Private Equity and Venture Capital

Finance Freak

Finance Freak

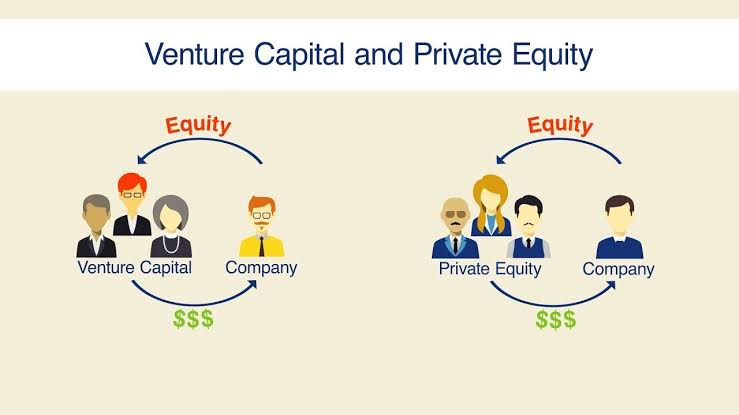

Though private equity and venture capital share some similarities, they are actually distinct and play major roles in the financial landscape. Both deal with providing capital to companies but do so at quite different stages of the respective business development and with quite different strategies targeted at different companies.

Private equity refers simply to investments made in non-publicly traded companies. Private equity firms typically raise millions of dollars in capital from institutional investors and high-net-worth individuals to acquire stakes in companies. This is normally done in mature companies that have underperformed or are undervalued but present a potential tremendous upside based on resulting strategic changes. The key business of private equity firms is to add value to such companies through restructuring, operational improvements, or financial engineering and exit the firms profitably through sale, merger, or IPO.

Equally, to a great extent, private equity invests largely in mature companies. These are businesses that have already established operations and have stable cash flows, but probably are losing market share or are inefficient or have less-than-optimal management. PE firms see opportunities where they can drive changes that unlock value—for instance, by streamlining operations, cutting costs, or changing management teams to drive better performance.

This has, in turn, significantly affected private equity and venture capital by offering an alternative channel for digital payments and wallets. However, with consumer demand for smooth and secure digital transactions on the rise, it has now become apparent that private equity and venture capital firms have been funding more and more business concerns involved in developing digital payment-solutions with mobile wallets, along with related infrastructure. But it only reinforces further the general uptake of digital financial services around the world and equally puts these investors on an excellent course to getting full gains from this pace of transformation that has now quickened in the payments industry and, through that, fuel growth and competition in the area of financial technology.

Control and influence are at the hub of private equity investments. Often, PE firms take controlling stakes in companies they invest in, and it gives them the authority in making sweeping changes. Since it is control, it is seen that the highly critical decisions concerning strategic direction, operational focus, and financial management are effected. One factor separating private equity from other forms of investment, such as venture capital, is the ability to affect management decisions

Leverage is actually another regular characteristic of private equity. As a matter of fact, most PE transactions are in the form of leveraged buyouts, meaning that a significant level of debt is used to finance the acquisition. This allows the PE firm to purchase a company by investing only a small amount of equity. Consequently, potential returns are magnified if the acquired business improves its performance beyond expectations. Finiancial risk increases in return as companies will have to generate enough cash flow to service the debt.

The horizon of most private equity investments is long, usually five to seven years. In these five to seven years, a PE firm works extensively in improving the performance of the company to achieve an appreciable market value of the company. This is all taken as a means to exit the investment at a far higher valuation to generate substantial returns for the firm and its investors. Standard exit strategies include selling to another firm, another private equity firm, or taking the company public via an IPO.

In comparison with private equity, venture capital deals are usually focused on young, early-stage companies showing great growth potential. VC giants invest money in young innovative companies in the fields of technology, biotech, or fintech. At the end of the day, these companies will have really nice ideas and a giant potential in the market but will lack the capital to grow. Venture capitalists give the required funding in return for equity in the company, usually in the form of minority stakes.

In venture capital, there is a higher risk and a higher reward. By their very nature, early-stage companies are risky investments, for the simple reason that many never gain commercial success. If one does, however, the returns can be huge—oftentimes far in excess of the initial investment. Exponential in nature, venture capital represents an attractive yet very risky way to invest.

Venture capital investments typically take place in a staggered fashion, with seed money availed upon the establishment of a firm. The company may, after some achievement, raise additional rounds of funding labeled Series A, B, and so on to match the pace of growth with the existing goals. At each stage in the investment, the company is being taken one step forward anyways, towards another level of development, with the intent of reaping the maximum value at the time of exit, either through an IPO or through acquisition by a larger company.

While the objective of private equity and venture capital is to generate returns by investing in companies, the methodology that both these entities use is quite different. Private equity invests in mature companies with proven business models and looks to enhance value through strategic changes and operational improvements. Venture funding is all about nourishing innovation by providing capital to start-up companies that have the potential for rapid growth.

Generally speaking, investments in private equity are less risky than venture capital since it is concentrated on established firms that have predictable cash flows. Again, the potential return on venture capital investments may be great, since high risk is associated with supporting untested startups.

The overall impacts of private equity and venture capitals in the business world are immense. For instance, private equity firms have played a major role in providing a 'turn-around' for underperforming businesses; hence, created jobs and made the economy more competitive, allowing it to grow. Venture capitalists typically provide financing for innovative new start-ups that drive technological change and bring new goods and services to the market through innovation and dynamism in the economy.

In a nutshell, private equity and venture capital are very important financial mechanisms making their contributions in terms of financing companies at various stages of the company lifecycle. Their operations are different, but both are vitally important in enhancing and developing businesses in the economy.

Subscribe to my newsletter

Read articles from Finance Freak directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by