Introduction to the Indian Stock Market

Pankaj Singh Jat

Pankaj Singh Jat

Definition and Purpose of Stock Markets

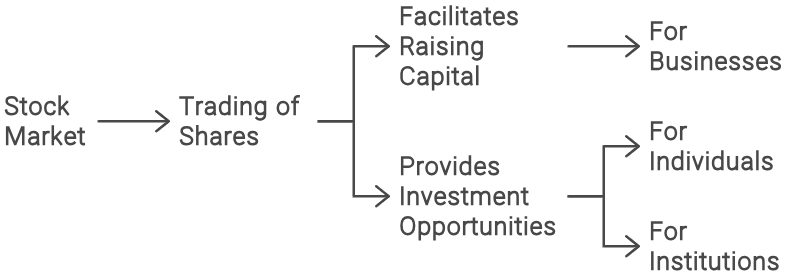

A stock market is a platform where shares of publicly listed companies are traded. It allows investors to buy and sell ownership of companies in the form of stocks. The primary purpose of stock markets is to facilitate the raising of capital for businesses and provide investment opportunities for individuals and institutions.

Key Purposes:

Capital Formation: Companies issue shares to raise funds for expansion, operations, and other business activities.

Liquidity: Stock markets provide liquidity, allowing investors to buy and sell shares easily.

Price Discovery: The stock market helps in the valuation of companies through the mechanism of supply and demand.

Economic Indicator: The performance of stock markets is often considered a barometer of the economic health of a country.

Example:

If a company like Reliance Industries wants to expand its operations, it can issue new shares to the public through the stock market. Investors can buy these shares, providing Reliance with the necessary capital, while investors gain partial ownership and potential dividends from the company’s profits.

Evolution of the Indian Stock Market: Pre- and Post-Liberalization Era

Pre-Liberalization Era

The Indian stock market's history dates back to the 19th century. The Bombay Stock Exchange (BSE), established in 1875, is Asia's oldest stock exchange. During the pre-liberalization era (before 1991), the Indian stock market was heavily regulated, with limited participation from foreign investors.

Key Features:

Controlled Economy: Strict government regulations-controlled market activities.

Limited Foreign Investment: Foreign investments were restricted.

Manual Trading: Trading was manual, with physical share certificates and floor-based trading.

Lack of Technology: Technological advancements were minimal, leading to inefficiencies.

Post-Liberalization Era

The economic reforms of 1991 marked the liberalization of the Indian economy, leading to significant changes in the stock market.

Key Changes:

Deregulation: Reduction in government control over the market.

Foreign Investment: Opening up to Foreign Institutional Investors (FIIs) and Foreign Direct Investment (FDI).

Technological Advancements: Introduction of electronic trading platforms.

Market Reforms: Establishment of regulatory bodies like the Securities and Exchange Board of India (SEBI) to oversee market operations.

Example:

Post-liberalization, the introduction of the National Stock Exchange (NSE) in 1992 revolutionized the Indian stock market with electronic trading systems, which increased efficiency, transparency, and participation.

BSE and NSE: Structure, Operations, and Differences

Bombay Stock Exchange (BSE)

Established: 1875

Structure: BSE operates through an electronic trading system known as BOLT (BSE On-Line Trading).

Operations: BSE provides a platform for trading in equities, derivatives, debt instruments, and mutual funds.

Index: The benchmark index of BSE is the SENSEX, which comprises 30 prominent companies.

National Stock Exchange (NSE)

Established: 1992

Structure: NSE uses the NEAT (National Exchange for Automated Trading) system for electronic trading.

Operations: NSE offers trading in equities, derivatives, currencies, and debt instruments.

Index: The benchmark index of NSE is the NIFTY 50, consisting of 50 major companies.

Differences:

History: BSE is older and more established, while NSE is relatively new but technologically advanced.

Trading Volume: NSE typically has higher trading volumes compared to BSE.

Technology: NSE is known for its advanced technology and faster trade execution.

Indices: SENSEX (BSE) vs. NIFTY 50 (NSE) as benchmark indices.

Example:

An investor looking to trade shares of Infosys can choose to do so on either the BSE or NSE. While the stock price may be similar on both exchanges, the investor might prefer NSE for its higher liquidity and faster trade execution.

SEBI: Role and Importance in Market Regulation

The Securities and Exchange Board of India (SEBI) was established in 1988 and given statutory powers in 1992 to regulate the securities market in India. SEBI's primary objective is to protect the interests of investors and ensure the smooth functioning of the securities market.

Key Roles:

Regulation: SEBI regulates stock exchanges, brokers, and other market participants.

Supervision: It oversees market activities to prevent fraudulent and unfair trade practices.

Development: SEBI works on developing the market infrastructure and introducing new products.

Investor Protection: It ensures transparency and fairness in the market to protect investor interests.

Importance:

Market Integrity: SEBI's regulations help maintain the integrity and efficiency of the market.

Investor Confidence: By safeguarding investor interests, SEBI enhances confidence in the market.

Economic Growth: A well-regulated market contributes to the overall economic growth by attracting domestic and foreign investments.

Example:

SEBI's stringent regulations and surveillance systems were instrumental in uncovering the Harshad Mehta scam in 1992, leading to significant market reforms and increased transparency.

Conclusion

The Indian stock market has evolved significantly from its inception in the 19th century to the present day. With the establishment of BSE and NSE and the regulatory framework provided by SEBI, the Indian stock market has become a robust platform for capital formation and investment. Understanding the structure, operations, and regulatory environment of the Indian stock market is crucial for investors and market participants.

Subscribe to my newsletter

Read articles from Pankaj Singh Jat directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by