Mastering Financial Literacy: Understanding Sources of Income and Building Wealth

Parth Chauhan

Parth Chauhan

Introduction

💡 Did you know the average person makes over a million dollars in their lifetime? In this blog, we'll explore different sources of income, the importance of financial literacy, and how to make informed money decisions to achieve financial independence.

What is Financial Literacy?

📚 Financial literacy is the ability to understand and use various financial skills, including personal financial management, budgeting, and investing. Being financially literate helps individuals make informed decisions about earning, spending, saving, borrowing, and investing money.

Sources of Income

💼 Employment Income:

Wages and Salaries: Most people earn money by working for others, receiving wages or salaries.

Benefits: Additional benefits like health insurance, retirement plans, and bonuses are often part of employment income.

🚀 Self-Employment:

- Working for yourself as an entrepreneur or freelancer can be a lucrative source of income.

📈 Investment Income:

Capital Gains: Profits from selling assets like stocks or property.

Interest: Earnings from savings accounts, bonds, or other interest-bearing investments.

Inheritance: Money or assets received from deceased relatives.

Government Transfers: Benefits like social security, unemployment benefits, or other government aid.

Lotteries and Gambling: Though not a reliable source, some people earn money through lotteries or gambling.

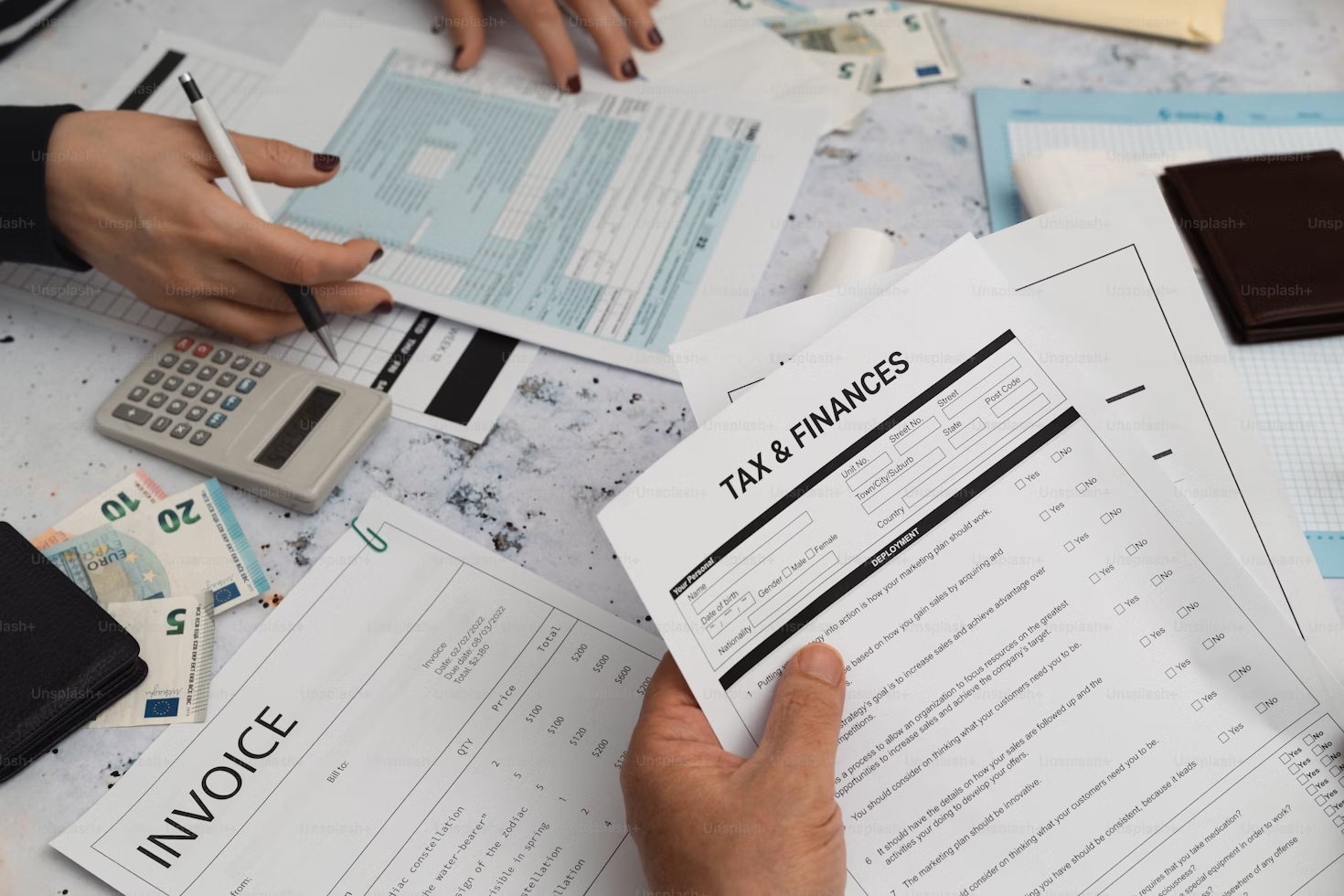

Making Money Decisions

💵 We will all make many money decisions throughout our lives. These include earning money, spending, saving, borrowing, investing, and donating. The first challenge is finding ways to earn money. Obtaining money is often a challenging task. However, even with modest incomes, most people will earn significant amounts over their lifetime.

Importance of Good Money Management

💰 Regardless of income, making good money decisions is crucial. Managing money wisely is often more important for those with limited income to get the most from what they have.

Planning for Financial Independence

🔑 Financial independence means not having to rely on others for the income you need. Start saving and investing early, manage debts wisely, and plan for retirement. For example, if you save $50 a month from age 20, earning 3% interest, you'll have over $56,000 by age 65.

Tips for Financial Literacy and Wealth Building

📝 Educational Resources: Books, websites, and courses on personal finance. 📊 Budgeting Tools: Apps like Mint and YNAB can help track spending and budget effectively. 💸 Investing Basics: Start with simple investments like index funds or retirement accounts.

Conclusion

🌟 Financial literacy and smart money management are crucial for everyone, regardless of income level. Start your journey to financial independence today by improving your financial literacy and making informed money decisions.

Subscribe to my newsletter

Read articles from Parth Chauhan directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Parth Chauhan

Parth Chauhan

I'm Parth Chauhan, a versatile web developer with expertise in both frontend and backend technologies. My passion lies in crafting clean, minimalistic designs and implementing effective branding strategies to create engaging and user-centric experiences. I am proficient in Java, Python, C, C++, SQL, MongoDB, computer networks, OS, NoSQL, and DSA. I thrive on bringing ideas to life by building solutions from scratch and am always excited to explore and master new technologies. My approach is centered around coding with precision and creativity, ensuring each project is both functional and aesthetically pleasing. Currently, I'm open to freelance opportunities and eager to collaborate on new ventures. Let’s connect to discuss how we can work together to enhance your project and achieve outstanding results.