Company Profile: GoldenPi (The Oldest OBPP Platform In India)

Aayush Pandit

Aayush Pandit

KEY TAKEAWAYS

GoldenPi, established in 2017, is India's oldest online bond platform, offering a wide range of fixed-income investment options to retail investors.

The platform shifted its focus from peer-to-peer bond trading to creating a large distribution network for bonds and debentures due to market liquidity issues.

GoldenPi was the first to receive a debt broker license under SEBI's OBPP guidelines in January 2023, enhancing its credibility and regulatory compliance.

The company operates a dual business model, serving both retail investors and instrument issuers, and earns revenue by charging issuers for using its platform.

GoldenPi provides a diverse selection of bonds, allowing investors to make informed decisions based on their financial needs, while also highlighting the importance of credit ratings in assessing investment risk.

Most of the current Online Bond Platforms (OBPs) started their business during or after the pandemic. The reason was simple: more people were looking to invest and explore alternative options in India.

GoldenPi, however, is an exception. They started in 2017, long before the pandemic, when retail investors were mostly aware of only Fixed Deposits, Mutual Funds, and Direct Equity.

Initially, GoldenPi aimed to build a platform for investors to buy and sell bonds among themselves. But due to a lack of market liquidity, they changed their strategy. The new goal was to create India's largest online distribution network for bonds and debentures. They brought various large debt houses onto their platform, allowing them to sell debt securities directly to retail investors.

After SEBI released the OBPP guidelines in November 2022, GoldenPi was the first online bond platform to receive its debt broker license on January 4th, 2023.

Through our platform, we're opening up new investment options to the 70 million retail investor segment across the country. Our vision is to make quality debt investing in this bond market an easy, affordable, and staple household opportunity for all," said Abhijit Roy, Co-Founder and CEO, GoldenPi

Today, the company claims to have a daily inventory of Rs. 5000 Cr in fixed income offerings on its platform. It has become a key player in India's bond and debenture market, serving retail investors, financial institutions, and bond and debenture issuers. Returns range from 9% to 12% per annum.

Like any other OBPP platform, GoldenPi must follow SEBI's rules and regulations. To learn more about OBPP, please check this blog.

For more information from the founders, check out the podcast here. We will soon have our own podcast with the founders as well.

Corporate Structure & Founders

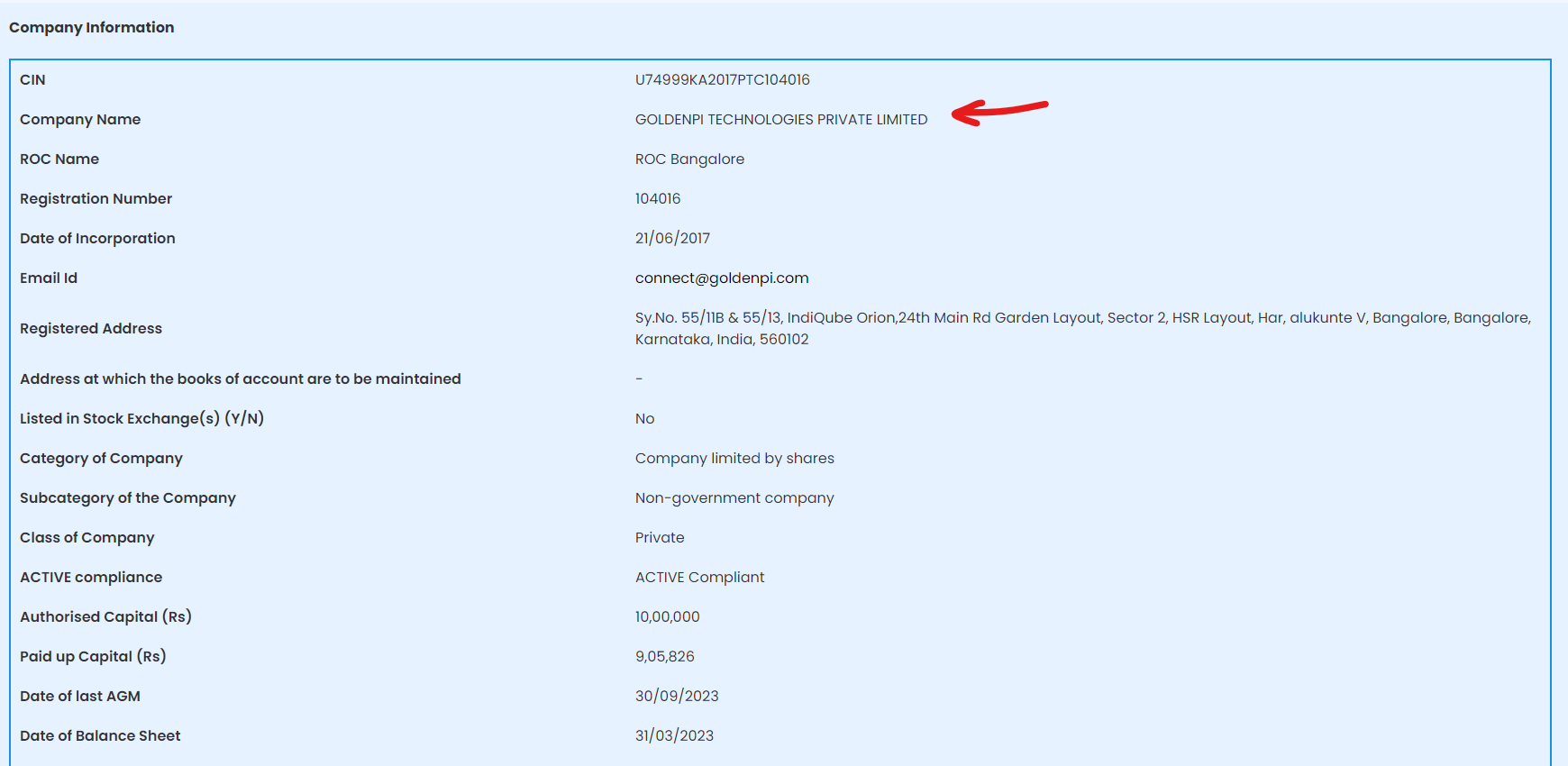

GoldenPi (GoldenPi Technologies Pvt. Ltd), the tech investing platform operates under the banner of GoldenPi Securities Pvt. Ltd.

GoldenPi Securities Pvt. Ltd. has the debt broking license and is the wholly owned subsidiary of GoldenPi Technologies Pvt. Ltd.

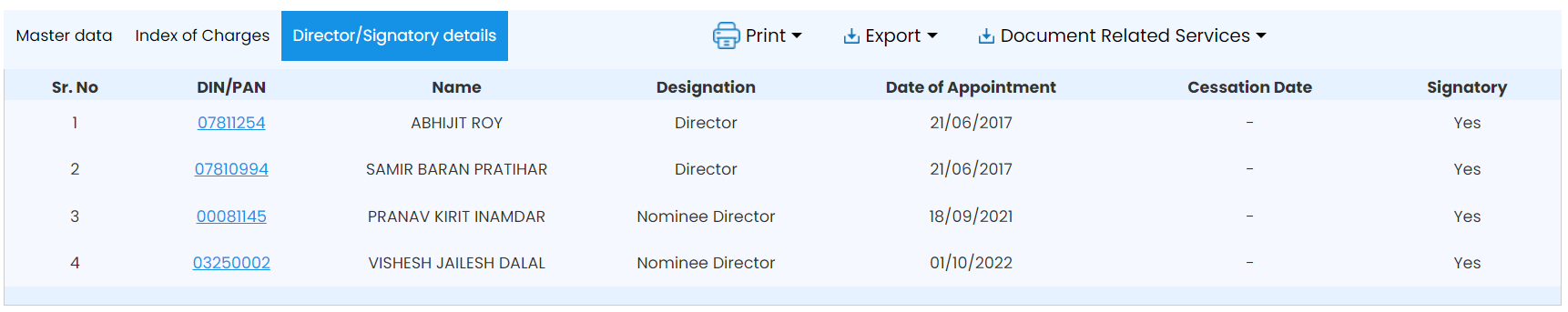

As per the latest MCA filings and their Linkedin profiles, the Directors are:

Abhijit Roy (Co-Founder & CEO)

Samir Pratihar (Co-Founder & CTO)

Abhijit and Samir's combined expertise in finance and technology has helped GoldenPi become a key player in the bond market, connecting issuers and investors on one platform.

There are two Nominee Directors assigned to the company as well. A nominee director is appointed to represent another person or entity, such as a shareholder or beneficial owner. So Pranav Inamdar and Vishesh Dalal most likely represent their respective investors on GoldenPi board.

GoldenPi's Business Model

GoldenPi operates a dual business model, serving both retail investors (B2C) and instrument issuers (B2B).

B2C Model: Retail investors can sign up on the GoldenPi website and, after completing a simple KYC process, browse a wide range of bonds available for investment and make purchases seamlessly. The available investment instruments are as follows:

Listed Corporate Bonds - Bonds issued by various corporations or private companies that are listed on the stock exchange.

NCD IPOs - Non-convertible debentures IPOs, which are initial public offerings by the issuing company on the stock market.

Corporate FD - Term deposits that are not regulated by DICGC or RBI insurance. Since the risk is higher than conventional FDs, the returns are higher as well.

Sovereign Gold Bonds (SGBs) - An easy way to invest in digital gold hedged against the country's gold reserves. Although future issuances of SGBs are unlikely.

Government Securities - Government bonds or offerings by the government directly, which can also include offerings from government-backed entities.

B2B Model: GoldenPi offers a SaaS solution to instrument issuers, allowing them to list bonds on the platform. Issuers with a proprietary book of ₹50 crore or more can automatically connect to GoldenPi's marketplace and offer their instruments for retail investors to invest in.

How They Make Money: GoldenPi does not charge retail investors for making investments on the platform. Instead, they charge issuers fees for using their tech stack and also charge them for each investment transaction made through their bond platform.

How is it Different from Other OBPPs?

GoldenPi suggests that their USP is their tech stack, making it easy for both the retail investors to invest and the issuers to list their instruments on their platform.

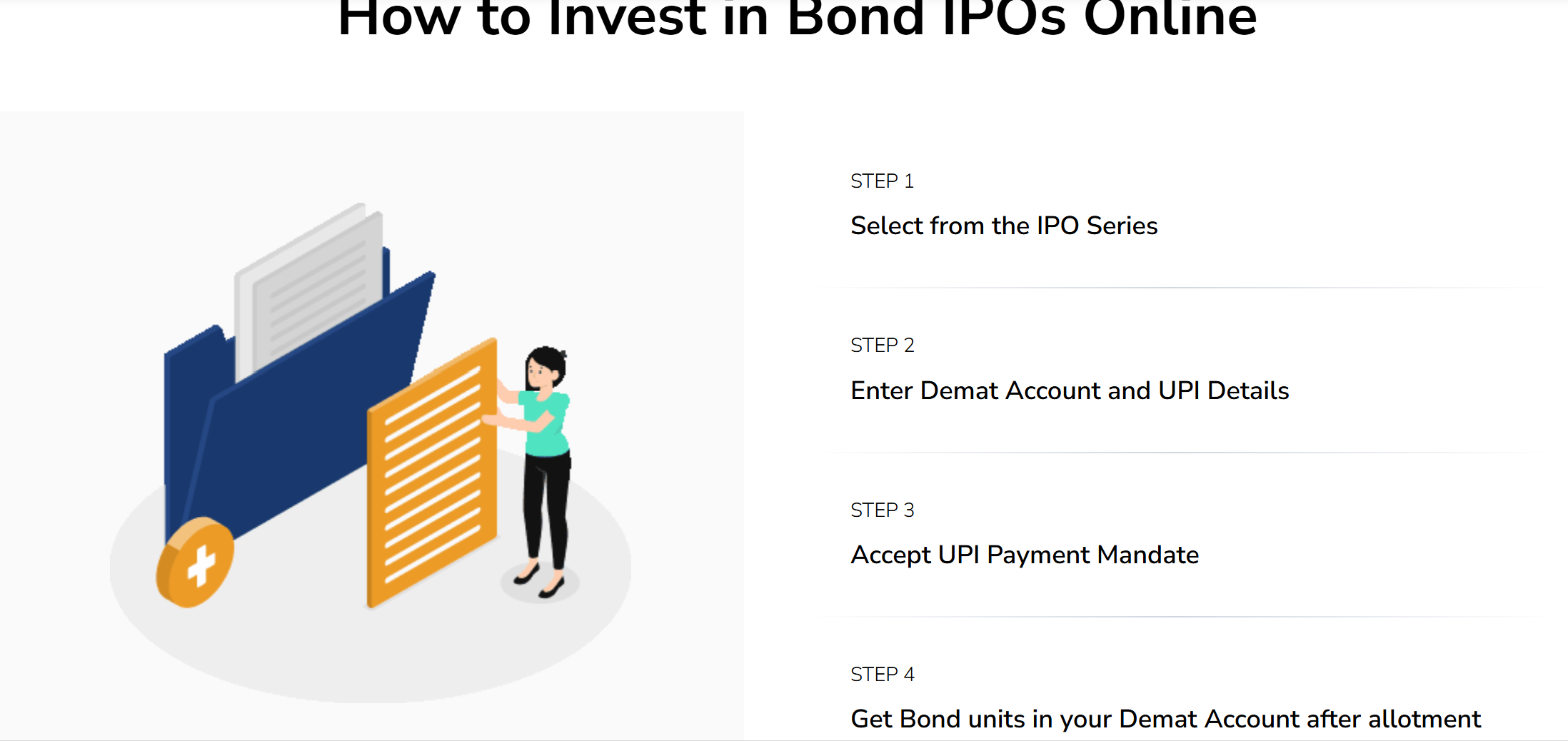

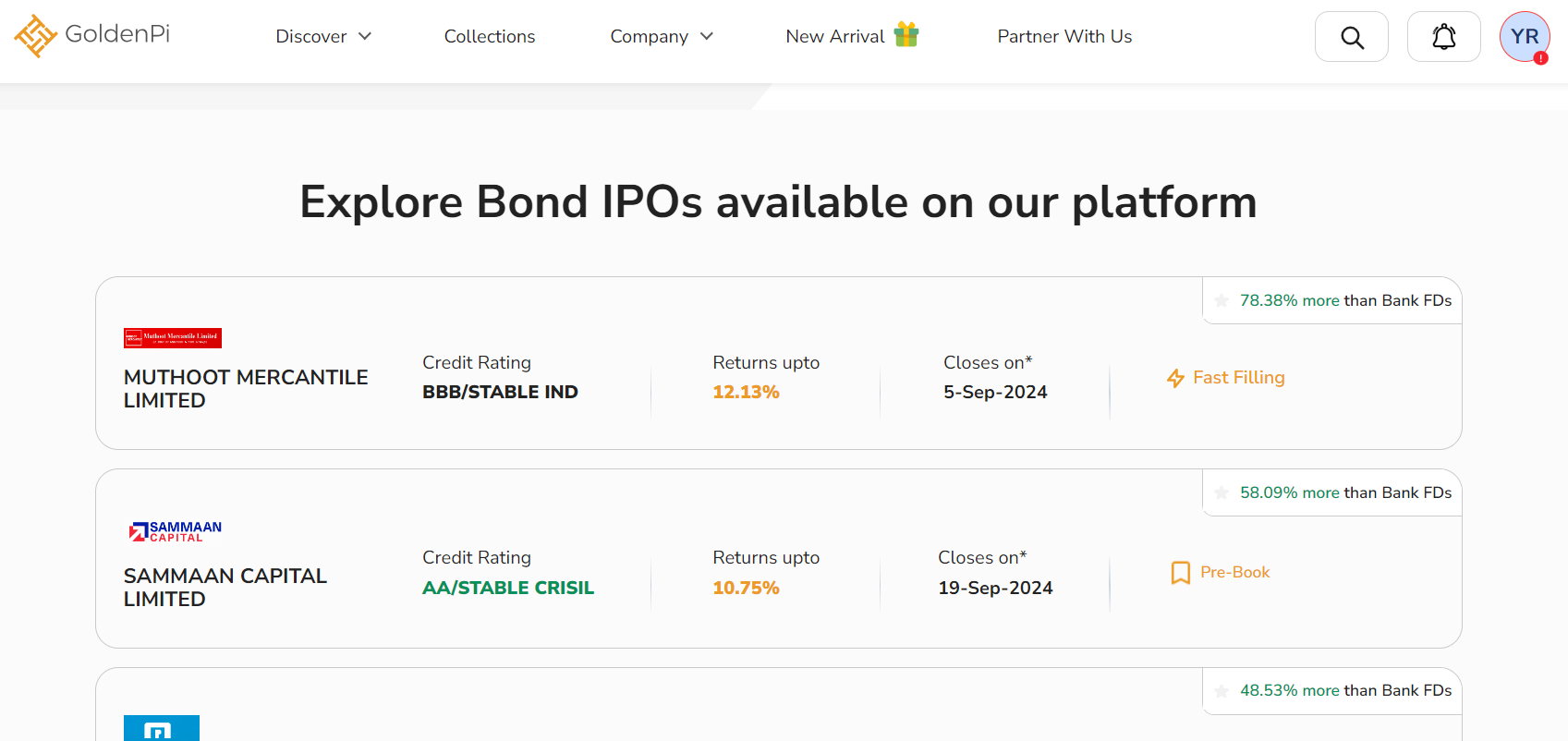

NCD IPOs

GoldenPi offers retail investors to invest in upcoming Bond IPOs. Very few platforms have the infrastructure to support that. They enable that via ASBA process. (Similar to how you apply for Equity IPOs)

At the time of writing, they have a couple of Bond IPOs are live on the platform. Users can invest in them and get allocation. Once the issue closes, money is deducted from bank account of the investor.

These are publicly listed bonds and thus regulated by SEBI. The return and rating will differ for each and every bond. A simple tool to measure any investment has to be remembered in the fact, that if the returns are good, the risk probably is high as well.

Aggregator Model (Competitive Pricing)

The platform aggregates bonds from multiple financial institutions like Yubi, Oxyzo, Tipsons Group, various issuers and other financial intermediaries, allowing investors to choose from a broad selection.

This wide assortment creates a competitive marketplace for issuers to offer their bonds to retail investors like you and me. So, if I wanted to invest Rs. 10k, I have multiple investment options with different return rates, risks, and credit ratings. This allows me, as a user of the platform, to make the best possible decision based on my financial needs, ensuring I get the maximum return for my Rs. 10k with the least possible risk.

This is very different from platforms like Grip, Wint, Aspero who set their price themselves. Think of GoldenPi as a Flipkart for Bonds.

Can Defaults Happen?

Debt instruments in nature are less riskier than equity investments, but it highly depends on which kind of bond you have purchased. Now with so many options available in the market like NCD, MLD, Unlisted Corporate, Govt Bond, it can get very confusing on which option works best for you. But one thing which is always very helpful to know is the rating of the bond.

Source: Kundan Kishore

The higher the rating of the bond, the lower the credit risk. So in above table, if a Bond X is rated AA and Bond Y is rated BB, Bond X will be much more safer than Bond Y but will also yield less returns when compared. The beauty of debt market is there is something always available suiting the investors risk profile.

For Fixed Deposits done with a bank, any deposit upto INR 5 Lakhs is covered under the DICGC Insurance. However, any deposits done with a Deposit Taking NBFC will not be covered under this scheme and still faces a risk of default. Investors can get comfort by evaluating the credit rating of NBFCs in these cases.

What We Like About GoldenPi

The very first thing is they are regulated under the SEBI OBPP framework which has very clear defined rules, regulations and dispute resolution frameworks. So no dealing with ambiguous investment vehicles and structures.

Transparency and Accessibility: The platform's commitment to offering high-quality bonds at competitive prices, coupled with an easy-to-use interface, makes it accessible to both novice and experienced investors.

Diverse Offerings: By focusing on both sides of clientele, the investors and the issuers, GoldenPi can bring in a diverse range of offerings that allows the retail investor, to make better-informed decisions about their investment to get the best possible returns with the least possible risk. Very very good for people who like to browse lots of options.

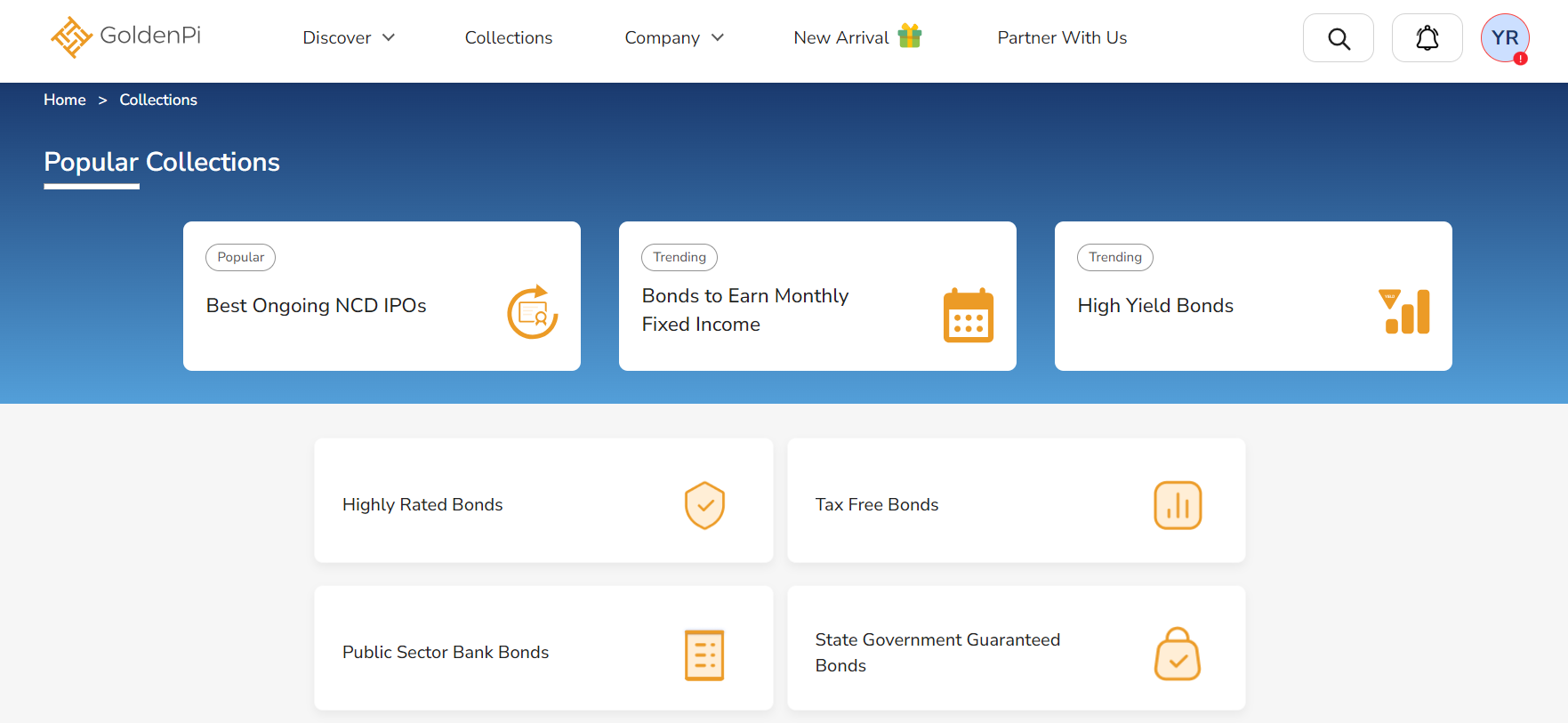

Their website is easy to navigate, we like the "Collections" feature on their website which filters all available bonds based on option selected.

What We Don't Like About GoldenPi

All opportunities are shown in IRR (Internal Rate of Return) which can be misleading for bonds as it assumes all interest payment received is reinvested at the same interest rate, which is not always true as TDS payments are also deducted and clearly can't be reinvested at same rate. To be fair this is an industry wide problem and not specific to GoldenPi.

For a normal retail investor, ratings are a good metric to check, however what would be helpful for Goldenpi is to show the average default rating for that rating across the overall Indian debt markets. This figure is published by rating agencies regularly and would give a fair idea to the investor on history of defaults for that rating.

Conclusion

Our regular readers might notice that this article is very similar to our Company Profile article on other OBPP platforms. This is because all the platforms follow the same rules set by SEBI and are good platforms.

As ALT Investors, we are very optimistic about diversification and believe that Indians should diversify away from Fixed Deposits if their risk profile allows it. Platforms like GoldenPi offer fantastic opportunities to do that.

What remains to be seen is which platform can best appeal to investors. While some platforms choose to curate a specialized list of bond investment options, almost like a financial advisory, others choose to lay everything out in the open and let investors make their own informed decisions about which investment is the best for their money!

What GoldenPi does provide is a valuable service for those looking to diversify their investment portfolios with fixed-income instruments. However, as with any investment, potential investors need to weigh the risks and benefits carefully, considering their risk profiles and their personal investment goals.

We hope this piece was helpful, we will see you in the next one. If you have any questions on this piece, please mention in comments below or join our WhatsApp Community to ask your questions directly. You can join the community by applying here.

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India, and none of these views reflect those of my current employer. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.

Subscribe to my newsletter

Read articles from Aayush Pandit directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Aayush Pandit

Aayush Pandit

My work in the events & exhibitions industries has not swayed me away from my core passions, a love for the legal field and all things finance.