your mobile money, with a single prompt, you can purchase stable coins and receive it in less than 5 minutes

How does one ramp work?

Do you want to quickly turn your fiat to cryptocurrency and do you want to quickly sell your cryptocurrency for some cash. Then one ramp has the best interface to help you buy and sell your crypto assets. Here is how you do it

visit oneramp.io

Select the coin you want to buy

Ensure you are choosing the coin and the right network

Input the amount of crypto you want to buy

One ramp shows you how much USDC you will be receiving

Connect your wallet, to the website, remember oneramp can not access your crypto without your permission

Alternatively, you can paste your wallet address in the input box

Include your phone number connected to your mobile money

One ramp will prompt a purchase with your mobile money and in less than 5 minutes you will receive your crypto in the designated wallet. Easy right, you can try buying stable coins with as little as 1 dollar, you can also compare the transaction fees of different coins.

Would you be trying any stablecoins? which of these stablecoins do you transact with? What is your preferred network with which you always send your stablecoins

share your thoughts by tweeting at @oneramp.io & @onukogufavour on twitter

#stablecoins #stablecoinsnetwork

Subscribe to my newsletter

Read articles from WildFlower.Eth🌺 directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

WildFlower.Eth🌺

WildFlower.Eth🌺

Favour Onukogu is a Product Manager, UX Writer & now studying to be a smart contract developer. She is passionate about using user behavior to transform products to meet business expectations. She has been endorsed as an Enterprise Design thinking practitioner by IBM and a certified Digital Marketer by Google. She started her career working creating content for several blogs including SheLeadsAfrica & TEDx Port Harcourt. She has worked with several startups including an Agritech, Coworking Hub, Consulting firm, and currently, a crypto exchange platform where she works as a Creative Strategist where she has created solutions to shorten customer response time & curb fraud issues on social media In 2020, she founded BookQuest Africa, a peer-to-peer sharing platform for book lovers, where she guides a team of developers & designers to build the BookQuest Platform Her vision is to help founders and product teams understand problems, validate business models & create Impactful solutions. When she's not working, she is reading a book, watching videos on YouTube (which she plans to product manage), or tweeting furiously on Twitter You can find some of her works here: https://onukogufavour.medium.com/ Check her portfolio: https://sites.google.com/view/favouronukogu-portfolio/home