The Role of Fractionalisation In India's Financial Growth

Yash Roongta

Yash Roongta

KEY TAKEAWAYS

Fractionalisation allows retail investors to participate in high-value investments by breaking down large projects into smaller, more affordable units, promoting financial inclusion and diversification.

The concept is not new, with historical examples like Reliance's IPO in 1977, which allowed small investors to buy shares in a large company.

SEBI has supported fractionalisation through measures like mutual funds, REITs, and reducing ticket sizes for corporate bonds, enhancing retail participation in various asset classes.

Securitized Debt Instruments (SDIs) are a recent development in fractionalisation, allowing investors to buy into pooled assets like loans with smaller investments.

Fractionalisation benefits include affordability, diversification, and increased liquidity, making the financial ecosystem more accessible and robust for retail investors.

In a casual conversation with a friend last week, he commented "These Adanis, Ambanis know very well on how to make their money work for them". Rich folks usually have an appetite to invest large capital in mega projects like airports, seaports, movie production houses and get a great return on their investments.

The thought resonated with me, because I have also wanted to invest in these mega projects and get a good risk adjusted return over my investments, but I don't have INR 100 Crores of capital like Mr. Ambani and Mr. Adani would do.

But wait, what if the larger projects like an airport/seaport can be Fractionalised into small pieces so multiple investors like you and me can invest in the project? That would probably give you an entry point right?

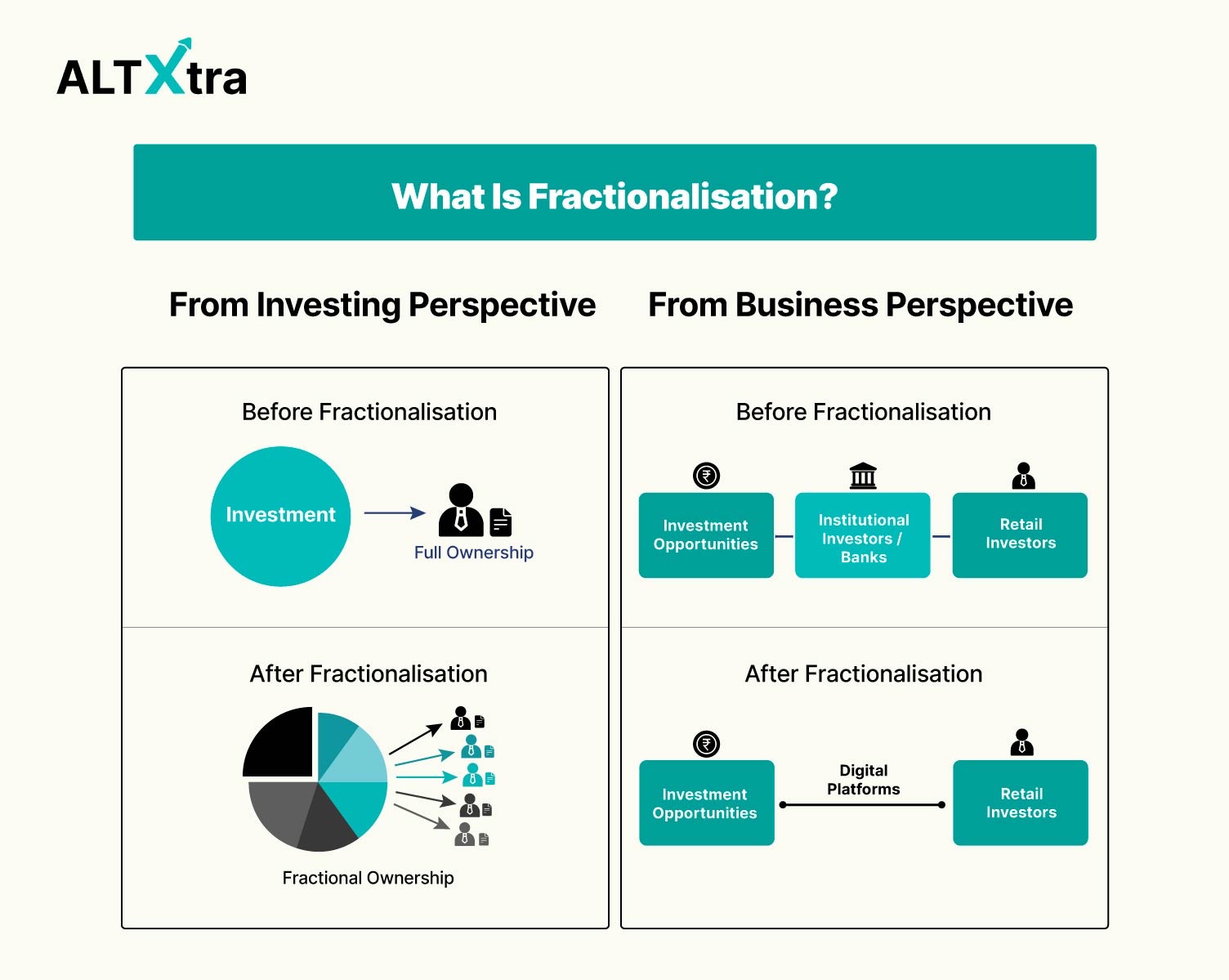

Fractionalisation (also called as Sachetisation) lets investors dip their toes in high-ticket-size assets that were earlier inaccessible or exclusive. To put it simply, it's reducing the ticket size of existing large value investments so an average retail investor can participate.

If you are a video person, you can watch this video instead of reading this blog!

Fractional Investing Is Not New

The robust equity markets that we know of now had to make its beginning somewhere. The first Initial Public Offering (IPO) was done by Reliance Textile Industries in 1977, around 15 years before SEBI was even formed.

An IPO allowed a large company like Reliance to be fractionalised into 2.8 million smaller units of INR 10 each. This allowed every small investor to participate in the growth story of the company and this allowed Reliance to raise some money to expand its business or to give exit to some large investors. Needless to say, if you had invested in those shares at the time and have kept it till now, you would have made a decent wealth for yourself.

Fractionalisation Is More Prevalent Than We Think

SEBI has implemented several measures in support of fractionalisation. These measures are aimed at fostering more robust and inclusive financial system while safeguarding investors. Lowering ticket sizes by the way of fractionalistion has worked very well for SEBI to promote wider retail participation. Lets look at some examples:

Mutual Funds

Fractionalisation has not only disrupted the equity markets, it also gave rise to Mutual Funds where an investor would invest whatever small sums of money they had in a pool of assets which would offer them better diversification. So investors don't have to worry about investing in different stocks individually, instead, the regulator allows all those stocks to be put in one basket, allowing fractionalisation of that basket which can ultimately be invested in by a retail participant.

Real Estate Investment Trusts (REITs)

Indians love owning real estate for various reasons, but it has always been tough for the average retail investor to buy land or property in Tier-1 or Tier-2 cities due to high upfront capital. SEBI introduced REIT regulations in September 2014, allowing real estate entities with a portfolio of at least INR 500 Crore in income-generating assets to be listed on the stock exchange as a REIT for as low as INR 1000.

SEBI also released SM REIT regulation on 7th March 2024, which aims to regulate the Fractional Ownership Platforms. The minimum ticket size in this model is being reduced from INR 25 Lakhs to INR 10 Lakhs and if the market grows, SEBI may fractionalise it even further to encourage retail investors.

Corporate Bonds

On 30th April 2024, SEBI made a groundbreaking move to encourage wider retail participation in the corporate bond markets. The face value of bonds was reduced from INR 1 Lakh to just INR 10,000. This will apply to all listed Non Convertible Debentures that are privately placed with the appointment of a Merchant Banker.

Securitized Debt Instruments (SDIs)

The newest entrant in the fractionalisation space, SDIs are also disrupting the retail investing market by pooling in assets like invoice receivables, lease rentals, personal loans in a separate trust and then creating an asset which can be purchased by an investor for as low as INR 1 Lakh. To give an example:

You like NBFC XYZ because they have a great promoter and you believe they have a strong loan book. You want to invest in the loan book directly, but the NBFC requires a minimum investment of INR 10 Crore. An intermediary like Grip Invest can step in, structure the transaction by picking up the loans, and sell those assets in INR 1 Lakh units. You will get interest and principal payments from the asset based on how the loan book performs.

There are many more areas like Digital Gold, Exchange Traded Funds (ETFs) which have increased retail participation in the asset classes.

Benefits of Fractionalisation

Affordability: Fractionalisation reduces the barrier to entry for an investor especially for unlisted assets where the ticket sizes can be large. More retail investors can afford to enter into the market with smaller ticket sizes.

Diversification: If more different types of assets can get fractionalised, investors can have a piece of everything and build a diverse portfolio.

Liquidity: There is more volume in assets when the ticket size is reduced as its easier for other investors as well to enter and exit from small size assets. Imagine how easy it can be to sell a INR 10 Lakh fractional ownership in a commercial property instead of selling the INR 50 Crore property in full.

Conclusion

In conclusion, fractionalisation has significantly democratized the investment landscape in India, allowing retail investors to access high-value assets that were previously out of reach. By breaking down large investments into smaller, more affordable units, fractionalisation fosters greater financial inclusion, diversification, and liquidity. As regulatory bodies like SEBI continue to support and refine these models, the potential for wider participation and growth in various asset classes will only increase, making the financial ecosystem more robust and inclusive for everyone.

We hope you liked this informative piece and it helps you in your investing journey. Stay tuned for more articles on ALTXtra and do reach out to Grip Invest & ALT Investor if you have any specific questions about this piece.

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/ or default in payment. The investor is requested to read all the offer related documents carefully and to take into consideration all the risk factors before subscribing to debt instruments.

This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities.

Neither ALT Investor or its associates/associated entities, assigns or affiliates takes or accepts any liability for consequences of any actions taken based on the information provided.

Subscribe to my newsletter

Read articles from Yash Roongta directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Yash Roongta

Yash Roongta

I am a CFA and FRM Charterholder. I used to work as a Portfolio Implementation Manager for Aviva Investors managing £3bn+in Assets Under Management in the UK. I am very passionate about educating people on how they can make more money with their existing investments sustainably.