What’s next for Solana after FTX move $23.75M?

CryptoChamp

CryptoChamp

A wallet tied to FTX/Alameda recently redeemed a huge chunk of Solana tokens. But there’s still a significant amount left, and this has raised some important questions about Solana’s future. Let’s break down the key points.

1. What Happened?

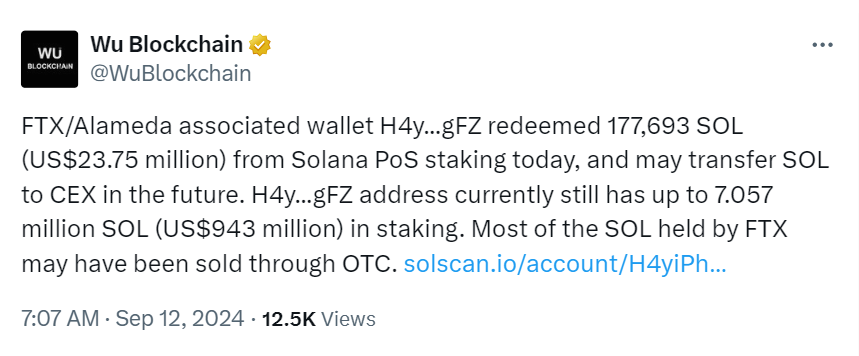

FTX/Alameda’s wallet (H4y...gFZ) redeemed 177,693 SOL, worth $23.75 million, from Solana’s Proof of Stake system.

The same wallet still holds around 7.057 million Solana coin, valued at about $943 million, which is still staked.

The big concern? There’s a chance that this SOL could be transferred to centralized exchanges (CEXs), which could shake up the market.

2. Solana's Market Impact

Solana (SOL) was trading at $134.36, down 2.63% over the last 24 hours, according to Coinpedia Markets.

With a market cap of $61 billion, Solana is currently the fifth-largest cryptocurrency.

The movement of such large sums of SOL has put the spotlight on Solana. Market watchers are questioning what the next steps from FTX/Alameda will be and how they’ll affect SOL’s price.

3. FTX’s Financial Obligations

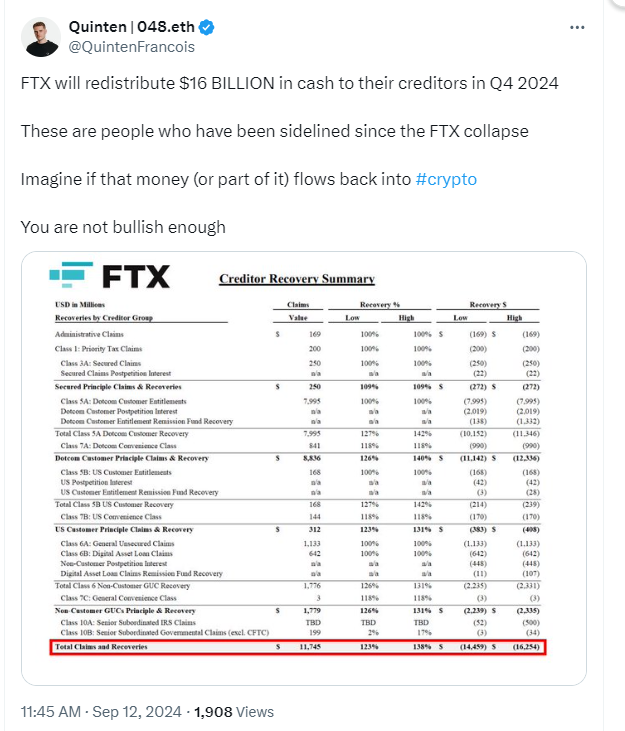

FTX is still dealing with the aftermath of its collapse, and it's been ordered by the courts to repay investors, with repayments expected to start in the fourth quarter of 2024.

The company has $16 billion to repay.

FTX plans to use stablecoins to cover some of the repayments.

This means they may need to sell more of their SOL holdings to raise funds.

4. Will FTX Dump SOL?

A key question here is whether FTX will dump all its Solana holdings on the market. If they do, it could seriously impact SOL’s price, especially with the large amount they’re still holding.

There’s been some cautious optimism though. An analyst from NFT Perks said, “It looks like they’re getting closer to paying everyone back!” This suggests that FTX might be on the right track, but the market impact remains uncertain.

5. Legal Developments

Another major factor to watch is the legal side. Caroline Ellison, the former CEO of Alameda, is scheduled for a court hearing on September 24. If her cooperation with authorities leads to concessions in her sentencing, it could accelerate FTX's repayment plans, potentially leading to faster sales of SOL.

6. What Should Investors Do?

For now, market participants should stay cautious. FTX’s next moves, especially concerning its SOL holdings, could lead to price fluctuations. The $23.75 million redemption is only a small part of the $943 million still locked in staking.

The big question remains: Will FTX offload all its SOL onto the market? Investors should keep an eye on these developments as they unfold.

Subscribe to my newsletter

Read articles from CryptoChamp directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

CryptoChamp

CryptoChamp

I'm your on-the-pulse crypto analyst, get breaking headlines, on-chain analysis, market trends, and bold price predictions - all in one place.