How DePIN and RWA Tokenization are Revolutionizing Digital Asset Transactions

Noor

Noor

Introduction

The blockchain sector is leading the charge in technological innovation, constantly breaking new ground to merge the physical and digital realms in ways never seen before. At the heart of this transformation are two pivotal elements: Real World Assets (RWA) and Decentralized Physical Infrastructure Networks (DePIN). This article explores the journey, importance, and future potential of RWA and DePIN, weaving the narrative in an engaging, story-telling style that appeals to both tech enthusiasts and those less familiar with the technology.

The Birth of Real World Assets (RWA) on Blockchain

What are RWAs?

Real World Assets (RWA) encompass tangible assets like real estate, commodities, and art, which are tokenized and represented on a blockchain. This groundbreaking process involves creating digital tokens that signify ownership or a stake in these physical assets, making them easily tradable and accessible on the blockchain.

The Spark of Innovation

The idea of tokenizing real world assets first emerged in the early days of blockchain technology. Visionaries envisioned a future where ownership of high-value assets could be divided into smaller, tradable units, similar to how stocks represent shares of a company. This concept promised to revolutionize the way assets were bought, sold, and owned, making markets more accessible and efficient.

Historical Growth and Adoption

2012-2013: The initial concept of using blockchain beyond cryptocurrencies starts to take shape, but RWAs remain a theoretical idea.

2017: The ICO boom brings significant attention to blockchain's potential, including the tokenization of real world assets. Ethereum's smart contract capabilities provide a foundation for these innovations.

2018-2019: Companies like RealT and Harbor begin offering tokenized real estate, marking some of the first practical implementations of RWA.

2020-Present: The adoption of RWA accelerates with projects like Centrifuge and Tinlake, which focus on bringing real world assets onto the blockchain, allowing for new forms of collateral and liquidity in decentralized finance (DeFi).

Significance and Benefits

Liquidity: Tokenization allows for fractional ownership, making it easier to buy and sell portions of an asset, thereby increasing liquidity. For instance, RealT enables investors to purchase fractional shares of real estate properties.

Accessibility: Tokenizing high-value assets democratizes investment opportunities, enabling a broader range of investors to participate in markets that were previously inaccessible.

Transparency and Security: Blockchain's immutable ledger ensures transparent and secure transactions, reducing the risk of fraud and enhancing trust among investors. A report by Deloitte projects that the global tokenized market could reach $24 trillion by 2027.

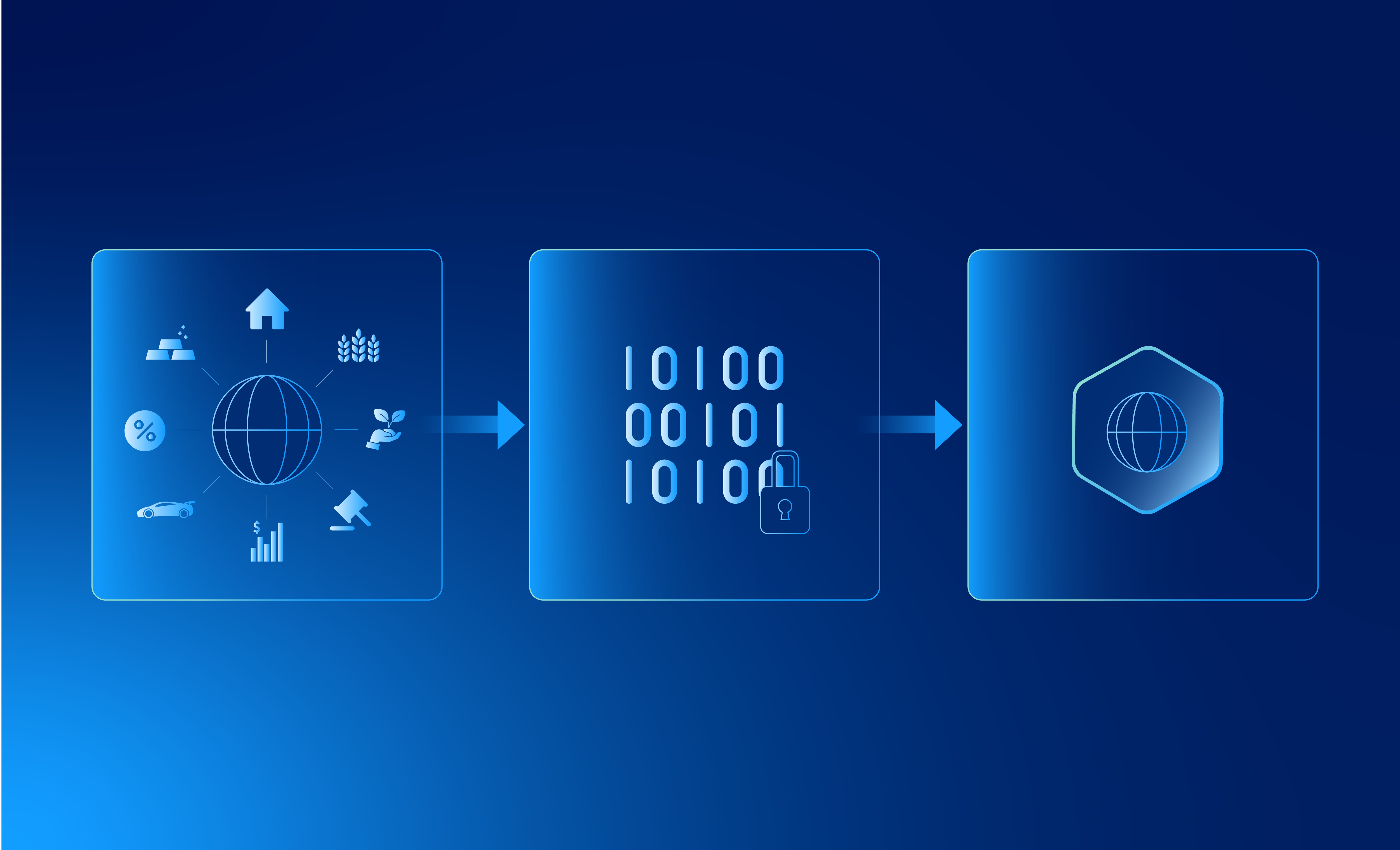

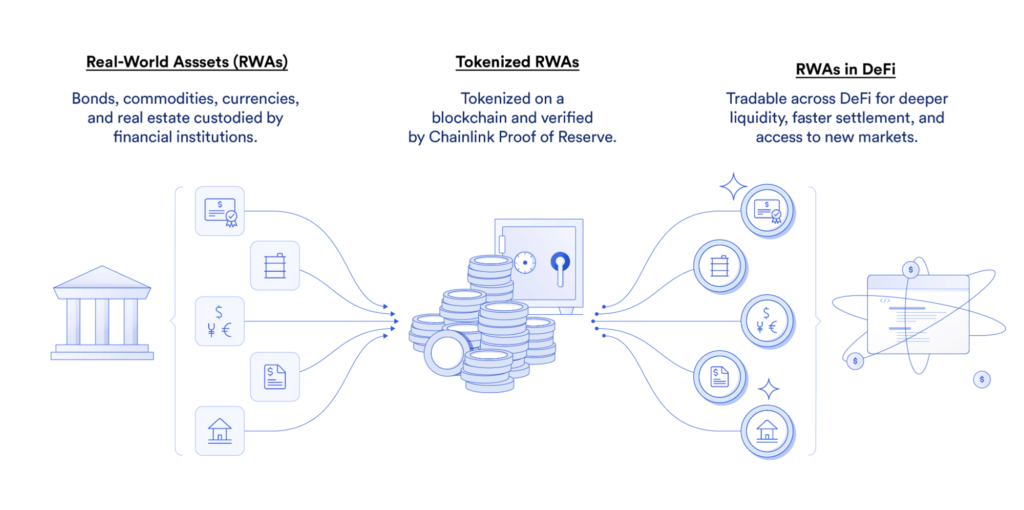

RWA Tokenization

Real World Asset (RWA) tokenization involves creating digital tokens that signify ownership of physical assets. This process allows these assets to be traded on blockchain platforms, enhancing liquidity and providing access to a broader range of investors.

Technical Foundations

RWA tokenization leverages blockchain technology to ensure transparency, security, and immutability of transactions. The process typically involves the following steps:

Asset Digitization: The physical asset is digitized, creating a digital token that represents ownership.

Smart Contracts: Smart contracts are used to manage the ownership and transfer of these tokens.

Compliance: Regulatory compliance is integrated into the smart contracts to ensure that all transactions adhere to relevant laws and regulations.

Key Technical Elements:

Digital Tokens: These represent fractional ownership of the physical asset, allowing for greater liquidity and easier transferability.

Blockchain Ledger: Ensures all transactions are transparent, secure, and immutable.

Regulatory Compliance: Smart contracts can be programmed to include compliance checks, ensuring that all transactions meet legal requirements.

Growth and Adoption

The market for RWA tokenization has been growing steadily. According to a report by Deloitte, the tokenization of real estate alone could unlock $16 trillion in value by 2030. Other sectors, such as commodities and art, are also experiencing increased interest in tokenization.

Numbers and Statistics:

Real Estate Market: Potential to unlock $16 trillion in value by 2030.

Funding: Significant investment is pouring into RWA tokenization projects, with billions of dollars raised in funding rounds.

The Rise of Decentralized Physical Infrastructure Networks (DePIN)

What is DePIN?

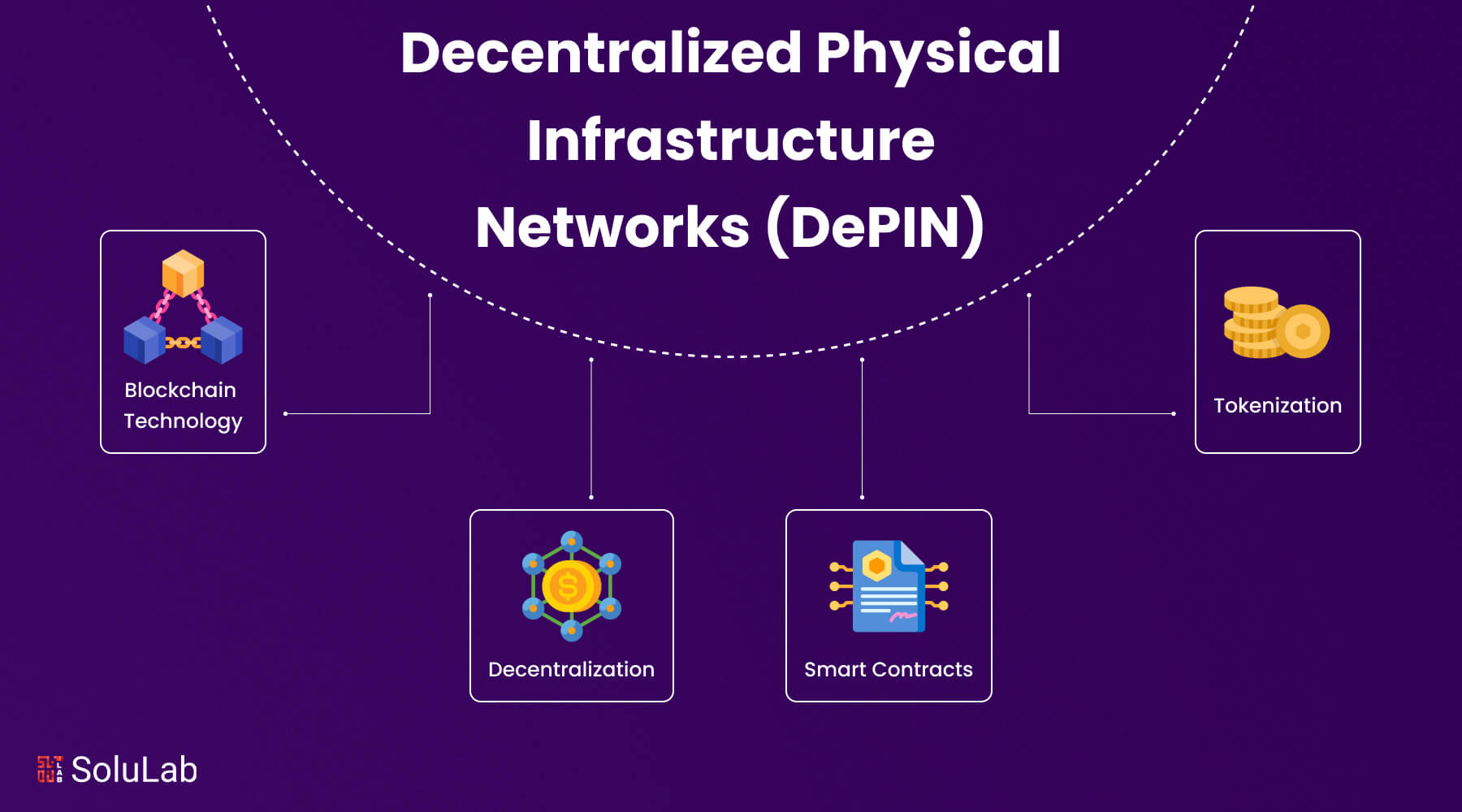

Decentralized Physical Infrastructure Networks (DePINs) are networks that leverage decentralized blockchain technology to manage and optimize physical infrastructure. This concept extends beyond traditional digital assets, incorporating tangible assets such as telecommunications networks, transportation systems, real estate, renewable energy sources, and even supply chain logistics. The goal of DePINs is to create a more efficient, transparent, and secure way to manage these physical assets.

A New Frontier

The concept of DePIN emerged as blockchain enthusiasts began to realize the potential of decentralizing not just digital assets but also physical infrastructure. The aim was to create a more efficient, resilient, and equitable system by distributing control and ownership across a decentralized network.

Technical Foundations

DePINs operate on blockchain protocols, using smart contracts to automate and secure transactions involving physical assets. These networks can tokenize physical assets, converting them into digital tokens that can be traded on the blockchain. This tokenization process involves creating a digital representation of a physical asset, which can then be bought, sold, or traded like any other digital asset.

Key Technical Elements:

Smart Contracts: These are self-executing contracts with the terms of the agreement directly written into code. They facilitate, verify, and enforce the negotiation and performance of a contract, eliminating the need for intermediaries.

Tokenization: The process of converting rights to an asset into a digital token on a blockchain. This allows for fractional ownership and easier transferability of physical assets.

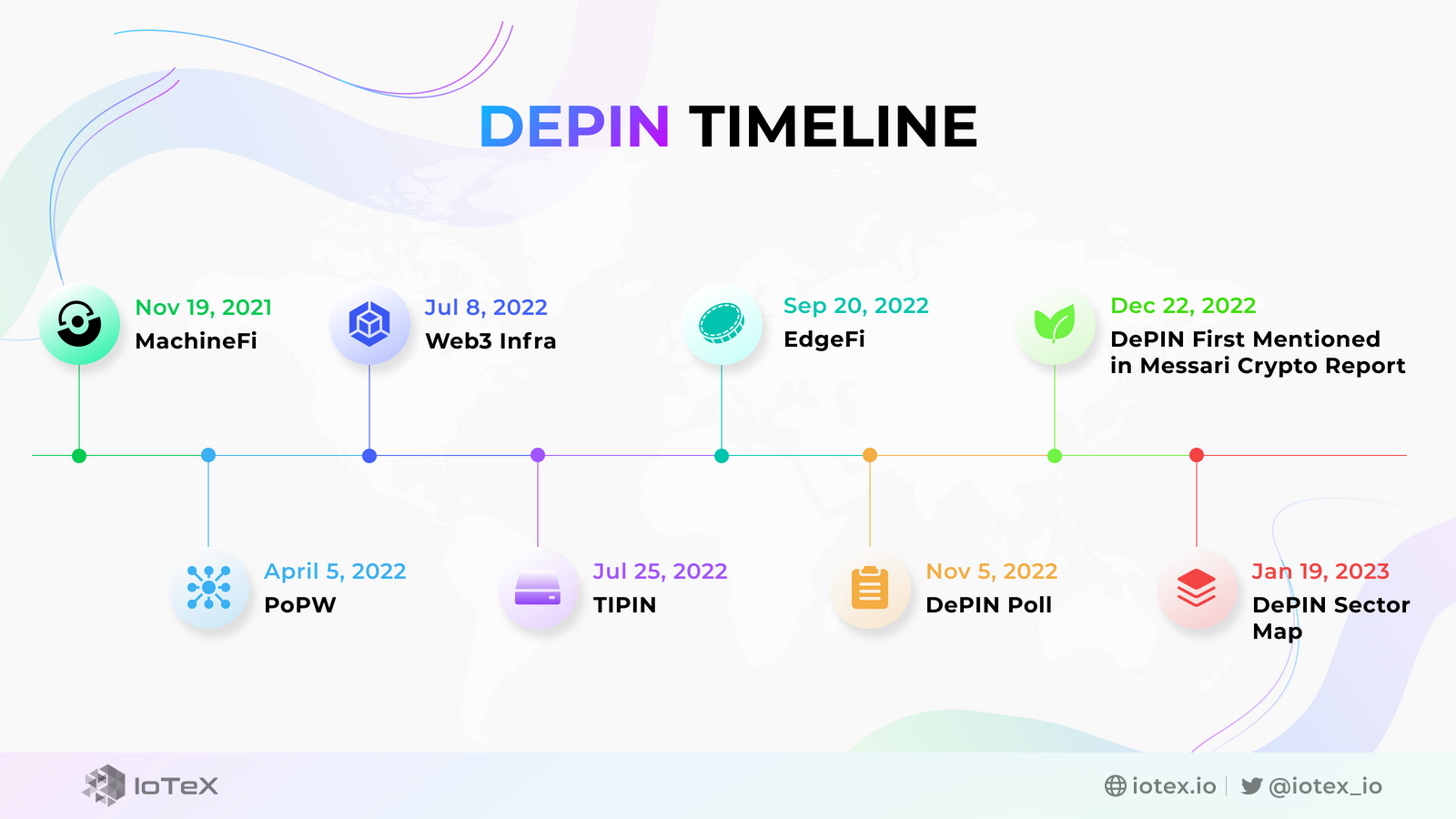

Historical Growth and Adoption

Early 2010s: The idea of decentralizing physical infrastructure begins to surface, but practical implementations are limited.

2017-2018: Initial projects like Grid+ and Power Ledger start exploring blockchain applications in the energy sector, laying the groundwork for DePIN.

2019-2020: Helium launches its decentralized wireless network, utilizing blockchain to manage and incentivize the operation of network hotspots. Helium has grown to over 25,000 active hotspots worldwide.

2021-Present: Projects like Filecoin and Arweave focus on decentralized storage solutions, while Helium continues to expand its decentralized IoT network.

Technical Milestones

The DePIN model has experienced substantial growth over the past few years. For instance, Helium Network, a pioneer in this space, has significantly expanded its decentralized wireless infrastructure. As of 2024, Helium's network boasts over 900,000 hotspots globally, showcasing the scalability and potential of DePINs.

Numbers and Statistics:

Helium Network: Over 900,000 hotspots as of 2024.

Investment: DePIN projects have attracted significant investment, with hundreds of millions of dollars raised in funding rounds to support development and expansion.

Significance and Benefits

Decentralization: By distributing control and ownership, DePIN reduces the risk of centralized power and promotes fairer access to infrastructure services.

Efficiency and Cost Reduction: Blockchain's transparency and automation capabilities streamline operations, leading to reduced costs and increased efficiency.

Enhanced Security: Decentralized networks are less vulnerable to single points of failure, making infrastructure more resilient to attacks and disruptions.

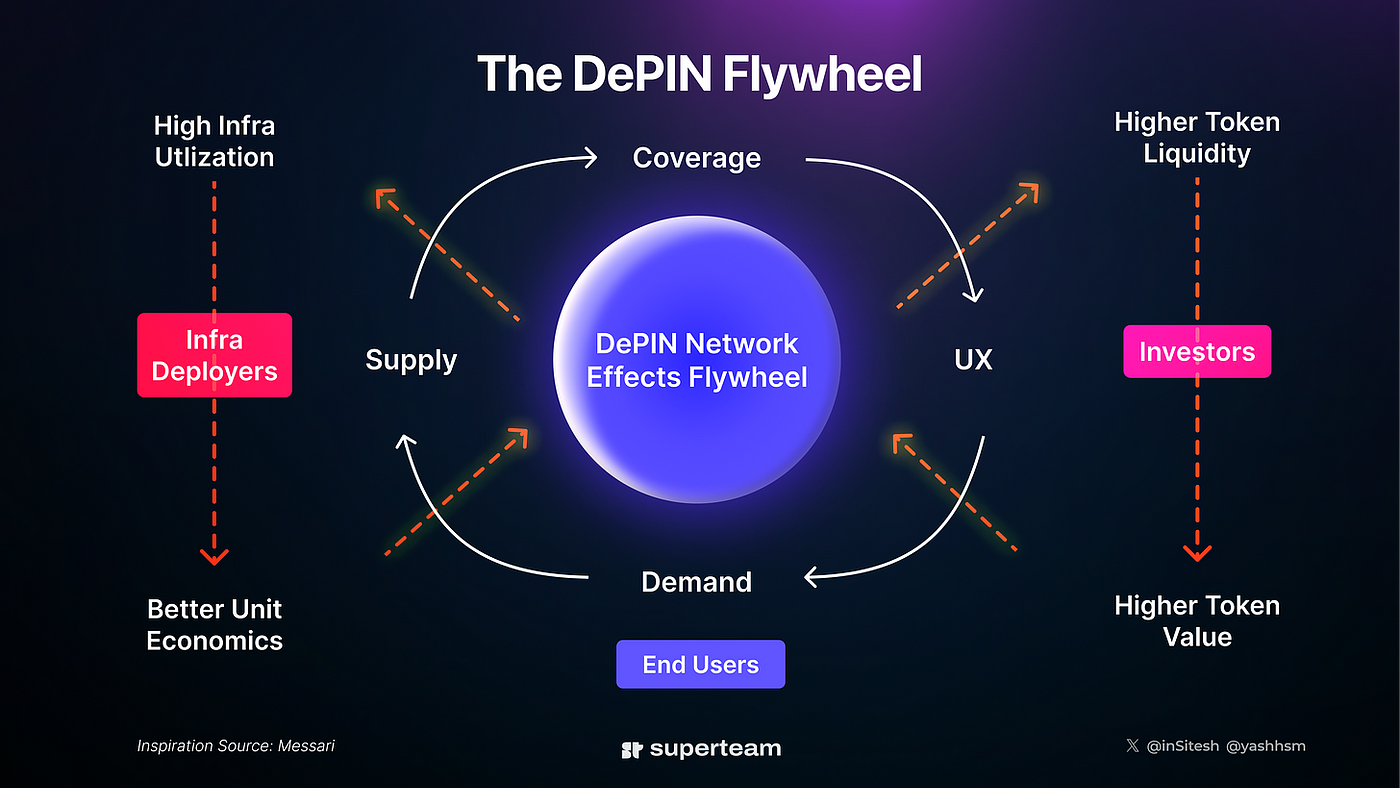

The DePIN Flywheel Concept

A critical concept in understanding the potential of DePINs is the DePIN flywheel. This concept describes a self-reinforcing cycle that propels the growth and success of DePIN projects.

DePIN Flywheel Components:

User Adoption: As more users join the network, the value of the network increases.

Infrastructure Expansion: Increased value drives further investment in physical infrastructure, enhancing the network.

Token Incentives: Token incentives attract more users and infrastructure providers, fueling further growth.

Network Effect: The growing network attracts even more users and investment, creating a virtuous cycle of growth.

The flywheel effect ensures that as DePIN networks grow, they become more valuable and attractive to new users and investors, leading to exponential growth and sustainability.

Examples and Impact:

Helium Network: The DePIN flywheel has been evident in Helium's growth, where increased hotspot deployment has driven more users and investment, further expanding the network.

Investment: The flywheel effect has attracted significant investment, with projects like Helium raising over $200 million in funding rounds.

The Synergy of RWA and DePIN

Integration and Mutual Benefits

The integration of RWA and DePIN can create a robust ecosystem where physical and digital assets coexist and enhance each other. For instance, tokenized real estate (RWA) can benefit from decentralized energy grids (DePIN) for sustainable power management. Similarly, decentralized transportation networks can streamline the logistics and management of tokenized commodities.

Case Studies and Real-World Examples

Real Estate and Energy: Tokenized properties managed through blockchain can integrate with decentralized energy grids, optimizing energy consumption and costs while promoting sustainability. For example, Power Ledger's platform enables peer-to-peer energy trading using blockchain.

Supply Chain and Logistics: Tokenized commodities can be tracked and managed through decentralized logistics networks, ensuring transparency and efficiency in supply chain operations.

Telecommunications: Decentralized networks like Helium can support smart city initiatives by providing reliable and cost-effective connectivity, enhancing the utility of tokenized assets within urban environments.

Future Prospects and Challenges

Future Prospects

The future of RWA and DePIN is promising, with numerous opportunities for innovation and growth:

Widespread Adoption: As blockchain technology matures, more industries are likely to explore RWA and DePIN applications, driving broader adoption. For instance, the total value of tokenized real estate is projected to surpass $1.4 trillion by 2025.

Increased Tokenization: More sectors, such as renewable energy and supply chain logistics, are likely to explore tokenization.

Technological Advancements: Ongoing advancements in blockchain technology, including enhanced scalability and interoperability, will significantly boost the capabilities of RWA and DePIN, enabling more efficient and secure tokenization processes.

Regulatory Support: Supportive regulatory frameworks will play a crucial role in facilitating the growth and acceptance of RWA and DePIN. Countries like Switzerland and Singapore are already developing favorable regulations for tokenized assets.

Challenges

While the potential of DePIN and RWA tokenization is immense, several challenges need to be addressed for widespread adoption:

Regulatory Uncertainty: The regulatory landscape for blockchain and tokenized assets is still evolving, leading to uncertainty for businesses and investors. Ensuring compliance with local and international regulations is essential. According to a PwC report, regulatory clarity is vital for the widespread adoption of tokenized assets.

Technical Complexity: Managing the technical aspects of integrating physical assets with blockchain technology can be complex, requiring significant expertise and resources to implement and manage RWA and DePIN solutions effectively.

Market Acceptance: Educating investors and users about the benefits and risks of DePIN and RWA tokenization is crucial for achieving widespread market acceptance and trust. Stakeholders need to be thoroughly informed about the advantages and security measures of these technologies to build confidence and drive adoption.

Conclusion

DePIN and RWA tokenization are pioneering advancements in the blockchain sector, offering transformative potential across various industries. By seamlessly integrating physical and digital assets, these technologies enhance liquidity, accessibility, and efficiency while fostering decentralization and transparency. The growth of these sectors is propelled by blockchain's technical innovations, the strategic deployment of smart contracts, and the self-reinforcing DePIN flywheel. As these trends progress, they promise to create more efficient, transparent, and inclusive financial systems. The evolving blockchain ecosystem will see the synergy between RWA and DePIN playing a pivotal role in shaping the future of decentralized finance and infrastructure management.

Useful Resources:

RealT: A platform offering tokenized real estate.

Centrifuge: Bringing real-world assets onto the blockchain.

Helium: A decentralized wireless network.

Filecoin: Decentralized storage solutions.

Arweave: Decentralized data storage network.

Power Ledger: Blockchain applications in the energy sector.

Deloitte Report: The future of asset tokenization.

Deloitte Report: Real Estate Tokenization

PwC Report: The impact of regulatory clarity on tokenized assets.

In the rapidly evolving blockchain sector, two trends are gaining significant traction: Decentralized Physical Infrastructure Networks (DePIN) and Real World Asset (RWA) tokenization. Both are set to revolutionize digital asset transactions by bridging the gap between physical assets and blockchain technology. This article delves into the intricacies of DePIN and RWA tokenization, exploring their growth, technical foundations, and impact on the digital asset landscape.

Subscribe to my newsletter

Read articles from Noor directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by