Exploring Thala Protocol: Unleashing DeFi Innovation on the Aptos Blockchain

Adityaa kr

Adityaa krTable of contents

- What is Thala Protocol?

- Move Dollar (MOD)

- ThalaSwap & Launchpad

- Vault Mechanics

- What Are Collateral Auctions?

- Understanding Stability Pools and Liquidations

- Collateral Deficit Risk:

- Example Scenario:

- Stability Providers:

- Liquidation Process:

- Key Takeaways:

- Understanding Redemptios and Peg Stability Module (PSM)

- Understanding ThalaSwap’s Liquidity Pools

- Flash Loans

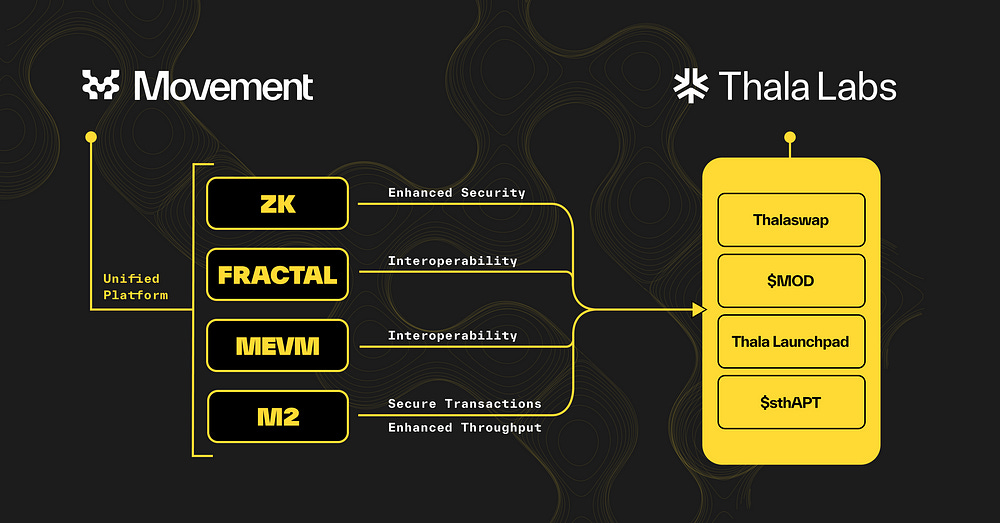

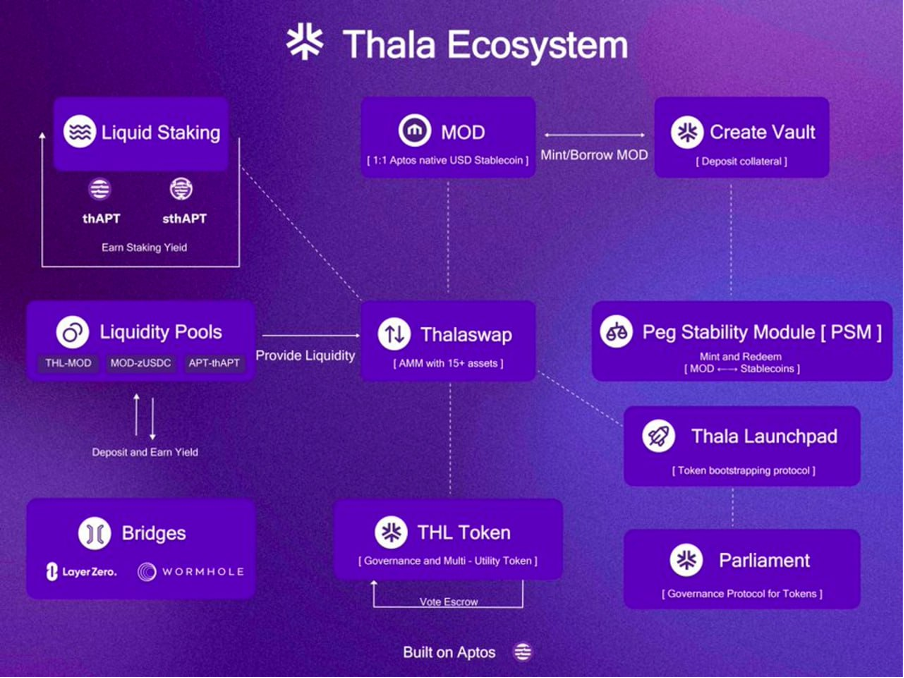

In this post, we take a closer look at the Thala Protocol, an innovative DeFi platform on the Aptos blockchain. Thala is distinguished by two major products: Move Dollar (MOD), a stablecoin backed by overcollateralization, and ThalaSwap, a flexible automated market maker (AMM) designed to maximize liquidity. We’ll unpack the workings of these products, including features like liquid staking, vault mechanics, and how the system manages collateral risk.

By the end of this discussion, you’ll have a clear picture of how Thala boosts capital efficiency and makes a significant contribution to the Aptos ecosystem and the broader DeFi sector.

What is Thala Protocol?

Thala Protocol is a DeFi platform built on the Aptos blockchain, focusing on two key products that aim to redefine liquidity and stability in DeFi:

Move Dollar (MOD)

ThalaSwap & Launchpad

Move Dollar (MOD)

Move Dollar (MOD) is a stablecoin built for the Aptos blockchain that’s backed by more collateral than the value of the MOD in circulation. This overcollateralization is crucial for keeping MOD stable and secure. MOD serves multiple purposes: it acts as a reliable store of value, a medium for transactions, and a unit of account. It’s supported by a variety of assets, including staked tokens, liquidity pool tokens, and real-world assets (RWAs). This diverse backing helps ensure that MOD remains decentralized and secure.

The design of MOD aims to keep its value close to $1. When users want to mint MOD, they must provide collateral that exceeds the amount of MOD they wish to create. This approach helps maintain a safe balance between collateral and debt. If the collateral value drops too low, the system automatically liquidates assets to restore balance and stability. Thanks to Thala’s protocol, MOD stays well-collateralized, maintaining its $1 peg and offering a dependable stablecoin.

ThalaSwap & Launchpad

ThalaSwap is a cutting-edge automated market maker (AMM) that makes trading tokens straightforward. It offers both weighted pools, where token ratios can be adjusted, and stable pools, where token balances are kept steady. One of ThalaSwap’s standout features is its Liquidity Bootstrapping Pool (LBP). This tool helps new projects launch their tokens smoothly by gradually adjusting liquidity to minimize volatility and avoid price manipulation.

The LBP is also a key component of Thala’s Launchpad. This platform, built on ThalaSwap, provides a secure and transparent environment for new projects to distribute their tokens. It ensures a fair process for price discovery and equitable token distribution.

Vault Mechanics

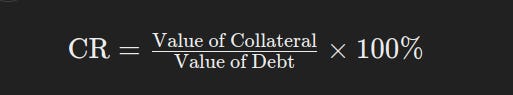

Thala’s vault system is designed to let you deposit collateral and mint Move Dollar (MOD). How much MOD you can create depends on the collateral ratio of the asset you’re using, which helps keep the system overcollateralized. For instance, if an asset has a collateral ratio of 120%, you’d be able to mint 833.33 MOD for every $1,000 of collateral you put in.

There’s a minimum requirement of 500 MOD that you must mint per vault. If the value of your collateral falls below a certain level, the system will automatically trigger a liquidation process to ensure everything stays stable. This mechanism is in place to keep the vault system secure and functioning smoothly.

To mint 500 MOD, you would need $600 worth of collateral,

calculated as: 500 MOD x $1.20 = $600.

What Are Collateral Auctions?

In the Thala protocol, collateral auctions come into play when a vault doesn’t meet its minimum collateral requirements. These auctions help recover the outstanding debt and ensure the system remains stable. The Minimum Collateralization Ratio (MCR) is crucial here as it protects against liquidation by ensuring the loan is adequately backed.

When liquidation is necessary, the person who initiates it earns a liquidation bonus. The process involves auctioning off all assets from the vault to raise the needed funds. The auction uses a Dutch auction format: it starts with a high price that gradually decreases until someone bids and buys the collateral.

How It Works:

To borrow funds, users deposit valuable assets like “APT or zUSDC” as collateral, providing more collateral than the amount they want to borrow. If the value of the collateral falls below a specified threshold, like 125% of the loan amount, the loan becomes under-collateralized. At this point, the system automatically triggers a liquidation process, starting with the Stability Pool, which attempts to cover the debt.

If the Stability Pool can’t fully cover the debt, an auction is held. During this auction, the collateral is sold to the highest bidder at a discounted price, and the funds raised are used to repay the loan. This process helps ensure that the system remains balanced and that loans are properly secured.

Auction Details:

Thala's collateral auctions use a Dutch auction method. This means that the auction starts with a high price that gradually decreases over time. Bidding kicks off with a price above the current market rate, and as time goes on, the price drops, giving bidders the chance to buy the collateral at increasingly lower prices. If no one places a bid before the price reaches the lowest point, the auction will reset with new market prices. Typically, these auctions last for either 5 or 24 hours. They start with a price that’s about 20% higher than the market price and have a floor price set around 60% of the starting price. This system helps ensure a fair and efficient way to recover the collateral.

Example:

Initial Situation:

Debt: 1,000 MOD

Collateral: 1,250 zUSDC worth $1,250

Value of Collateral = Debt × MCRRequired Collateral Value = 1,000 MOD × 125% = 1,250 USD

Since $1,250 in collateral meets the MCR of 125%, and position is initially safe.

Minimum Collateralization Ratio (MCR): 125%

Collateral Price: $1.00 (meets the MCR)

Price Drop:

The goal is to ensure that the debt remains adequately secured by the collateral and that the Minimum Collateralization Ratio (MCR) is maintained

If the price of zUSDC falls to $0.90, the collateral value drops to $1,125.

New Collateralization Ratio: 112.5% (below the MCR)

The system will trigger a liquidation and auction process.

Auction Details:

Starting Price: $1.08 (20% above $0.90)

Floor Price: $0.65 (60% of $1.08)

Duration: 24 hours

During the Auction:

The price starts at $1.08 and decreases to $0.65 over 24 hours.

A bidder buys 250 zUSDC at $0.85, paying 212.5 MOD, reducing the debt from 1000 to 787.5 MOD.

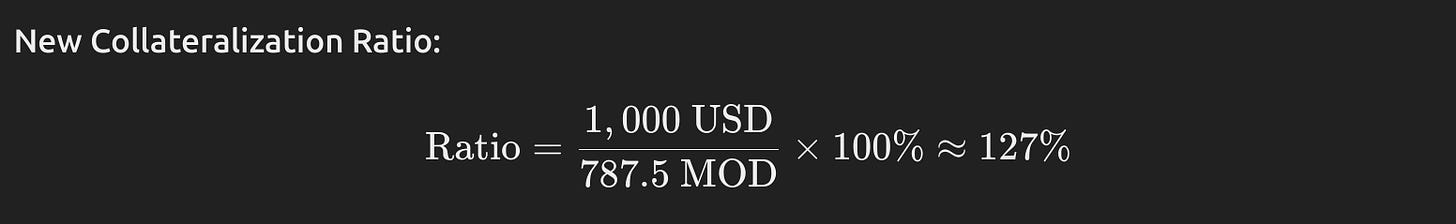

Calculation: (1000 - 212.5)MOD = 787.5 MOD Remaining

After the Auction:

Remaining collateral: 1,000 zUSDC. (worth $900 at $0.90 per zUSDC)

Remaining debt: 787.5 MOD.

Auction Reset:

- If the collateral price improves, the auction restarts with updated prices reflecting the latest market conditions.

For Example let's assume zUSDC has reached $1.00. With 1,000 zUSDC and 787.5 MOD in debt and After reset, the auction will appear as:

Collateral: 1,000 zUSDC

Debt: 787.5 MOD

Price of zUSDC: $1.00

With zUSDC at $1.00, the collateralization ratio is 127%*, which is above the required 125%, indicating the position is safe.*

If no more bids are placed, the auction runs until the collateral price drops to $0.65*. At that point, the auction resets with updated market prices for the collateral.*

Understanding Stability Pools and Liquidations

Stability Pools are designed to absorb debt from liquidations and maintain the protocol's solvency. They act as a primary defense mechanism, not a backup to auctions. Stability Providers deposit MOD into these pools and, in return, receive liquidated collateral as rewards. When a borrow position is liquidated, MOD from the Stability Pool is burned to cover the debt, and a portion of the liquidated collateral is transferred to the pool.

To prevent actions that might undermine the pool's stability, there are fees imposed on early withdrawals. This helps ensure that the pool remains effective in stabilizing the system and safeguarding against fluctuations.

Collateral Surplus:

What It Means: If a vault's Collateralization Ratio (CR) is above 100% after liquidation (e.g., between 110% and 125%), the auction or sale of the collateral will likely cover all the debt, and there might be a surplus.

After a liquidation, if the value of the collateral you receive plus any accrued rewards is greater than your original deposit, you profit from the liquidation.

Collateral Gain + Compounded Deposit > Initial Deposit

Collateral Deficit Risk:

What It Means: If a vault's Collateralization Ratio (CR) falls below 100% during a liquidation (e.g., due to a market crash or technical failure), the auction proceeds may not fully cover the debt, potentially resulting in losses for Stability Providers.

Collateral Gain + Compounded Deposit < Initial Deposit

However, if MOD eventually returns to its $1 peg, these losses are only realized when the provider withdraws their deposit.

Withdrawal Fees:

This mechanism helps maintain total MOD backing and typically results in profits for Stability Providers, especially when liquidations occur at collateralization ratios between 110% and 100%. To discourage short-term speculation, the system implements a decaying withdrawal fee, starting at 2% and decreasing to 0% over 24 hours.

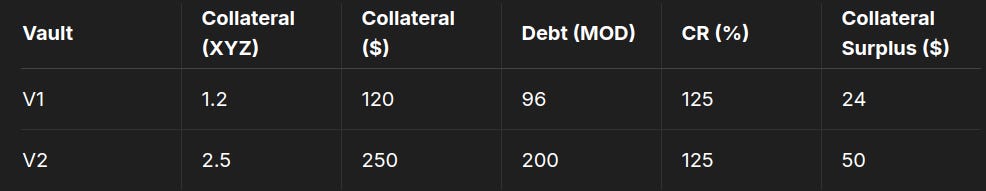

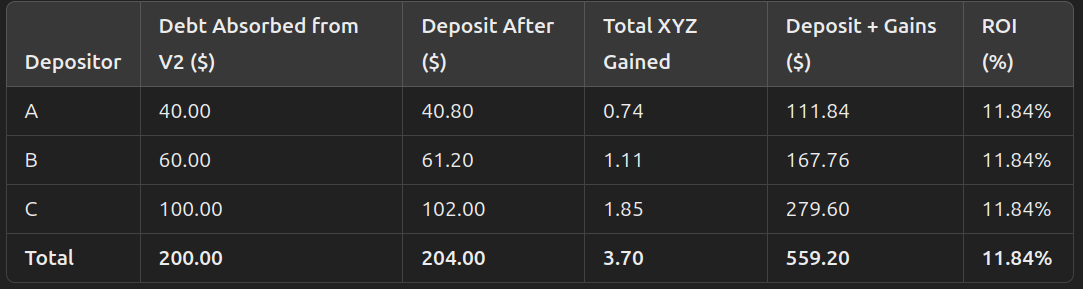

Example Scenario:

Vault 1: 1.2 XYZ collateral ($120), 96 MOD debt, 125% CR

Vault 2: 2.5 XYZ collateral ($250), 200 MOD debt, 125% CR

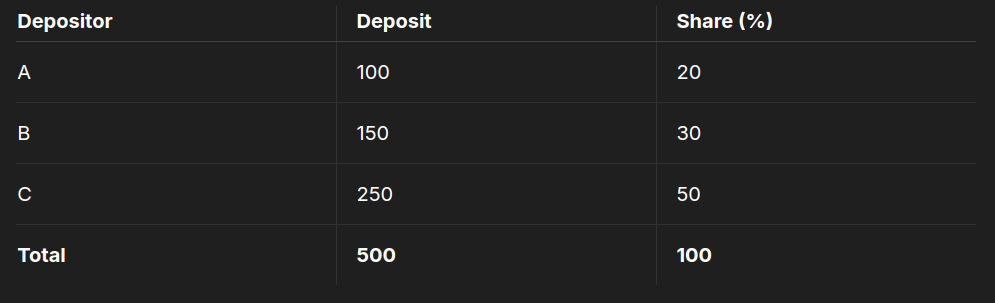

Stability Providers:

Provider A: 100 MOD (20%)

Provider B: 150 MOD (30%)

Provider C: 250 MOD (50%)

Total Deposits: 500 MOD

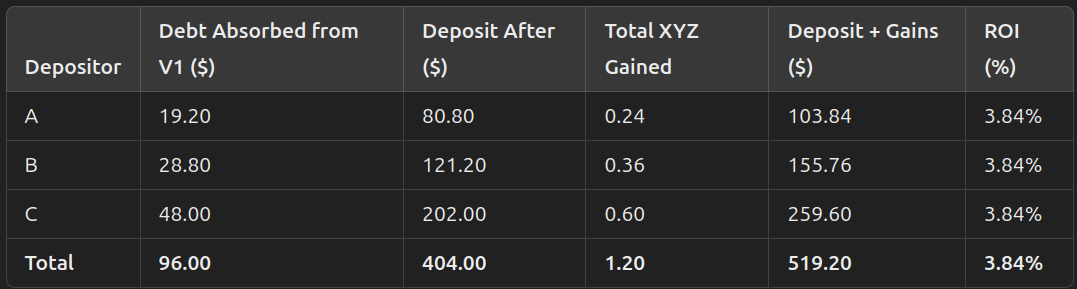

When the value of XYZ falls, both Vault 1 and Vault 2 are liquidated. The liquidated collateral is distributed among the Stability Providers based on their share of the pool:

Liquidation Process:

When the value of XYZ falls to $96, the collateral value for V1 and V2 decreases:

V1 Collateral: $115.20 (CR = 120%) → subject to liquidation.

V2 Collateral: $240 (CR = 120%) → subject to liquidation.

After Vault 1 liquidation: 3.84% ROI

After Vault 2 liquidation: 11.84% ROI

Liquidation of Vault 1:

The liquidation of Vault V1, the

$96debt is absorbed by 96 MOD, and the 1.2 XYZ is split amongst Stability Providers at the new price of$96per XYZ. The liquidation gains of the Stability ProvidersA, B, and Care proportional to their respective share of the total MOD in the stability pool.

Liquidation of Vault 2:

The liquidation of V1, the second liquidation, V2, occurs.

200debt is absorbed by the200MOD in the pool, and the2.5XYZ collateral is split amongst Stability Providers. The accumulated gains below represents both liquidation profits from vaults V1 and V2 with the new price of$96per XYZ

Key Takeaways:

Stability Providers benefit from liquidations when CR is above 100%, but they face risks if the collateral falls below 100%.

The liquidation process and auction dynamics are designed to maintain system stability and ensure fair value recovery.

Understanding Redemptios and Peg Stability Module (PSM)

Redemptions:

What It Is: Redemptions let you exchange MOD for assets like Collateral A. Not all assets are always redeemable. Redemption rules change based on the system's needs.

Example: If Collateral A is too high, only other assets can be redeemed to balance things. Only vaults with a Collateral Ratio (CR) >= Minimum Collateral Ratio (MCR) can redeem.

Example:

With $1,000 collateral and $833 debt (833 MOD), the MCR is 120% (calculated as $1,000 / $833 × 100%). Redemption is allowed if the Collateral Ratio (CR) is equal to or greater than 120%. Since the CR here is 120%, redemption is possible.

Fees: There's a 0.50% fee. Redeeming 100,000 MOD means you get $95,500 in collateral after fees.

Emergency: All assets can be redeemed in emergencies.

Rules: Redemption is blocked if the system's total collateralization ratio (TCR) is below 110%.

Peg Stability Module (PSM)

Purpose: Keeps MOD's price at $1.

How It Works:

If MOD > $1: Convert zUSDC to MOD at a 1:1 ratio and sell MOD. This helps bring MOD’s price down to $1.

If MOD < $1: Buy MOD, convert to zUSDC at a 1:1 ratio, and sell zUSDC. This helps push MOD’s price back to $1.

Details: The PSM allows 1:1 conversion between MOD and stablecoins (zUSDC, zUSDT, etc.) to maintain price stability.

Understanding ThalaSwap’s Liquidity Pools

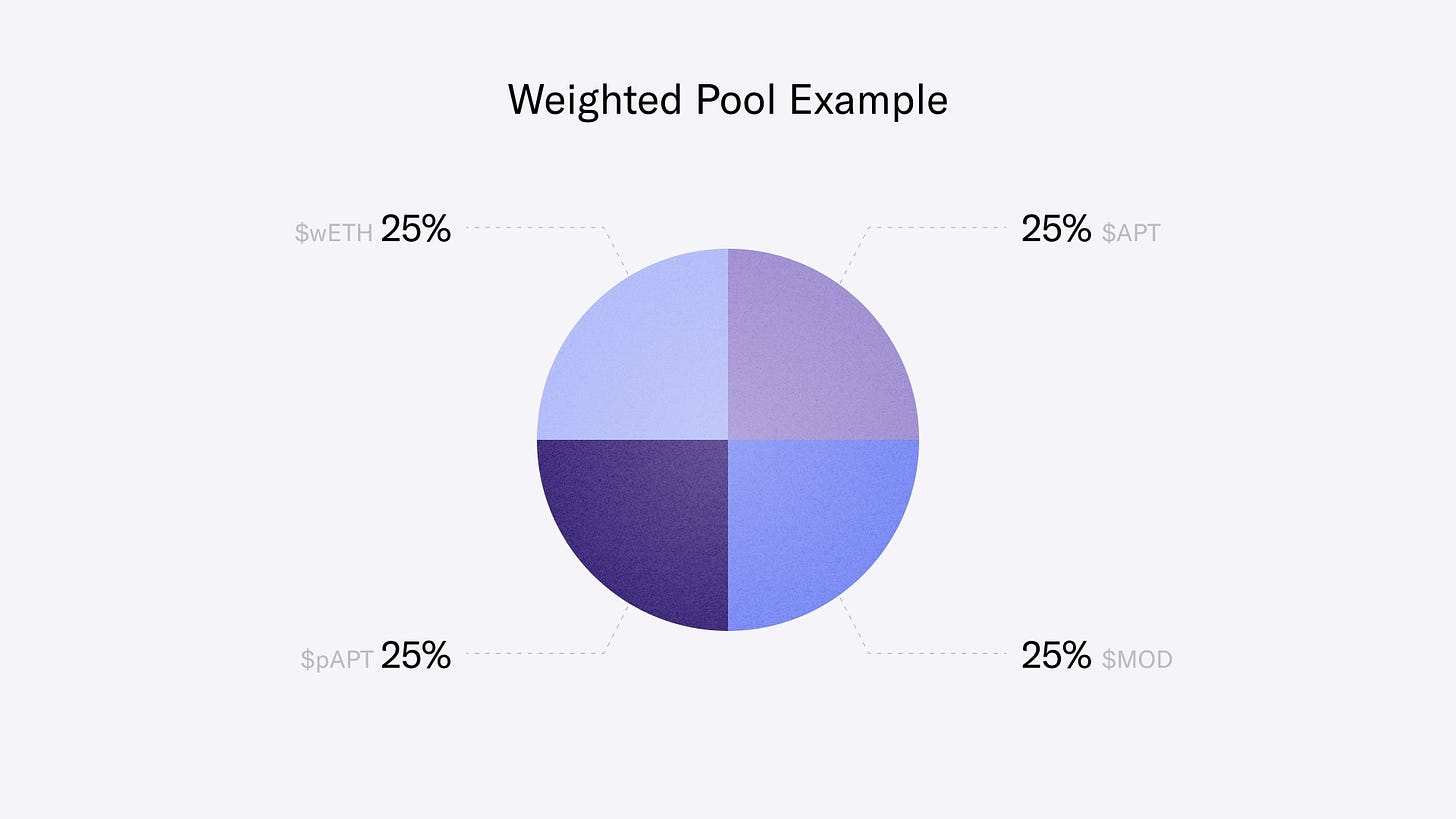

1. Weighted Pools:

What Are They? Weighted pools are advanced liquidity pools that allow more flexibility than traditional pools. Unlike the classic model, which uses two tokens with a 50:50 ratio, weighted pools can include up to four different tokens.

Why Use Them? These pools enable more direct trading between token pairs, which increases trading options and can generate more fees for liquidity providers. For example, you might see a pool with an 80:20 ratio of tokens, which helps in specialized cases like vetokenomics.

Learn more: Click Here

2. Stable Pools:

What Are They? Stable pools are designed for trading pairs that are closely related, such as stablecoins or wrapped assets. They are optimized for capital efficiency.

How Do They Work? They use something called an "amplification coefficient" (A-Factor) to fine-tune the price curve, reducing price changes (slippage) during swaps.

Learn more: Click Here

3. Liquidity Bootstrapping Pools (LBPs):

What Are They? LBPs are a special type of weighted pool that helps in distributing tokens effectively.

How Do They Work? They use a modified auction system to ensure fair pricing and wide distribution of tokens while needing less capital compared to other methods. ThalaSwap will use LBPs for its token offerings, similar to how Fjord Foundry uses Balancer’s LBPs.

Learn more: Click Here

ThalaSwap and $MOD

1. Integration Benefits:

What’s the Connection? ThalaSwap will work directly with $MOD, another important product. If there’s enough liquidity, key pool tokens like $MOD-$USDC might be used as collateral in the CDP (Collateralized Debt Position) with governance approval.

What Are the Benefits? This allows users to leverage their positions and potentially earn higher returns. If borrowing isn’t ideal, users can stake certain pool tokens directly on the AMM (Automated Market Maker) for additional rewards.

2. Staking Pools:

Available Pools: Three core liquidity pools will be available for staking:

$APT-$MOD

$MOD-$USDC

$THL-$MOD

Flash Loans

Flash Loans are a pretty cool financial feature that lets you borrow any amount of assets without needing collateral, as long as you pay it back within the same transaction. Here’s how it works: you request the loan through a smart contract, use the borrowed assets however you like, and then return the borrowed amount plus a small fee before the transaction finishes. If you don’t pay it back in time, the whole transaction is undone.

In the Move programming language, Flash Loans are handled by setting up a `Flashloan` [abilities] struct to track the borrowed assets. You calculate the fee and make sure the loan is repaid within the same transaction. Usually, the fee for a Flash Loan is just 1 basis point (bps).

The typical fee for a Flash Loan is 1 basis point (bps).

Learn more About it here: Click Here

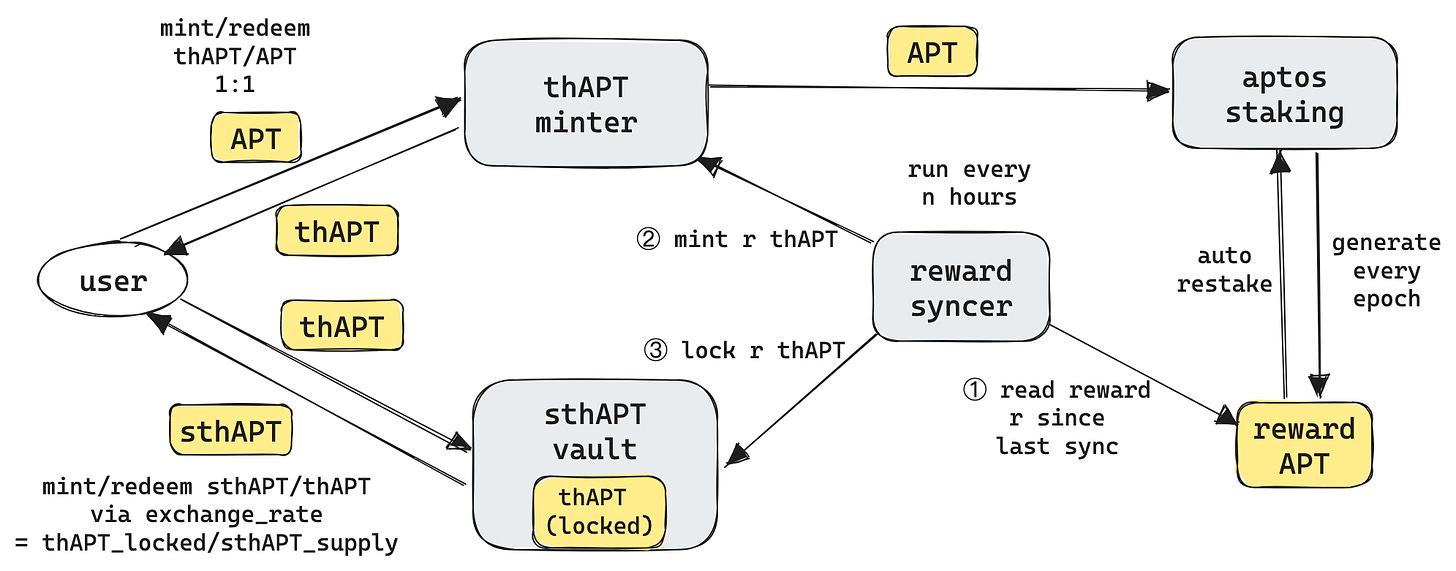

Thala's Liquid Staking: A Dual-Token Solution for Aptos

Thala’s liquid staking solution is characterized by the two token structure with thAPT and sthAPT tokens:

thAPT represents a 1:1 spendable deposit receipt of APT with no additional value added depreciation. Users are able to mint and also redeem APT directly, although after certain unstaking waiting periods.

sthAPT is a security deposit that redeems itself and accrues staking rewards from Thala’s APT validators and other earnings made on thAPT. Over the time, its worth appreciates due to these source of earnings that are rewarded.

Rewards and Fees:

The holders of sthAPT receive all the validator rewards of 100% from sthAPT and the rewards from thAPT at the rate of 80%.

Out of these thAPT rewards, 20% is directed towards promoting the thAPT-APT stable pool on ThalaSwap.

Lots of limit fees include 15 basis points on any thAPT to APT redemptions made, 1 basis point on thAPT to sthAPT minting fees , 5% of the said Fees on APT redemptions all directed to sthAPT reward pool

Commission on APT staking is set at 5% except out delegated nodes who add as much as 7% giving a commission rate of 12%

Liquidity Staking Process:

Send APT to Thala and get thAPT in return.

Put thAPT in the LSD module to exchange for sthAPT which increases in value over time.

Run network nodes for Validators to be rewarded for maintaining security and stability of the network.

ThAPT-APT stable pool facilitates an essential feature of allowing the transactions and liquidity of thAPT and APT blending in between them.

Benefits for Participants:

sthAPT Holders: Enjoy high returns through validator rewards and liquidity incentives.

Validators: Earn APT as rewards, with a 7% commission charged by service providers.

Liquidity Providers: Benefit from reduced emissions in stable pools and increased incentives.

Thala’s Liquid Staking enhances asset liquidity and offers impressive returns while safeguarding network security. As the sole comprehensive DeFi platform on Aptos, Thala’s suite of integrated products is a crucial component of the Aptos ecosystem.

To summarize, this overview covers the essential elements of Thala Lab, including Move Dollar (MOD), ThalaSwap & Launchpad, Vault Mechanics, Collateral Auctions, Stability Pools, Redemptions, the Peg Stability Module (PSM), Liquidity Pools, Flash Loans, and Liquid Staking. Familiarizing yourself with these features provides a deeper understanding of how Thala Lab contributes to the Aptos ecosystem. Thanks for exploring, and stay tuned for more updates!

Subscribe to my newsletter

Read articles from Adityaa kr directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Adityaa kr

Adityaa kr

Passionate about tech and driven by curiosity.