EigenLayer and Restaking: A New Era in Ethereum Staking

Noor

NoorTable of contents

- A Look Back at Ethereum’s PoS Journey

- Understanding Restaking: A Simple Breakdown

- Here are three strategies typically associated with restaking:

- 1. Direct Restaking

- 2. Restaking Through Liquid Staking Tokens (LSTs)

- 3. Cross-Network Restaking

- The Role of Liquid Staking Tokens (LSTs)

- The Risks to Keep in Mind

- EigenLayer’s Growth and Impact

- Ethereum’s Staking Growth

- EigenLayer's Impact on Ethereum's DeFi Ecosystem

- Looking Ahead: Restaking’s Role in Ethereum’s Future

- Hyperlinks for Further Reading:

Ethereum has always been at the forefront of blockchain innovation, and its shift to proof-of-stake (PoS) has unlocked exciting new opportunities. One of the standout developments from this transition is EigenLayer—a protocol that’s taking staking to the next level.

As Ethereum evolves and cements its place as a leading blockchain, EigenLayer is stepping in to push the boundaries even further. By introducing the concept of restaking, EigenLayer isn’t just adding another feature; it’s transforming how validators and stakers interact with the network. This means more security, more utility, and a stronger, more decentralized Ethereum for everyone.

A Look Back at Ethereum’s PoS Journey

Ethereum’s transition from proof-of-work to proof-of-stake in 2022 was a true game-changer. The Ethereum Merge marked this pivotal moment, shifting from energy-hungry mining to a greener, more scalable staking model. Now, instead of mining, validators secure the network by staking 32 ETH, earning rewards much like interest, but with a far-reaching impact on the future of decentralized finance (DeFi).

This wasn’t just a technical upgrade—it was a bold step toward sustainability. And from this shift, innovations like EigenLayer have emerged, pushing the boundaries of what’s possible in the blockchain space.

Understanding Restaking: A Simple Breakdown

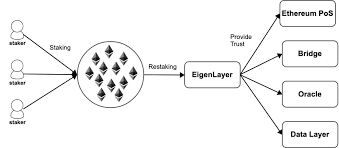

So, what exactly is restaking? Imagine getting more out of your staked ETH without needing to invest more. With EigenLayer, validators can take their staked ETH or liquid staking tokens (LSTs) and use them to secure other networks or services at the same time. It’s like having your money work for you in multiple places without doubling your initial investment.

For example, if you’re already earning rewards by staking with Ethereum, restaking lets you use that same ETH to secure a new DeFi project, earning additional rewards. That’s the beauty of restaking with EigenLayer—maximizing your returns without needing to lock up more assets.

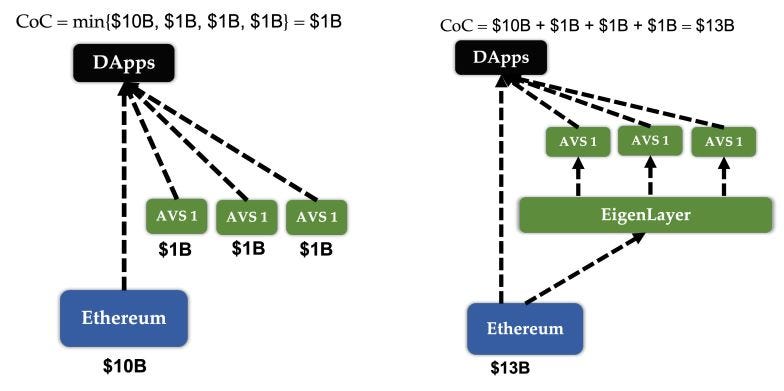

In essence, restaking allows Ethereum validators to "double-dip" their rewards by securing multiple protocols simultaneously. EigenLayer leverages the security of Ethereum’s PoS network, enabling stakers to help secure new decentralized applications (dApps), sidechains, or even new blockchains, all with the same ETH they’ve already staked.

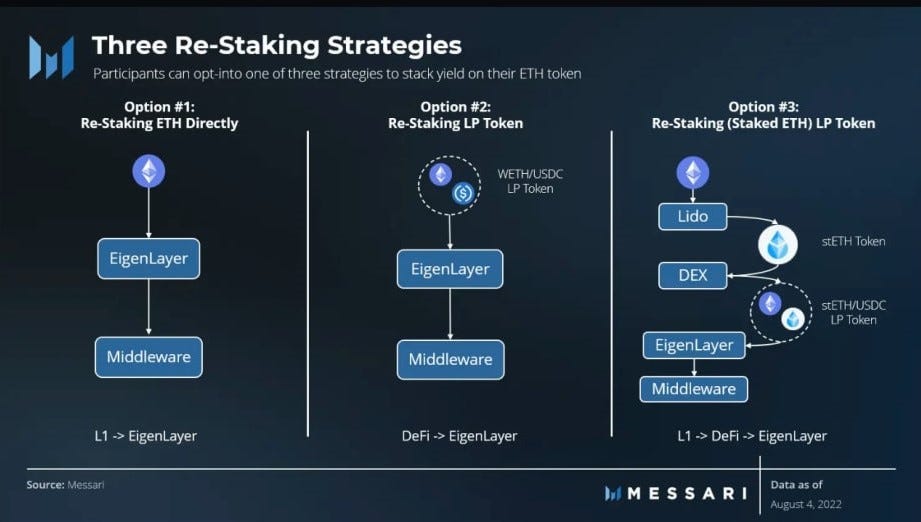

Here are three strategies typically associated with restaking:

1. Direct Restaking

Concept: In this strategy, stakers take their staked ETH or Liquid Staking Tokens (LSTs) and use them to secure additional networks directly.

Example: A staker who has ETH staked on Ethereum can also use the same ETH (via LSTs like stETH or rETH) to secure other decentralized networks or applications. By doing this, they can earn additional rewards on top of the existing staking rewards.

Risks: The primary risk here is slashing—if a validator fails in one network, it could lead to slashing in all networks secured by that validator.

2. Restaking Through Liquid Staking Tokens (LSTs)

Concept: This strategy involves using Liquid Staking Tokens (like Lido’s stETH or Rocket Pool’s rETH) to stake on other protocols while still earning rewards from the original staking.

Example: A validator might use stETH to provide liquidity in a DeFi protocol while also securing another network via EigenLayer. This effectively doubles the utility of the staked ETH without requiring additional capital.

Risks: The value of LSTs is tied to the underlying ETH, so any volatility in ETH’s price or issues with the staking protocol could impact the value of these tokens, thereby affecting the overall strategy.

3. Cross-Network Restaking

Concept: This strategy involves using staked assets to secure multiple networks simultaneously, leveraging the security guarantees of Ethereum to bolster other chains or applications.

Example: A validator could use their staked ETH to secure not just Ethereum but also participate in securing a new DeFi project, a Layer 2 solution, or even a sidechain. EigenLayer facilitates this by enabling the validator to “restake” the same assets across different networks.

Risks: This strategy increases the complexity and risk, as a failure in one network could potentially lead to slashing across all networks involved.

These strategies highlight the potential of restaking to increase the efficiency and profitability of staking, but they also introduce new risks that need careful consideration.

The Role of Liquid Staking Tokens (LSTs)

Tokens like Lido’s stETH or Rocket Pool’s rETH are key players in this system. These Liquid Staking Tokens (LSTs) represent your staked ETH but remain liquid, meaning you can trade them, use them in DeFi, or even restake them with EigenLayer to secure additional networks.

This flexibility is a game-changer. Instead of having your ETH locked up in just one project, you can now put it to work across multiple networks, earning rewards from each one. It’s like multitasking with your assets, contributing to the security of several systems while maximizing your returns.

LSTs, like stETH and rETH, make staking more dynamic and profitable. They let you keep your staked ETH liquid and usable in various ways—whether it’s trading, participating in DeFi, or restaking to support other networks through EigenLayer. This approach not only boosts your staking rewards but also strengthens the entire Ethereum ecosystem by encouraging broader participation in network security.

The Risks to Keep in Mind

Restaking is an exciting concept, but it’s not without its risks. One of the biggest concerns is slashing—where a validator can lose their staked assets if they fail to perform correctly or act maliciously. With restaking, this risk doesn’t just affect one network; it extends to all the networks you’re securing. It’s like walking a tightrope with more steps involved, making it a bit more precarious.

Then there’s the role of Liquid Staking Tokens (LSTs), like stETH or rETH. Since their value is tied to ETH, any major swings in Ethereum’s price or issues with the staking protocol could impact their value, and in turn, affect the stability of the networks they’re securing. But as with any investment, with greater risk comes the potential for greater rewards.

While the opportunities for restaking are impressive, they do come with a need for caution. The risks are higher, especially with slashing potentially affecting multiple networks at once. The reliance on LSTs adds another layer of complexity, making it crucial to carefully consider the potential volatility and its impact on your staked assets. However, for those willing to navigate these risks, the rewards could be well worth it.

EigenLayer’s Growth and Impact

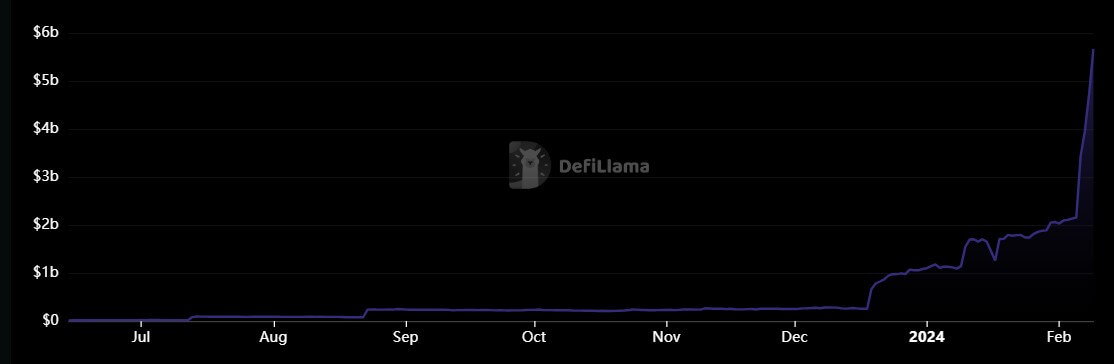

EigenLayer isn’t just an interesting idea—it’s experiencing rapid growth. By mid-2024, the protocol has already attracted over 1 million stakers and amassed a Total Value Locked (TVL) of over $5 billion, a significant leap from just $1 billion the previous year. This explosive growth reflects the increasing appeal of restaking as more people recognize its potential to maximize staking rewards.

The rapid expansion of the EigenLayer ecosystem underscores its ability to attract significant capital and secure a variety of decentralized networks and applications. With over 1 million stakers now involved, it’s clear that restaking is resonating strongly with both individual and institutional participants in the Ethereum network. It’s exciting to see where this momentum will take us next.

Here's a graphical representation of how EigenLayer’s TVL has grown:

Ethereum’s Staking Growth

Ethereum’s staking ecosystem itself has seen significant growth, particularly after the PoS transition. The number of ETH staked in Ethereum’s Beacon Chain has increased from 12 million ETH in early 2022 to over 30 million ETH by mid-2024, with LSTs like stETH and rETH leading the charge. As of 2024, Lido’s stETH alone accounts for nearly 33% of all staked ETH, highlighting the increasing reliance on liquid staking solutions.

These numbers aren’t just impressive—they’re a clear sign that staking, and by extension, restaking, is here to stay.

EigenLayer's Impact on Ethereum's DeFi Ecosystem

EigenLayer’s restaking model has the potential to significantly impact Ethereum’s DeFi ecosystem. By allowing stakers to maximize the utility of their assets, EigenLayer can drive greater participation in decentralized finance, as more assets are deployed to secure and interact with various DeFi protocols.

Additionally, the integration of LSTs into restaking can create new avenues for yield generation, attracting more users to the DeFi space. As stakers seek to optimize their returns, the demand for LSTs could increase, further solidifying their role within the Ethereum ecosystem.

Furthermore, EigenLayer’s model promotes greater decentralization by enabling new projects to bootstrap their security using Ethereum’s established PoS network. This could lead to the proliferation of innovative dApps and sidechains, each contributing to the growth and diversification of Ethereum’s broader ecosystem.

Looking Ahead: Restaking’s Role in Ethereum’s Future

EigenLayer and restaking are truly paving the way for a new era in Ethereum, expanding the possibilities within the blockchain space. This isn’t just about boosting profits (though that’s a great bonus); it’s about fostering a more secure, decentralized, and innovative ecosystem by giving validators and stakers the ability to do more with their assets.

From my perspective, this is a game-changing development that goes beyond just technology—it’s a statement about the future of decentralized finance. The idea that you can maximize the potential of your staked assets across multiple networks is revolutionary, and it aligns perfectly with the ethos of continuous improvement that drives the crypto community.

But let’s be clear—this is just the beginning. The future of Ethereum’s security model might very well depend on innovations like EigenLayer, making the stakes—literally and figuratively—higher than ever. Managing the risks and enhancing security will be critical as we advance.

For me, EigenLayer is more than just a protocol; it’s a vision of what Ethereum can become. As it continues to gain momentum, I believe restaking could become a cornerstone of Ethereum’s evolution, enhancing the utility of staked ETH and LSTs while strengthening the network’s decentralization and security.

Watching this unfold, I’m genuinely excited about where this could lead. The future looks incredibly bright, and this feels like just the start of an extraordinary journey.

Hyperlinks for Further Reading:

Ethereum Proof-of-Stake

Ethereum Beacon Chain Statistics

Subscribe to my newsletter

Read articles from Noor directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by