Introducing STRKFarm

web3Gurung

web3Gurung

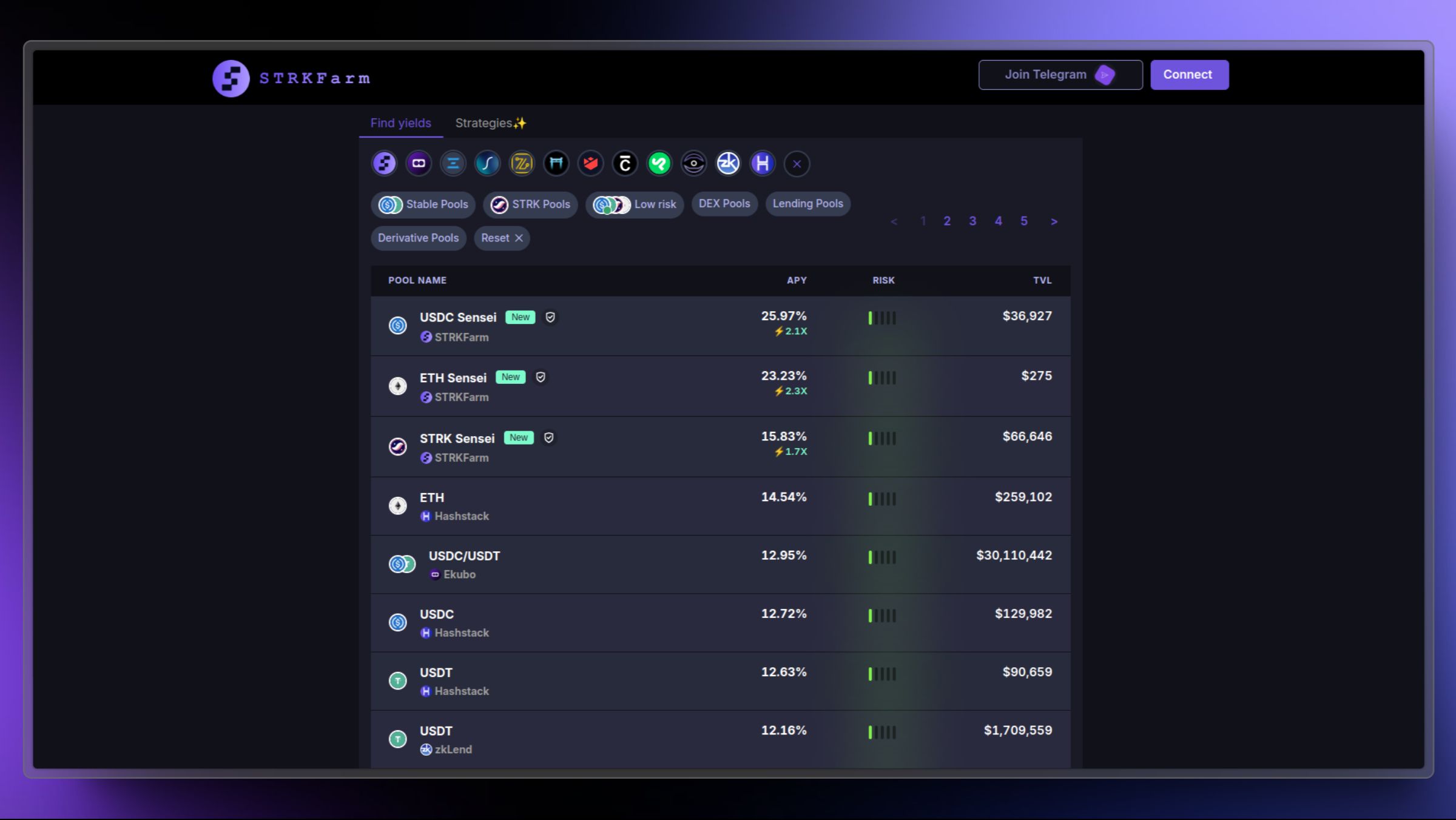

Discover STRKFarm, the leading yield aggregator on Starknet, where you can effortlessly find the best yields across the entire Starknet ecosystem.

Our platform not only brings together top-performing projects in one convenient location but also offers tailored yield strategies designed to maximize your returns. With STRKFarm, you can optimize your investments and take your earnings to new heights 💹

Our vision

STRKFarm envisions to provide advanced DeFi solutions to Starknet users, starting with yield aggregation and optimizing user returns through automated vaults/strategies. The platform focuses on leveraging Starknet's scalability and low transaction costs to bring professional DeFi solutions to everyday onchain users.

By prioritising transparency, security, and user experience, STRKFarm aims to provide users with the best possible yield farming opportunities, fostering growth and innovation within the DeFi ecosystem.

Deep dive on existing strategies:

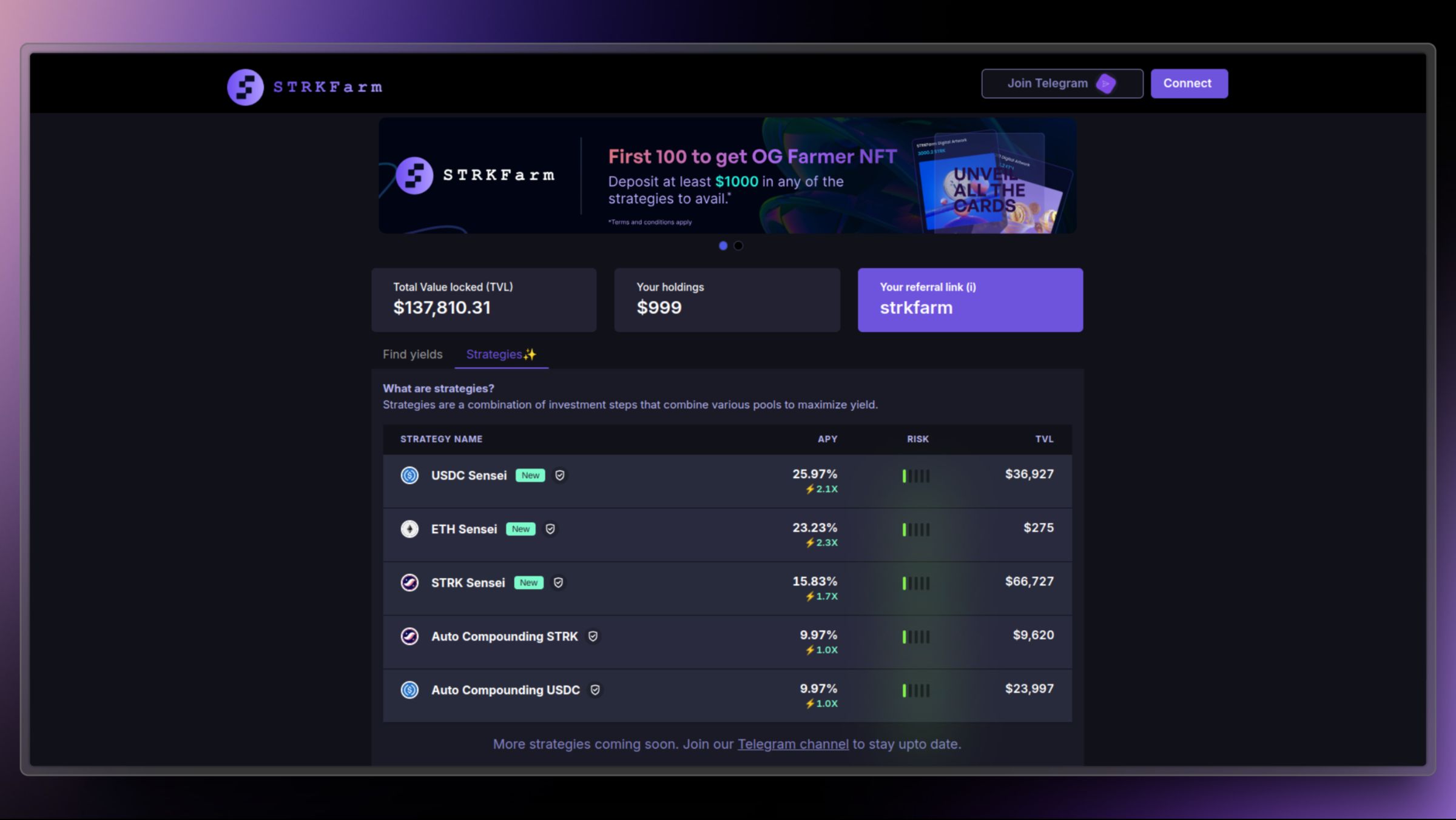

Right now, there are 2 types of strategies available on the dapp:

Auto-compounding strategy

Sensei - Delta neutral Lending

We’ll provide you a simple explanation on what goes behind the scenes of these strategies!

Auto-compounding strategy

In this strategy, we’ve created a vault which automatically claims your Defi Spring rewards and deposits back to the vault. Which means, it re-invests your STRK rewards every 7 days.

Here are other benefits which this strategy provides:

Maximised Returns: Automatically reinvesting yields ensures that your earnings continuously grow, leveraging the power of compound interest.

Time Efficiency: Eliminates the need for manual intervention to reinvest rewards, saving you time and effort.

Cost Efficiency: By automating the process, it minimizes transaction costs, especially on a scalable and low-fee network like Starknet.

Optimisation: Ensures that your assets are always working at their highest potential without requiring constant monitoring.

Sensei - Delta neutral Lending

Have you ever heard of the "looping" strategy? It works similarly to our Sensei strategy.

Here's how it works if you do it manually: First, deposit collateral (e.g., ETH) on a lending platform like Nostra. Then borrow another token with a low borrow APR (e.g., STRK) and deposit it as collateral in another lending protocol, such as zkLend. Next, borrow ETH from zkLend and deposit it back into Nostra as collateral. Repeat the process by borrowing STRK again to use as collateral on zkLend. By looping this 4-5 times, you can achieve a higher overall yield.

Learn more about this strategy here: https://docs.alpacafinance.org/alpaca-finance-2.0/step-by-step-guide/looping-strategies.

Ensure that the supply APR is significantly higher than the borrow APR to avoid a negative ROI.

The Sensei strategies operate similarly to what you read above as Single sided pools. You provide one token (ETH, STRK, or USDC), and we manage the entire looping process on zkLend and Nostra.

Here are the high level benefits of Sensei strategy:

Expertly Curated Strategies: Sensei Strats are designed by experienced DeFi strategists, ensuring optimal asset allocation and yield optimisation.

Diversification: These strategies often include a mix of assets and protocols, reducing risk through diversification.

Automatic Risk Management: health of the contracts are monitored in real time and automatically rebalanced, allowing for a hands-off investment approach.

Enhanced Returns: By leveraging advanced strategies and automated compounding, Sensei Strategies aim to maximize your returns efficiently.

Audits

Our contracts have undergone an audit by the cairosecurityclan team. You can find the details here.

Team

We have akiraonstarknet working full-time on STRKFarm. Behind the scenes, four more people (including hemantwasthere, web3gurung & minato) are helping to scale STRKFarm.

Open source efforts

STRKFarm is very community driven product, having 13+ active contributors. Thanks to grants from the Starknet Foundation, we have distributed over 6,600 STRK (approximately $2,800 at the time of writing) through OnlyDust. We'll provide more details about this programme in our upcoming articles!

Subscribe to my newsletter

Read articles from web3Gurung directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

web3Gurung

web3Gurung

a community x tech person. learning to code and share my progress.