What is Blockchain?

Daniel Kambale

Daniel KambaleIf you've heard about blockchain, you might be wondering what it is and why we should use it. In this article, we will dive into the concept of blockchain, exploring its basic mechanisms and advantages, and why it is becoming a groundbreaking innovation across virtually every sector. From finance to supply chains, and even healthcare, blockchain technology has the potential to transform how we conduct business and store information. We will break down this complex concept into simple terms, use real-world examples to make it more relatable, and explore why it has the potential to revolutionize the way we interact with digital systems.

The Basics of Blockchain: A Simplified Example

It's important to understand the basics, so let’s start with the TL;DR. At its heart, a blockchain is essentially a distributed digital ledger. Imagine it as a spreadsheet that’s spread across multiple computers within a network. Every computer (referred to as a node) has an identical copy of the ledger. This ledger is automatically updated whenever new transactions occur.

Blockchain technology was first introduced in 2009 by an individual (or group) under the pseudonym Satoshi Nakamoto, who created the first decentralized digital currency, Bitcoin. Despite Nakamoto’s anonymity, the innovation has taken on a life of its own, evolving into something much larger than just digital currency.

But what does this actually mean? Let’s break it down further:

Digital: Blockchain exists purely in the digital realm—there are no physical ledgers involved.

Ledger: It’s simply a record of transactions or data.

Distributed: Rather than being stored in a central location, the ledger is replicated across many computers in a network. This decentralized structure makes blockchain secure and resilient.

Here’s where it gets interesting: unlike traditional databases like a Google Sheet, you can't just modify or delete entries in a blockchain. Once data is recorded and verified, it’s nearly impossible to alter or erase. This immutability is one of the key features that make blockchain both secure and trustworthy.

How Blockchains Work: A Look Under the Hood

To better understand how blockchain works, let’s take Ethereum as an example. Ethereum is often referred to as “the world computer,” as it allows for decentralized applications (dApps) and smart contracts to operate. Ethereum goes beyond mere value transfers (like Bitcoin) and facilitates complex computations.

Let’s explore the fundamental components of how blockchain functions:

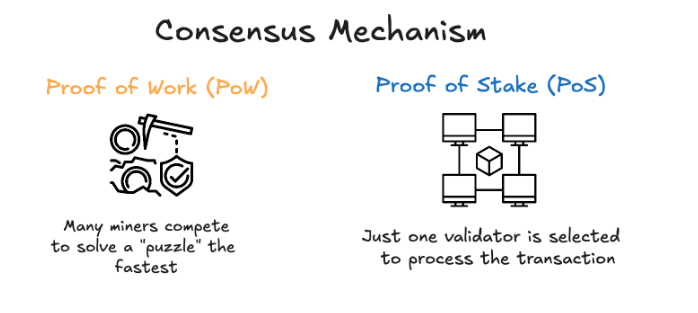

Consensus Mechanism

Blockchain requires all participants (or nodes) to agree on the validity of transactions. This agreement is achieved through consensus mechanisms, the two most prominent being:

Proof of Work (PoW): Nodes (miners) compete to solve complex mathematical puzzles, which are highly energy-intensive.

Proof of Stake (PoS): Validators stake their cryptocurrency (like ETH) to propose and validate blocks. This is more energy-efficient and is now the consensus method used by Ethereum after its transition via The Merge.

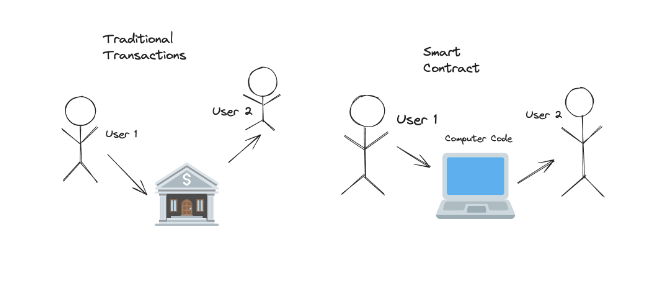

Smart Contracts

Smart contracts are another crucial element of Ethereum's blockchain. These are self-executing pieces of code that automate the terms of a contract.

Written in languages like Solidity;

Compiled into EVM (Ethereum Virtual Machine) bytecode;

They can automatically execute once certain conditions are met.

Gas Fees

In Ethereum, users must pay "gas fees" for the computational power required to execute transactions. These fees are dynamic, ensuring that the blockchain doesn’t get overloaded by too many operations.

Gas: Unit of computational work.

Gas Limit: Maximum allowable gas for a block.

Base Fee: Adjusts according to network demand and is partially burned to prevent inflation.

Advantages and Use Cases of Blockchain

So, why are people so excited about blockchain? Well, it brings some useful advantages and use cases to the table that can help solve many problems in the real world.

1. Stablecoins as a Store of Value

In high-inflation economies, the local currency can lose its value pretty quickly, negatively impacting businesses, local people, and the whole economy. Stablecoins, which are cryptocurrencies pegged to the US dollar, have the potential to serve as a more reliable store of value. We can think of USDT (Tether) or USDC (USD Coin). These stablecoins can be easily acquired and held by people in countries with high inflation using different platforms like centralized exchanges or wallets.

The benefits of a stablecoin can include things like:

Preserving assets’ value against local currency devaluation;

Facilitating cross-border transactions without traditional banking procedures, delays, and restrictions;

Providing access to a stable currency to promote savings and commerce.

For example, in Venezuela or Argentina, where hyperinflation has devastated the local currency, many citizens have turned to stablecoins to protect their savings and use it for everyday transactions.

2. Verifiable Ownership of Assets

In the traditional world, proving ownership of assets like real estate, art, or intellectual property can be prone to disputes, and involves intermediaries that can delay and complicate the process. Blockchain pretty much solves this problem by providing a transparent ledger that can record the ownership and provenance of any asset.

In a nutshell, such a ledger can achieve:

Eliminating the need for trust in third-party intermediaries;

Reducing fraud and disputes by providing a verifiable chain of ownership; and

Facilitating faster transactions and transfers of ownership.

For example, real estate transactions could be greatly simplified through use of the blockchain. If a property deed is stored as a digital asset on the blockchain, transferring ownership could be as simple as sending a transaction, drastically reducing the time and costs associated with property sales.

3. Censorship Resistance

In countries where the political climate is unstable there can be a serious lack of freedom in communication, access to financial resources, or even general economic participation. This is where blockchain can actually solve a real-world problem: when transactions, information, or assets cannot be easily censored, blocked, or controlled by any single entity or government, people traditionally at risk of being left outside the system can participate.

4. Decentralized Banking Systems

Traditional banking systems can be limiting, especially for people in underbanked or unbanked regions where access to financial services is limited (like Argentina, as mentioned above). Blockchain introduces decentralized finance (DeFi), uses blockchain to offer financial services like lending, borrowing, savings, and insurance without relying on traditional banks. It leverages smart contracts and it allows these platforms to enable anyone with internet access to participate in financial services without needing a bank account or encountering the traditional barriers to entry.

For example, platforms like Aave allow users to lend and borrow assets directly from each other, earning interest or accessing capital in a permissionless way. This opens up financial opportunities to people in regions like Africa or LatAm, but also it gives freedom to everyone who doesn’t want to rely on a centralized, traditional financial system.

5. Composability

One of the most unique features of blockchain is the ability to "compose" different financial services together in a seamless way, For example, in traditional finance, creating complex financial products requires even more complex and costly infrastructure, and that’s when composability in different products come to solve this - since applications can be built on top of each other without the need for new infrastructure. This composability allows developers to innovate quickly, creating new financial products and services that interact with each other.

In a nutshell, the benefits of “composability” are:

Facilitating the innovation of these apps by allowing developers to build on existing protocols;

Creating ecosystems where different dApps work together seamlessly and are compatible; and

Enabling users to maximize the usage of assets by interacting with multiple protocols.

For example, users can provide liquidity on Uniswap, stake their liquidity provider (LP) tokens on a platform like Yearn Finance for yield farming, and even use those yield-bearing tokens as collateral on another DeFi platform.

A Look at Morph L2: A Scalable Layer 2 Solution

In the world of blockchain, scalability remains one of the most pressing challenges. Layer 2 (L2) solutions, like Morph L2, address this by enabling faster and more affordable transactions on top of existing Layer 1 blockchain, such as Ethereum. Morph L2 enhances the scalability of Ethereum by offloading a significant portion of transaction validation and data processing to secondary layers. This ensures that the Ethereum main chain remains secure and decentralized while increasing throughput and reducing. By adopting Morph L2, developers, and businesses can build applications that are not only more efficient but also capable of handling a much higher volume of transactions without compromising on decentralization. Morph L2 is instrumental in pushing blockchain technology closer to mainstream adoption by solving critical bottlenecks like transaction speed and cost.

Conclusion

Blockchain technology — with its promise of security, transparency, and efficiency — has the potential to revolutionize how we interact, transact, and trust. It's not just about cryptocurrencies. It’s about reimagining the very fabric of our current digital infrastructure when we think of baking systems or the internet as a whole. The ultimate goal is to make this technology mainstream in a way that we can onboard millions of people to build on the blockchain and revolutionize the “consumer” crypto.

Subscribe to my newsletter

Read articles from Daniel Kambale directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Daniel Kambale

Daniel Kambale

Hello! I’m Daniel, a Web3 developer specializing in Solidity and smart contract development. My journey in the blockchain space is driven by a vision of a fully decentralized world, where technology empowers individuals and transforms industries. As a Web3 ambassador , I’m committed to fostering growth and innovation in this space, helping to shape a future that values transparency and security. Fluent in both English and French, I enjoy connecting with diverse communities and sharing my insights across languages. This is why you’ll find some of my articles in French, while others are in Swahili, as I believe knowledge should be accessible to all. I use my Hashnode blog to document my learning process, explore decentralized solutions, and share practical tutorials on Web3 development. Whether it's diving deep into Solidity, discussing the latest in blockchain, or exploring new tools, I’m passionate about contributing to a decentralized future and connecting with others who share this vision. Let’s build the future together!