All About Securitized Debt Instruments (SDIs)

Yash Roongta

Yash Roongta

KEY TAKEAWAYS

Securitized Debt Instruments (SDIs) are financial products that allow banks to convert loan assets into cash by selling them to investors, similar to mutual funds but for loans.

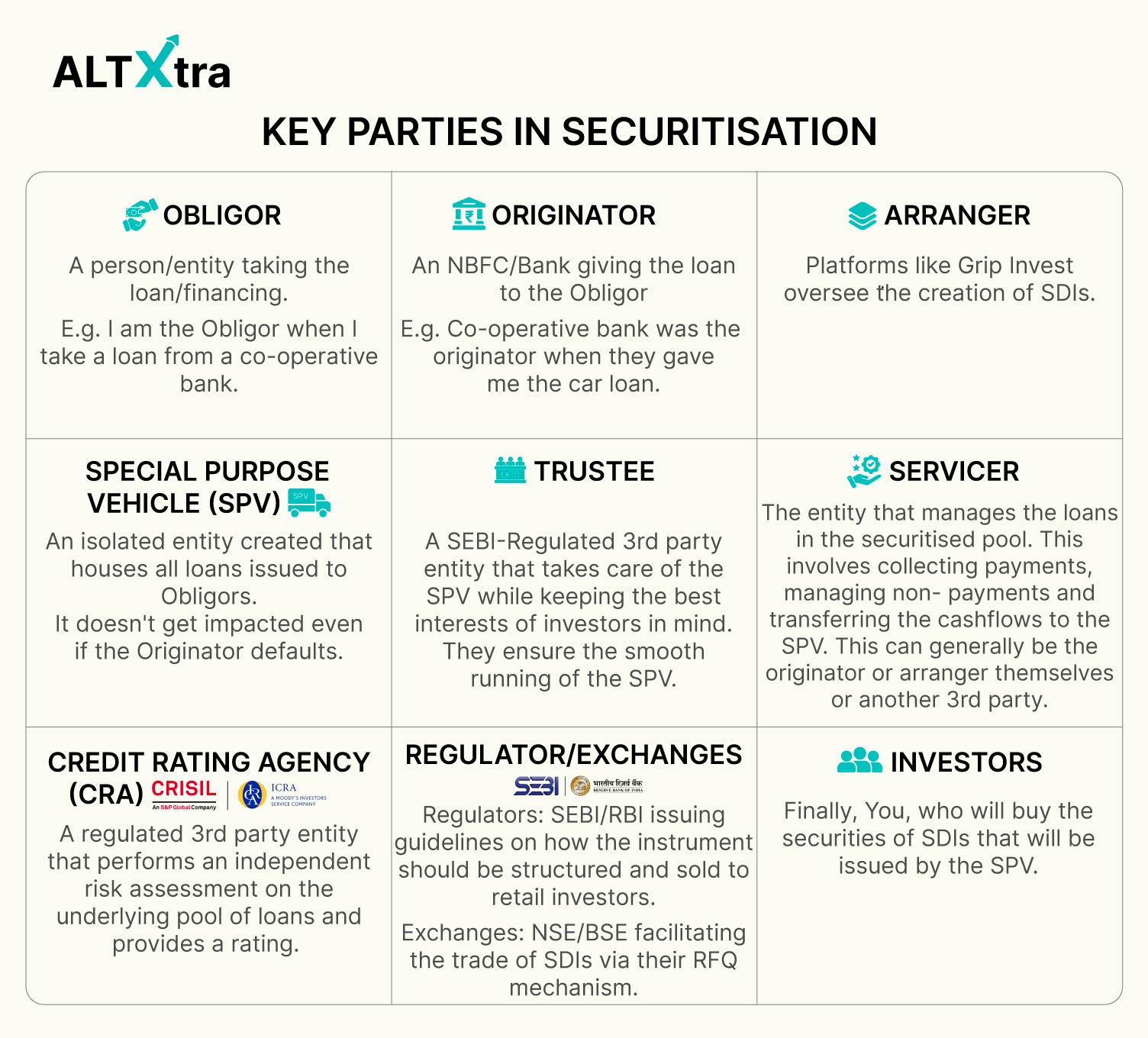

The securitization process involves multiple parties, including originators, arrangers, special purpose vehicles (SPVs), trustees, and credit rating agencies, to create and manage SDIs.

SDIs offer diversification and potentially higher returns, with safeguards like overcollateralization and excess interest spread, but they come with complexities, taxation, and liquidity challenges.

The Indian SDI market is growing, with Grip Invest leading in offering various SDI options like InvoiceX, LoanX, LeaseX, and BondX to retail investors.

SDIs provide bankruptcy remoteness, meaning they are protected from the originator's bankruptcy, as demonstrated by the Dewan Housing Finance case study.

In this ALTXtra article, we are going to understand Securitized Debt Instruments (SDIs) in detail in simple language. SDIs are a very interesting product and are quite renowned in developed markets as well as among institutional investors in India, and now slowly picking up pace for retail investors, so let's get into it.

I recently took a car loan from a small co-operative bank in Mumbai. The loan was issued to me at a 10.5% XIRR (8% interest rate). Given my previous pleasant experience with the bank and lower interest rates compared to other banks, I encouraged my father and my father-in-law also to take loans from the same co-operative bank for their new car purchases.

The small bank has now taken the risk of all of the car loans on its loan book. If we stop paying the loan, the bank has the right to seize our vehicles and sell them in the secondary market. But the bank is bullish on its credit assessment on its car loan book and wants to grow it even further. To do so, the bank needs more money to lend out.

How does the bank obtain more money to grow its loan book?

While it has the option to raise funds via traditional savings account deposits, fixed deposits or issuing bonds, it also has one other interesting avenue to raise capital. Why not sell the existing loan book itself to interested investors who then take on the risk and benefits of the loans and earn a decent return on their investments? This way, the bank can convert its assets (loans) into cash which in turn can be used to grow its car loan book even more.

The process of selling these existing loan books is called securitization and results in the creation of a SDI. And if you invest in this SDI issued by this cooperative bank, you essentially will be exposed to all the car loans in that package (me, my father, father-in-law & many others). So to put it simply from a retail investor's point of view:

Securitized debt instruments or SDIs are like mutual funds but for loans. Banks/NBFCs bundle many loans (like home/car/gold loans) into a single package and sell pieces of this package to investors. Investors earn returns from the loan repayments, providing a steady income similar to interest earned on corporate bonds.

SEBI introduced SDI regulations for India in 2008. Let's now understand this instrument in more detail, along with its pros, cons and the risks involved in them.

If you are a video person, you can watch this video instead of reading this blog!

Parties Involved In Securitization

To make securitization work, multiple entities in the financial ecosystem have to work together to bring these loan books as a security to retail investors. Here is a snapshot of all of them in one frame.

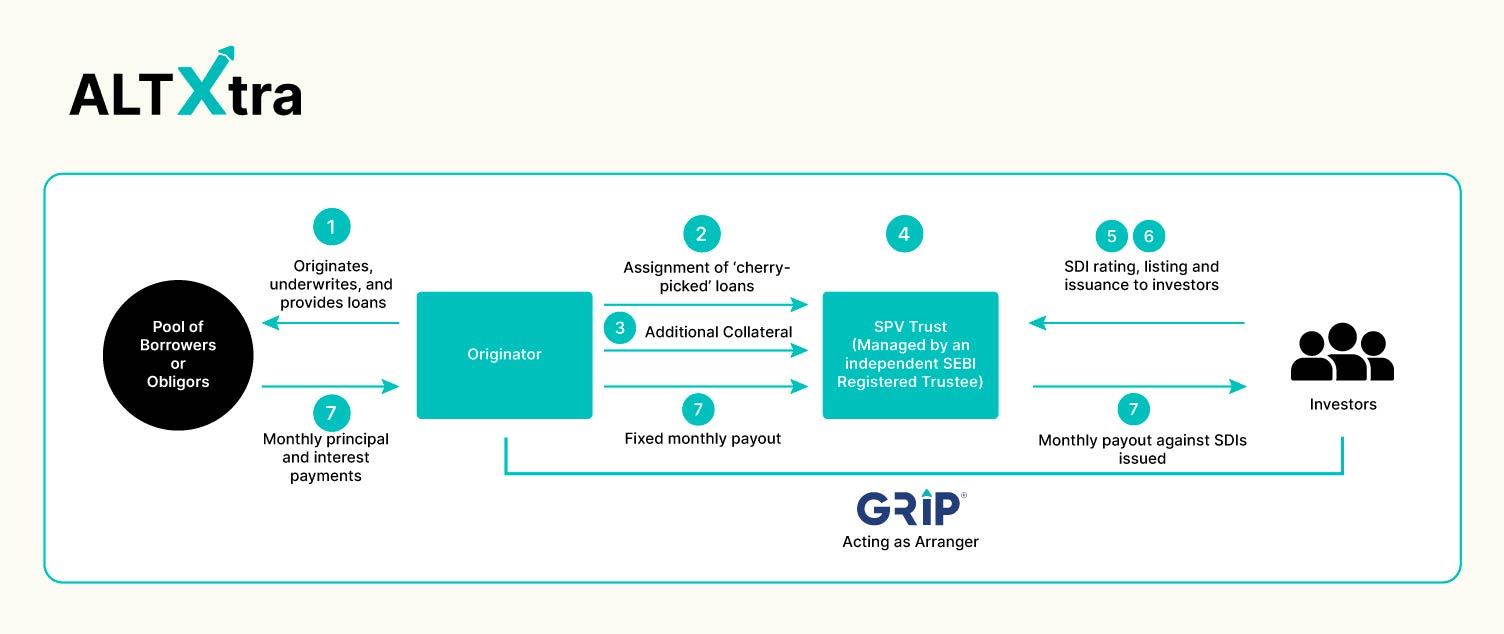

Steps Involved In Securitization

Now that you know about all the various parties involved in the securitization process, let's understand step by step how an SDI (Securitized Debt Instrument) is created.

Step 1: The originator (Bank/NBFC) has given loans to individuals/entities. These can be personal loans, car loans, credit card loans, lease financing, invoice financing or any other form of debt.

Step 2: An arranger like Grip Invest would work with the originator and create a package of loans that is favourable for both entities. This methodology is unique to each arranger and created based on the preferences of retail investors like you and me.

Step 3: Once the pool of loans has been finalized, those assets will be transferred to a Special Purpose Vehicle (SPV) created and maintained by Grip Invest. The originator will also post some collateral to the SPV to protect the retail investors. This collateral can be in the form of cash, physical assets, personal guarantees, etc.

Step 4: Grip Invest would assign an independent SEBI-Registered Trustee who would oversee the pool of loans with the best interest of investors in mind.

Step 5: Next, they would also assign a regulated Credit Rating Agency (CRA) to assign the pool of loans a fair rating. Grip Invest would then get the security listed on exchange if required.

Step 6: The SDIs, which comprise a pool of loans would then be sold to retail investors via its platform. As money is received, it is passed on to the SPV and ultimately to the originator who can use the fresh money to give out more loans.

Step 7: All interest + principal repayments on the loans are managed by a servicer (which can be the same as originator or arranger) who passes it onto the SPV (after taking a small cut) and pays it to the retail investors. The independent trustee oversees all these operations.

Types Of SDIs Available In Market

I hope the above has given you a fair idea of how the SDI is structured end to end without any jargon. SDI market is new for retail investors in India, but as we mentioned before it is very common in developed markets and among institutional investors in India primarily in the form of RMBS (Residential Mortgage Backed Securities) where large banks have given out residential mortgages to individuals and pooled all of them in various packages and sold to investors via SDI structure.

In fact in FY24, INR 2.4 lakh crore worth of such securities were issued in India. With the majority of investors being large banks and financial institutions like the ones in image below.

In India, Grip Invest, the largest retail player in the SDI market, brings out various options for retail investors:

InvoiceX: It is a pool of loans backed by invoice discounting receivables where the invoices are raised to very well-capitalised anchors (companies). It is generally a short-tenure product.

LoanX: This is the most famous form of SDI in India even in the institutional category. It is essentially a pool of loans packaged together and sold to an end retail investor. These loans can be personal loans, car loans, property loans, etc. RBI has very well-defined securitization guidelines for these types of assets.

LeaseX: This is a first-of-its-kind model in the SDI industry. It is essentially a pool of leases with some anchor companies. Think of leasing solar panels to 100 different companies for 3 years and pooling all these leases together to create an SDI product. Investors get paid as and when the lease rentals by these companies are paid.

BondX: To oversimplify it, it is like a Debt Mutual Fund with some selective bets. You pool a couple of bonds together in a trust and create an SDI. As and when the different bonds receive interest and principal repayments, the SDI investors would do so as well. This is a good product if you want to diversify your exposure to different categories of bonds.

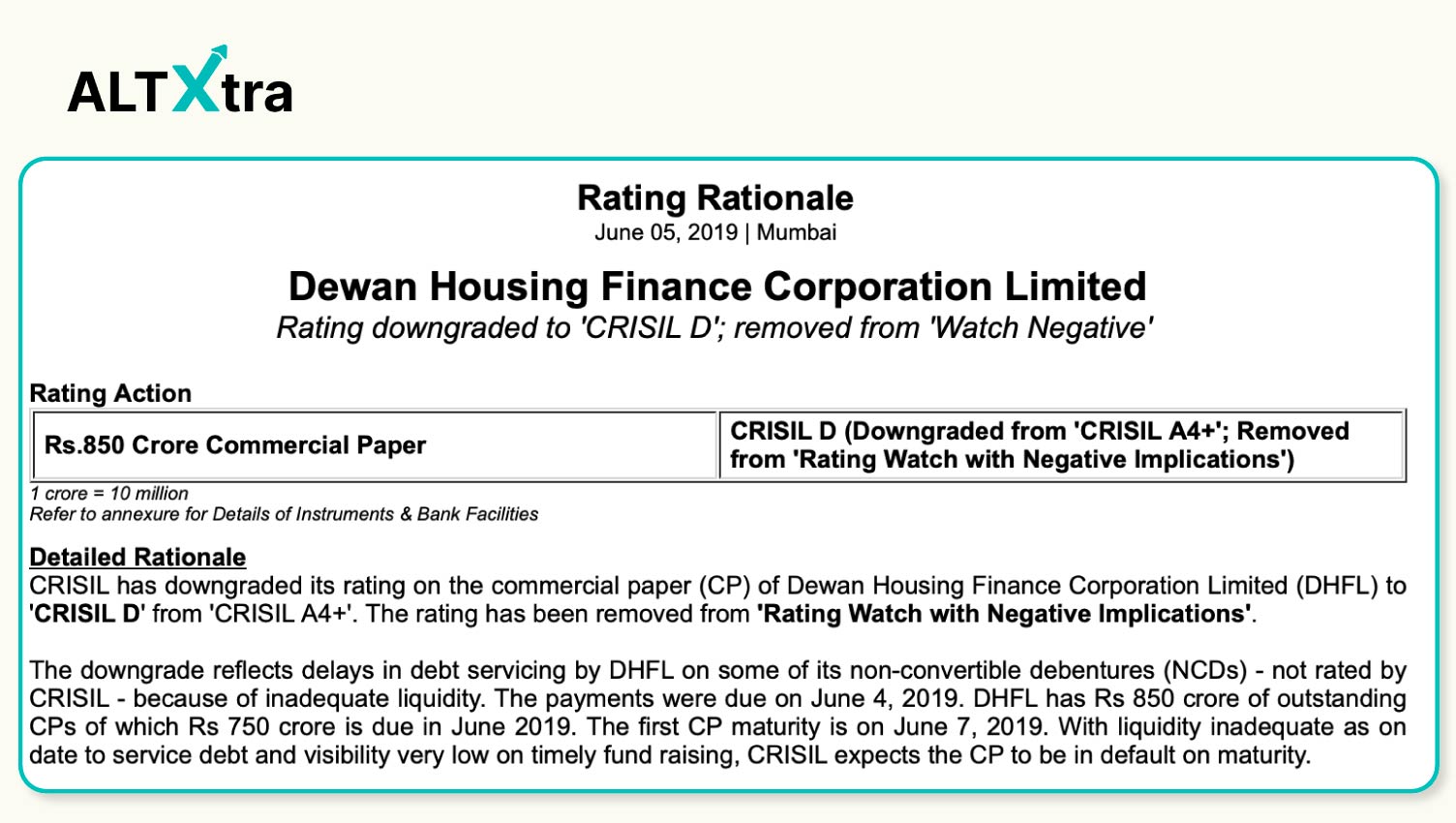

Case Study: Dewan Housing Finance (DHFL)

Some common questions that I have heard from investors on the SDI topic:

What happens if the originator defaults, will I still get repayments on the loan package I have bought?

Is this product different from a corporate bond a.k.a non-convertible debenture?

The answer to both questions is YES and there are examples to prove it. You may have heard of Dewan Housing Finance Limited, a housing finance company which was founded in 1984. In the middle of 2019, they ran into an asset-liability mismatch crisis. This meant that the tenure of their assets (long-term home loans) was not in sync with their liabilities (money raised via debentures, commercial papers, etc) and some repayments came in faster than they could get back via their loan book.

Due to this they were not able to meet their interest repayments on Non-Convertible Debentures, CRISIL took note of this and immediately put all their other securities in default category.

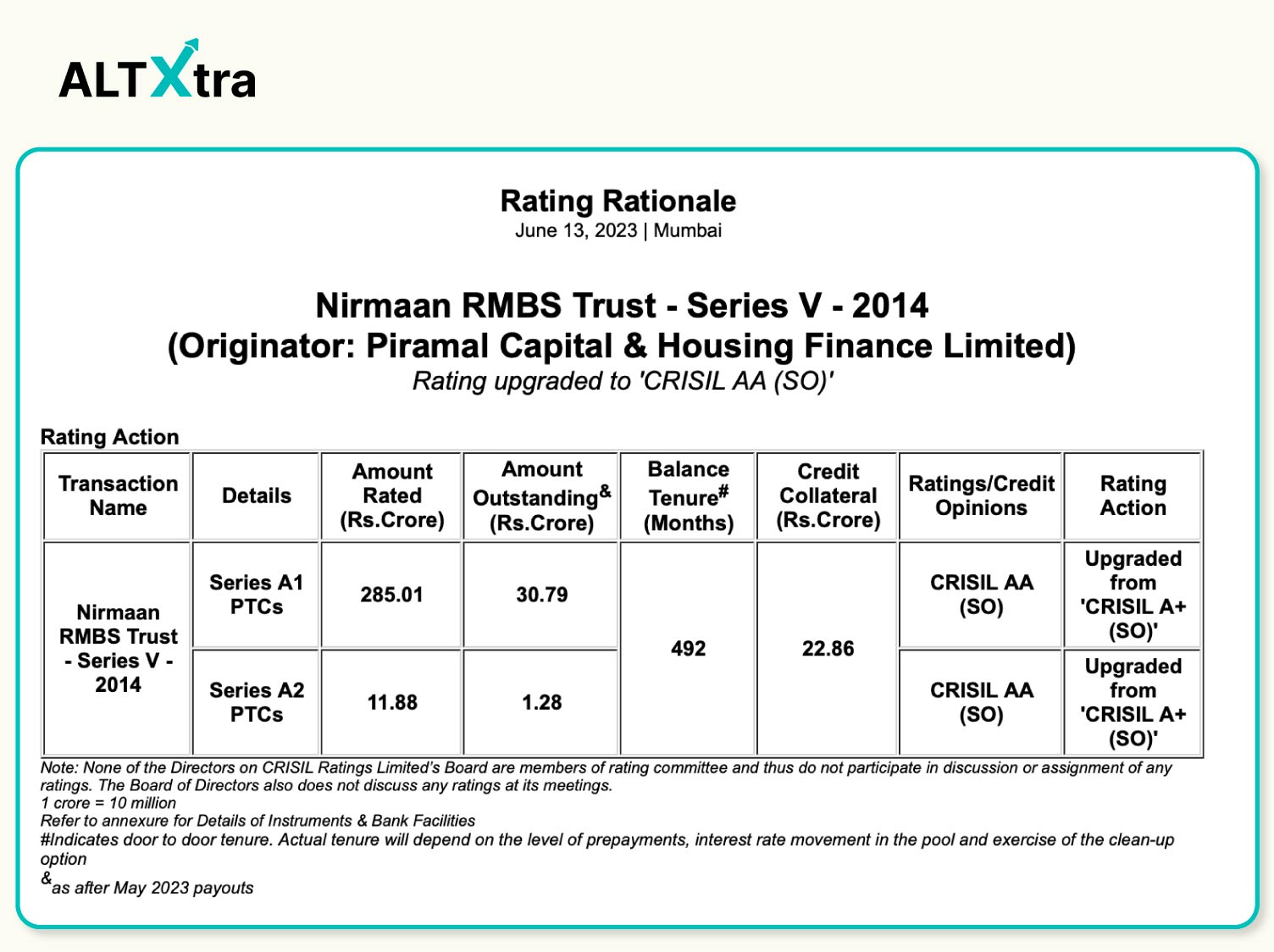

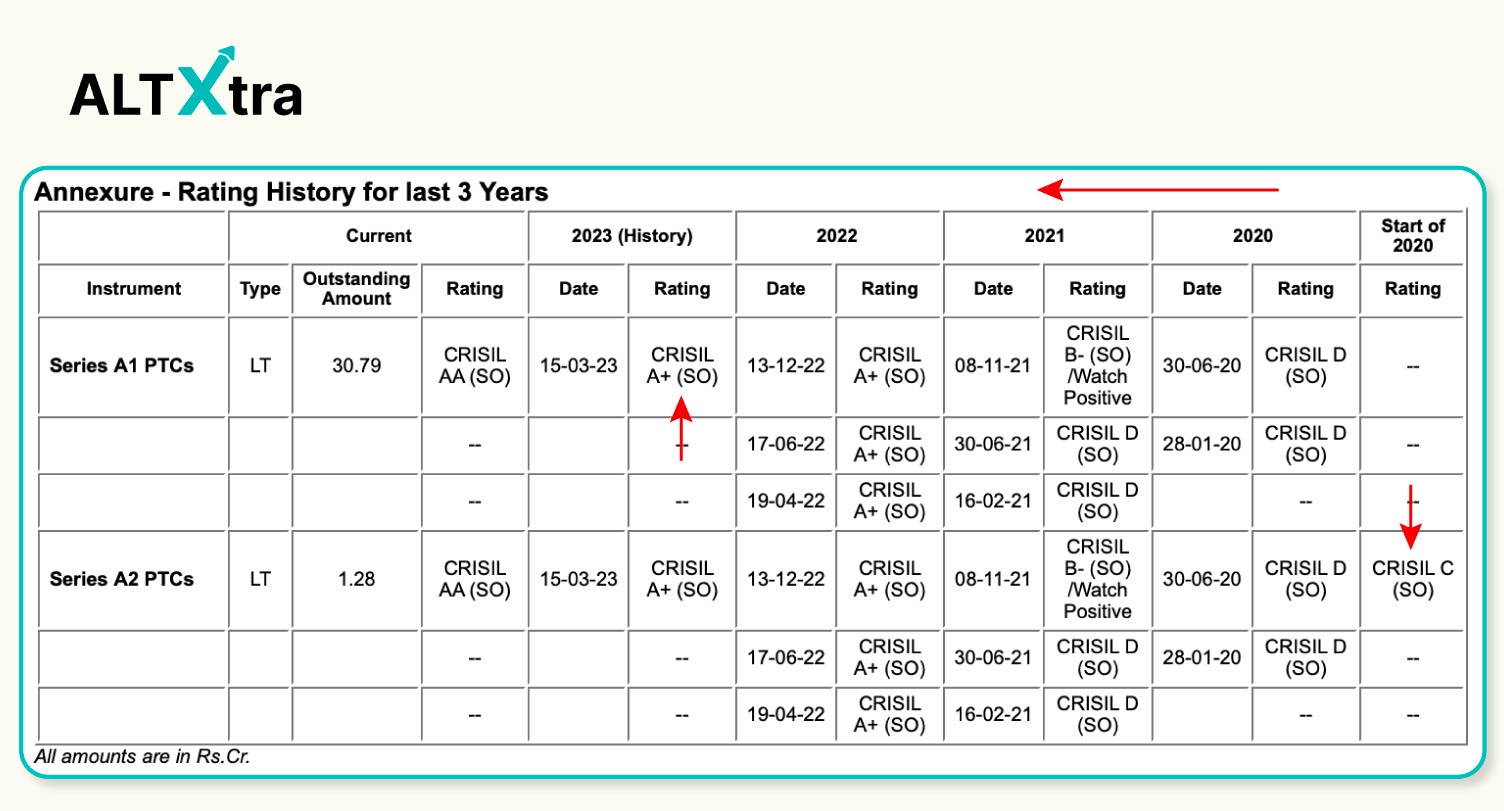

Prior to 2019 and the rating downgrade, DHFL had sold off some of its housing loan book in an RMBS format (similar to the SDI structure) under the name of Nirmaan RMBS Trust - Series V - 2014. The RMBS had a tenure of 20 years and just within 5 years, DHFL, the Originator, had defaulted. This spooked the buyers of the RMBS if their money was gone as well. Fortunately, this was not the case at all. The rating of the RMBS was downgraded by CRISIL in 2019 but eventually was upgraded over time since 99.9% of the loans in the pool were still performing and investors were able to get all their promised payments on time. In fact, the rating was even improved by CRISIL over time seeing the strong performance of loans.

If interested, you can read latest rating rationale by CRISIL here.

What the above demonstrates is the very superior feature of securitization called bankruptcy remoteness. Even if the main originator goes bankrupt as DHFL did, the pool of loans does not directly get impacted by that bankruptcy event and continues to repay back to investors if the trustee and servicer are all in place. Even if some of the loans in that pool stop performing, the credit enhancements and collateral present in the pools can be used to pay back the investors. But if you had the non-convertible debenture (bonds) from DHFL, you would have faced a default on that. It is also important to note that the investors in the DHFL bonds could not access the assets of the securitized pool - those assets belong exclusively to the investors in the RMBS.

Check out this fantastic video which we created in this series on DHFL!

What do we like about SDI?

Let's talk about some features that we like about an SDI as compared to other alternative investments in the category.

These are listed, rated, regulated instruments. RBI/SEBI clearly defines a framework for multiple areas of SDI functioning, including how it should be sold, how it should be handled in cases of default, etc.

They are non-market linked and their exposure to diversified assets like a pool of loans in different categories can act as a good diversification in an individual's portfolio.

Excellent safeguarding mechanisms structured within the instrument like:

Overcollateralization: Let's say the total loan book is INR 30 Crore, but a SDI is only created for INR 27 Crore, the rest of INR 3 Crore is kept as collateral within the trust posted by the originator. If Non-Performing Assets (NPA) increase, the interest and principal repayments from these extra loans are used so the investor doesn't face a default.

Excess Interest Spread: Generally, in the market, the originator issues a loan at a higher rate than what is passed onto the trust and ultimately investors. For e.g,. if the Bank/NBFC has given loans at 13% interest and passed on 12% to investors in the form of SDI, the extra 1% buffer can be used to cover NPAs if needed and pay back investors.

Cash Collaterals: The originator also posts a certain % of the overall SDIs as cash collateral. This cash can be utilized if NPAs are piling up to cover pending payments to investors.

They are available at a very reasonable ticket size of INR 1 Lakh and you can get access to the same opportunities like big banks/AIFs/PMS, etc.

Bankruptcy remoteness to the originator as we have demonstrated via the DHFL example above.

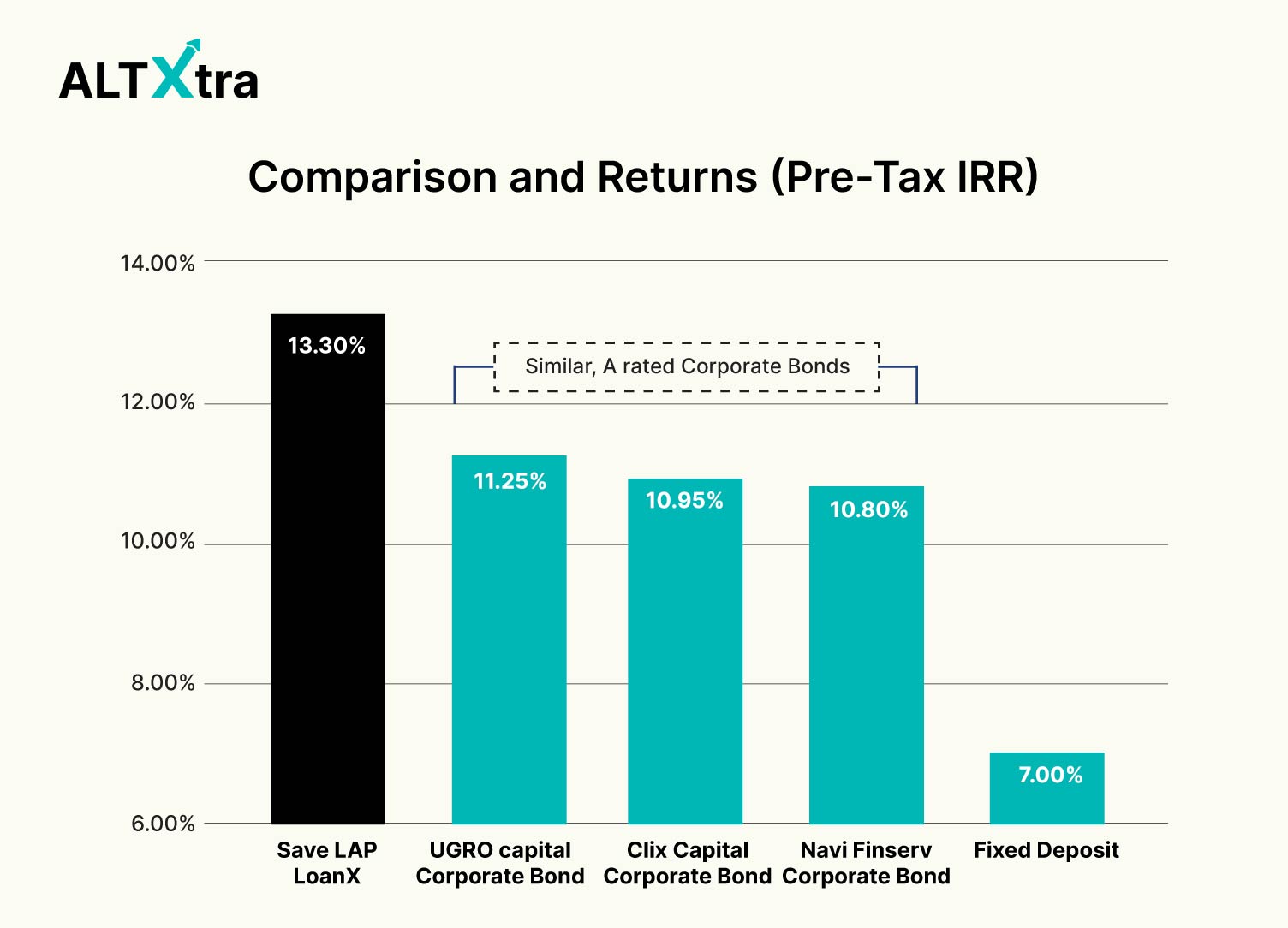

Due to better diversification, they offer a higher risk-reward ratio for similar rated instruments. E.g. Grip’s LoanX LAP SAVE instrument offers 13% interest as compared to other A-rated NCDs offering 11%.

What Do We Not Like About SDI?

SDI is any day a better instrument than a non-convertible debenture (bond) from a risk-reward standpoint, but there are still a few things that we don't like about them:

Complexity: Despite our efforts above to explain this instrument to you, we do recognize that it's a complicated instrument/structure. It can vary a lot based on how the arranger wants to structure it and it can sometimes confuse a regular retail investor to identify risks. In those cases, it is better to seek help from a financial advisor or us.

Taxation: All SDIs in the retail category are more or less making interest repayments on a monthly basis (because they are backed by loans/leases which pay monthly) and all interest payments are paid after a 25% TDS deduction. This is just 10% in an NCD. While this gets adjusted in annual income tax filings and investors in lower tax brackets can claim a refund, there is some timing gap.

💡India's Finance Ministry had in Union Budget 2025 announced a 60% drop in TDS rate on SDIs (Securitized Debt Instruments), from 25% to 10%, which came into effect from 1st April 2025.With effect from today, 1st April 2025, the TDS rate on SDIs has been reduced from 25% to just 10%! But what does it mean for investors? We explain it to you!

Liquidity: The Indian debt markets are immature, so liquidity for such complicated instruments doesn't exist for now. If you are buying an SDI, buy it with the mindset of holding it until maturity.

Prepayment Risk: Because most of the SDIs have loans as underlying assets, borrowers can choose to prepay their loans (without penalty) sometimes and you may start receiving money faster than expected without getting the opportunity to invest at the same terms of SDI you invested in.

Conclusion

Securitized Debt Instruments (SDIs) offer a unique investment opportunity by converting various types of loans into tradable securities, providing diversification, and potentially higher returns. While they come with inherent risks and complexities, the structured safeguards and regulatory frameworks in place make them a compelling choice for informed investors.

SDIs inherently help rotate capital within the economy, helping deepen the debt market. As the Indian market continues to mature, SDIs are likely to become an increasingly popular investment vehicle. Grip Invest is currently the market leader with over 80% market share in structuring SDIs and bringing them to retail investors.

That's it for this long article. There are a lot more interesting pieces to come out of this and hopefully, you all will enjoy them. If you have any feedback, please don't hesitate to reach out to us at ALT Investor or Grip Invest.

Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/ or default in payment. The investor is requested to read all the offer related documents carefully and to take into consideration all the risk factors before subscribing to debt instruments.

This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities.

Neither ALT Investor or its associates/associated entities, assigns or affiliates takes or accepts any liability for consequences of any actions taken based on the information provided.

Subscribe to my newsletter

Read articles from Yash Roongta directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Yash Roongta

Yash Roongta

I am a CFA and FRM Charterholder. I used to work as a Portfolio Implementation Manager for Aviva Investors managing £3bn+in Assets Under Management in the UK. I am very passionate about educating people on how they can make more money with their existing investments sustainably.