How To Invest In High-Growth Companies Before They Go Public

Yash Roongta

Yash Roongta

KEY TAKEAWAYS

Investing in high-growth companies before they go public can be done through private equity investments or by purchasing unlisted/pre-IPO shares, which are accessible to retail investors via platforms like InCred Money.

Unlisted shares offer benefits such as early access to promising companies, portfolio diversification, potentially lower valuations, and lower investment thresholds compared to private equity.

Platforms source unlisted shares from founders, institutional investors, and employees, providing liquidity options for these stakeholders.

The process of buying unlisted shares involves selecting shares on a platform, completing KYC, and purchasing them, while selling requires contacting the platform or using a broker or depository.

Investing in unlisted shares carries risks like liquidity issues, lack of regulatory oversight, and limited information, but these can be mitigated with proper due diligence and long-term investment strategies.

How many times have you applied for a blockbuster IPO and actually received an allocation? It must be in the single digits, right? Generally, good company IPOs are oversubscribed hundreds of times due to high demand from the retail category, making it extremely difficult to get a piece of your favorite company at a fair price.

The question then is, can you get exposure to these companies even before they go the IPO route? The answer is yes, you can. Here are some common ways:

Private Equity Investment: You invest in the company directly or via an AIF if you know the promoters/owners. This route generally requires you to invest at least INR 4-5 Lakh in the company.

Unlisted Shares / Pre-IPO Shares: You invest directly in the shares of public limited companies you are interested in before they go for an IPO. Many HNIs and institutional players do this frequently to get larger exposure to companies they like. For retailers, some platforms allow investing in Pre-IPO Shares for as low as INR 10,000.

This article is a part of our new series called ALTShares powered by InCred Money where we discuss unlisted shares and some specific sectors and opportunities in the unlisted shares space.

In this first article, we will do a deep dive on unlisted shares, we will talk about their advantages, bust some myths around them and also explain to you all the risks associated with them.

All About Unlisted Shares

Unlisted shares are a form of an equity based alternative investment. These are also sometimes referred to as grey markets. Grey Markets in general sounds like a bad word but its just a terminology, it doesn't really suggest that this is a shady market to deal in (like some people think)

Reasons To Invest In Unlisted Shares

Early Access: If you're tired of oversubscribed IPOs and want a guaranteed way to invest in a promising company, unlisted shares can provide early access.

Diversification & Uniqueness: You might want to invest in a sector with no other listed companies, like the Ola Electric IPO, which is the first tech-based 2-wheeler EV company going public. By buying unlisted shares, you can diversify your portfolio in advance.

Potentially Lower Valuations: Unlisted shares might be available at more attractive valuations compared to their listed counterparts, especially if the company is expected to grow rapidly.

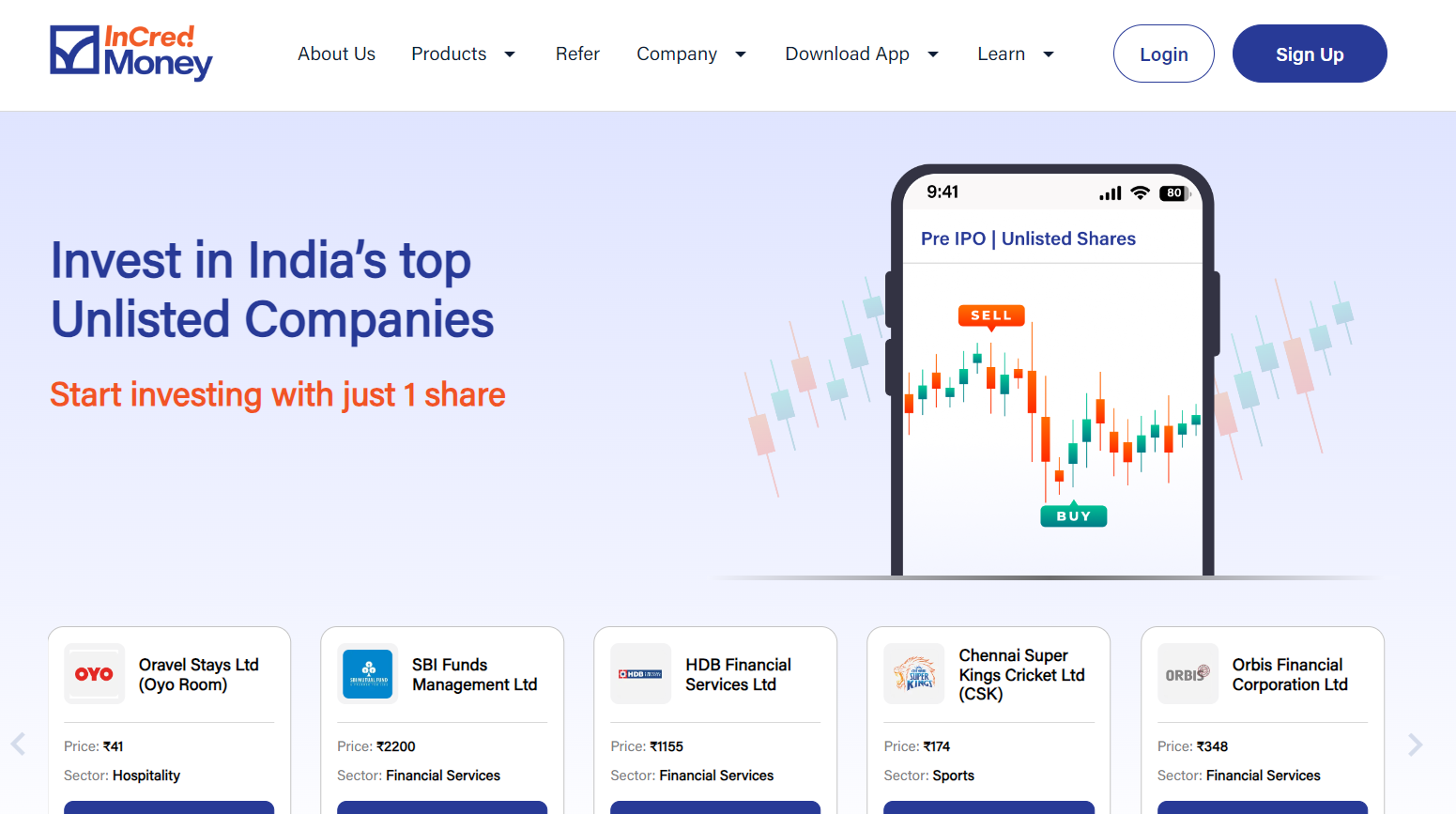

Lower Ticket Size: Comparing it with the private equity investing, you can invest in unlisted shares for as low as 500 INR on platforms like InCred Money.

Who Sells These Unlisted Shares In The Market?

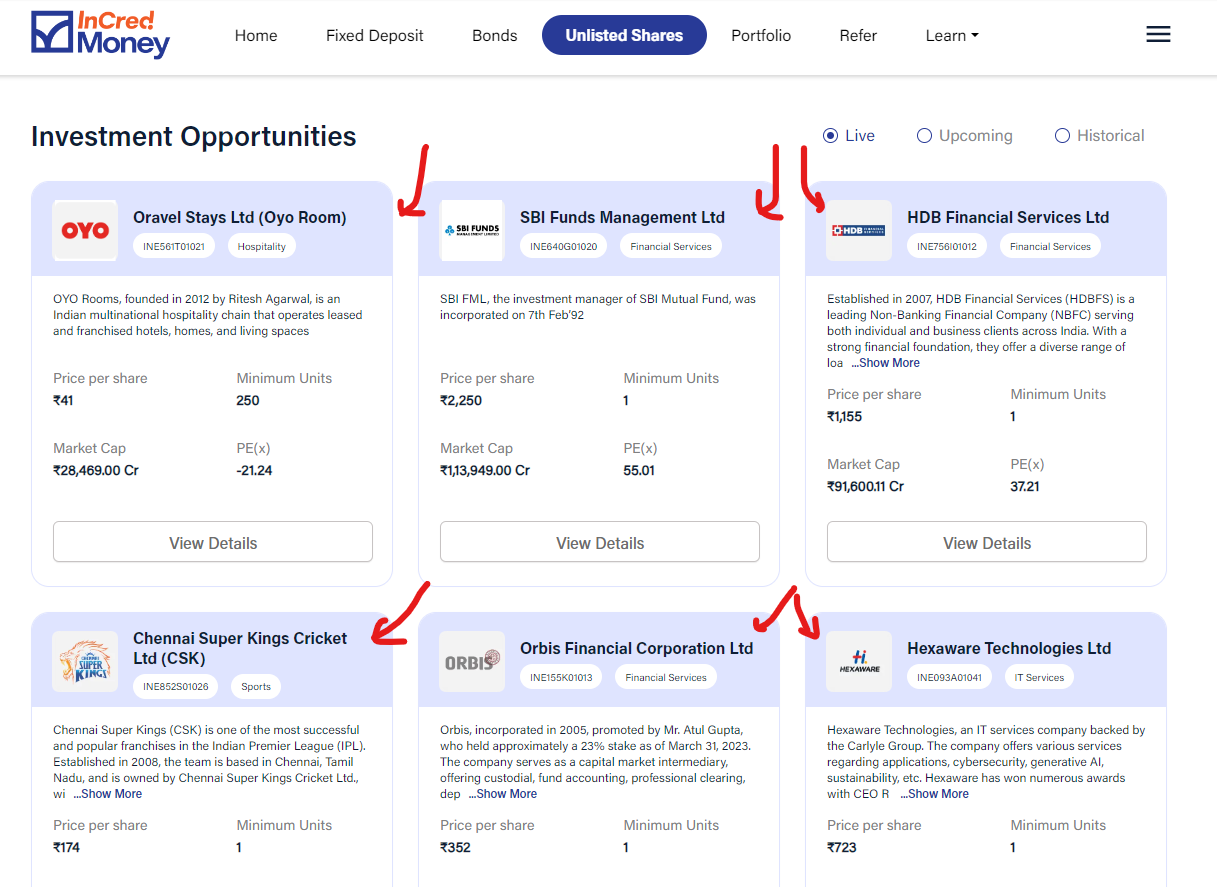

Whenever a platform like InCred Money sources these opportunities from the wider market and offers them to retail investors, a common trust issue arises: where does InCred Money get these shares from? There are actually multiple ways platforms can source these shares:

Founders: The founders or promoters of the company can approach InCred Money and sell their stake at an agreed valuation. This helps founders get liquidity for their personal needs.

Institutional Investors: Early investors in a startup or a mature company may want to sell their stake to meet liquidity needs or satisfy regulatory requirements. They might not be able to wait until the company's IPO, which can sometimes be months or even years away.

Employees / Ex-Employees: Many early-stage growth companies offer ESOPs (Employee Stock Option Pool) to their valued employees. These employees can also approach unlisted market platforms and sell their stake at a pre-agreed valuation.

How To Buy & Sell Unlisted Shares?

Process To Buy

There are multiple platforms out there, but this is still a very fragmented industry in general, so it is crucial that you transact with a reliable/trusted player. The reason we chose to partner with InCred Money for this series is that they are part of the larger InCred Group, a diversified financial services group, and are pretty reliable in the market.

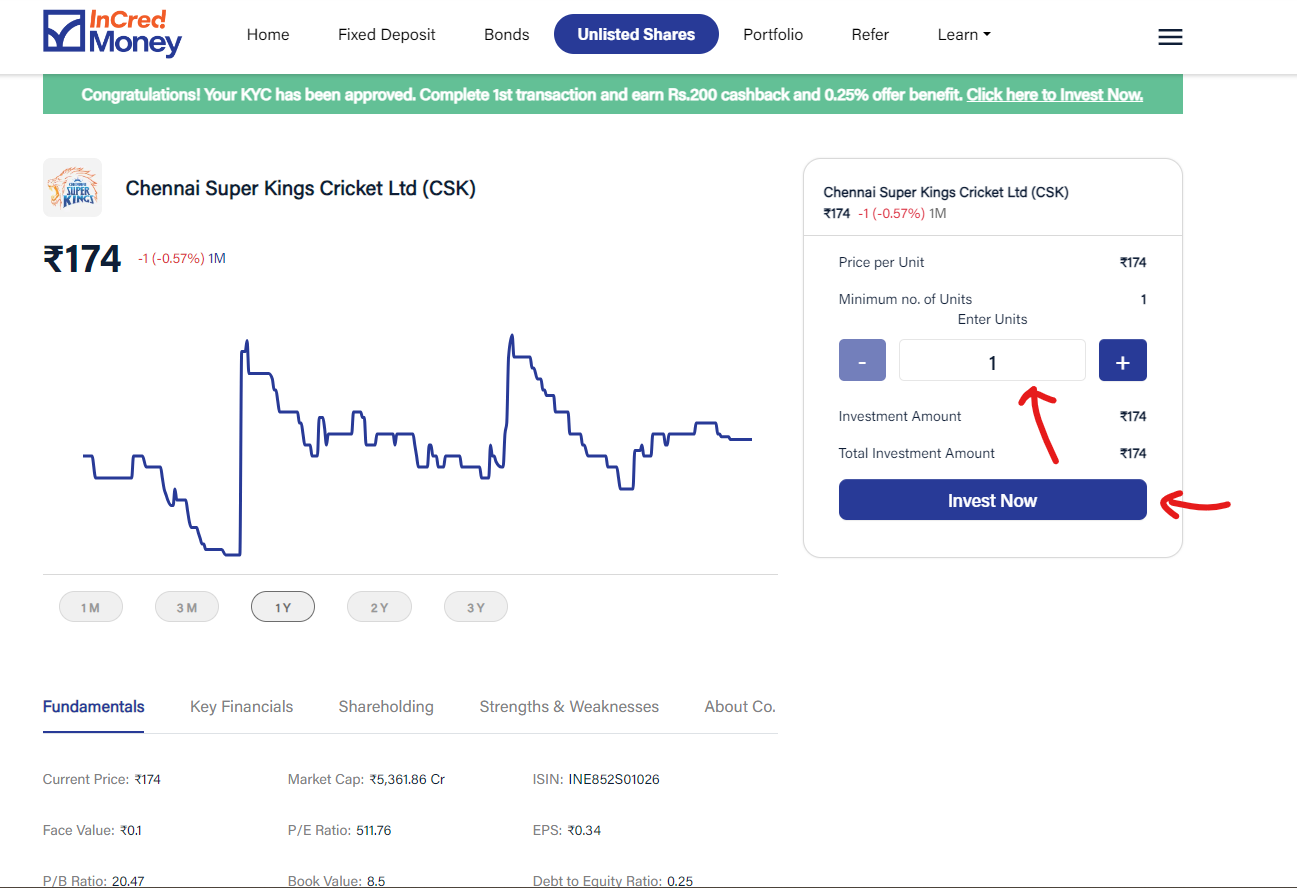

On InCred Money, you can buy the unlisted shares they offer within a few clicks, you don't have to haggle for the prices or need to have anxiety if the units will really be transferred to you or not.

After finishing the KYC, you just select the share you want to purchase, click on Invest Now, pay via Net Banking or UPI and done. InCred will transfer the shares on T+3 basis i.e. you will receive it in your demat within the next 3 working days.

The best part about this platform is that in most cases, you can buy just a single share. Other platforms generally mandate you to buy at least a minimum of INR 20,000 to INR 1 Lakh to get some exposure, which can become an entry barrier for some investors.

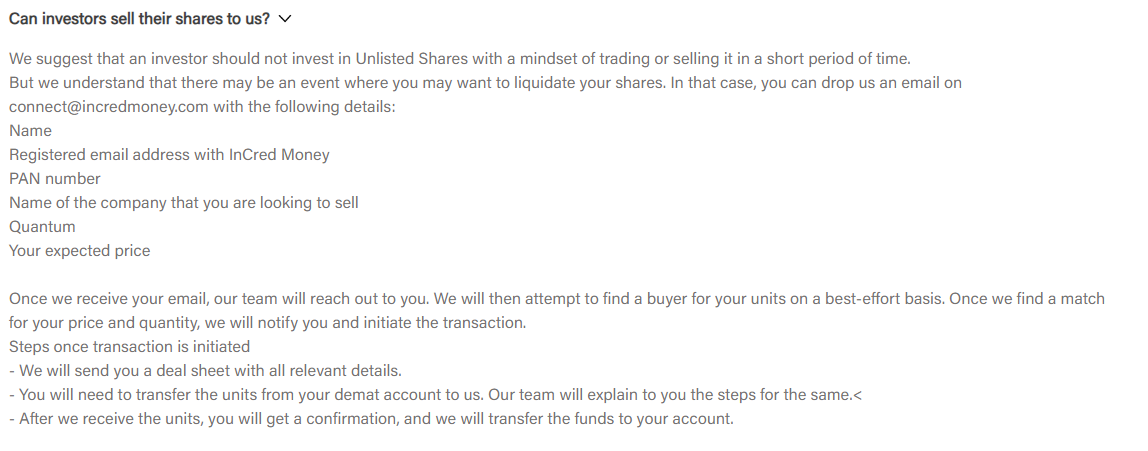

You will receive an email like this, once you place an order on InCred Money. Stay tuned for our next blog to know more on why I bought OYO unlisted shares.

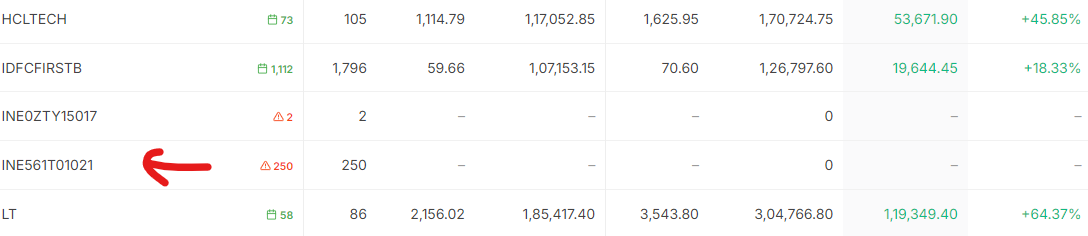

You should be aware, that once the securities get transferred you will not directly see it on your holdings, best to check it with the depositary or the backend of most brokers. Like for Zerodha, the holdings show up in Console. See sample screenshot.

Process To Sell

InCred Money as a platform right now doesn't have a workflow to sell unlisted shares, if you intend to sell these shares, you will have to email their team.

However, there are other platforms which do have this feature, although the workflow there is manual as well. To transfer these shares to the platform, you will have to do this through your broker (if it provides this facility) or in most cases through your depository. CSDL and NSDL provide online facilities to transfer shares to a specific account. In most cases, the platform will help you with the procedure to transfer the shares. InCred Money suggests they will build the sell feature if they see enough demand for it. Right now, most of the investors in the unlisted shares category buy the stocks to hold them for a longer term.

Tata Technologies IPO Case Study

The Tata Technologies IPO was subscribed 69.43 times. The public issue was subscribed 16.50 times in the retail category. People who got the shares were considered to be very lucky. Not many people know, but in the Pre-IPO market, Tata Technologies was trading in the band of 875-955 INR. When it was listed on 30th Nov 2023, the stock opened at 1200 INR and closed at 1313 INR.

Although, because there is a lock-in of 6 months, the Pre-IPO investors were not able to sell their shares until 30th May 2024. The price that day was around 1030 INR. If Pre-IPO investors decided to sell that day, the stock still made a profit depending on the buy price. Buying the Pre-IPO shares ensured that the users got an allocation in a massively oversubscribed IPO.

Are Unlisted Shares Regulated?

To be completely honest, the buying and selling of unlisted shares is in the unregulated territory. Until the security gets listed, it does not come under the ambit of SEBI. But these unlisted shares are issued by public limited companies and they have to follow strict guidelines by the Ministry of Corporate Affairs (MCA) under The Companies Act, 2013.

The platforms as well are not SEBI-registered stock brokers, investment advisors or stock exchanges. Thus, before investing you need to ensure that the platforms are genuine and trustworthy.

Risks In Unlisted Shares

Like every other asset class, unlisted shares also carry some form of risk, here is a list of risks that you should definitely be aware of.

Liquidity Risk - One of the biggest risks in unlisted shares. It can be hard to find buyers and even harder to find one at the right price, so you may have to hold onto the unlisted shares for a long time.

No Defined Timeline for IPO: Generally investors buy unlisted shares because they expect to make gains when IPO happens. But due to various issues, sometimes companies may take years before they go for an IPO and it may be difficult for you to get an exit.

Lock-In Period - Unlisted shares have a lock-in period of 6 months when the company goes public. This means you cannot sell your shares immediately after the IPO and must wait for 6 months after the listing. If the company does not perform as well as you expected, you may lose some money.

Price Discovery - Price discovery is challenging with limited buyers and sellers. You do not know if the price is fair for the company. Even if you have a price in mind, it is difficult to find a seller at that price.

Lack Of Data - There is little to no publicly available data about unlisted companies except for annual MCA filings. You cannot find out what is happening day to day, and it may be hard to get more context about the business without enough information.

Platform Risk - Many platforms act as intermediaries to create a market for unlisted shares. However, since these are unregistered and unregulated entities, investors should carefully analyze the platform before making any financial transactions. Our partner InCred Money is a vetted player in this space, and transacting through them will reduce this risk significantly. They also have a feature on the platform where you can consult with a RM for 30 minutes free of cost.

Some of these risks can be mitigated by having a proper asset allocation, investing with a long term horizon and by not getting carried away with the momentum.

Taxation Of Unlisted Shares

With several taxation changes in Budget 2024, we thought it maybe best to clarify the current tax rates applicable on Unlisted Shares.

| Short Term Capital Gains (STCG) | Long Term Capital Gains (LTCG) | |

| Holding Period | 0 - 24 Months | Greater than 24 Months |

| Taxes | Taxed At Slab Rate | 12.5% without indexation |

Once the shares become listed, the tax rate changes and is in line with other listed securities, to avoid confusion, here it is:

| Short Term Capital Gains (STCG) | Long Term Capital Gains (LTCG) | |

| Holding Period | 0 - 12 Months | Greater than 12 Months |

| Taxes | 20% without indexation | 12.5% without indexation |

Conclusion

To conclude, investing in unlisted shares offers a unique opportunity to gain early access to promising companies, diversify your portfolio, and potentially benefit from lower valuations.

However, it does come with certain risks, including liquidity issues, lack of regulatory oversight, and limited information. Platforms like InCred Money can facilitate these investments, but it's crucial to conduct thorough due diligence. Understanding the risks, regulatory environment, and tax implications is essential for making informed decisions in this alternative investment space.

Stay tuned for our next article in the ALTShares series powered by InCred Money where we will be talking about the hospitality sector and the travel sector linking them to the opportunity of investing in OYO Unlisted shares. Meanwhile do checkout other unlisted share opportunities on InCred Money.

Investment in Pre IPO | Unlisted Shares is subject to risk. This communication/ report / note / one-pager is general and educational in nature. Alpha Fintech Pvt. Ltd under the brand name ‘InCred Money’ and its representatives are not SEBI-registered research analysts or advisors. Any research, analysis, or information presented on this platform does not constitute investment advice or a recommendation by InCred Money or its affiliates. Visit www.incredmoney.com for the full disclaimer.

This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities.

Neither ALT Investor or its associates/associated entities, assigns or affiliates takes or accepts any liability for consequences of any actions taken based on the information provided.

Subscribe to my newsletter

Read articles from Yash Roongta directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Yash Roongta

Yash Roongta

I am a CFA and FRM Charterholder. I used to work as a Portfolio Implementation Manager for Aviva Investors managing £3bn+in Assets Under Management in the UK. I am very passionate about educating people on how they can make more money with their existing investments sustainably.