Uniswap : Pioneering Decentralized Trading

Abhinav Verma

Abhinav VermaTable of contents

Uniswap is one of the most influential and widely used decentralized exchanges (DEXs) in the cryptocurrency space. It has revolutionized the way digital assets are traded by leveraging the power of blockchain technology and decentralized finance (DeFi) principles.

Introduction

Uniswap is a decentralized exchange protocol built on the Ethereum blockchain. Unlike traditional exchanges that rely on order books to match buyers and sellers, Uniswap utilizes an automated market maker (AMM) model. This model allows users to trade cryptocurrencies directly from their wallets without the need for intermediaries or centralized authorities.

Origins and Evolution

Uniswap was created by Hayden Adams and launched in November 2018. The protocol was inspired by Vitalik Buterin's concept of a decentralized exchange and has since undergone significant upgrades. Uniswap V2 launched in May 2020, introduced numerous improvements, including ERC-20 token pairs and flash swaps. Uniswap V3 released in May 2021, brought even more innovations, such as concentrated liquidity and multiple fee tiers.

Key Features of Uniswap

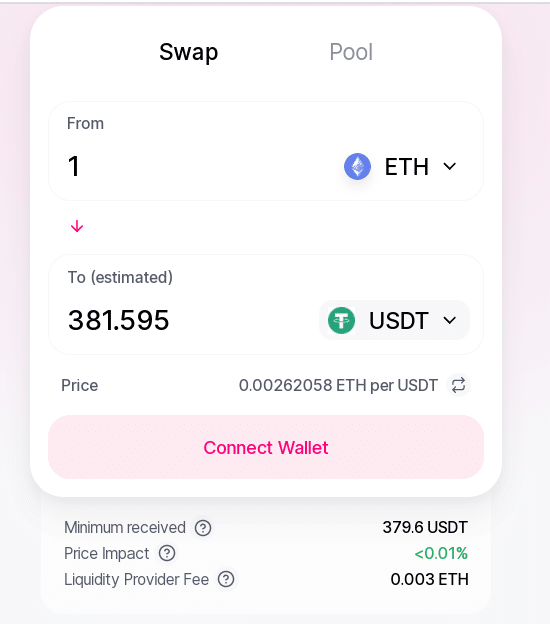

Automated Market Maker (AMM): The core innovation of Uniswap is its AMM model, which replaces traditional order books with liquidity pools. Each pool contains two tokens, and users can trade against these pools. Prices are determined by a constant product formula (x + y = k), where x and y represent the quantities of the two tokens, and k is a constant. This formula ensures that the product of the token quantities remains unchanged after each trade, maintaining liquidity.

Liquidity Pools: Liquidity pools are the backbone of Uniswap's AMM model. Users, known as liquidity providers (LPs), contribute equal values of two tokens to a pool, earning fees from trades made against their liquidity. These fees are distributed proportionally to all LPs in the pool. By providing liquidity, users not only earn passive income but also contribute to the overall liquidity and efficiency of the exchange.

Conclusion

Uniswap has established itself as a pioneer in the decentralized exchange space, offering a secure, transparent, and efficient platform for trading cryptocurrencies. Its innovative AMM model, permissionless nature, and continuous development have made it a cornerstone of the DeFi ecosystem. While challenges such as impermanent loss, scalability, regulatory uncertainty, and competition exist, Uniswap's commitment to innovation and decentralization positions it as a key player in the future of decentralized finance. As the DeFi landscape evolves, Uniswap will likely continue to play a pivotal role in shaping the future of digital asset trading.

Subscribe to my newsletter

Read articles from Abhinav Verma directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by