The Good Old Marriage Of Risk And Returns

Om Shukla

Om Shukla

KEY TAKEAWAYS

The article explores the relationship between risk and return, emphasizing that understanding this relationship can enhance fixed-income investment decisions.

It highlights the importance of assessing risk through both quantitative and qualitative factors, with different approaches for equities and fixed-income investments.

The article also explains that higher returns typically come with higher risks, using examples like fixed deposits and corporate bonds to illustrate this point.

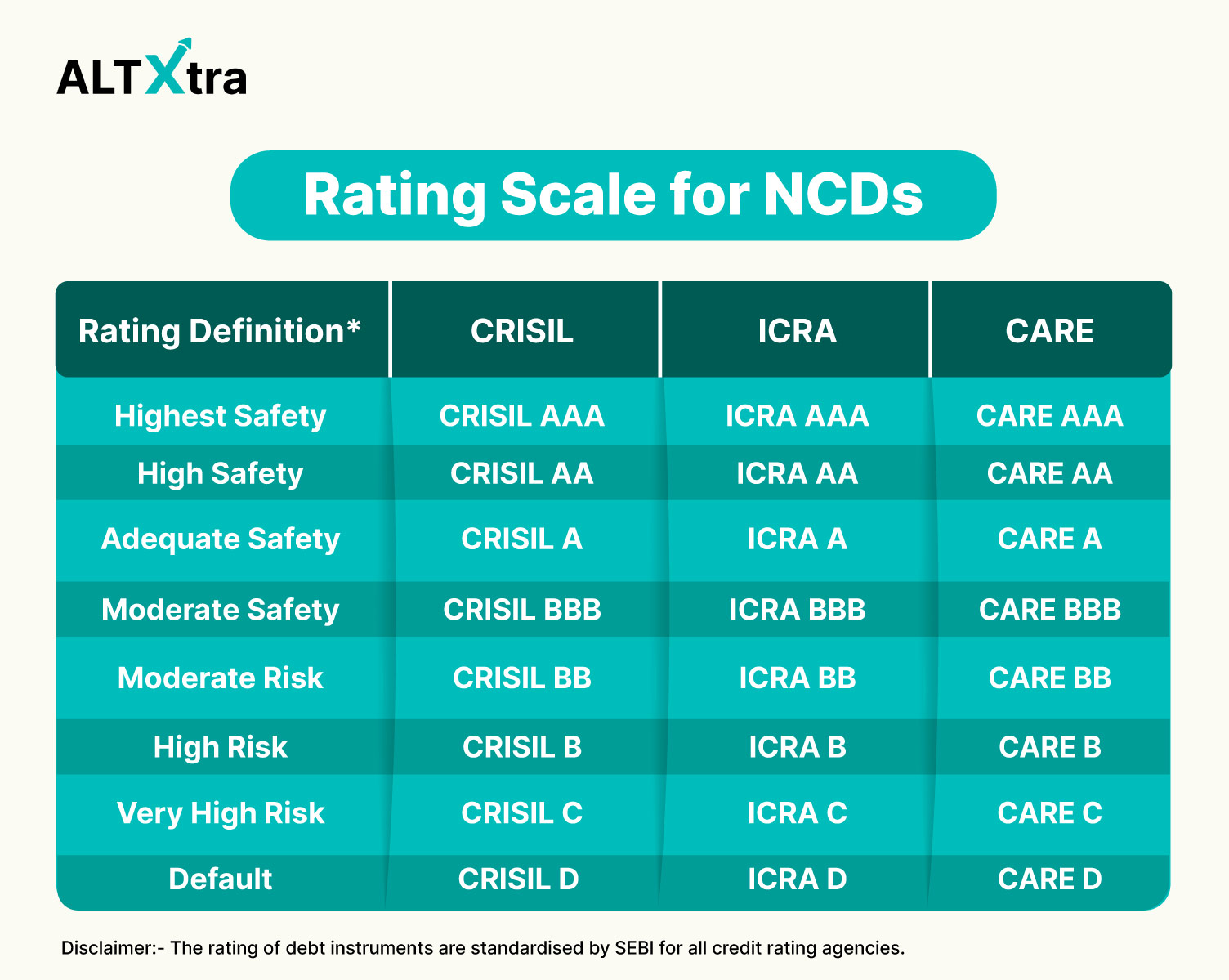

It discusses the role of credit rating agencies in evaluating fixed-income products, noting their importance but also cautioning against relying solely on their ratings.

A comprehensive checklist is provided for assessing risk in fixed-income products, including evaluating the platform, company, existing debt, cash flows, and security structure.

In this ALTXtra article, we are going to touch upon the relationship between risk and return. If you understand this relationship, you can become a better fixed-income investor. Let's start with a short story!

A few months back, an analyst friend of ours walked into the meeting room, and declared, “I guarantee you Tata Motors will double in the upcoming year”.

“What if it doesn’t? Will you pay me the difference?” asked one of the fund managers sitting across the table.

“Good jokes, but we will see who is laughing 12 months down the line”, said the analyst, who had just completed his speed run of reviewing quarterly results of companies. He obviously couldn't assure the return on the stock at that point. But lucky for him though, the stock doubled in the next 8 months.

What did you observe from this rather typical conversation between 2 colleagues?

For starters, It is quite similar to how most products in the market are sold on the promise of:

A) High Returns

B) Guaranteed Returns

A and B are quite common tactics for getting investors to open their wallets and sell them products that may not even return the principal—forget the returns.

And this is where the knowledge of risk and reward comes in, which can aid investors in such situations. So let's get into the main article now.

If you are a video person, you can watch this fun video instead of reading this blog!

How Can You Measure Risk?

For one second, let's forget the returns and focus on the risk. There is no one tool for calculating the risk of an asset class. It is a mix of quantitative and qualitative factors and the methodology changes depending on the asset class.

For instance, in the world of equities, investors typically analyze:

1. Company’s fundamentals, including cash flows, activity and leverage ratios, as well as sales and profit growth.

2. Subsequently, they examine metrics such as Beta or Standard Deviation relative to the underlying index to evaluate volatility.

3. Additionally, they review management discussions and future plans.

This comprehensive analysis is a rigorous and exhaustive process, but it yields significant benefits over the long term.

In the world of fixed income, a company's share price performance is less significant. Instead, the critical concern is whether the issuer can service the debt until maturity. The returns from products like corporate bonds, asset leasing, real estate, and fixed deposits are generally fixed or predictable within a certain range. Therefore, the primary risk involves the solvency of the issuer or the asset.

Think of it this way, in equities, you try to judge how well the company will perform in future, while in fixed-income, you try to figure out whether the company will be alive till the maturity of the product.

Relationship Between Risk & Returns

Every asset class offers a certain range of returns. For example, FDs current return is anywhere between 6-9%, while AAA corporate bonds yield a modest 7-10% interest. These numbers depend upon factors such as interest rates, economic conditions, demand supply, etc.

Let's break it down simply: the higher the returns, the higher the risk. If a company offers a bond yield that's above the usual rate, it probably means there aren't many takers at lower interest rates. This is something to keep in mind.

For instance, take a look at this: an HDFC Bank 3-year FD currently offers a 7% annual return, while a similar FD from Suryoday Bank provides 8.15% per annum. Both FDs are insured by DICGC up to INR 5 Lakh, but there's a noticeable difference of 115 basis points between them, compounded quarterly or half-yearly. Why such a difference, you might wonder? Well, it's pretty straightforward: HDFC is a much larger, more established, and more risk-averse bank compared to Suryoday Bank.

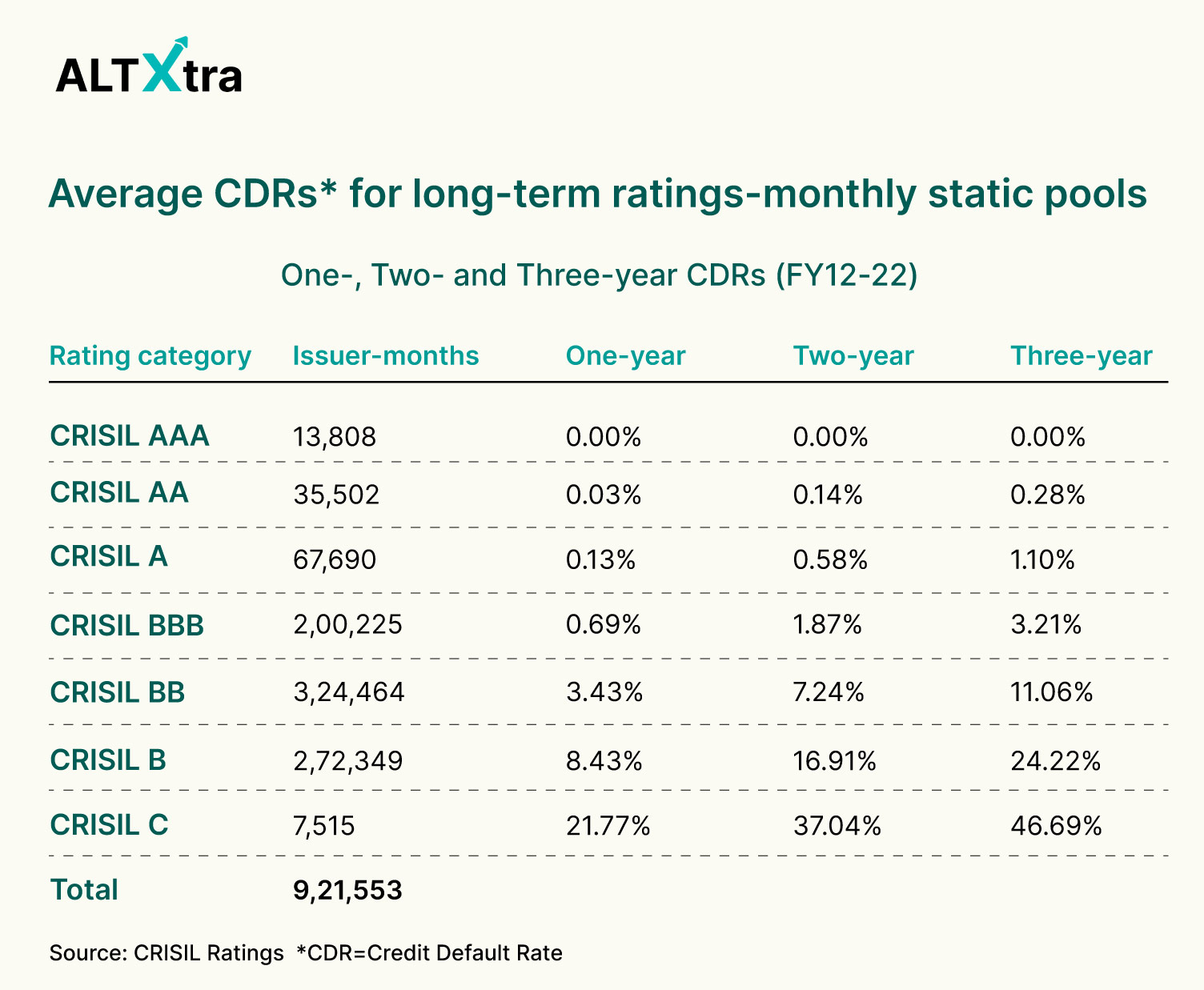

A similar pattern is observed in corporate bonds, which we covered in our last blog, how going down the credit rating increases the default rate of the bonds.

How To Measure Risk and Risk-Adjusted Returns

Now coming to the crux. If a fixed-income or alternative investment product is regulated, most likely it will be rated by a credit rating agency. In these cases, you can look at the average Credit Default Rates (CDRs) for the past to get some comfort on default probabilities.

And if you are a geek, then you can go through the credit rating report, and understand in which areas the rating agency has flagged the issuer. You can see a sample rating report by CareEdge (click here) on a LoanX KrazyBee product brought by Grip Invest.

Often, the warning signs are in the cash flows—profits are recorded, but instead of cash, receivables rise in the balance sheet. Or sales are steady, but inventory keeps growing. A credit report identifies these red flags, showing that an issuer might struggle to pay back its debt.

But if the product is unrated and unregulated, what options do you have?

First and foremost, check the credibility of the platform bringing that deal to you. You can check the founders’ background, their Venture Capitalists (if any), whether they have any risk and compliance heads, what their dispute resolution process is, etc.

The second step is to verify the credibility of the company seeking funds through the platform. Often, these are small startups or SMEs raising money via invoice discounting or Community Subscription Offer Plans (CSOPs), with minimal sales, no proven market fit, or a solid team. In fact, sometimes these companies don't even fully grasp the financial transactions they are involved in. Clearly, these cases are challenging to assess, and it's the responsibility of the investment platform to conduct thorough due diligence. We've observed numerous defaults recently in this category, typically by startups struggling to secure additional funding.

All these risks tend to reduce when the product is backed by assets, rated by an external agency, involves trustees, etc. Regulated OBPP platforms fall into this category and consciously reduce the majority of the risks to investors.

Also, if the periodic returns generated by the product comprise interest and principal repayments, the risk goes down significantly compared to a product that repays only periodic interest and the principal at the end of maturity.

Other risks in fixed-income include liquidity in the secondary market and changes in realizable value there. These risks hinge on liquidity and demand-supply dynamics, which are currently unpredictable. In equities, straightforward formulas like the Sharpe ratio, Treynor ratio, and Jensen Alpha are used to assess market-risk-adjusted returns.

For fixed-income, we don't really have straightforward tools like those used in equities. You can dive into things like yield curves and the modified duration of fixed-income securities to grasp how yields or the value of bonds change with interest rate cycles. However, for a retail investor, this might be a bit too much.

The Other Side of Credit Rating Agencies (CRAs)

While Credit Rating is one of the most important metrics in evaluating a fixed-income product as it also sets a benchmark for pricing the risk in the bond, the CRAs have also made mistakes in the past.

The CRA business model is simple, but a bit skewed. The issuer of security pays them to rate their instruments, as SEBI mandates that all issues of more than INR 5 Cr must be rated by a CRA. If you have seen movies such as The Big Short, you would know that this business model was one of the primary reasons behind 2008 crisis.

The rating agencies prepare a long report that contains the majority of bonds, commercial papers (CPs), and bank loans of a company, and rates them according to their ability to repay the debt without delays and defaults. Their reports give us a fair idea of the solvency of the company, and they even mention the key risks that may hurt the business.

If you look at long-term data, with a large sample size, CRAs have delivered fairly accurate ratings. But their occasional mistakes (which have been very rare in reality) have also become very costly for investors.

For instance, take the case of IL&FS. The company first defaulted on their Commercial Paper (CP) repayment in June 2018, even though they still held a AAA rating as late as August of that year. Back in 2015, the RBI had already flagged issues with IL&FS. By 2017, it was clear there were significant problems, like a lack of liquidity in bond markets and a huge mismatch in assets and liabilities. Despite these warning signs, the CRAs overlooked the company’s cash flows and balance sheet issues and continued to give it the highest rating.

When the situation worsened, the CRAs quickly downgraded the ratings from AAA to D and even stopped covering them. This kind of drastic change is almost typical in the industry and has been seen repeatedly. Similar patterns occurred with major defaults in the past, like with Bata and tractor company Escorts in the 90s, and more recently with Ricoh India, Amtek Auto, and DHFL.

This goes to show that while credit rating agencies usually give us a decent overview of the financial products we're considering, they shouldn't be relied on without question. They depend on two main factors: funding from the issuers they rate and the financial data those issuers provide. This can sometimes lead to less accurate ratings.

Therefore, it's wise not to take these credit ratings at face value without doing some homework of your own.

Checklist to Assess Risk in Fixed Income Products

Okay if we now have to take the credit rating agencies’ work also cautiously, what other pointers are there to check? Well consider this as a comprehensive checklist:

Visit the platform, check the founding team and management, and check whether they have a dedicated compliance officer who can handle disputes if necessary.

Check the profile of the company raising debt, check their management, and the sector they are in.

Check existing debt on the balance sheet, upcoming repayments, cash in hand and the history of debt repayment. This can all be checked in the Information Memorandum document, which is generally issued with every bond.

Check the cashflows (if available). This is the key. Check if the profits translate into operating net positive cash flows.

Verify the security structure for the debt raised. This can take the form of cash collateralization, asset cover, post-dated cheques (PDCs), personal guarantees, etc. Basically, ask yourself, how am I protected if the company defaults?

Check which other co-investors are investing in that deal. This gives you confidence that other big players have done their due diligence and are happy with it.

The repayment track record for the company raising debt can also be checked via the Information Memo or rating reports available for that issuer.

Conclusion

As we wrap up, I'll repeat my favorite saying: "High Returns Mean High Risk." No one will offer you more than a government bond return, which is about 7%, without some risk involved. Credit Rating Agencies do a decent job of pointing out these risks in their reports, but you should still review their ratings and form your own opinions. Besides that, the other checks we've discussed can help guide you in your fixed-income investing journey.

We hope you liked this informative piece and it helps you in your investing journey, stay tuned for more articles on ALTXtra and do reach out to Grip Invest & ALT Investor if you have any specific questions on this piece.

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/ or default in payment. The investor is requested to read all the offer related documents carefully and to take into consideration all the risk factors before subscribing to debt instruments.

This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities.

Neither ALT Investor or its associates/associated entities, assigns or affiliates takes or accepts any liability for consequences of any actions taken based on the information provided.

Subscribe to my newsletter

Read articles from Om Shukla directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by